Case study: Tangoe acquisition $TNGO

So sorry for the lack of posts recently; I have been working on a few things that, for one reason or another, I didn't want to post on the blog. I'd expect a few more in the near future.

Last week, Marlin closed on its deal to buy Tangoe (TNGO) for $6.50/share. We had acquired a position in the stock in late March at ~$5/share (unfortunately, it was a rather small position). Because historical case studies can be educational, I've posted my rough working thesis from late March below. Enjoy!

Tangoe (TNGO; disclosure: long) is interesting in that it hits two categories that frequently result in indiscriminate selling: it’s undergoing an accounting restatement / it’s more than a year behind on its financial filings (they still haven’t filed their 2015 10-k), and they were recently kicked from the NASDAQ + unceremoniously dropped from the indices. It’s also interesting because the company has received not one but two acquisition offers so far this year yet trades at a large discount to both of the offers. Given how long it’s been since the company’s filed financials (their last financials were from Q3’15) and the two bids at a large premium on the table, the range of outcomes here is pretty wide. The company could file financials that show the business is doing better than expected and see shares go through the roof. The company could file financials that shows the whole thing is a house of cards and sends shares collapsing. The company could be acquired for a big premium in the next month or so. Just about anything’s on the table, but I tend to think the range of outcomes skews much more positive than negative at these prices.

Let’s start with a quick overview. Tangoe provides connection lifecycle management (CLM) software and services. To simplify it, Tangoe helps enterprises manage their budget of things like mobile phones and cloud software. They’ll help companies identify and resolve billing errors, track cell phones they’ve given to their employees, accurately pay vendors, etc. An example might be best: Tangoe has specialized expense management that takes bills from vendors of large corporations, automates the process of approving and auditing those bills, and then automatically puts the bills into what allocation software the customer uses. Or if you’re an employee looking to upgrade your corporate cell phone, you’d use Tangoe’s offering to put in and manage the request.

Tangoe IPO’d in 2011. Driven by ~$82m in acquisitions from FY11-FY14, the company grew quickly, going from ~$68m in revenue in 2010 to $105m in 2011 and $212m in 2014. Things started to crack in FY15, as weak earnings and outlook in both Q2’15 and Q3’15 sent the stock into the high single digits. However, the worst was yet to come for investors. In March 2016, the company announced they would need to restate their financials for FY13&14 plus the first three quarters of 2015 and they wouldn’t be able to file their 2015 10-K. It’s now more than a year later, and Tangoe still hasn’t been able to get their financial house in order or file their financials. In fact, other than telling us how bad the restatements will be and providing updated cash and debt balances, Tangoe has provided investors exactly zero updates on how their business is performing. Sales could be down 75% or up 4x and we’d have no real idea. In response to TNGO’s continued inability to file financials, Nasdaq decided to kick Tangoe off the exchange on March 10th 2017 (effective March 14th).

Ok, so things obviously look awful from a reporting / information standpoint. So why do I think there could be opportunity here?

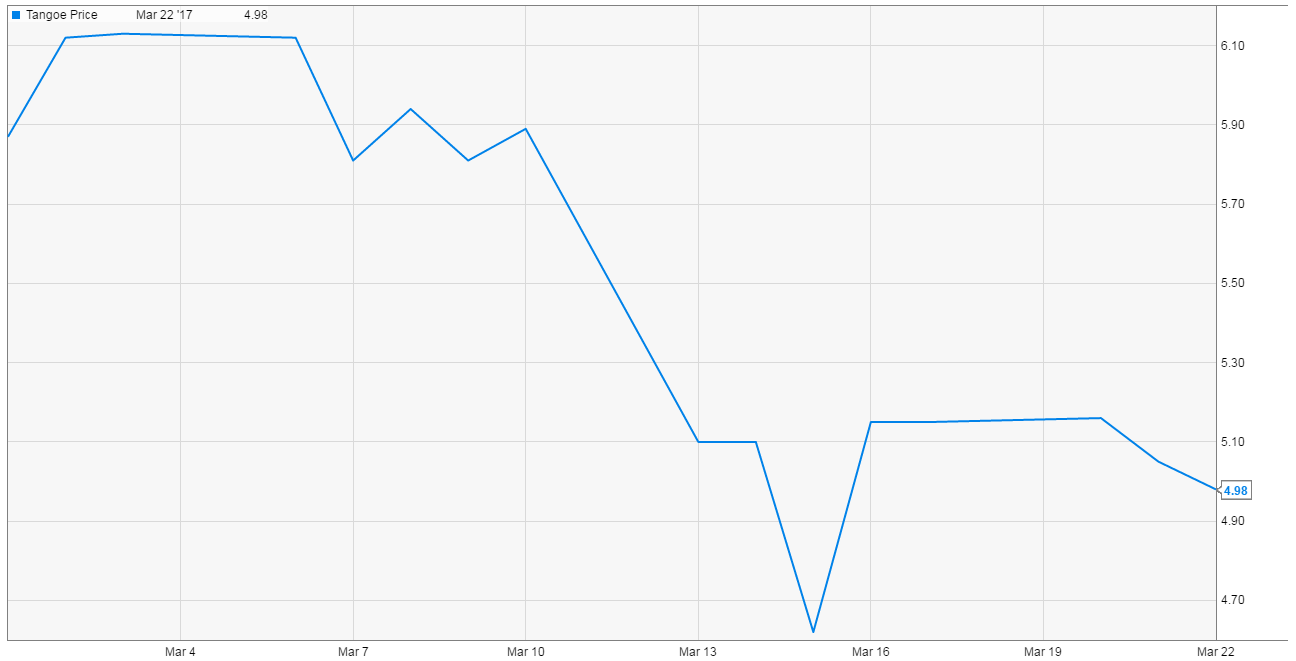

First, the exchange kick has likely created a bunch of uneconomic selling. Some funds simply can’t own non-exchange traded stocks, and in addition to getting kicked off the exchanges, Tangoe was kicked out of several indices (see here and here). We can see good signs of that uneconomic selling in Tangoe’s price and volume since the kick was announced. Tangoe has traditionally traded 75-100k shares per day; in the 4 days post kick (starting march 13th), Tangoe traded 3.3m, 2m, 8m, and 2.3m shares. Over that time frame, the stock sank from ~$5.80 in the days before the kick to today’s prices below $5.

Second, we have several parties who likely have significantly better information than us who were buying the stock at levels much higher than today’s prices and who have offered to take the company private at a big premium to today’s prices. In the wake of the Q3’15 miss, two private equity firms (Clearlake and Vector) started buying up shares of TNGO at prices ranging from ~$7.00 - $8.50. They were joined by a third PE fund, Marlin, in the wake of TNGO’s initial 10-k delay in March 2015. Today, Marlin owns ~10% of TNGO, Clearlake owns 15%, and Vector owns 10%. At the start of the year, Marlin lobbed in a bid to buy all of TNGO for $7.50/share, and Clealake and Vector partnered up to lob in their own bid of $7/share. Clearly, these funds see some value in TNGO to buy up such big stakes in the market and spend the time necessary to put together bids.

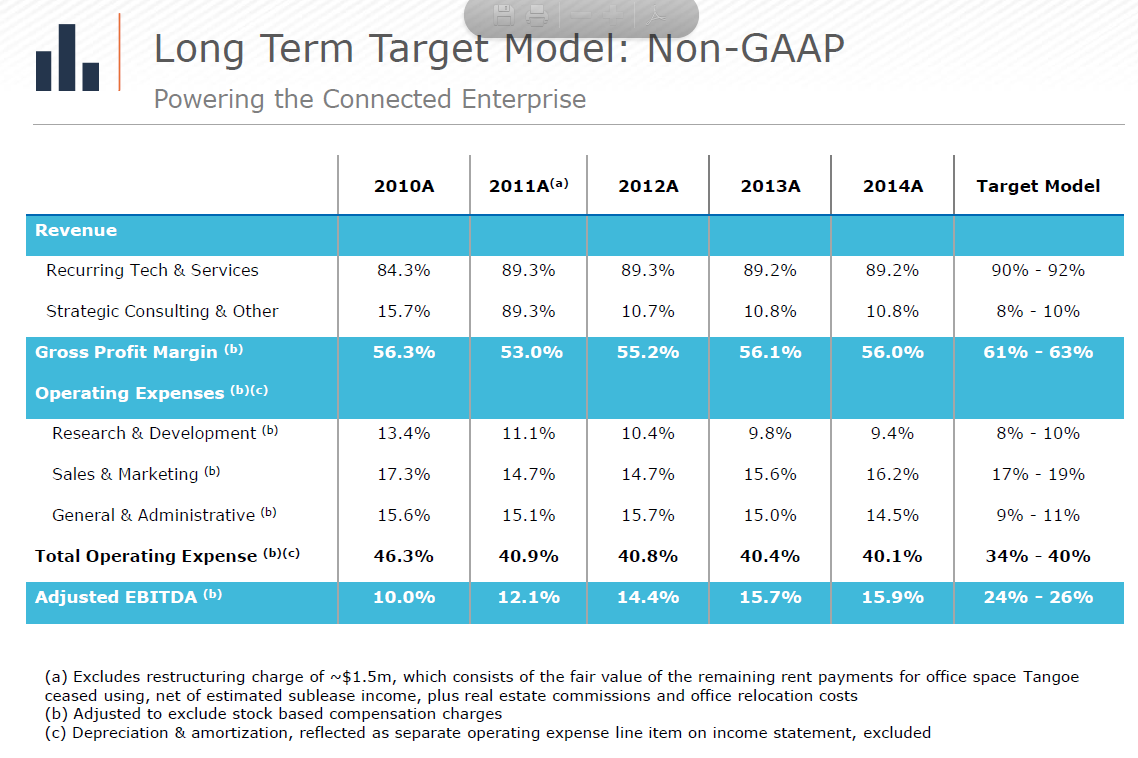

So what is it exactly they see in TNGO? I can’t claim to be an expert in the space, but there are clearly some signs of a good / interesting business here. The 2014 10-K mentions that customer retention rates are higher than 90%, and most of the company’s revenue comes in the form of recurring revenues (private equity companies love stable / sticky recurring revenues as they result in strong, consistent cash flows that you can put a ton of debt on). There are signs that TNGO’s business model would scale up nicely to generate a significant amount of cash as it matures.

If you go through old analyst calls and conference presentations, you can find plenty of other things to like about Tangoe. Of course, all of these things assume you believe what management was saying and that the restatement doesn’t change some of the things below, but in general I do think these are interesting facts / statements.

Depending on the product, Tangoe’s offerings save their customer 3-10x what they invest.

Some banks spend $50-100m/year in costs; it’s not unusual for TNGO to save them >$5m/year (Raymond James Conference December 2015)

Tangoe has 6% of the overall market and is 10x larger than the next nearest comp (Deutsche Bank Conference September 2015)

The company believes the market would support them growing mid-teens organically over a multi-year basis (Deutsche Bank Conference September 2015)

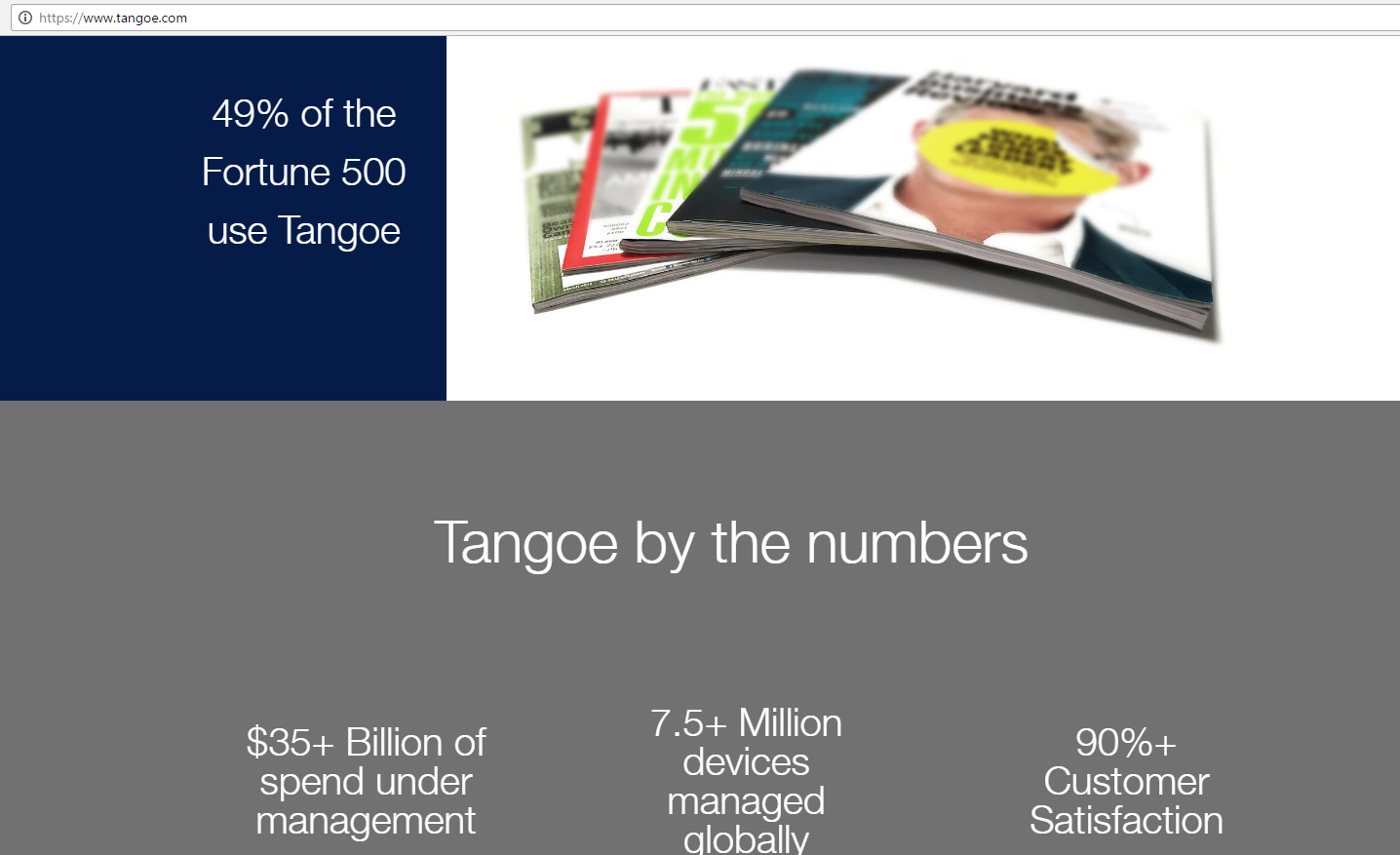

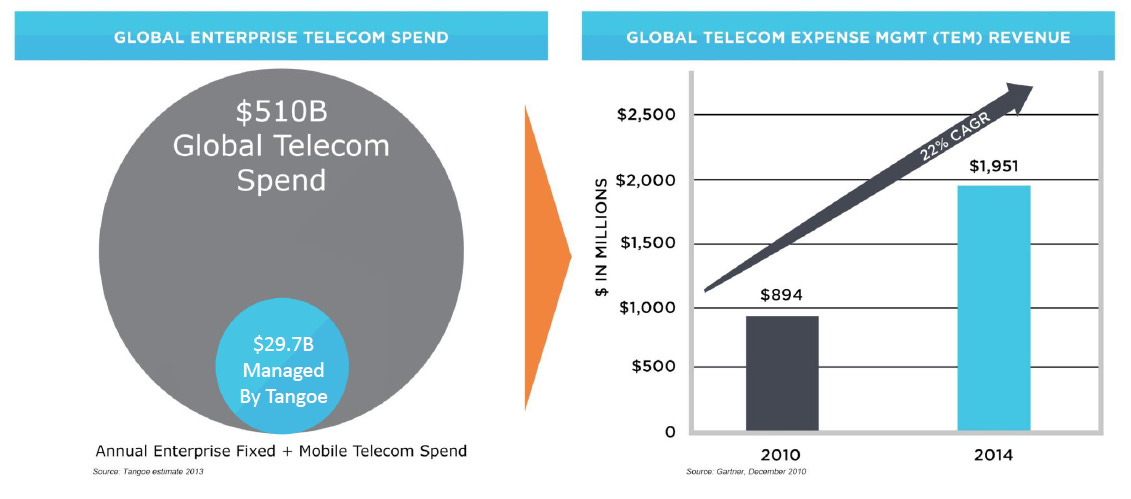

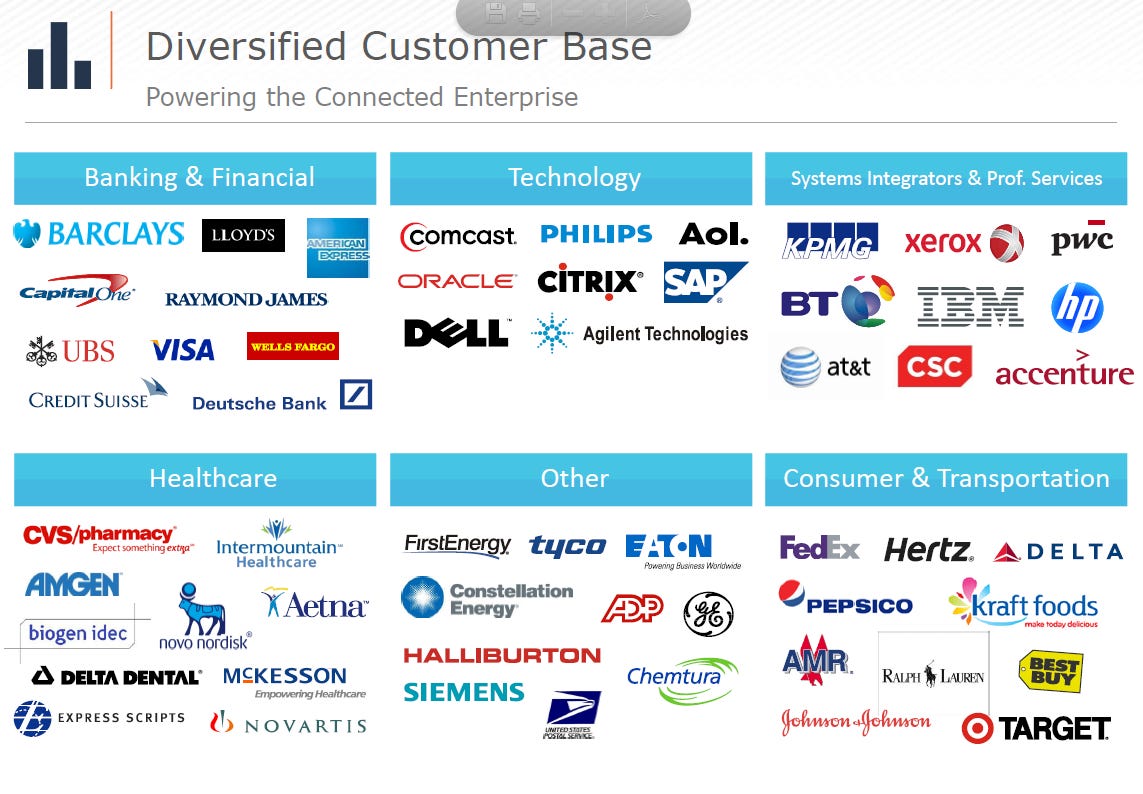

Tangoe manages >$30B in spend for their customers. (The chart below is from March 2015; they were over $30B by the second half of the year)

I also think the activist have to be thinking a bit about the price they’re getting here as a relative bargain. At today’s price of ~$5, TNGO is trading for a market cap of ~$200m. The company has a bit of excess cash on their balance sheet, but for ease we’ll just assume market cap = EV. Obviously we don’t know how the company is performing, but given 90%+ customer retention our best guess as a base case is probably that the business currently looks about like it did in the most recent twelve months of financials we have (i.e. for the twelve months ending Q3’15). After the restatement, TNGO did ~$210m in LTM revenue. TNGO was doing ~53% GMs before the restatement; if we assume all of the restatement revenue drops straight down as a reduction in gross profit (probably a bit aggressive; roughly 50% of the restated revenue will be recognized in later periods), they’d become a ~50% GM business and have done LTM gross profit of ~$105m. Clearly the business has hair on it, and SG&A expenses are real, but a PE firm has to be looking at the ability to buy $105m in gross profit for $200m today (or $275m at $7/share) and licking their lips at the cash flow they can turn that into after cutting SG&A to the bone. Tangoe also sells to >30% of the Fortune 500; for a strategic, access to a software product with recurring revenues embedded in a significant amount of the Fortune 500 is probably worth a significant amount of money just for the cross selling potential alone.

Ok, so the price looks quite cheap and the company has some signs of being a good business / something private equity looks interested in. That’s a nice start, but this is also a space that has been very active with deals / M&A / funding recently, which can help spur a more competitive auction. P. 18 of TNGO’s last (2014) 10-k listed 3 direct independent competitors (Calero, MDSL, and Telesoft) as well as 5 independent software vendors who had cloud expense management solutions (Aptio, Cloudability, Cloudyn, Cloud Cruiser, and Cloud Checker). A bit of googling tells me that, of those 8 companies, all but MDSL and Calero have been involved in some form of deal (IPO, take out, or VC raise) in the past 18 months or so. Of particular interest are the 2 direct independent competitors, Telesoft and Calero. Telemark was acquired by Sumeru Equity Partners (SEP) last August, which helps confirm the overall PE interest in the space. But Calero is even more interesting; they were formed in late 2013 by merging 3 independent TEM players (Veramark, Pinnacle, and Movero (itself the result of a rollup of 3 companies)) into one company backed by… Clearlake Capital, the same firm that currently owns 15% of TNGO and is bidding to buy the whole thing. While Clearlake is bidding with Vector, the fact the helped three independent firms merge just a few years ago provides several clues to how Clearlake’s thinking, suggests they like the space, and provides an obvious path to a strategic merger between Calero and Tangoe in the long run. For Clearlake to tell Tangoe in their acquisition proposal, “We believe Tangoe has exceptional people that have built strong technology and customer relationships that have enabled the Company to be the largest and most noteworthy company in the TEM space” takes on extra meaning when you consider Clearlake is involved with a competitor!

It’s worth wondering: if TNGO hasn’t filed financials since late 2015, how the heck are Clearlake / Vector and Marlin coming up with the numbers to bid on Tangoe? Marlin’s most recent letter (dated Feb. 27th) provides some clues. The second paragraph mentions reviewing and having a follow-up call with Alvarez and Marsal on a Quality of Earnings (QoE) report. A QoE report is a pretty standard due diligence where an accounting firm goes through a company’s income statement line by line and calls out different things that they think should be adjusted and tries to normalize a company’s earnings for any accounting quirks. That TNGO has a QoE suggests that 1) while the accounting issues might be tough, they do have some grasp of how the business is performing and 2) the bidders are working with much more knowledge than we are and coming up with bid prices well above today’s levels.

Marlin’s Feb. 27th letter contains a couple of other interesting tidbits.

Tangoe put out a process letter on Feb. 15 asking for final bids. This suggests a real process is being run. Is it possible Marlin and Clearlake / Vector aren’t the only biddersr?

Marlin cites several other investments in the space, suggesting that, similar to Clearlake, they have a deep understanding of the space and could have some potential synergies from combining Tangoe with other portfolio companies.

Material Assumptions: with any accounting issue, particularly one that goes on this long, there’s going to be some class action lawsuits. Marlin agrees to assume those damages.

It’s also worth thinking through the little info we know about the company to try to assess how the business is doing. At their last financials (q3’15) the company had $32m in net cash. Per the most recent NT 10-K, they currently have $5m in net cash ($15m in cash and $10m in indebtedness) at March 15, 2017. So it seems like the company has burned ~$27m in cash over the past year and a half. However, that same filing says they spent $16m in severance and restatement costs through December 2016; add that back and it looks like the company’s burnt ~$11m over the same time frame. There are a couple of other adjustments that you could make to get a little more precise answer (some of that debt comes from setting up a strategic partnership with Vodafone, but if you go through the purchase agreement it looks like Vodafone also paid them some cash as part of the deal as well), but it doesn’t change the bottom line too much: based on their cash balance, it seems like TNGO is roughly cash flow breakeven to slightly below breakeven as a standalone business. While that’s not great, it suggests that the business hasn’t fallen off a cliff or anything, and that’s really good for investors at today’s prices.

Ok, so to review the positives.

The company appears to be running a process

Several major shareholders are bidding on the company. Given they have other investments in the space, they should be pretty knowledgeable about the space. And, given a process is being run and they have a QoE report, they likely have better information than us. So it’s probably fair to say they are much better positioned than an average investor to value Tangoe, and they’ve submitted bids that are significantly higher than today’s prices.

The company was unceremoniously kicked from indices and exchanges, likely resulting in significant forced selling.

At today’s prices, it’s not really clear how much downside given the recurring revenues and potential cost synergies to an acquirer. It would probably take the business having collapsed during the accounting issue period to lose money, and given their reported cash balances it doesn’t seem likely the business has fallen off a cliff.

Of course, there are plenty of negatives, even putting aside the rather obvious accounting issues.

First, while it seems the business hasn’t fallen off a cliff, it also doesn’t appear to be doing well. This is a company that was actually generating pretty decent cash flows when they were still reporting. For example, operating cash flow in 2014 was ~$20m versus just $3.6m in capex. Now, a lot of that cash flow was because a big piece of their expense structure was non-cash stock compensation (of the $19.5m in OCF in 2014, $18.5m came from stock comp), but it still seems like this should be a business that pretty easily throws off cash. For them to be burning cash right now (even after adjusting for the one time expenses) raises a bunch of questions about how the underlying business is performing. It doesn’t help that the company isn’t providing any info other than a cash balance; if they were performing well, I guarantee they’d find metrics to highlight it. Generally, when a company goes completely dark like this, it’s because they don’t want to say anything.

Second, while it’s nice to have bids way above today’s stock price, the way the bids are trending and structured don’t suggest a ton of dynamism in the process. The first bid we heard of came from Marlin on December 29th, when they bid $7.50/share. Clearlake / Vector responded with a bid of $7/share on Jan. 2, and Tangoe acknowledged receipt of both proposals. We didn’t hear anything else until Marlin’s Feb. 27th bid at $6.50, which Tangoe acknowledged on March 10.

Let’s review a few things about all those bids

Vector / Clearlake saw Marlin’s public $7.50 bid and offered $7. Then, knowing that $7 was out there, Marlin put out a $6.50 in late Feb. For these guys to publicly see other bidders higher than them and still put out lower bids / drop their bids as the process goes on isn’t exactly a sign that an “under the hood” look at Tangoe reveals a ton of value, nor does it lend great hope that there’s going to be a super competitive auction that results in a bidding war and huge premiums.

I’m surprised by the level of contingencies from these offers given how late stage the process seems to be. Vector and Clearlake, for example, signed NDAs with Tangoe in early September. I would guess Marlin’s been working with the company for a similar amount of time. Yet Marlin’s bid is still subject to a lot of DD, including a technical review, more 3rd party DD, and calls with customers, partners, and suppliers.

Tangoe’s press release March 10th only mentions the “previously disclosed, non-binding” proposal from Marlin. Maybe they only mention Marlin because marlin had a new public offer and Vector / Clearlake don’t and Tangoe had already mentioned the old Vector / Clearlake offer. But is this a sign that Vector / Clearlake have left?

The “downward trickle” in bids is quite concerning. And I can’t imagine the company is in great negotiating shape: it seems pretty clear that the business isn’t performing that well, and with 35% of the company’s stock in the hands of 3 owners who clearly want to the company sold, Tangoe probably isn’t in the best negotiating position. But price solves a lot of woes, and at today’s prices of ~$5/share I think investors are more than paid for the risk they’re taking that the accounting gets even worse / business continues to detoriate / all the bidders walk.

Odds and ends

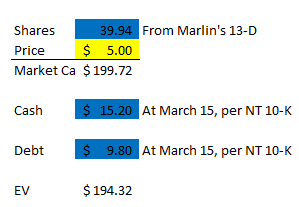

I’ve been using ~$200m as they company’s EV. You can see how I get there in the cap table below. Actually EV is probably a tad higher; I’m simply using the shares outstanding number from Marlin’s acquisition offer but not including the 2.7m in the money options or 1.7m RSUs. Obviously those bump the EV up a tad (~$20m assuming full dilution with no cash coming in from the options), but honestly I don’t think it changes the math here one way or the other.

A lot of times with accounting issues, you’ll see a ton of people abandon ship (that’s what really concerned me at ComScore). But aside from firing the CEO in May, you haven’t seen any “bailing” here. I haven’t seen any board members quitting, and the company’s interim CFO (named in April 2016) was actually appointed full time in August. I like to watch what happens w/ CFOs; sudden resignations of people (particularly ones who just joined) is generally a red flag. In this case, the interim guy being willing to go full time suggests he was comfortable putting his reputation on the line / that this wasn’t a complete house of cards.

Tangoe’s also made some top levels hires since the accounting issues popped up; again, this doesn’t mean there’s nothing wrong, but I would guess people who are looking at the company at the top level realize that there are some issues at the company and have done enough DD to ensure themselves that the company isn’t a complete fraud / they like the opportunity set. Again, anything can happen and frauds can be awfully sophisticated, but another incremental sign in the right direction.

Another fund, Sagard, started buying Tangoe right after the big Q3’15 miss (TNGO didn’t pop up in their 9/30/15 holdings but did in their 12/31/15). As of 12/31/16, Sagard owns ~3% of Tangoe. Sagard recently partnered with Fairfax to buy Performance Sports Group for $575m, so it’s certainly possible they could look to get involved bidding here as well.

Clearlake has been very active so far this year; they bought LANDESK in January and NetDocuments in March. I’m not sure if there’s a read into that- maybe they’re massively bullish and ready to do deals? Maybe they’ve already spent a bunch of their money and have shifted Tangoe to the back burner? Who knows, but clearly this is a real buyer.

Any time you have an accounting delay / stock drop that goes on this long, there’s going to be class action suits and investigations. The bids to date have made pretty clear they’ll assume this risk (provided DD doesn’t uncover additional issues), which is nice in terms of deal completion / moving some MAE overhang if a deal was reached.

Tangoe has made a ton of changes to their top management CoC agreements in recent months (here’s on in Feb; here’s one in Jan); clearly, they are prepped for a sale.

Another sign things the business probably isn’t performing too well while the accounting issues are ongoing? TNGO brought in Michael Pray as CRO in July 2015; they let him go in September 2016. You generally don’t fire a CRO because the business is growing.

I don’t put a ton of faith or credence into these, but Tangoe has consistently been in the “Visionaries” quadrant of Gartner’s Magic Quadrant for Managed Mobility Services. They also won an award for their service in 2016.

The front page of Tangoe’s website is interesting. It says 49% of the Fortune 500 use Tangoe and that Tangoe manages >$35B of spend (See screenshot below). Why is that so interesting? Because the last time I heard them talk about these numbers was on the heels of Q3’15, when they were managing ~$34B of spend and saying they served over 30% of the Fortune 500 (if you look at the 2nd screenshot below, the customers page still says that). Maybe this is just a data / marketing mismatch, but it’s possible that TNGO has actually grown a bit while they were dark / grabbed a few new customers and the new financials / outlook is going to look at lot more positive than we expect.