Yet another guide to media stocks, Part 1: broadcasters $NXST

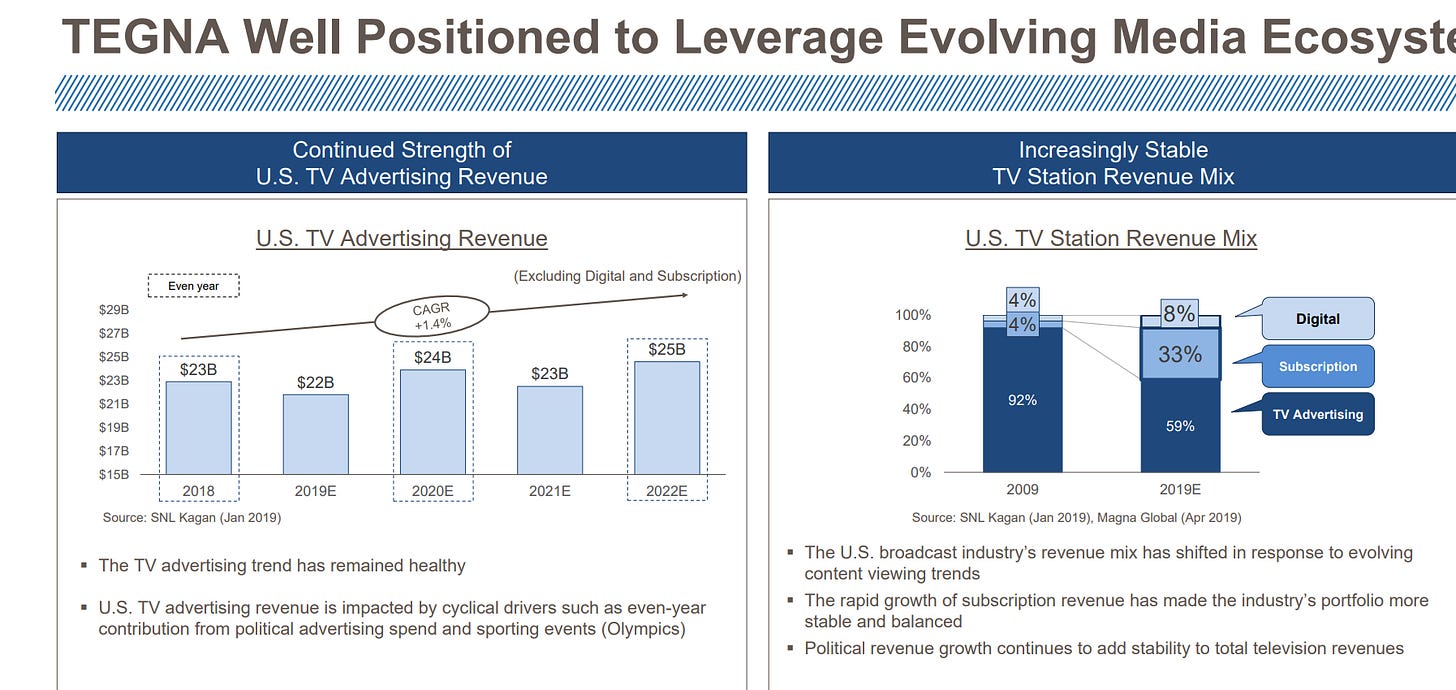

Hi! Welcome to Part 1 of Yet Another Guide to media stocks. This part will cover the local broadcasters. Before diving in, I'd highly encourage you to check out the intro section to the guide, which goes over why I'm doing this and dives into the most important thing hitting the media sector today: cord cutting. You can also find links to all of the pieces in this series here. That out the way, on to part 1: the local broadcasters. Local broadcasters Local broadcasters own the affiliate of the Big 4 Networks (FOX, NBC, ABC, CBS) in individual markets (i.e. in New Orleans, the local Fox station is owned by Gray Television, GTN). The networks provide the broadcasters with programming (think sports rights like the NFL, prime time shows like Law and Order, national news, and late night shows like the Tonight Show); in exchange, the broadcasters provide the networks "reverse retrans" fees. Broadcasters make their money from two places: distributors (cable companies and the like) pay them retransmission fees (i.e. for every one person who subscribes to the cable bundle, the cable company will pay the broadcaster fee (around $1.50-2/month)) and from advertising fees (for every hour of programming, a broadcaster gets to sell a few minutes of advertising. The network and the cable company get a few minutes for themselves as well). Retransmission revenue is relatively new for the broadcasters, but it has grown rapidly; the slide below (from Tegna's 2019 investor day) does a nice job of showing both how quickly retransmission revenue ("subscription" in the slide) has grown and how advertising revenue tends to rise in even years as political revenues pop.

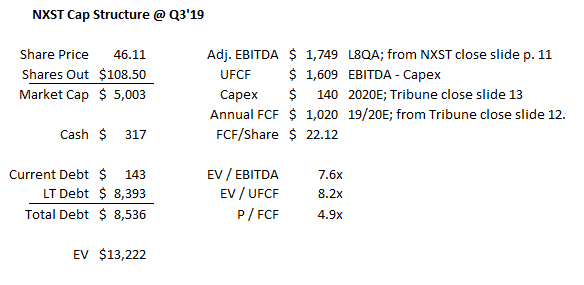

I've actually written the broadcasters up relatively extensively on the blog before (see mixed feeling on broadcasters from September 2018 and notes from Sinclair's lawsuit), so I don't want to dive too deep into them here. However, I did want to start with them because they provide a nice baseline for both valuation purposes and for understanding some of the issues affecting legacy media companies. When it comes to valuation, there's only one place to start with broadcasters: they're cheap. I don't think many people will argue when I say NXST is the best run broadcaster out there; they trade for ~8x unlevered free cash flow and ~5x free cash flow to equity. I think you could probably make a rational argument that NXST is even cheaper than I'm showing here; they just bought Tribune, and while their numbers do include some synergies from Tribune, I think there is still more upside as they full integrate the companies (NXST has historically been conservative when guiding to synergies). Most of the integration and MVPD renegotiations should be complete in 2020 (for example, on their Q3'19 call, NXST suggested that retrans would be done by Q1'20), so I'd guess there's additional upside as that flows through. Even ignoring the synergies from that deal, I think there's also some upside in the near term from retrans revenue going up in general; networks tend to get paid a heck of a lot less on a per subscriber / ratings basis than other cable channels (CBS / Via mentions that they are ~22% of viewing in the cable bundle yet command just 11% of retrans revenue), and I wanted be surprised if networks manage it increase share going forward. However, as I'll discuss in tomorrow's post, I'm not convinced that broadcasters will be able to keep any increases in retrans revenue longer term; I think it's likely to get clawed back to the networks through reverse retrans. I'll save that discussion for tmr; for now, i just want to note there's some upside if broadcasters are able to maintain any of that potential increase.

Given the broadcaster's profit is increasingly coming from retransmission fees, which are subscription like in nature, and that broadcasters absolutely spit off cash flow (capex needs are minimal; see NXST cap structure above), that valuation is really interesting. Most of the broadcasters do a nice job of running the levered equity model and repurchasing shares, which will do shareholders well at these multiples if earnings remain stable, and the low multiples are attracting sophisticated financial buyers like Apollo. 2020 will also be interesting for broadcasters; it was already set to be a mammoth year for political spend, but with a slew of billionaires increasingly trying to buy their way into office, political advertising is going to go absolutely bonkers. I have three major concerns when it comes to local broadcasters:

I don't see where they fit into the ecosystem longer term. Most of their value comes from being an affiliate of the major networks; overtime, I would guess the major networks and distributors look to cut out the middleman (the broadcaster) and keep all of that value for themselves. NXST and the like would argue that their local news product is incredibly valuable; I understand that argument, but I highly doubt that local news value comes close to explaining how profitable these stations are (i.e. say the cable company pays NXST $2/sub for the station, and NXST pays CBS $1/sub to be an affiliate. I highly doubt local news is worth the difference). I've mentioned this concern in previous articles, so I'm not going to dive into it further here.

Ok, I lied. I do want to dive into it just a little bit further. It's worth noting that broadcasters only exist because of legacy regulation. ~Fifty years ago, television was only delivered by antennae / rabbit ears. Airwaves require regulation; without regulation, everyone will just stuff a signal onto the airwaves and no one will be able to get a signal through. So regulators control who could send transmission over which airwaves. However, there are also natural benefits to scale in content: it costs the same amount to create a television program whether its watched by one person or one million. Tight, controlled distribution + benefits to scale is the recipe for an oligopoly, and naturally we eventually ended up with the Big 3 Networks (CBS, ABC, NBC). However, regulators decided that having 3 companies control all the local news across the country would create too much dominance, so they limited how local broadcasters each of the networks could own nationwide; once a company approached those limits, they'd have to sell their programming to "affiliates" (Nexstar) who would air the networks national programming but provide their own local programming. (You can find a bit of background on the regulations here and here)

Rational people can argue whether limiting the ownership levels of networks 50 years ago was good regulation that promoted diverse viewpoints or simple regulatory overreach. However, I find it silly to believe that in today's era CBS owning all of their affiliates across the country would create some type of local news behemoth. There are simply way more alternatives for both programming and news than there were fifty years ago; no one argues that Netflix shouldn't be allowed to provide their service internationally or that Fox News shouldn't be able to broadcast nationwide.

I went into cord cutting in the intro, so I won't dive further into it here. I'll just note that cord cutting is obviously a huge issue, and it's difficult to see the value of a broadcaster as cord cutting continues to play out. A huge chunk of this relates to the "where do they fit in problem" above; if someone likes CBS shows or the NFL and they cut the cord, I feel pretty confident that they are still going to seek out CBS programming (if that's their jam) or the NFL. I don't think they'll be as passionate about finding their local news team. Don't get me wrong- I'm sure they will find a local news team if they watch the local news; I just think they'll take whichever is most convenient / cheapest to them. That puts broadcasters in a really tough spot as the world goes DTC; they've been overmonetizing in the bundle, and they'll lose that overmonetization as the bundle unwinds.

I guess an easier way to put this is simply: I'm not sure how sustainable today's earnings are / what the terminal value of the business is. A few years ago, ~100m households subscribed to the payTV bundle. Today it's something like 80-85m, and it's dropping something like 6-8% every year. What happens if in a few years we've dropped from 80m to 60M? Note that this concern isn't just for local broadcasters; it's a mammoth concern for all cable channels and particularly anyone locked into longterm sports rights (like ESPN). If you agreed to pay $1B/year for the NFL assuming you'd have 100m subs and now you have just 60m, all the sudden your cost per sub for that single property is almost double what you projected.

This fits along with problem two, but I'm not convinced that this level of advertising revenues is anywhere close to sustainable. Despite continued ratings declines, advertising revenue at all of the broadcasters remains strong. Seriously, it's impossible to read a media call without them mentioning how strong the advertising market is (whether that's the spot market or the upfront market depending on the time of year). That simply can't last forever; it makes no sense for advertisers to continually pay more money for less viewers

A natural way this would end would be a mild recession drives advertising demand / rates way down.

On the other hand, there could be some revenue upside as direct to consumer apps or streaming allows for more targeted adverting (which commands much better advertising rates); however, I'd guess most of the upside to that flows through to whoever owns the consumer relationship, which I doubt is going to be a local broadcaster (i.e. if you watch through the CBS All Access app, I would guess CBS itself keeps the upside from targetted advertising, not the local broadcaster. If you watch through Hulu, I'm guessing Hulu keeps that upside). The counter to this would be if the distributer is getting more ad revenue from targetted advertising, they'll be less likely to black channels out / more likely to increase retrans fees (i.e. if Hulu is just printing money through targetted video ads, they are not going to ruin that gravy train by blacking someone out. Making more on advertising increase their bottom line / customer value and allows them to pay more in retrans revenue).

There are lots of nuances to all of those points. Some of them I've covered in previous articles, some of them have been covered well elsewhere, and many of them are still yet to be decided. But I think I'm going to wrap this article up here. I wanted broadcasters to be my jumping off point for this series because they're really cheap and I think they hit on a lot of problems facing the rest of the sector. My bottom line with broadcasters is that they're probably too cheap. The leveraged cash flow is mammoth, and most of them buy back shares pretty eagerly, which is hugely accrettive for the remaining shares. I didn't dive into here, but there's also an interesting M&A angle here, as they can all gobble each other up or eventually be gobbled up by the networks if anti-trust law ever gets more lax (I think it should; I see no reason why Netflix can be international but CBS can't own all of their stations across the country). But I have two hesitations when it comes to broadcasters. The first are all the tail risks and long term business model uncertainty mentioned above; I'm just not sure that these guys really have a place in the future. The second is on opportunity cost; CBS and FOX both trade at similar unlevered multiples to the broadcasters. That seems insane to me; CBS and FOX are, without a doubt, a better business than the broadcasters (a decent percentage of their earnings comes from broadcasters, and the rest comes from "reverse retransmission" revenue; high margin dollars the broadcasters pay for the right to carry their programming) and (IMO) have more optionality as we head into a streaming future, yet they trade for similar multiples. To drive that point home further, below is a point I have at the end of my upcoming article on the networks; I'll put it here too just because I think it highlights that optionality point well.

Just to build on that last point: I like that they (the networks) get more optionality as we move to an unbundled / streaming world. Consider a world where everyone signs up for every app / channel they want individually (Eventually they all probably get rebundled and sold by Amazon or someone, but bear with me). What does Nexstar have to offer to that bundle outside of their network programming that they get from CBS / FOX / ABC? Local news and that's pretty much it. I'm not saying local news isn't valuable, but in just about every market there are four to five good local news teams; I doubt people are itching to sign up for 5 local news broadcasts. I tend to think that gets competed away or a large player ads it as part of their content. In contrast, CBS has all of their shows, sports rights, etc. That's enough to drive people to sign up for CBS, and I'm not sure long term why CBS would let NXST take a cut of that.

To be continued.... Other odds and ends

Just to dive in a bit further on M&A: It's probably too punitive of me to give them no credit for future M&A. It's tough to find a local broadcaster deal that's been done that hasn't been massively accrettive. There's obviously a ton of synergies between two broadcasters combining: G&A is obvious, but there's plenty of revenue synergies from increased negotiating leverage from negotiating with MVPDs (i.e. the distributor is going to think harder about blacking out a station owner that covers 20 markets than a station owner that covers 10 markets). A few of the largest players don't have tons of M&A opportunities out there because they're brushing up against the national ownership limits, but several of the mid-sized players have plenty of room to go till they hit the limit, and I think the limits will eventually get raised at some point. In addition, most of the M&A has been done on an all cash basis: combine low multiples and high cash flow with lots of leverage and synergy upside, and these transactions are massively, massively accrettive to the buyers.