Cruise ship pirates: how $OSW's management plundered their shareholders

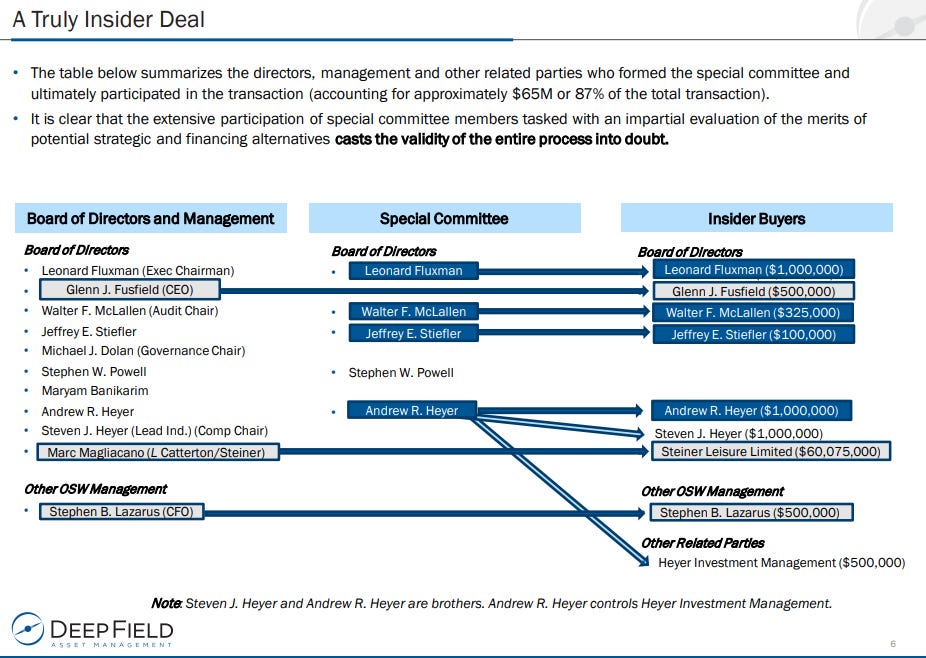

Yesterday I saw perhaps the strangest (financial) press release I've ever seen. OneSpaWorld (OSW) issued a press release applauding Stifel for publishing a research report that acknowledged OSW did not have enough cash to pay down their revolver and remain solvent. It's hard to emphasize enough how strange that press release is. Normally, if an investment bank comes out with a report that suggests a company is facing a liquidity crisis or is insolvent, the company is going to respond with full out nuclear war. Literally everything is on the table: an immediate conference call to rebut the analyst report is a near given, but things like threatening to sue the analyst and their bank are absolutely in play, and refusing to work with the analyst's bank ever again is par for the course as well. So OSW doing the exact opposite and issuing a press release to applaud Stifel for that report was a real curiosity. It raised a bunch of red flags for me. Seriously, why would a company want an analyst to think they were insolvent? The answer is pretty simple: because of their (alleged?) insolvency, OSW is raising a bunch of money from insiders. A shareholder (Deep Field) was opposing the deal, noting that the financing was horrifically conflicted as insiders stood to make tens of millions of dollars from the financing. OSW management needed the market to believe that the company would be insolvent without this financing, because if the market didn't believe that, shareholders might vote down the proposed financing and insiders would lose out on a (hypothetical) fortune. Why do I mention all this? Well, first, because it's all super interesting. It's rare to see a deal this conflicted, and when they pop up it's worth paying attention. But I also mention it because there's the potential for value here: management just created tens of millions of dollars for themselves (well, they didn't create it.... they took it from minority shareholders), but all of that value is tied to OSW's stock price. While they were highly motivated to paint OSW in a negative light over the past few months in order to get this financing done, with the financing complete management will be incentivized to maximize OSW's stock price. If you believe the world returns to a normal environment at some point, OSW looks reasonably cheap, and the combination of a reasonably cheap stock price as things normalize plus a management team highly incentivized to realize value is generally a good combination. Let's dive in by starting with a quick overview of OSW. OSW was formed when Haymaker (a SPAC) bought OneSpaWorld from Steiner Leisure in late 2018. OSW operates spas on cruise ships. They are, by far, the dominate player in the segment, with 80%+ market share. This is a reasonably good business (with the big asterisk / assumption that cruise ships are actually operating!): OSW operates the spas on cruise ships pursuant to long term contracts, which gives them extremely limited capex and a big captive audience (the people on the cruise ship) to sell to. That's great, but the obvious question is why would a cruise ship give up those economics to OSW? The reasoning is pretty simple: OSW operates on a revenue share model (i.e. the cruise line gets a cut of any revenue OSW generate), so the cruise ship participates in most of the upside that OSW generates. OSW has some scale advantages that a cruise line wouldn't have if they tried to operate a spa themselves (for example, Botox is a huge revenue generator for OSW. By combining the purchasing power of several cruise line's spas, OSW is able to get better pricing on Botox than any individual cruise line could. OSW also gets better data than any individual cruise line could get because they combine spa data across cruise lines, and as a focused player they're likely able to offer a better service that guests enjoy more). Put it all together, and it's a win-win for cruise lines: by sharing in OSW's upside, they get more revenue than if they operated the spa themselves, and OSW offers a better product than the cruise line could offer themselves (resulting in happier customers who are more likely to cruise again!). One thing I want to emphasize here: when I first heard of OSW, I thought, "Outsourced massages on cruise lines? That's dumb. Even if they're better than cruise lines, the cruise ships are going to suck all the economics out for themselves. That's a commodity." OSW is much more than just massages; believe it or not, a lot of people want to get high end services like coolscultping, Botox, skin tightening, etc. on cruises. The costs of these services run in the thousands of dollars per session, and that's a big advantage for OSW. First, it means that their sales / data expertise is a big edge: if OSW can reliably sell just a handful more of these high end services per cruise than a cruise line's self operated spa, than the cruise line is economically incentivized to outsource their spa to OSW just from the increased revenue (and ignoring things like improved customer satisfaction from an OSW spa or OSW's cost advantages in sourcing). Things like acupuncture and Botox are also much more complicated than a simple massage (licensing, storage and handling, etc.), so outsourcing to OSW can solve some logistical headaches too. While at first blush it might seem a little weird for a cruise line to outsource their spa, I think when you add it all up you can see why it all makes sense and why OSW's scale gives them a big edge. So that's the business. It all made sense... until COVID docked cruise ships worldwide and sent OSW's revenue to zero overnight. That sudden stop meant OSW would be in default of their credit agreement, which could accelerate all of their debt and drive them into bankruptcy (note: you should read the background to their financing plan on p. 27 for more on this). Knowing that OSW was in trouble, in late March Steiner Leisure (who sold OSW to Haymaker and still had involvement in OSW from some deferred shares they were owned) offered to inject a ton of money into OSW at ~$2.61/share. OSW ultimately ran a mini-process on the heels of Steiner's offer: they contacted a bunch of potential investors and settled on Steiner's improved / revised offer as the best offer. Ok, everything so far sounds reasonably normal. OSW's business had ground to a halt, and their old owner (who, theoretically, should know them best and have a long term view on the business / "deep understanding") offered to provide them financing to get through their issues and remain in compliance with their debt covenants. Plenty of other companies have resorted to similar financing and seen their stocks soar as the market priced in the company having enough liquidity to get through to the other side of COVID (PLAY stands out, though there are plenty of others). What's so unique (and troubling!) about OSW's financing is that it allowed for the participation of "certain members of the board of directors," including the Executive Chairman and CEO. While I would never want to question management's integrity (as the exec chairman suggested questioning the process did), their participation raises a ton of questions. The simplest is: if executives are participating in the financing, are they really incentivized to strike the best deal for the company? Or are they incentivized to make the financing as lucrative as possible for the financers so that the financers (and thus insiders) can profit at the company's expense? It also raises questions about the process soliciting other deals; if execs knew that the Steiner financing would let the execs participate and possibly (probably?) make tens of millions of dollars, would they really give other financing proposals a fair shake? All of these concerns (and more!) are raised by Deep Field (particularly in their May 20) letter, so I won't go further in to them. But the conflicts are real and troubling (and well illustrated by Deep Field in the Chart below)

To drive home just how much money insiders will make, let's take a look at the transaction. You can find the details of the transaction in this 8-k, but the basics are three things will happen:

OSW will sell 18.8m shares of stock for ~$4/share (15m shares to Steiner; 3.7m shares to the "Co-Investors", which are OSW's management and board

OSW will give them 5m of warrants excerisable at $5.75 with a cap at $14.50. (4m to Steiner, 1m to the co-investors)

In exchange for backstopping the offering, OSW will accelerate 5m of deferred shares owed to Steiner as well as improving the terms for some founder's shares owned by some of the board of directors.

There is real value in #3; however, that value is very difficult to calculate so I'll ignore it for now. Let's just focus on #1 and #2. As I write this, OSW's stock is at ~$7.50. When the financing goes through, OSW will sell 18.7m shares of stock at $4/share. That will instantly create $65m of value (~$45m for Steiner, ~$20m for the co-investors). In addition, OSW will give them 5m of warrants that are already $1.75/share in the money. Ignoring the volatility / time value of money, those warrants are already worth another ~$9m ($7m to Steiner; ~$2m to co-investors).... and ignoring volatility is a pretty big deal given how volatile OSW currently is and the somewhat binary nature of OSW's path (i.e. if we return to normal in the next few years, the stock is probably a home run; if no one ever goes on a cruise ship again, the stock is a zero). Altogether, I've got management pocketing just shy of $30m from the deal, and Steiner making >$50m.... and, again, that ignores the real value creation from reworking the deferred / founder's shares. That's $80m of profits (plus the volatility kicker on warrants and the real value from #3) on a $75m investment in less than two months. Seriously, real pirates would be jealous of OSW's high seas plunder here. So OSW management is making out like bandits here. But I don't think that precludes OSW from being an interesting investment at these prices. Remember, post deal, OSW's management will have tens of millions more invested into OSW. If they can return the business to normal over the next few years, those tens of millions could easily become hundreds of millions. Post equity raise, OSW will have ~91.5m shares outstanding (they had 61m before the raise, they're raising 18.8m, issuing 5m warrants that are in the money, and I assume all of the 6.6m in deferred shares accelerate and vest) for a market cap of ~$700m at $7.50/share. Net debt, assuming all of the warrants exercise, would be ~$120m for an EV of just over $800m. Pre-Covid, the market was valuing OSW at >$1.2B in EV. If you think OSW can ever approach that level of earnings / valuation again, that would imply a ~$12 stock price on today's share count. Is that an unreasonable assumption? I don't know. It really depends on if you think OSW's earnings can ever approach their pre-Covid levels. In general, I'm bearish on a lot of travel businesses reaching pre-Covid earnings levels for a long, long time, but I actually think OSW can approach their pre-Covid levels. If you look out to like 2023, it's hard for me to imagine that cruise demand hasn't return to close to where it was pre-covid (yes, I know that seems crazy. I personally can't imagine going on cruises now, but when people are comparing your product to rats addicted to cocaine you know they'll be back). Maybe there's some occupancy short fall, but as long as the cruise industry is reasonably humming along OSW should be fine (cruise ship operators lose a bunch of money if they're sailing ships with <100% occupancy, but OSW's financials shouldn't change too much if they're operating a spa on a 95% full ship versus a 100% full ship. Even at 50% occupancy, their unit economics are roughly breakeven). In fact, I think OSW's earnings could be higher a few years down the line. In 2019, OSW had a spa open on 165 ships (average throughout the year; they ended the year at 170) and did $58m in EBITDA. Pre-Covid, they were forecasting being on 191 ships by year end 2020 (they were on 175 ships at the end of Q1'20). Even without any more ship growth, I see no reason why OSW couldn't do $70m in EBITDA in a few years given the ships they've already expanded to plus a little pricing power. Free cash flow conversion is outstanding here; capex is limited (<$4m in 2019) and taxes negligible (thanks, offshore cruise ship tax loopholes! Let's definitely bail out the cruise industry, American tax payer!). $70m in EBITDA could easily be >$65m in unlevered free cash flow. With interest rates low and reasonable consistency to OSW's earnings (excluding, you know, pandemics), I could easily see the market supporting that $1.2B EV we discussed earlier. Throw in some cash flow generation in the mean time plus some capital allocation moves (I would guess OSW returns a lot of cash to shareholders, either through dividends or share repurchases, once things normalize), and the stock could easily double over the next few years. Note that the new warrants OSW issued expire in five years and cap out at $14.50; I think it's reasonable to assume management chose that price because they think there's a very good chance they can get there.` Bottom line: OSW's management is making out like bandits in the current financing. Shareholders today aren't getting nearly as good a deal as management, but management will be very incentivized to maximize shareholder value after this deal. With the deal solving OSW's liquidity problems and a clear path to earnings growth as cruise ships normalize, I think the company is pretty interesting. Some additional resources

There were some small insider transactions back in March. I tend to discount insider transaction done in March, but given they followed these up with a mammoth financing insiders participated in a month later I figured it was worth highlighting.

DFAM letter on Glass Lewis / ISS recommendations

Look, it's really hard for a prxoy advisor to recommend a vote against a deal when management says the company will basically be insolvent without it. For Glass Lewis to come out against this deal and ISS to be so cautious on it is pretty telling.

DFAM comments on Stifel report

This is the PR that lead OSW to put out the bizarre release praising Stifel for recognizing their insolvency