SPACs: the most ludicrous bubble we'll ever see... why not $IAC?

There are a lot of things about financial markets that confuse me these days. For example, I'm confused by the pricing of a bunch of consumer experience type stocks (high end restaurants, movie theaters, etc.). It's pretty clear to me that their current capital structures are completely unsuitable for today's environment, and they'll need to raise huge amounts of equity and/or restructure to make it through to the other side of COVID. I'm not saying these businesses are worthless; just that they need capital to make it through. That creates something of a circularity problem: if their share price is high, they can just issue stock to get through to the other side. If their stock is low, they'll need to file for bankruptcy in order to make it through (this is a simplification but directionally correct). In general, when businesses are struggling, have large fixed costs, and clearly need capital to make it through to an uncertain future, their equity is decimated and they have to file (the stock is too low to use equity to fund the business through). Today, however, the market just doesn't seem to care: it's near wide open for basically unlimited equity raises and massive dilution of current shareholders. The headliner here is clearly Hertz (HTZ), which filed for bankruptcy and made clear that their equity was almost certainly worthless yet the market was ready to buy up gobs of stock until the SEC stopped them, but there are plenty of others (for example, I think PLAY (Dave and Buster) is hitting their ATM program so hard that they'll roughly double their share count by the time they report their next quarter). But that's a tangent to what I want to talk about in this post. I think the current "SPAC bubble" is the silliest bubble we'll ever see, and it bewilders me that a bubble can even form in SPACs. There have been bubbles before, but I don't think there's ever been a bubble where investors got excited to buy into an asset class with a proven track record of failure that combined buying assets for absolute top dollar with management teams incentivized to get a deal done at any price. Let's start with the basics. A SPAC (Special Purpose Acquisition Company) is pretty simple. A group (from here on, "the founders") go to the market and say "we're really good at buying companies; give us some cash and we'll go do a killer deal." If investors agree with the founders, the investors buy into the IPO and will be given units in the SPAC. Units are generally priced at $10/unit, and each unit generally consists of one normal share of stock and one warrant exercisable at $11.50/share. The SPAC takes all of the money it raises in the IPO and puts it in a trust account. The founders then go and start looking for a company to buy. Once they find one and strike an acceptable deal, the founders go to their investors / unitholders and say "Look at this deal. It's going to be such a good deal. Vote for it!" Unitholders can then vote to approve the deal, or they can redeem their stock and get their cash back (plus whatever interest their cash has earned while sitting in a bank account). If enough unitholders vote for the deal, the deal goes through, the SPAC changes its name to whatever company they bought, and the company has effectively completed an IPO and become a normal publicly traded company. Seems simple enough, right? The bull case here is pretty simple: as an investor, buying a SPAC unit is free optionality. If you like the deal, you can vote to approve it. If you don't like the deal, you can just redeem your stock and get your cash back (or, if the market likes the deal, you can sell your stock for a premium to cash). In fact, it works out a little better than that: when you redeem your stock, you are given your cash back and get to keep the warrant. If enough shareholders vote against the deal, that warrant would be worthless. But if other shareholders approve the deal, you've got all your cash back (plus interest!) and effectively gotten the warrant for free. I get investing in pre-deal SPACs; in fact, I think doing so to get a free look at a deal / see what the warrant is worth is a really interesting strategy! So that's not what perplexes me about SPACs. What perplexes me about SPACs currently is how many of them are trading at premiums to cash value, and how enthusiastic the market has become for any SPAC that announces a deal. The enthusiasm for the space is causing a slew of new people to issue SPACs. The poster child for the current mania is almost certainly Nikola (NKLA), a pre-revenue Tesla wannabe that has seen their stock fly higher (up ~4x, with a peak of >8x) since completing a deal in June. Why is it so perplexing that the market is enthusiastic about SPACs? Well, the most obvious reason is that a SPAC is really, really expensive for an investor who holds through the deal. Remember, nothing in life is free, and the founders of the SPAC certainly aren't working for free. In general, founders of a SPAC will deposit ~5% of what they are raising into a trust account in exchange for "founder's shares" in a SPAC. This money is used to cover the SPAC's costs while they try to find a deal and in the event the SPAC is unsuccessful. In particular, this money will be used to pay the bankers if the SPAC is unable to complete a deal. An example might show this best. Say I'm raising a $200m SPAC. In general, as the founder, I'll deposit ~$5m into the SPAC for my "founder's shares." In the event that my SPAC can't successfully find a deal, that $5m will cover any legal expenses for the deal and the banker fees for helping me to raise the money. The table below might help illustrate; it's from VTIQ's IPO (which became NKLA) and shows that of the $200m they were hoping to raise, $4m would be eaten up by the underwriting fees. Remember, if VTIQ hadn't found a successful deal, investors would have still got their $200m back; that $4m would have been covered by the money the founders put in.

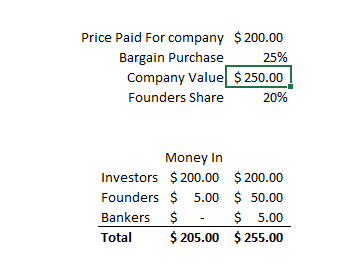

So why would founders put in so much money? Well, if they successfully find a deal, the founders are rewarded substantially for putting up the risk capital. The mechanics of it can be a little complicated, but the simple answer is that if the company successfully finds a deal, the founders will be rewarded with 20% of the equity in the deal. Just to summarize: if no deal happens, the founders cover all the expenses and are out ~$5m. However, if a deal happens, the founders get 20% of the equity. Given they just raised ~$200m, getting 20% of the equity means that their share of the deal is worth $40m if they can successfully complete a deal. Not bad for a ~$5m investment! Again, a table might illustrate this best. The table below is pretty simple. On the left is all of the money coming into the SPAC. The middle is the money flowing out if the SPAC can't find a successful deal: investors get their money back, and the founders money goes to cover the bankers and other fees. The right hand is what happens if the company announces a deal that is value neutral (i.e. they buy a company for $200m and the company is worth $200m): the bankers still get their $5m, the founders get 20% of the equity (worth $40m), and the investors get the rest of the equity (now worth $160m). Note the math is simple: I've assumed the deal is value neutral, so in all cases the the money in/out sums to $205m (the total money put in upfront; $200m from investors plus $5m from founders).

Obviously, the "deal scenario" is not a great deal for investors. So why would they vote for a deal? Well, they need to believe a deal is mammothly value creative in order for them to justify voting for the deal. Basically, you need to assume the founders bought a company for more than a 20% discount for investors to even break even on the deal (i.e. if the founders buy a company for $200m, you have to believe the company is actually worth $250m for the investors to simply break even on voting for the deal; see math below).

Again, that's all pretty simple math, and it's all been done elsewhere. So why am I writing this piece, and why do I think the SPAC bubble is so ridiculous? Well, I think incentives behind the SPACs are actually much, much worse than the simple math would have you believe for two key reasons. First, remember that most acquisitions destroy value. The reason is pretty simple: the winner's curse. When you buy a company, you're generally buying them because you were willing to pay the highest price for the company. That means if you bought a company and turned around and tried to sell it the next day, you wouldn't be able to recoup what you paid for it (i.e. the second highest bidder would pay less than you paid), and that's ignoring all the fees and expenses that come with an acquisition. There are only three ways to create value from an acquisition: have synergies with the target company that no one else does (i.e. we're in the same line of business, so even though I'm paying more than anyone else to buy you we have a bunch of cost synergies between our two businesses that make the deal worth it), buy companies outside of an auction ("proprietary deal sourcing" in private equity terms), or be able to see the future so clearly that you can selectively pay more for companies today because your vision allows you to see they'll be worth way more in the future (alpha). None of those three possibilities apply to SPACs broadly. SPACs are cash shells, so they have no synergies when they buy companies. SPACs generally don't have proprietary deal sourcing; I'm skeptical anyone really does these days, but it's tough for me to look at any SPAC and compare them to the hundreds of private equity companies out there and think that the SPAC has better deal sourcing. And, as a whole, SPACs can't have alpha; maybe one or two teams do but there's simply no way that every SPAC does (similar to how there's no way that every hedge fund / private equity firm / VC can generate alpha!). So, right off the bat, the base case should be any SPAC acquisition should destroy significant value for their investors (and this is generally born out by the history of SPACs!). If you hold a SPAC through the deal as an investor, you're basically paying 20% more than the highest price for that acquisition (the SPAC was the high bidder to buy the company, and you're paying 20% more than the high price because founders get 20% of the equity on a completed deal). But it's actually even worse than that. Remember that the founders will lose millions of dollars if their SPAC fails to get a deal through. That means that they're eventually incentivized to do a deal at any price. Most SPACs have a 12-24 month lifespan; if they don't get a deal through in that time frame, they have to return their investors money. Imagine that you're a SPAC founder and your SPAC has two months of life left. You hear about an auction for a company. Bids are due this Friday. You think the company is worth $100m. What are you going to bid? I can guarantee you're going to bid a lot higher than $100m. You need to win this deal so you can at least bring your investors something and have a chance at earning your founders shares. The ramifications for SPAC investors are pretty bad: not only were you the high bidder for any asset / deal that your SPAC announces, but you were probably the highest bidder by a significant margin because the founders knew they needed a deal and their bid reflected that desperation. It seems that the recent way to overcome this issue is for a SPAC to buy a speculative tech or consumer focused company that no other financial or strategic buyer would touch but that could be easily hyped to the masses. Again, Nikola serves as the perfect example here: a basically pre-revenue start up in a notoriously difficult industry. Maybe the company could have found some VC backers, but no strategic company was going to buy them for anywhere close to what they SPAC'd for, and obviously no private equity company could make a deal work. By being essentially the only buyer into a company that could be hyped with a crazy growth story, the current SPACs currently seem to be able to wave away the conflicts of interest and 20% management take by pointing to massive growth opportunities (who cares that you're paying 20% of the deal to management now; don't you want 80% of this potentially massive pie?). It reminds me of the old finance "joke" (and I use the term joke loosely) that it's easier to value a pre-revenue company highly because before they have revenue you can basically model their econmics, revenues, and growth as whatever you dream them to be. Once they actually start delivering products, financial reality sets in really quickly and multiples tend to constrain your valuation (I.e. "give you a $50B valuation? You only did $2m in revenue this year and $1m the year before! That multiple is crazy!!!!" versus "we value this company at $10B because they are attacking the $500B real estate industry and we expect they'll take 5% share"). Anyway, bottom line: I'm shocked by the current SPAC bubble / enthusiasm. Again, there have been bubbles before, but I don't think there's ever been a bubble where investors got excited to buy into an asset class with a history of failure that combined buying assets for absolute top dollar with management teams incentivized to get a deal done at any price. Before I wrap this up, let me circle back to why I wrote this post. A little of it was because Ackman's massive SPAC (with an interesting twist on the SPAC structure!) IPO'd today, but I mainly wrote it because of IAC's investor day. IAC trades at a discount to asset value (cash + their publicly traded stake in ANGI) despite having an incredible track record of value creation. I can't help but wonder if there's some type of opportunity there; if the market is going to get excited about SPACs predeal and price them at a premium to cash value, why can't IAC (and other companies with big cash balances) take advantage of that? It seems like it would be pretty easy: IAC could IPO a SPAC tomorrow. They could put $100m of their own cash into the SPAC (some into the founders shares, the majority just into normal SPAC units) and then raise as much capital from new investors as they could. That would create massive value for IAC: it would increase their war chest for deals, it would be (at worst) value neutral for their cash (at best, if the SPAC traded for a premium to cash, it would create some temporary value), and it would create huge economics for IAC (I'm assuming IAC would be the sponsor /founder and get the founders shares, so when they announced a deal they would capture tons of value for themselves). Just a thought. The SPAC bubble is crazy, but good investors and operators (which IAC absolutely is) tend to find creative ways to take advantage of other people's insanity. PS- one last thought before I go. As I wrap this up, Hims is seeking to go public through a SPAC. If the SPAC bubble continues, we are going to see some wild deals. It becomes something of a weird cycle: if investors are willing to price SPACs above cash / encourage deals, a ton of SPACs are going to come out. Each will compete with each other for deals, driving prices ever higher. The remaining SPACs will become more desperate for deals, and will be willing to pay higher and higher prices for sillier and sillier companies. Eventually, SPACs will start merging with completely crazy companies (we could already be there with some of the NKLA-like companies that have been announced recently) and the influx of cash will likely price out every other buyer i.e. SPACs will have so much money they'll outbid private equity and even traditional synergistic buyers). Eventually, the bubble will pop, but it could take a long time to get there....