Cutting into Lifetime's Value $LCUT

A recent bid from a major shareholder with a history of buying companies could be the beginning of the end for Lifetime Brands (LCUT)

A strategic acquirer could likely realize huge synergies from buying Lifetime

Even absent an acquisition, shares are currently trading for a discount to their likely standalone fair value.

In mid-March, Mill Road Capital offered to buy the ~89% of Lifetime Brands (LCUT; disclosure: long) it didn’t already own for $20/share. It’s my view that the offer substantially undervalues the company; however, Mill Road has a history of starting bidding wars for its portfolio company after lobbing in bids, so I believe it’s only a matter of time until Lifetime is taken private a substantial premium to today’s share price.

In order to understand my belief that Lifetime will be taken private for a price substantially higher than Mill Road’s initial offer / today’s price of just over $20, it’s important to understand both Mill Road’s history and Lifetime as a company. I’ll start with Mill Road’s history before moving on to Lifetime.

Mill Road is an investment firm with a flexible cap structure; for simplicity, I think of them as a hybrid public / private fund (or, in their terms, the “Berkshire Hathaway for small companies”). They focus on buying stakes in smaller companies and building longer term relationships with those companies. These investments often lead to Mill Road offering to buy the company in full and take them private; Mill Road estimates they have completed more going private transactions with publicly-traded micro-caps than any other firm over the past seven years. Unfortunately, there’s not a lot of public firm level history on Mill Road, but they raised a $420m fund in late 2013; combined with the $362m of assets they already had under management, I would guess the firm is pushing $1B of AUM at this point. Despite the lack of freely available public info on the firm, we can discover a lot about them through their past actions at publicly traded firms they’ve invested in.

The most recent company Mill Road successfully engaged with was Skullcandy, a company / situation that we were invested in last year. A quick recap of the situation: last summer, Skullcandy reached a deal to be acquired by Incipio for $5.75/share; in response, Mill Road bought ~10% of the company and lobbed in a $6.05/bid for the whole company. A modest bidding war eventually broke out, and Mill Road ended up buying Skullcandy for $6.35/share after Incipio wouldn’t raise their bid above $6.10. This represented a 43% premium to Skullcandy’s unaffected price, though that somewhat underestimates the premium paid since Skullcandy also needed to pay $6.6m (~$0.23/share) to Incipio as a break fee; add that break fee in and Mill Road paid almost a 50% premium to Skullcandy’s unaffected price and ~15% over the initial Incipio deal. I mention this to highlight that Mill Road is not afraid to pay up for companies it wants / thinks are undervalued.

Skullcandy is by no means an isolated incident; an analysis of Mill Road’s other investments show they tend to end with a buyout offer. Mill Road is currently running a proxy contest at Ecology & Environment (EEI) after they bought up a stake in the company and EEI rejected a go-private offer, and they also offered to buy out Learning Tree (LTRE) in 2015 after holding a stake since 2009.

All of those investments suggest that Mill Road is willing to invest in stocks for a long time while waiting to take a company private, as well as pay large premiums for companies they want. The Mill Road investment that really strikes me as most similar to the current Lifetime offer is their investment in R.G. Barry. Mill Road first started buying shares in R.G. Barry in 2008 and offered to take R.G. Barry private in 2009 (at a 40-55% premium to the then market cap; though from depressed early 2009 prices). No deal was reached then, but Mill Road continued to raise their stake in R.G. Barry over the years and made another bid for the company in 2013. That bid eventually lead to Mill Road partnering with Blackstone to take the company private in 2014. Interestingly, while Mill Road bought R.G. Barry for $19, the proxy reveals that Mill Road’s bid lead to a competitive offer from a strategic bidder. While the strategic offer was higher than Mill Road’s ($21/share vs. $19), the company went with Mill Road’s offer because the strategic wouldn’t agree to a “hell or high water” antitrust provision. The strategic bidder coming into the auction particularly interests me because I think Lifetime could be an interesting fit for several strategic bidders.

With Mill Road’s investing background covered, let’s turn to their history with Lifetime. Mill Road first started buying shares of Lifetime in late 2013. They increased their stake in 2014 and several times in 2015, but they’ve been relatively quiet in Lifetime since then until March, when they bought up ~1% of the company the day after Lifetime’s Q4’16 earnings announcement and then lobbed in their $20 bid. So what exactly are they seeing in Lifetime?

Lifetime is a consumer products company with a focus on home products, mainly kitchenware, cutlery, tableware, etc. The company is a combination of owned and licensed brands, and they’ve got some of the best brands in the industry. Their best owned brand is probably Farberware, while their best licensed brand is probably KitchenAid (which they have licensed through 2018 and have licensed since 2000), but they’ve got plenty of other strong brands.

As you might expect, the kitchenware and tableware industry isn’t exactly a growth industry. The biggest part of being a player in the space involves having distribution / shelf space at major retailers, and Lifetime has a long customer list with all of the major players you’d expect (Walmart, Kohl’s, Target, Macy’s, etc.). A good DD trip is to go to a big box store or two and wander their kitchen / table type aisles; if you don’t find a few of Lifetime’s products, I’ll give you a full refund for this write up. In addition to their retail presence, Lifetime also has a burgeoning online presence. Below I have two screenshots. The top one is a screenshot of Amazon’s “favorite brands” in their wedding registry. KitchenAid is specifically called out (see bottom right). The bottom is a screen shot from Walmart’s online “kitchen & dining” section; Farberware was the top “featured brand” and KitchenAid was the third (the Classic KitchenAid mixer was also the #1 kitchen appliance on Walmart). You can do similar searches for a host of Lifetime brands on a variety of websites and you’ll find similar strong placements.

Given the pretty mature industry and absent acquisitions, Lifetime should really be a low single digit growth type company, plus or minus any market share gains. That assumption is relatively confirmed by recent results: organic growth was low single digit in 2016, and the company is guiding for low to mid-single digit organic growth in 2017. Margins, return on capital, etc. are all acceptable but uninspiring. Lifetime’s been pretty consistently profitable; their worst year was 2008 when they were basically breakeven but aside from that they’ve generated profits every year and thrown off some cash flow. Put it altogether, and while I wouldn’t compare Lifetime to Google or Apple, I do think Lifetime is a perfectly nice business.

So Lifetime is a decent business, but there hasn’t been a ton of change between now and when Mill Road first started building their position in 2013. So why did Mill Road decide to make a bid for the whole company now? I think there are a few reasons; for ease, I’m going to switch to a bullet form on these:

First and foremost, I think it’s a question of price and value. At Mill Road’s offer price of $20/share, LCUT’s EV is ~$375m. That translates to ~8x LTM EBITDA and ~18.5x LTM P/E. That EV / EBITDA multiple is insanely cheap for a relatively consistent consumer products in today’s market; given LCUT’s size, I’m not aware of any great pure play public peers for them, but I’d be hard pressed to come up with a single loose peer trading for below 10x EBITDA, particularly one forecasting modest growth.

As an example, I’d point to Newell (NWL) and Spectrum (SPB). Newell has several competing brands to Lifetime (Calphalon, Crock-Pot, Rival Products, etc.), while Spectrum isn’t a direct competitor but several of their brands have a lot in common w/ Lifetime’s space. Each trades at ~12x forward EBITDA with projections for low to mid-single digit organic growth. Again, not perfect, but that’s a pretty big valuation gap versus LCUT at 8x LTM EBITDA post buyout offer. At 10x EBITDA, we’d be looking at ~$25/share for LCUT. 12x would get into the low $30s.

Yes, LCUT’s P/E multiple doesn’t look super cheap in a vacuum (I’d highlight both SPB and NWL have ~20x P/Es though), but LCUT is probably a bit underleveraged. Management has guided they want to keep leverage below 4.0x; I see no reason they couldn’t consistently operate at ~3.0-3.5x (that’s what Newell, for example, targets, and they’re investment grade at that level). Taking LCUT’s leverage to 3.5x would imply room for a ~$4.25/share special dividend, or the room to buy back ~15% of their shares at ~$20/share. Levering up to do either of those would solve for that high P/E real quick.

Ok, so Lifetime looks cheap. But I think that a simple glance at LCUT’s LTM earnings might undersell just how cheap Lifetime is. Lifetime was pretty inactive on the acquisition front in 2015; however, in 2016, the company made ~$22m in acquisitions, which might seem small but is actually quite the needle mover against a ~$375m EV. If done correctly, acquisitions can be hugely accretive to Lifetime: Lifetime can buy smaller brands and immediately realize synergies by putting the brand on Lifetime’s platform (i.e. don’t bring along any of the old SG&A), making the brands immediately accretive to the bottom line. Lifetime can then go and try to grow sales by pushing those brands into Lifetime’s retail / distribution network.

How much will these brands add in earnings? Really tough to estimate, but we know from their disclosures the acquisitions did $7.5m in total since Lifetime bought them in September / October (see 10-k p. F-15). With a full year in FY17, they should add at least $15m in sales to Lifetime’s 2017 sales. Assuming an EBITDA margin of 15% on those sales (Lifetime’s overall EBITDA margins are ~8%, but I assume roughly double margins here since they shouldn’t have much incremental SG&A), you’re looking at another $2m+ in EBITDA. Again, not earth shattering, but throw a multiple on that and it does start to move the needle quite a bit, and that’s not giving any credit for Lifetime growing sales by increasing distribution.

Lifetime also recently engaged in “Lifetime 2020”, which realigned some divisions and cut SG&A (among other things). Management hasn’t provided an annual cost cutting target, but they have called the program “the most important and most significant effort we’ve ever undertaken”. Results from the program should start to flow through in 2017; any incremental margin cuts from the program will make the company look even cheaper.

Speaking of margins and cost cutting, I have to think there’s some room for margin improvement here. Again, I don’t know of any perfect pure play comps, but for this company to do mid-30s gross margin (~36% in 2016) and get just high single digit EBITDA margins (~8% in 2016) seems off.

Probably the best peer I’ve found is Hamilton Brands, which is buried within the strange conglomerate that is Nacco Industries (ticker: NC). Hamilton did ~$605m in sales in 2016 and had EBITDA margins of ~8%, both roughly in line with LCUT. However, Hamilton also had 21% gross margins versus LCUT in the mid-30s. Maybe there’s a bit of accounting differences going on here that explains some of the gross margin gap (Nacco’s segment disclosure isn’t great), but it feels like Lifetime’s EBITDA margins should be significantly higher than Hamilton’s given that wide a gross margin gap.

Hamilton’s long term targets call for 10% EBIT margins (translates to ~11% EBTIDA margins) on $750m in sales. Even if you think Lifetime can just get a similar bump in margins, you’d be talking about a pretty significant increase in earnings, and I think that might be conservative once you look at the large peers discussed below.

Turning to the larger peers:

Before they were acquired by Newell, Jarden was doing ~33% gross margins and getting mid-teens EBITDA margins.

Newell is getting high teens EBITDA margins on 36-37% gross margins, and Spectrum Brands is in the same neighborhood.

Newell is particularly instructive for margin benchmarking. The company reinvented themselves in 2011 and managed to ignite growth while simultaneously expanding margins. The image below (pulled from one of their IR presentations) shows the fantastic results; I believe the same opportunity could be hiding at Lifetime.

Tupperware has similar products and gets high teens EBITDA margins. The business model is obviously completely different, but I mention it just as another proof point that these businesses can do much higher margins than LCUT is currently reporting.

R.G. Barry (the Mill Road take private) mentioned earlier, was consistently doing mid teen EBITDA margins before Mill Road took them private. Again, different products, but some similarities to the business (discussed further in the “synergies” section below).

I can’t help but look at the timing of Mill Road’s bid and think it was a bit opportunistic. I generally hate the words “opportunistic bid” but I think it could be the case here. Lifetime reported earnings on the morning of March 13th, sending their shares from $14.45 the previous day to close at $18.90 on the heels of strong earnings (3.4% organic growth in Q4) and guidance for low to mid-single digit organic growth in 2017. Mill Road lobbed in their offer that night; by doing so, they can credibly suggest that their offer is a 37.5% premium to the prior day’s price (which they do in their letter), not a ~5-6% premium to the post-earnings price.

To be fair, part of that big increase post earnings was likely driven by Mill Road purchasing ~1% of the company during the day to top up their position before the offer, so the price may have been a bit inflated by that aggressive offer, but I don’t think it makes much of a difference. If anything, the fact Mill Road aggressively bought 1% of the company at $17-18/share right before the offer provides another strong indication that Mill Road sees value well above these levels.

Other Odds and Ends

What’s our downside: In any event driven situation, it’s worth asking what the downside is if no deal happens / the offer is withdrawn. Normally, we’d just use the price from the day before the offer (~$14.50). However, as mentioned above, I think the bid was a bit opportunistic and the stock price was up strongly right before the offer on the good earnings. The stock closed at $18.90 after earnings but before the offer was made public, but honestly even that feels below fair value given it’s <8x LTM EBITDA and, as mentioned above, I think we should see pretty decent earnings growth in 2017. When I fundamentally look at this company, I generally think ~$25 is a low end fair value for the company as a standalone. Putting it all together, it’s tough for me to really see any downside from today’s price on an offer break (all else equal; huge economic issues or company specific issues could obviously change that).

Hidden asset: Grupo Vasconi. Lifetime may have a small hidden asset in Grupo Vasconi. This is a publicly traded Mexican company that Lifetime owns 30% of. The shares are held on Lifetime’s balance sheet at ~$23m; however, using current exchange rates and market prices, those shares would be worth ~$32m. Again, the $9m difference between fair value and book isn’t earth shattering, but it does move the needle.

What’s really interesting about this situation is that Grupo Vasconi owns just under 5% of Lifetime (see their financials here; just search for lifetime and you’ll find they own 670k shares). Obviously, that value should be captured in Vasconi’s market cap, but it does present interesting financial levers that the company or a potential PE buyer could pull as they evaluate their bids (i.e. swapping a big chunk of the company’s Grupo’s shares for Grupo’s LCUT shares).

Management: Lifetime is run by Jeffrey Siegel, who’s been CEO since 2000. His son, Daniel, serves as President and is in his mid-40s.

I’m roughly neutral on management here. The stock is up ~250% since the end of 2000 which is nice but roughly in-line with the Russell 2000 over the same time. The recent deals are nice, but I feel like matching the index over 15 years with a company this size and with their distribution is a disappointment. I think EBITDA margins are a little low for where their GMs are and their industry, working capital swings a bit and could’ve been better managed, and overall it’s tough to look at this company without thinking that a bit better dealmaking could have pushed this to a much bigger / better return category.

The CEO is in his mid-70s. Normally I’d look at that and think it would help push him to selling in the face of activism, but with his son as President he might fight it and try to keep the company under family control. Mill Road’s letter is pretty nice on management, which could be key to reaching a consensual deal (keep the family on and they’re much more likely to support a sale).

Insiders own ~22% of the company, which I find to be the sweet spot for investors: enough ownership that management’s incentives should be relatively aligned with investors, but not so much that they couldn’t be voted out if they were hell bent on retaining control.

Synergies with Mill Road: While Mill Road’s initial offer for Lifetime didn’t call for a merger with one of their portfolio companies, I do think there are some potential synergies between Lifetime and a few of Mill Road’s portfolio companies. RGBarry is the most likely candidate, as they have a similar distribution base (national chains, department stores, etc.) and there would be some overlap between their products and Lifetime’s (mainly Bagallini and Built, but I could see a few others with loose overlap).

Synergies to a strategic acquirer: I think Lifetime would make a decent bolt on to a variety of strategic acquirers. Both Spectrum Brands (SPB) and Newell (NWL) come to the top of my mind as serial acquirers in related spaces, but I’m sure there would be several others (Conair, a private company which owns Cuisinart, comes to mind, and there never seems to be a shortage of bidders for bolt on consumer focused acquisitions). Newell was forecasting $500m in annual synergies when they bought Jarden (5-6% of sales), and they’re now targeting $1B (>10% of sales). I would guess synergies as a % of sales would be higher for a more bolt-on situation like Lifetime, but assuming a similar synergy level and a strategic acquirer would be looking at increasing LCUT’s earnings by ~75% through synergies.

In 2015, LCUT spent $900k on board fees and $6.2m for their top 4 execs. Add in ~$1m in annual costs as a public company, and you’re already up to $8.1m (~1.3% of sales) in synergies through very quickly removable overhead costs for a strategic.

Again, all of these acquisition are significantly larger than Lifetime would be, but there haven’t been any acquisitions in the industry that forecasted <5% of sales as a synergy target, further backing up that 5-6% should be achievable at a minimum.

At a recent presentation, Newell suggested they could take out 60-80% of target company’s SG&A cost as a synergy. Lifetime is spending 25%+ of sales on SG&A, suggesting a pretty high level of potential synergy.

I’ve obviously mentioned Newell a ton, but I think there’s good reason for that. The company is clearly on the prowl for acquisitions, and they think the industry needs to consolidate and they’re poised to be the consolidator. I thought the chart below, comparing Newell’s markets to the CPG market, was interesting in that regard. Newell would have plenty of overlap with Lifetime’s brands.

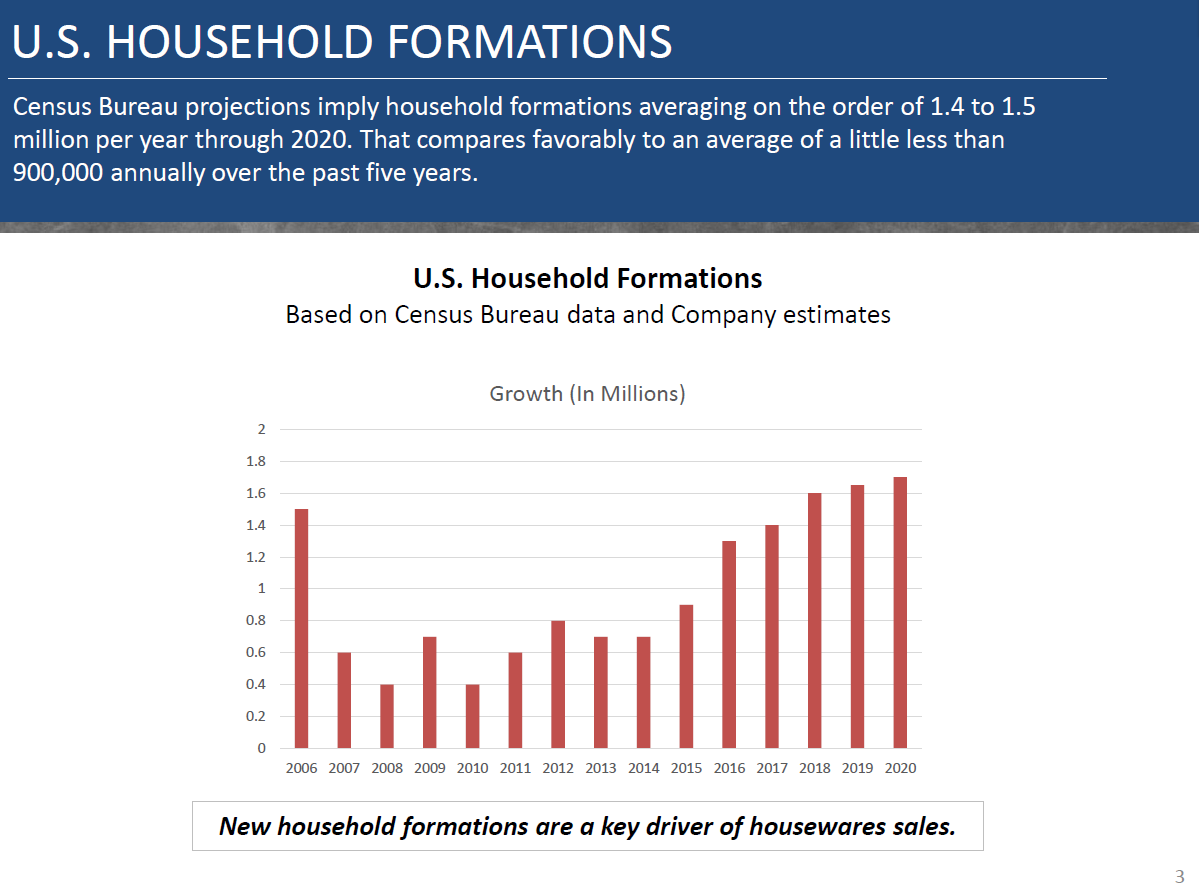

Household formation: LCUT’s sales are driven to some extent by household formation; if you think we’re still recovering from the lows of the recession, the recovery could be an added tailwind here.

Taxes: The company pays a normal tax rate (mid to low 30s), so corporate tax reform would be helpful. I tend to think a lot of the benefits from a lower corporate tax rate get competed away, but I’m sure the company would get to get some of that benefit, whether from higher net margins or lower net consumer pricing resulting in some incremental market growth.

Key risks

Unwillingness to sell- Lifetime’s response to Mill Road’s bid was pretty “blah”; as an investor, you’d probably prefer the company just announcing “we’re going to do a full auction and immediately sell to the highest bidder.” It’s possible management doesn’t want to sell, and with a 20%+ stake in the company it will be tough (but not impossible) for investors to make them if management decides to start making crazy moves to entrench themselves and avoid a sale.

Mill Road’s LCUT offer notes they are highly impressed by the company and management team and praises the CEO, and Mill Road kept on R.G. Barry’s CEO when they bought R.G. Barry (he’s still CEO). If Mill Road partners with management, a deal is much more likely.

Mill Road bid issues: Most of Mill Road’s previous offers have been for companies in the $150-200m EV range. At their initial bid, Lifetime would be a $375m takeover, substantially bigger than their previous takeovers, and if I’m right that the offer would need to be substantially increased to approach fair value, a takeover of LCUT would dwarf Mill Road’s previous takeouts, which raises questions of financing ability, probability of close, etc.

Mill Road’s top management came from Blackstone, and they partnered with Blackstone on R.G. Barry. I would guess they could structure another partnership structure if funding was an issue.

Mill Road also has decreased their bids in the past (if you read through the Skullcandy docs, they offered as high as $6.50 and then lowered their bid, and they publicly offered $20 for R.G. Barry but eventually agreed to a lower $19 price), so while I think they’d need to pay more than $20 to buy Lifetime / approach Lifetime’s fair value, it’s possible after DD they decide they need to lower their bid.

Private label: Across the consumer goods sector, a lot of big retailers are moving in with their own private labels in an attempt to both lower prices and capture some margin for themselves. Amazon has been particularly aggressive in the private label area and is making a move in the home goods sector as well. Below is a screenshot of a search for “dinnerware”; notice Mikasa and Pfaltzfraff (both LCUT brands) are sponsored and not prime eligible, while the top results are amazon basics brands that are prime elgible.

Even short of direct private label encroachment from Amazon / Walmart, those are obviously major costumers and they have no problem turning screws on suppliers in their ongoing price war. Pressure from them would hurt margins.

Retail falling off a cliff: A good portion of Lifetime’s sales are from traditional physical retailers. Obviously the on-going shift online creates some risks, both in terms of inventory management and making it easier for new brands to enter (similar to the private label risk above). So far, the shift hasn’t hurt LCUT too much, and they constantly highlight they’ve made a significant investment in building capabilities for online.

KitchenAid and other licenses: ~40% of Lifetime’s sales come from licensed brands, the largest of which is KitchenAid (Farberware is also licensed, but it’s through a royalty free license running through 2195). Losing licenses wouldn’t be great.

The KitchenAid license runs through 2018 and Lifetime has had it since 2000. I feel confident they can keep it on reasonable terms, but certainly a risk if they lose it.

The company doesn’t break out sales by brand, but they did say on the Q4’15 CC that Farberware was their largest brand “by far”, which lends some hope that even if they did lose KitchenAid or another brand it wouldn’t be too major a blow.

Economic downturn: As mentioned above, Lifetime’s products are somewhat tied to household formation. While it seems more likely we’ll see improved household formation over the next few years, any economic shock would hurt. Lifetime was basically breakeven even at the depths of the crisis, so I think they’ll be able to weather any storm, but obviously not ideal if the housing market cracks or something.

Border tax: Lifetime sources a ton of their products from China and other emerging markets. Any border tax or trade war would raise prices for their products and likely reduce demand.

Brexit: ~13% of sales come from the UK, so continued weakness there in the face of Brexit could be a small drag going forward.