Still bullish on Charter $CHTR

I’ve previously published some bullish thoughts on Charter (disclosure: net long through the Liberty complex), but I wanted to publish some random updated thoughts here (to tip my hand, I plan on publishing a Liberty Ventures (LVNTA, disclosure: long) update in the wake of the GCI proxy getting filed and wanted to have updated thoughts on Charter to go with it).

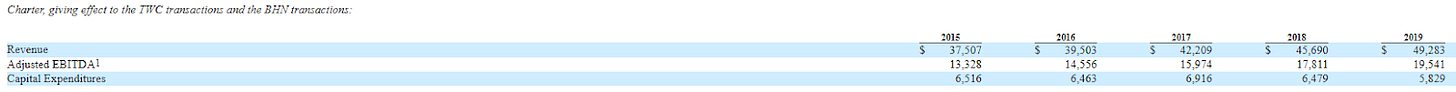

My basic thought remains pretty simple: I’m wildly bullish. On just about any metric (EBITDA margin, EBITDA / relationship, EBITDA / passing), Charter is well under-earning what peers like Comcast (CMCSA) and Altice (ATUS) are earning. I think they close that gap over the next few years as they fully integrate their TWC and BH acquisitions. So while you’re paying a bit of a premium versus peers to buy Charter today if you only consider trailing earnings (~11x LTM EBITDA versus maybe 8-9x at CMCSA (depending on how you adjust for NBC) and 11x at ATUS), the multiple looks much more reasonable when you look 3-5 years out. Combine a forward look at earnings with how much cash flow they’ll be spitting off in the next few years and that the majority of that will almost certainly be directed to share repurchases, and Charter shares look much too cheap on a forward looking basis.

There are a bunch of ways to break it down, but at its core the math looks something like this: CHTR is currently getting ~$300 EBITDA / home passed. CMCSA does ~$365, and ATUS does ~$435. CHTR is spending ~$150/ home pass in capex currently versus CMCSA at $139 and ATUS @ $112. By 2020, I think CHTR does ~$400 / home passed in EBITDA and spends ~$100/pass in capex (cable capex in general should come down over time, and CHTR’s specifically will as they fully integrate), so unlevered FCF is ~$300/home passed. Charter currently passes 50m homes; assuming that number stays constant (it almost certainly will increase a bit), Charter would be doing $20B in EBITDA and $15B in unlevered cash flow in ~2020. I’m not going to do a DCF here (I’ll let you do that on your own), but today’s EV is ~$170B with ~$60B in debt. Obviously you’ll need to adjust for taxes and interest expense, but it seems pretty clear that EV is going way up if CHTR even approaches those unlevered cash flow numbers, which will drive share price appreciation before even factoring in the massive share count shrink as cash flow from both operations and financial engineering (CHTR is committed to remaining ~4x leverage, so as EBITDA goes from $15B to $20B they’ll raise an additional ~$20B in debt) is directed towards share repurchases.

So that’s just my broad framework for looking at Charter’s valuation; you can take it or leave it (though I would guess a bunch of readers are also long Charter through some piece of the Liberty complex, so I’m sure you’re “taking” it). For what it’s worth, it’s also broadly in line with the projections the company made in the deal proxy.

Anyway, I wanted to focus a bit more on 1) how difficult it is to see a real downside scenario and 2) how insiders keep indicating just how cheap Charter is.

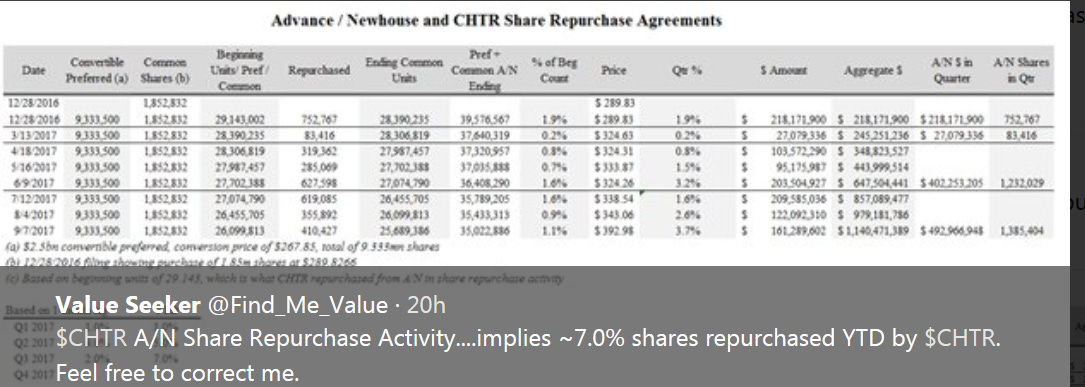

Let’s start with the second point- insiders keep indicating just how cheap Charter is. I mentioned Charter’s A/N form 4 repurchase “tell” in my last piece, so I won’t dive into it again here. But it’s worth noting that the repurchases have continued even as Charter’s share price has increased. That’s interesting, but perhaps more telling is that their most recent form 4 shows that their repurchase accelerated in August after the stock ran up to ~$400/share on the heels of the rumored Softbank and Altice bids. It’s a rare company that increases their repurchase on the heels of a stock run up, and I think it’s yet another sign of just how bullish the company becomes as they get deeper into the TWC integration.

Charter has already bought back 7% of their shares so far this year and, by year end, I think it’s likely Charter will have bought back more than 10% of their shares outstanding. That number is impressive in itself, and it’s even more impressive when you consider they were blacked out of repurchases for most of January and February. I’ve stolen the table below from my friend @find_me_value; I think it really highlights just how fast these repurchases are coming.

So the repurchases are impressive. But that’s just one indication the company thinks they’re undervalued; are there any others? Absolutely. Consider that three separate strategic bidders have approached Charter about a buyout in the past year (Verizon, Softbank / Sprint, and Altice). Charter has effectively turned them all down in favor of executing on their own operational plan / repurchasing their own shares.

Remember that Charter is quasi-controlled by John Malone and the Liberty Empire. Liberty makes no secret of the fact that they move through businesses when the time is right (here’s a quote to that effect, though I’ve seen better ones that I can’t find currently). If they had any concerns about Charter’s future in a 5G world or ability to execute on their operational plan, they probably could have started a bidding war between three strategic parties (perhaps more) and gotten out at a really nice premium. Instead, they chose to hunker down, buy back shares, and continue doing what they were doing. That’s another sign to me that they think the upside from executing the plan and buying back shares far outweighs selling at a premium (even a nice one!) at today’s prices. Bottom line to me here- if Malone is choosing to focus on shrinking float and running the business instead a selling for a big premium when that opportunity is available, you can bet it’s because the opportunity is huge.

Speaking of future concerns, the big bear case for cable in general is the eventual 5G rollout leading people to cut out cable internet altogether. We already know that Liberty and Charter think that wireless and 5G is more opportunity than threat, but they’re clearly biased so what do they know? Well, there are only four to five companies that are currently positioned to provide nationwide 5G (Sprint, T-Mobile, Verizon, AT&T, and maybe DISH (disclosure: long a little) if they develop their spectrum). Two of the four / five of them have made a run at Charter. What other confirmation do you need that cable will play a critical role in some form in a 5G world?

I don’t mean to be too cavalier here. Strange things can happen, and the market will certainly shift / change when 5G comes out. Who knows what happens with that tech going forward? Maybe someone invents a Pied Piper middle out compression technology that compresses data down to nothing and allows for streaming of 4k video on dial up type speed. That tech risk aside, I think when you boil it all down the Charter opportunity is a once in a lifetime one. You have a strategic asset that should have incredible stability (cable should do really well regardless of the economy) and cash flow with multiple potential bidders who have already indicated interest run by one of the cable industry’s best executives and controlled by perhaps the greatest capital allocator of all time who is directing the company’s cash flow towards buying back shares as fast as possible. How many more times will you see that set up?

I wanted to throw two last nuggets out there:

Most of the focus on Charter is on them selling, but don’t forget that they have significant scale advantages and there are still things they can buy (Cox and CABO come to mind). Competitor Altice has made it clear that they are looking to buy cable assets, so maybe Charter is going to get priced out of the market, but I would guess if we woke up tomorrow and saw Charter was buying Cox or some other cable operator, it would become apparent very quickly that the deal was somewhere between good to incredible for Charter shareholders. Any accretive M&A would be pure upside to the numbers discussed above.

One thing I like to think about is Charter buying someone like Cable One (CABO), who has completely shifted away from a video product. Imagine Charter getting CABO and using their video pricing power to reintroduce a video double play offering in CABO’s network. The synergy potential is unbelievable.

Everyone is discussing Sprint / T-Mobile getting ready to announce a merger. My personal thought is regulators are much more likely to block than approve the deal (maybe 60/40 in favor of block), but I think it’s a win-win for Charter either way. If the deal is blocked, Sprint / Softbank is desperate and might come in with a crazy bid for Charter (maybe spurring a bidding war with Altice) or be open to a sale (on the cheap) or partnership with either Charter or the Charter / Comcast JV. If the deal goes through, CHTR could pick up assets on the cheap that the combined company is forced to divest and (more importantly) it could be a regulatory signal that opens the door to Comcast making a run at Charter. I wouldn’t be surprised if the reason Charter is so hesitant to deal with S / VZ / ATUS (aside from demanding a super premium price) is they want to keep optionality of an eventual Comcast bid open.

The more I think about it, the more I think Comcast is the end game everyone is hoping for. Malone hates paying taxes, so he’s going to want to take a ton of stock in any deal given his cost basis. It doesn’t seem like Malone wants anything to do with the stocks of S, VZ, and ATUS (S is a disaster, VZ faces tons of operational questions going forward, and tons of people, including CHTR, have speculated that ATUS’s strategy results in strong short term results but could end in a blow up long term), so a buyout from them is pretty unattractive. Taking CMCSA stock solves tons of problems.

We already know Comcast’s top lobbyist thinks this administration is really open for business.

Speaking of Comcast- I think it’s way too cheap at today’s prices of ~$38.50 (my SOTP is closer to $45-$50). If they had the same capital allocation policy as Charter, I’d probably prefer Comcast to Charter at these levels. But when you start looking at the accretion from Charter staying 4x levered and directing everything to repurchases versus Comcast staying at 2x levered split between dividend and share repurchases, Charter just seems more attractive to me a year or two out (plus, you get the potential upside of a Charter takeout).