Liberty's no longer #trackersforlife $LSXMA $FWONA $LYV $SIRI

A few years ago, I was reviewing Liberty Media's investor day and noticed a funny typo in Bloomberg's transcript. Instead of Greg Maffei (Liberty's CEO) saying they would treat shareholders well, the transcript had Greg saying they would "mistreat" shareholders. I posted it and tagged Greg, and he responded that they were in the tracking stock business and treating shareholders poorly would be bad for business.

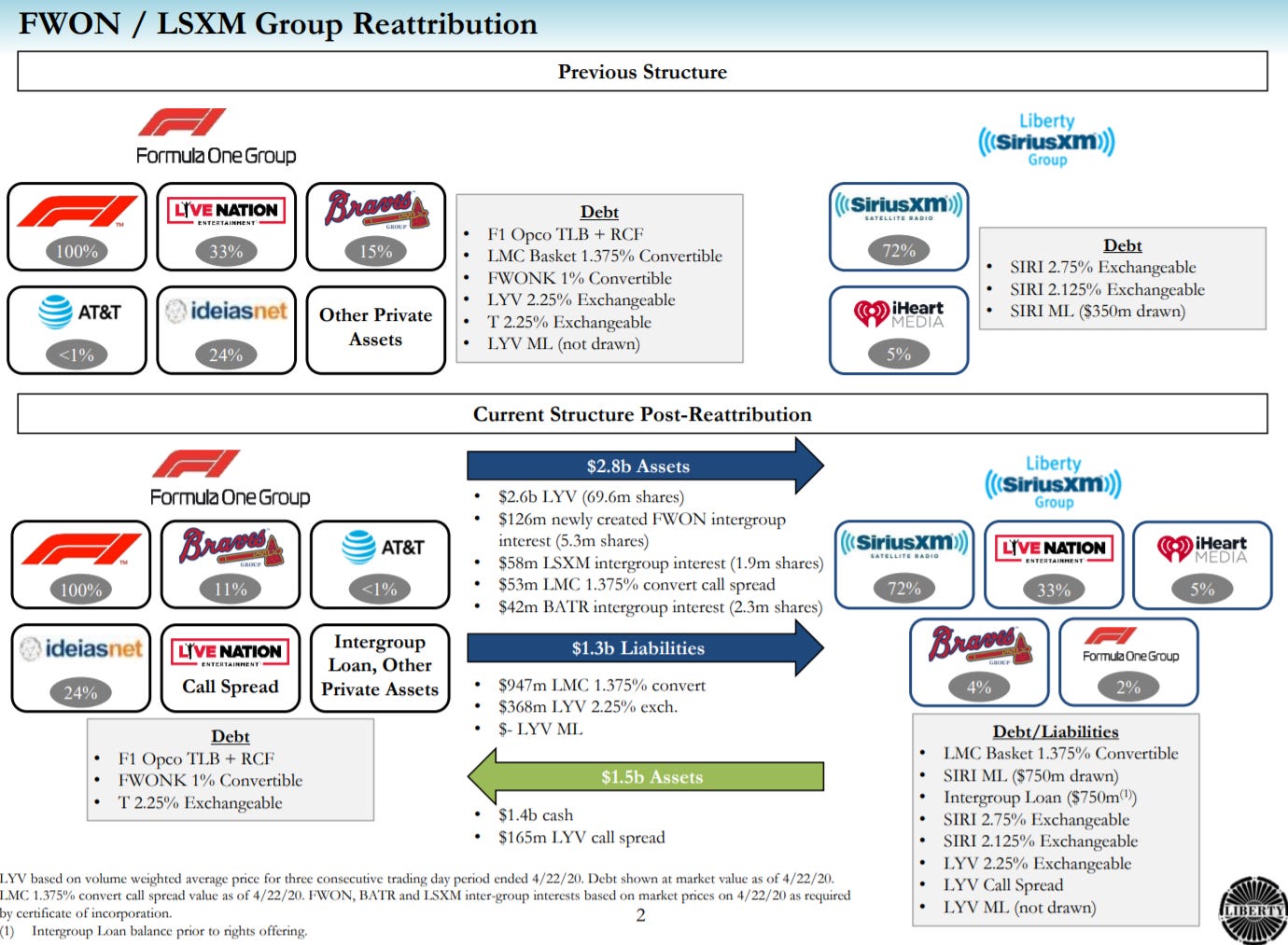

I couldn't help but think about that exchange after Liberty's "reattribution" announcement yesterday. It's an incredibly complicated deal, but the basics of the reattribution is Formula One is selling their Live Nation stake to Liberty Sirius. Again, it was not a simple transaction (slide below from their deal slides).

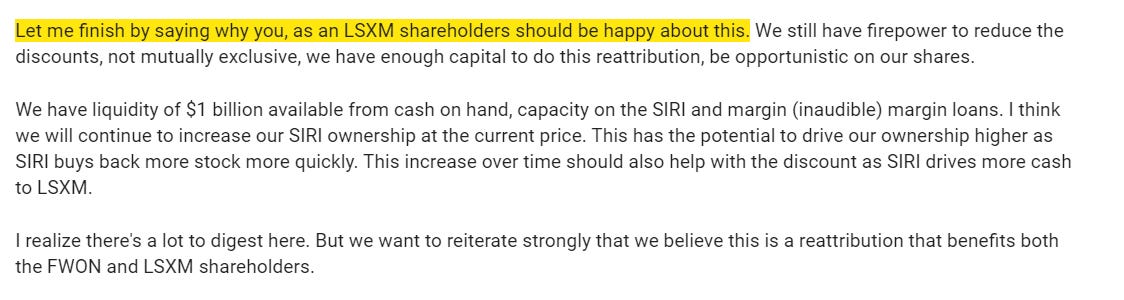

The party line for the transaction was pretty simple: this is fair for both sides of the transaction (below from the company's analyst call).

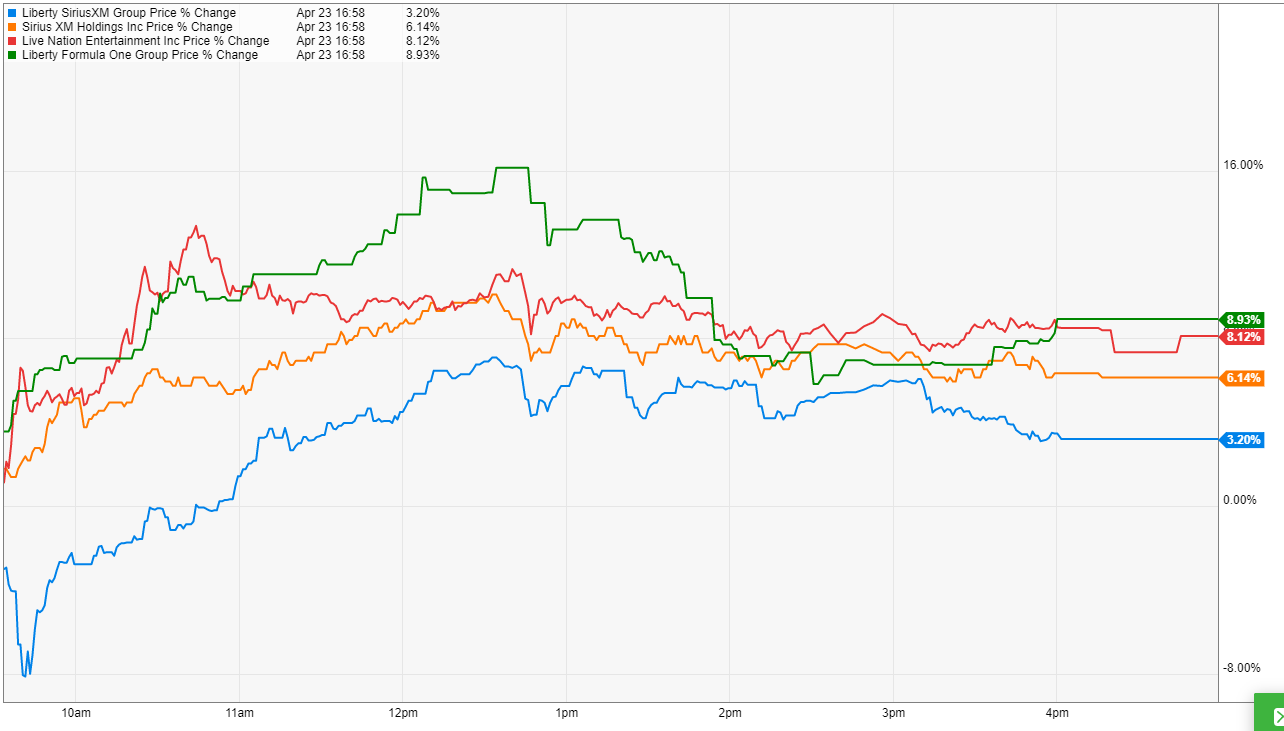

As a Liberty Sirius shareholder, I can tell you it doesn't feel super fair to me. One day stock price movements are notoriously filled with noise, but in this case I think it tells you everything you need to know about what an awful deal for Liberty Sirius this is. Liberty Sirius's main asset (SiriusXM) went up ~6% on the day (likely largely due to Greg's CNBC interview where he gave a pretty bullish outlook for SIRI, where he is chairman). The asset Liberty Sirius is buying (Live Nation) went up ~8% on the day. Formula One was up ~9% on the day. Liberty Sirius? Up just 3% on the day. Given Liberty Sirius should be a levered bet on the value of SiriusXM (and now Live Nation), for their stock to materially under perform the underlying assets tells you how bad a deal the market thinks this is.

Liberty clearly knew that the market reception to the deal for Liberty Sirius would be poor. Along with announcing the transaction, Liberty put out a little bit of a media blitz. Greg went on CNBC, and both the slide deck and presentation included half hearted attempts to explain why this was a good idea for Liberty Sirius:

Let me explain why this is such a bad deal for Liberty Sirius. It's not because LYV is a bad investment at these levels.... it might be a great one! At the beginning of March, Greg mentioned that he thought Live Nation was the most dislocated of all their businesses (see quote below). Obviously things have gotten materially worse since then, but Live Nation is a great set of assets and if you believe they can "make it through" and earnings revert where they were before the crisis, you could easily paint a picture where LYV's share price today is way, way too low.

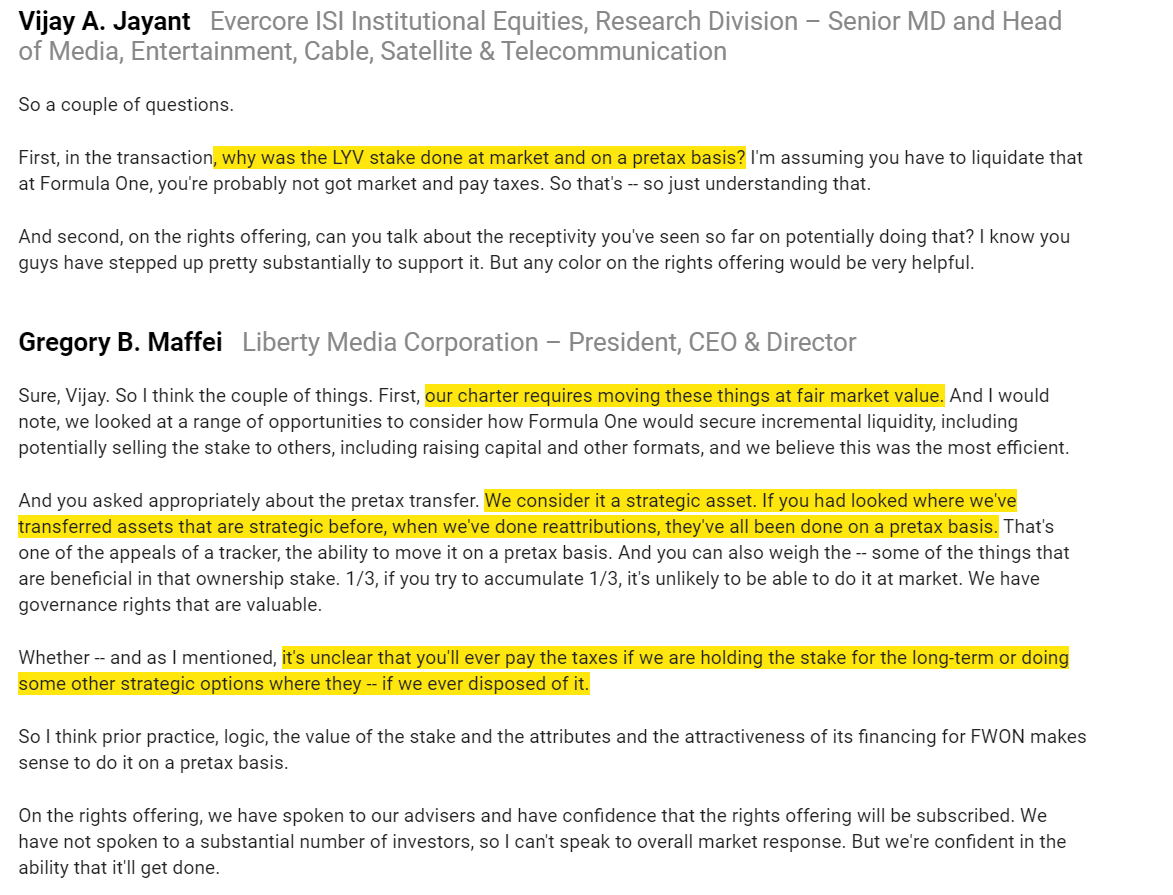

But LYV is publicly traded. As a Liberty Sirius shareholder, I could go out and buy LYV separately if I wanted to invest in LYV. I was in Liberty Sirius because I like the Sirius business model, I liked buying a pure play investment into Sirius at a discount, and I trusted that over time Liberty would be working to collapse that discount. Now, Liberty is both destroying my trust and murking up the Liberty Sirius story in order to bailout Formula One. And make no mistake: this is a bail out. Formula One has been hit by an unexpected typhoon in Corona. They needed money, and their most obvious liquidity source was their mammoth stake in Live Nation. Selling that stake would raise all sorts of issues: there'd be a tax drag, and given Formula One was something of a forced seller of a large but not controlling stake in Live Nation, selling the block would likely come with a mammoth discount. Instead, Liberty Sirius paid market price to Formula One for the stake. Liberty bailed Formula One out and got nothing in return. In fact, not only did Liberty Sirius get nothing in return; they got stuck with a potential tax liability (if Liberty were to ever sell the stake in a taxable manner, Liberty Sirius shareholders would now be on the hook for the taxes, not Formula One. Greg said they did that because their charter didn't allow them to account for taxes between subs) and they sold Formula One a call option on a piece of the Live Nation stake so that they can participate in some of the near term upside if Live Nation quickly bounces back.

I'm not saying this is going to turn out to be a bad deal. It's been obvious Liberty's LYV stake and Liberty Sirius (and maybe eventually Sirius and Live Nation in general) probably belonged together for a long time. People have speculated about that for years, and Greg even admitted they probably belonged together at the beginning of March (before the Corona "shoe" really dropped):

But, in Formula One, you had a forced seller. Liberty even admitted that Formula One could no longer hold the Live Nation asset in the current environment:

Just because Liberty Sirius could handle that risk doesn't mean they should. Liberty Sirius was in fantastic shape: it had a fine balance sheet with plenty of debt capacity given how over-collateralized their small margin loans were versus their Sirius stake, and it could wait for a distressed asset to hit the market and use the opportunity to opportunistically pounce. Alternatively, Liberty Sirius had a great asset that it could keep buying and easily create massive value: its own shares, which traded at a huge discount to the value of its Sirius shares. Liberty had historically and repeatedly suggested that their capital would go to closing that discount and that, unlike other trackers, they could be trusted to be responsible (Maffei has even dared people to bet against them closing that discount). Instead, Liberty management chose to forgo all that optionality and value creation in order to bailout Formula One shareholders, and they didn't even demand a "distressed" discount or anything. If you were looking at all of Liberty as just one entity, then the rearrangement at market value makes sense. But, if you looked at each individual tracking stock as a separate entity, yesterday's move is taking from Liberty Sirius shareholders to save Formula One. On top of being #trackersforlife, Greg Maffei once told me they were in the tracking stock business, and messing with shareholders wouldn't be good for business. After yesterday's moves, it's clear that Liberty is in the Liberty business, and ensuring the overall entity survives is the most important thing to them, even if it means significantly favoring one group of tracking stock shareholders over another.