My mixed feelings on broadcasters $NXST $SBGI $TRCO

This will not come as a surprise to frequent readers, but the two topics I spend most of my time thinking / reading about are sports media (a recurring theme in my monthly “some things I like” is a sports media update) and the cable business (though honestly I think calling it a cable business is a bit of a misnomer as it makes people think about the legacy cable TV bundle; Charter’s (Disclosure: long) CEO refers to the company as a connectivity business and that’s the side I really think about when I say cable). The sports business and the cable / connectivity business obviously connect (pun intended) in a bunch of ways and touch tons of different related industries: the wireless companies (Verizon (disclosure: short in small size), T-Mobile, etc.), the networks (CBS, ABC, etc.), the broadcasters (SBGI, NXST, etc. who run the local big 4 affiliate and air the local news), the cable channels (Viacom, etc.), the tech companies (all the FANGs are making moves into the video business, a frequent theme of the monthly update is how the tech companies will move into sports rights domestically and have been doing so internationally, and all tech companies rely on the broadband and wireless providers for consumer access), and plenty of others.

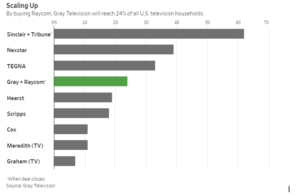

So I’ve been thinking about all of these companies in following them in one form or another for most of this summer. Outside of the cable companies, the companies I’ve thought about / considered investing in the most are the broadcasters. What makes the broadcasters so interesting is they are such a small piece of the overall media landscape (the leading broadcasters have enterprise values under $10B and reach <50% of American households) but to look at them involves touching on almost every single piece of the media business (sports rights, local news, spectrum value, cord cutting, M&A, politics, etc.).

Anyway, I’ve spent a lot of time looking at the broadcasters for the past few months and still haven’t managed to come out one way or another (i.e. bullish or bearish) on them (excluding my “avoid Sinclair” thoughts), so I figured I’d throw some thoughts out there. These are by no means definitive thoughts; they are more open ended questions as I continue to think about the broadcaster ecosystem. If you’ve been looking at the broadcasters and have thoughts on this piece / want to chat, shoot me an email (or slide into my DMs).

Let me start with the obvious: why am I interested in the broadcasters? The challenges of the legacy media companies / cable bundle are pretty well known at this point (Bloomberg is currently running a “who killed the great American cable tv bundle” feature), and the type of negativity that comes with the “death of an industry” wave of articles often leads to low valuations and can create interesting bargains. The bull case for broadcasters would look something like this:

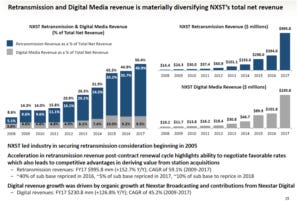

Above all, they’re extremely cheap. Most of them trade for high single digit EBITDA multiples, and with almost no capex requirements and ~half of their capital structure consisting of relatively low cost debt, the free cash flow yields on the equity are around 15%. As just one example, Nexstar is forecasting annual after tax free cash flow per share to average “a little over $13 per share” in 2018 & 2019 (due to political revenue spiking in election years, broadcasters tend to forecast a 2 year average cash flow in order to smooth out their results / valuation). Against today’s share price of ~$80/share, that obviously looks crazy cheap.

With their revenues increasingly driven by retransmission fees (per subscriber fees paid by cable companies like Charter for the right to broadcast their channel), the broadcasters’ revenues and earnings are increasingly more annuity-like versus more cyclical advertising fees.

The industry seems to be on the verge of consolidating with both financial and strategic buyers lurking. Fresh off the Sinclair deal breaking, Tribune will probably be the first domino to fall, but there will likely be plenty more.

On the financial side, I think Nexstar said it best on their Q2 earnings call. “Our sector is tailor-made for private equity, given the high margins and the high free cash flow and ability to delever quickly.”

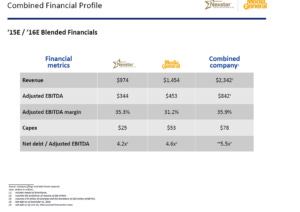

On the strategic side: whether you’re a buyer or a seller, it’s generally good to be involved in M&A in the broadcast industry as the synergies are huge. The Nexstar / Media General transaction from late 2015 / early 2016 is instructive here: the standalone companies did less than $800m in EBITDA, and Nexstar was forecasting synergies of $75m from combining the two of them despite needing to sell off some stations for regulatory / antitrust reasons; that’s a huge synergy number (and NXST actually delivered more than that)! The synergies are generally coming from cost cuts and better retransmission rates (larger size = more negotiating leverage), and because these are asset light businesses the synergies translate almost perfectly into increased cash flow. Combine that near perfect cash flow correlation with the leveraged nature of the company’s capital structure, and it’s not crazy for a deal to boost the combined companies’ free cash flow to equity by 25%+. (The recent Gray / Raycom deal had a similar synergy level, but they didn’t have a slide that laid it out quite as clearly as Nexstar / MEG so I went w/ them instead).

Potential “hidden assets” in the form of all their spectrum (even after last year’s Broadcast Spectrum auction, most of the major broadcast players still own lots of spectrum in their local markets).

Here’s what Nexstar’s CEO had to say on spectrum recently: And so, I started my career in independent television even before Fox existed and that can be a good business. I wouldn't say we want that to be our only business or our primary business, but again if you believe as we do that the next value lever for our industry is going to be spectrum monetization. And again, we believe that monetization is plus 5 years or more – 5 to 10 years before we fully monetize our spectrum assets, then spectrum in larger markets and creating a larger footprint of spectrum across the country would be attractive. So that's one thing that might not be in everybody's vernacular that would certainly be in ours. But the deal would have to stand on its own and be the most accretive opportunity in front of us before we would act on it just for spectrum purposes."

I’m not sure I believe the spectrum angle here. The broadcast spectrum auction was a bit disappointing. It also seems like wireless companies are more focused on spectrum that is higher frequency than what the broadcasters have, as higher frequency spectrum is better suited for 5G.

Elections only seem to be getting more competitive, and local broadcasting is an outsized beneficiary of increased political spending. (A bonus thought along these lines: I would guess that, between the rise of #metoo, more extreme political parties nominating more extreme candidates, and the ease of saying something stupid on the internet, the rate of political scandal in the future will increase. That likely means more special elections and more seats without an incumbent running, which could serve as another mini-tailwind for political spending going forward).

As mentioned in my MSGN (disclosure: long) write up, sports betting is coming, and it’s going to be rolling out on a state by state basis. The initial waves of sports betting advertising will likely focus heavily on local sports TV advertising, specifically the local NFL games (which the local broadcasters air, which should benefit advertising rates.

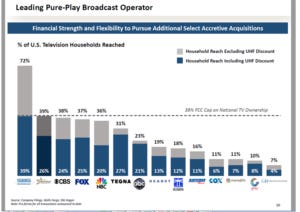

This is somewhat speculative and will touch on points discussed later, but I think the national ownership cap is pretty archaic and will be eliminated (or at least significantly increased) at some point. Broadcasters have argued this before and I agree with them; it simply doesn’t make sense to say one company can’t own a local news station across the U.S. when most people are getting their news online anyway.

All the broadcasters have talked up the future of ATSC 3.0; I’m skeptical but it is basically a free call option.

Alright, so that explains the bull case. The bear case is pretty simple: the whole legacy cable bundle is unravelling, and that’s probably not good for broadcasters.

The simplest piece of this is to simply worry about cord cutting. I get that fear, but I think you’re probably paid for it at today’s levels. Cord cutting seems to be slowing down (though maybe that’s temporary), and a lot of cord cutting seems to be driven by vMVPDs like Youtube TV offering what is effectively the cable bundle at negative margins. In many ways, the “cord shaving” that happens when someone switches from the legacy cable bundle to a vMVPD benefits the networks and broadcasters:

vMVPDs (like Youtube TV) have much less negotiating power because they have way less customers than the traditional MVPDs (like Charter), so the vMVPD generally has less negotiating leverage / has to pay more per sub. In February, CBS’s (soon to be former?) CEO noted they were getting twice as much per sub from vMVPDs versus their legacy cable contracts.

On a value basis, you could probably argue the networks / broadcasters are underearning versus smaller cable channels in the legacy cable bundle, and as skinny bundles rise in popularity the networks / broadcasters can capture some of that. Consider that the Big 4 networks earn ~$2/sub currently while something like Fox News gets ~$1.50/sub. The Big 4 networks get ~3x the ratings of Fox News, so it seems a bit strange that they get <50% more in retransmission fees (particularly when you factor in the value of their sports programming versus just how cheap Fox’s stuff is to produce).

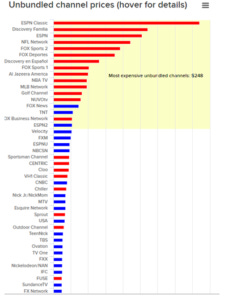

Fox News really isn’t the culprit here; I was just highlighting it because the numbers are really easy for them. I’d guess the real over earners are lightly watched channels like CMT or the Tennis Channel that clip a couple of nickels per sub but add up when thrown in bulk into a package. It’s possible some sports channels are overearning as well (the unbundled chart below is slightly stale (from this article) but pretty interesting), though I suspect live sports are the glue that is actually keeping the whole bundle together (implying they actually underearn despite their high per sub fees).

Bonus while we’re on the subject: I tweeted this out, but I can’t figure out why Fox News gets ~5x MSNBC’s retrans fee/sub despite ratings ~1.5x better. There’s a lot to unpack in that fact, but here are two things I find interesting from it. First, the government’s whole argument in suing to block the Time Warner deal was that combining a distributor with content would lead to massive consumer price increases; given how badly MSNBC (owned by Comcast, the largest cable company in America) is doing on retrans versus Fox (a pure play content company in America); only one data point, but it remains super unclear to me what evidence the government was looking at when they sued Time Warner. Second, if you’re a Comcast bull, you probably slap a simple ~8-9x multiple on the NBC side and spend most of your time on the cable side, but there’s likely a lot of upside over time at NBC as well. If you think MSNBC can close the gap so Fox only ~doubles their retrans fee (and assume MSNBC is in ~80m households), then you’re forecasting MSNBC will grow their EBITDA by ~$500m when they can adjust their retransmission rate. NBCU as a whole did $8.2B in EBITDA in 2017, so MSNBC’s retrans opportunity alone could drive 6% EBITDA growth at NBCU as the rates adjust. At an 8x EBITDA multiple, that’s almost $1/share in “hidden MSNBC retrans” value for Comcast. There may be some advertising upside here too- this article notes CNN is getting better advertising pricing than MSNBC, though demographics may play a role there and I’m much more skeptical that advertising rates would materially underprice. (Note: several people (wisely) pointed out that part of the Fox gap is driven by how “must have” it is for their viewers (if you black out Fox News, their base is cutting the cord and raising hell (and politically, every Republican from the President on down might demand an investigation), but if you blackout MSNBC most of their base is probably just switching to CNN), which makes sense on why Fox gets such a premium but doesn’t explain the MSNBC versus CNN gap, which is still massive).

So I think cord cutting is a bit overstated as a risk, and if that was the only issue I think all of the broadcasters would do really well from today’s prices given their low multiples / high free cash flow yields. Unfortunately, I have some wider fears for the broadcasters and some broadcaster specific tail risks.

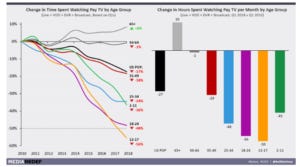

My first fear is around advertising. So far, I’ve mainly discussed cord cutting from “retransmission” side of the business. There’s also the advertising piece of the business to consider, as it makes up ~50% of revenues for broadcasters. Currently, network TV and the broadcasters are experiencing some pricing power (CBS’s most recent 10-Q notes that they concluded upfronts with “increases in pricing and volume compared” to the prior year). That seems really strange given the continued decline of PayTV watching; at some point, it seems like the decline in ratings will catch up to the advertising rates and we’ll see a correction there.

So an eventual decline on the advertising side is the first thing I’m worried about. The other big long term worry I have is that it seems like broadcasters’ value to the system continues to decline over time, but somehow they continue to increase their retransmission revenue net of what they pay their network. At some point, it seems like that trend has to reverse, and when it does the broadcasters’ earnings could be due for a swift drop.

You can really think about a broadcasters’ programming in three parts: their network programming (the primetime, daytime (soap operas and Today show type stuff), and sports programming) they buy from the major network, the local news (which the broadcaster creates and airs), and then their other programming (mainly their syndication stuff, like the Seinfeld reruns that air in the afternoons). The broadcaster makes money by airing advertising with their programming and by getting retransmission fees from their distributor (Charter or YouTube TV), and their main expense is mainly their network affiliate fees (what they pay NBC / Fox).

Why mention all that? Because the broadcaster is really negotiating with two parties (the distributor on one end, and the network on the other) and I’m trying to drive where the negotiating leverage lies. When they negotiate with the distributor, they are really doing so on the strength of their programming (“pay us or we will black out your customers and they will leave you for a competitor to find our programming”). The distributor is constantly weighing how many customers they will lose if they black out a channel versus how much the channel would cost them, so what matters in these negotiations is how many people watch your programming / would actually consider leaving if they lost it. Obviously the broadcaster’s syndication stuff doesn’t move the needle a ton here (maybe it was a slight needle mover when we didn’t have streaming, but today I doubt anyone is dropping cable channels because they are missing Seinfield reruns), so the question is how much of the value stems from local news and how much of it stems from the network programming. I know local news is quite popular, but I struggle to believe its super valuable in the negotiations between broadcaster and distributor. People get wedded to a local news team and watch the same team every night, but if a distributor dropped just a local news team (somehow they could black out only the local news but keep all the network programming on that channel), how many people would actually change their cable provider to follow that local news team? I doubt it’s a ton- if I lose my local NBC news team, I still have the option of changing channels to watch my local Fox, ABC, or CBS news team. If you follow cable closely, you’ll know Charter has talked about investing in local news as well, which would add yet another option if a local broadcaster was blacked out (sure, we blocked out your local NBC team, but why not switch offer and watch your local Charter team?). With that many local news alternatives and the difference between one news team to the next pretty low (Fox News viewers probably won’t switch to MSNBC in a blackout; I doubt the same is said for local broadcasting teams but I’d be interested in being proven wrong), I doubt the local news piece makes a huge difference in negotiations. Also, I’ve been focused on the switching from news team to news team piece here, but it’s worth noting that local news ratings seem to be declining rapidly, which makes tons of sense given the ease of checking online news. Those ratings declines further call into question the value of local news in the negotiations with distributors.

Contrast local news with the network programming. The headliner here is certainly football and sports: if you blackout a major network (or their broadcast affiliate), customers will be switching in droves if they have a competitive provider who carries the football channel (I believe it was CBS’s CEO who quipped that there was a reason every distributor caved in contract negotiations the Friday before football started). Popular network shows have some power here too (if you’re a fan of The Good Place and NBC gets blacked out, The Big Bang isn’t really going to cut it as a substitute), but given the proliferation of streaming the headliner here is really the sports packages.

So what drives broadcasters negotiating leverage against distributors really appears to be their networking programming. That puts them in a strange position: over time, shouldn’t the network be capturing all of that value for themselves? What negotiating leverage does the broadcaster have against the network? Currently the main leverage of the broadcaster seems to be “you (the network) have to deal with us (the broadcaster); FCC rules prohibit you from reaching more that 39% of the nation with your own station” but will that really hold? What happens if the FCC does away with the nationwide cap? Would the networks buy all their local broadcasters in an M&A frenzy in order to clean up their structure and launch direct to consumer products with less limitations, or would the networks simply negotiate directly with the distributors once the local broadcast contracts had expired?

Consider what happens with vMVPDs currently: the networks (CBS) collect from the vMVPD and then pay the broadcaster their share (source: Tegna at JPM May 2018 conference). If the network’s programming is generating most of the value, and the network is collecting directly from the vMVPD and then handing the broadcaster their share…. How hard is it to cut the broadcaster out over time? How much value is the broadcaster really adding there (aside from their legacy position in the media landscape)?

Or what happens as the networks go direct to consumer over time? Currently, CBS pays their affiliates a fee for everyone who signs up for their All Access pass (it seems like most of their affiliates have signed up for the program, and they get 10-15% of the monthly charge), but over time as more consumers go direct doesn’t CBS press their broadcasters hard to reduce the broadcaster’s share of that fee? If most consumers are viewing either directly on an app like All Access or through a vMVPD over time, doesn’t the temptation for networks to bypass broadcasters increase over time? (A random thought here: most of the broadcaster’s “value add” comes from local news, whose value expires almost the moment it airs. Is that a great fit for a DTC media app? I could be convinced either way. On the one hand, things that pull you in to watch live like local news and sports are great for driving engagement; on the other hand, the network apps will generally be targeting nationwide audiences with big content or national sports events, so a local news product seems like a better fit for something like Twitter or a local market news / events bundle, no?) (one more random thought: if every network and major media company is going DTC, where does that leave broadcasters long term? Most of them have the right to launch DTC apps, but if in the long run they can’t carry network programing, does anyone really care about them?).

Anyway, I don’t have any answers to a lot of these questions; I was more throwing them out to start a discussion than make a definitive pronouncement / view. And it’s 100% possible I’m off on the power of local here; Nexstar makes a pretty vigorous defense of local news programming in their Q4’17 call. The whole thing is worth reviewing but the headline quote here is probably- “we think the value proposition of our local content is equal to, and perhaps greater than, the value contribution from our key network content.” I think that’s crazy / he’s talking his own book, but maybe that’s because I’m a cord cutter who doesn’t really watch local news. If the Nexstar CEO is right, the broadcasters are probably all screaming buys!

Other odds and ends

It is possible I’ve undersold the cord cutting risk here. If cord cutting continues, at some point there will be an inflection point where the whole bundle collapses on itself due to price. An example probably shows this best: right now, ESPN pays something like $2B/year for Monday Night Football. ESPN has around 86m subs currently, so MNF costs them ~$23/sub (annually). In 2011, ESPN had ~100m subs, so the same contract would have been just ~$20/sub. If ESPN loses another 14m subs over the next ~7 years, suddenly the cost per sub of that one contract is approaching $28/sub. The more subs they lose, the more the contract costs them per sub. In order to afford that, ESPN needs to jack up their per sub pricing, which drives the cost of the whole bundle higher. Higher bundle pricing leads accelerates cord cutting, which makes the per sub cost of the contracts even higher, which just feeds into a crazy cycle until the whole thing breaks. I think we’ve stabilized for now, and it seems like cord cutting would really need to accelerate to hit the “collapse on itself due to price” point, but it is definitely a risk at some point.

Speaking of the NFL, the NFL itself probably poses some type of tail risk for broadcasters. All of the NFL’s TV packages (Sunday, Sunday night, Thursday, and Monday night) end in 2021 or 2022. The old deals were signed in ~2013, so they’re generally way under market, and I would guess the bidding war for the next deals are going to be insane. Fox’s bid earlier this year for Thursday Night Football is probably instructive: they paid a 47% premium to the prior season’s rates for a package that was “bleeding hundreds of millions of dollars” and had experienced a big drop in ratings. That new NFL contract presents two risks for broadcasters: first, what happens if you own a network and it loses the NFL completely (i.e. if you have the local NBC station and NBC loses football)? I’d guess you’re probably ok (ABC doesn’t have football), but if you think having football has positive benefits across a network (football doesn’t just help with lead ins to shows after it, but the advertisements and cross promotions on it boosts the local news and such on that show) it could result in some uncomfortable rate and ratings conversations. But the bigger risk might be what happens if your network keeps football- the networks are going to have to pay for the increased NFL rights fees somehow, and the easiest place to do so is probably to lean on their broadcast affiliates and demand a bigger chunk of the retransmission pie.

Related: I mentioned in my July links that I was really interested in the Dish (disclosure: sadly long a bit) Univision blackout. Blackouts from cable operators are rare but not unheard (particularly for DISH), but this one felt a bit different. Dish noted Univision was asking Dish to pay double what Univision’s DTC app cost and that Univision was looking for a huge price hike despite declining ratings and failing to secure the world cup. Dish’s founder, Charlie Ergen, seemed to think this black was different as well; on Dish’s Q2 call, he noted this negotiation was “probably an inflection point” and that customers were “satisfied with what they get off and they have Netflix.” I don’t think the “inflection point” means we’re close to the bundle collapsing, but maybe it does mean that distributors are going to be pushing back harder in negotiations and we’re about to see an uptick in blackouts. And, to go back to the previous point- if your network losses the NFL and we’re in a new world where blackouts are more frequent, are you exposed to increased blackout risk?

I mentioned it seemed like advertising rates have to come down over time given the drop in ratings across the board for linear TV, but it is interesting to note that (similar to what’s happening with online retailers realizing they need store fronts) a lot of online businesses are realizing the power of TV advertising. RDFN’s Q2 call includes this (from their CEO) on their marketing programs, “Over the past three months, we've completed a new analysis based on four years of testing TV ads in some markets but not others. In some markets running for only one year and another is running every year. This analysis has convinced us that a 2015 TV campaign is still lifting 2018 sales. We now believe the campaign's we launch in the next 12 months can have an effect that reaches to 2021 and beyond.” They go on to follow up and say they plan on increasing their TV ad spending.