Bob Evans and the Conference Call Question of the Year $BOBE

Bob Evans is selling off their restaurant side

The conference call was hilarious

They're probably roughly fairly valued around today's prices

Bob Evans (BOBE; disclosure: very long) has been a very large position of mine for some time (I posted the full thing over on SumZero; I believe you can access the write up w/ or w/o a membership). I wasn't going to mention it on here, but the conference call was so funny that I felt like I had to highlight it.

Some background: BOBE is selling off their restaurant side to Golden Gate and becoming a pure play CPG company. To help walk investors through the sale, they held a call yesterday and gave an overview of the standalone business and some other details investors might be interested in. Then, they opened the call to questions. All was normal until "Gil McClanahan of WCHS-TV" came on the call.

The questioning started out pretty normal. Gil wanted to know if Golden Gate buying the restaurants meant the "Bob Evans Festival" (actually, he didn't know what it was called exactly and asked for clarification there) would continue to be held. Then, he asked for confirmation that the restaurants would remain open and people could continue to go eat dinner there that night.

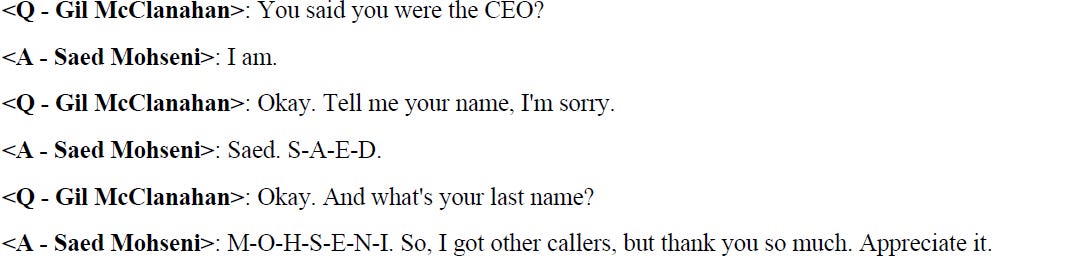

Things started to devolve from there. Gil started to ask for clarification on what the management's role in the new company would be. He seemed confused by the difference between managing and owning a company. After constant reassurance that Golden Gate would own the restaurants and the management team would continue to manage / operate them, Gil made the CEO confirm he was the CEO and flat out asked him what his name was. The full exchange is below.

Look, I absolutely get that transactions can be complicated for people who don’t deal with them in their day to day lives. But this isn’t about someone being confused about a deal; this is about someone who didn’t do any work or have any understanding of a transaction coming on and wasting everyone’s time.

Obviously, that exchange is hilarious, but it’s a symptom of a larger problem. Earnings calls are needlessly long. Management teams spend half the time just reading their earnings press release, and with exchanges like that you can’t really blame them- there’s a decent chance a bunch of their listeners haven’t even read the earnings release.

I know a lot of investors get frustrated that many companies only let sellside analysts ask questions, but can you really blame them? A lot of the small companies I follow open up their questions to everyone, and a good deal of the questions tend towards the super basic; many of them come close to “remind me again what business you’re in?” Could you imagine how awful the questions would be if some oil giant opened their Q&A up to the press and some environmental focused journalist used the opportunity to just rip into management for 15 minutes?

So I’m all for continuing to limit earnings call access. I’d suggest companies limit it to just analysts they know follow the company and investors they are familiar with, though I’d also suggest they continue to open the lines up to Wayne Enterprises and Gutterman Research.

And since this post was originally about Bob Evans, I might as well provide some updated thoughts here. I still own a lot of stock, but I think it’s relatively fair valued around today’s prices. I was a bit disappointed in the sale price on the restaurant side: I thought there were early signs the turnaround was on track, and I don’t think Golden Gate is paying too much more than the value for the restaurants (a few years ago, Golden Gate bought Red Lobster for $2.1B and immediately did a sale leaseback of their real estate for ~$1.5B; I would guess something similar plays out here). BOBE has 30 days to look for a higher bid for the restaurants, but given they are a turnaround operation I doubt someone gets comfortable enough to pay more during that short of a time frame. As for the remaining BOBE, it will be a pure play CPG business with a nicely growing side dish business with 50%+ market share. I think it's an obvious acquisition target for a lot of strategic players once the restaurant sale goes through, but I have the stock trading at ~11x next year’s EBITDA, which is probably fair-ish as a standalone company.