Brave deeper into the Liberty complex $BATRA

I’ve got a few other companies I wanted to write about, but given their shareholder webcast is early next week, my last post was on LVNTA (which I am very long), a tweet on them drew a nice response, and I am trying to convince Greg Maffei to let me race the Freeze at the next shareholder meeting, I thought now was as good a time as any to talk about Liberty Braves (BATRA/BATRK; disclosure: long).

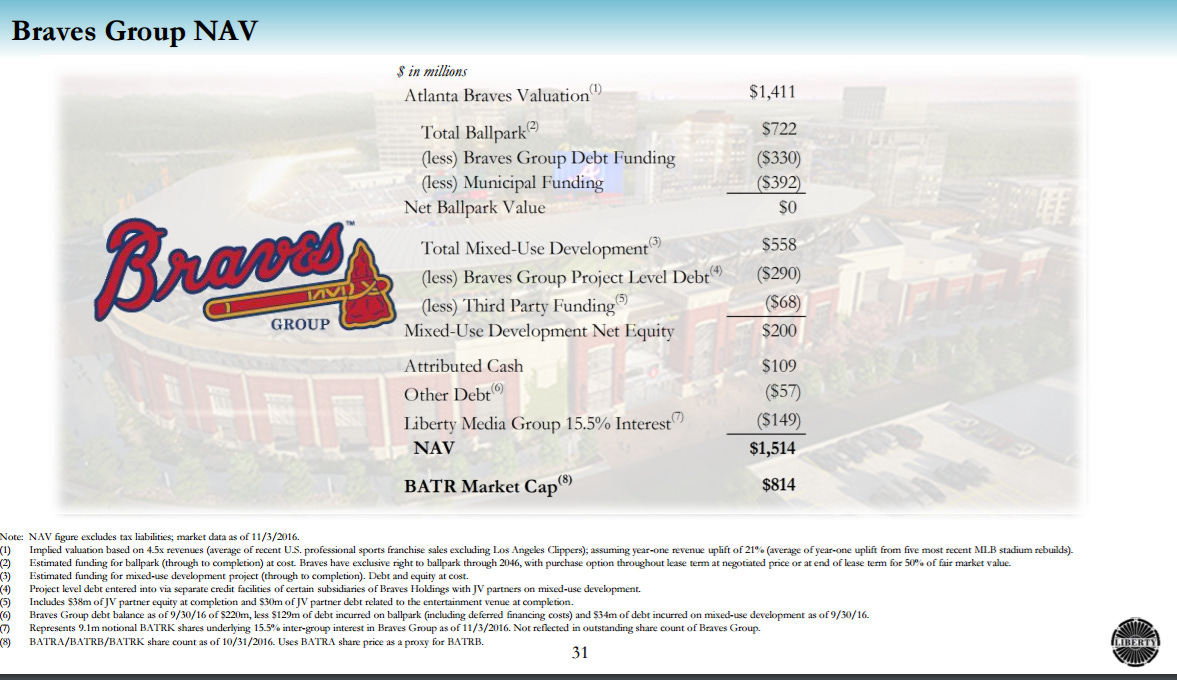

The entire Liberty complex is notoriously complex, but one of the nice things about Liberty is they’ll often just hand you a slide that shows you how to value a piece of the company (and it's just on you to verify and update). Sure enough, at their November investor day, Liberty presented the slide below.

Unfortunately for investors today (and that includes me), BATRA was priced at ~$17/share at the time versus today’s share price of ~$23/share. Fortunately for investors, that table is not exactly difficult to recreate and update with different assumptions. Here’s a Gabelli report that does just that and shows upside to $30.

I’ve spent a lot of time thinking about the Braves SOTP; in fact, I even recorded a podcast last year walking through its different pieces. And there’s one piece in the Braves SOTP that I gave the Braves credit for in the podcast and that Gabelli gives the Braves credit for that I no longer think is correct: the “hidden asset” of the MLB (technically, I only gave credit for MLBAM on the podcast, but it’s the same thinking).

Let’s start with the thesis for the hidden asset: each baseball team owns 1/30th of the MLB. The MLB is valued at $12B; therefore, the Braves have a hidden asset of ~$360m on their balance sheet. In addition, the MLB owns MLBAM (MLB Advanced Media), which has majority control of BAMTech (whose technology powers direct-to-consumer streaming services like MLB.TV (duh), HBO Now, and the WWE network). In late 2016, Disney paid $1B for a 33% stake in BAMTech. Since the MLB own 66% of BAMTech and the Braves own 3% of the MLB, the Braves stake in MLBAM is worth another ~$60m ($3B * 66% * 3%). Put it together and the Braves have a hidden asset through their MLB ownership worth ~$420m (the Gabelli piece estimates it at $450m and gives it a 50% haircut to get to $225m).

So why do I think that “hidden asset” story is off? Every team owns the same stake in the MLB / MLBAM / BAMtech. The MLB owners know that they have this stake, and I highly doubt they’re just giving it away when they sell their teams. In other words, when the Marlins sell to Derek Jeter (or whoever) for $1.2B, that valuation will certainly include the embedded value of BAMTech and MLB.

If you take the MLB hidden asset out and use the rest of the Gabelli numbers, BATRA today is worth ~$26/share. Not a huge upside from today’s share price of $23, so is it really worth buying / looking at?

Obviously, I think the answer is yes (again, I’m long). There are two reasons I believe that. The first and most important reason is that I think every American sports team in the big three sports (basketball, baseball, quidditch) is massively undervalued by analysts and Forbes. The second and less important reason is I think the Braves in particular are undervalued.

Let’s start with my first point: I think every big three sports team (actually, I’d be willing to extend it to the big five and include football and hockey) is undervalued by analysts and Forbes right now. Public analysts generally value sports teams like this: take whatever Forbes has valued the team in their most recent rankings and add a 30% premium to get to private market value. To justify that 30% number, they take the past sales prices and average them out. Here’s a really helpful slide from the most recent Braves presentation that shows what a typical analyst does.

Notice anything about that chart? A few things jump out to me

The Mariners premium was really small.

There was only one professional sports team sold in both 2016 and 2015

The Clippers premium was so massive that is has to be excluded or else you end up with silly high premiums

Here’s my theory: in the old days, team owners weren't as rich as they were now (often a team was the vast majority of their net worth), and teams were often a bit of a headache as much lower revenue numbers lead to more contentious labor fights and teams were often money losers. Today, leagues are printing money (leading to a relatively benign labor environment), team owners are often billionaires outside of their team ownership, and teams are, at a minimum, breakeven and often producing a nice profit. The combo means that there are much fewer sports teams in general for sale, and I believe that going forward when teams are up for sale the premiums are going to be startling. I’ll dive more fully into that theory in a second, but let’s address the elephant in the room: isn’t that thesis disproved right off the bat by the small premium for the Mariners?

I don’t think so. Nintendo owned the Mariners, and they made it clear they wanted a quick and non-contentious sale to their minority partners that would allow Nintendo to keep a stake in the team. Nintendo was also something of a forced seller as they “could use the infusion of cash”. A semi-forced seller who openly admits to not wanting a full auction / shop process and wants to sell to their minority owners while maintaining a stake themselves is not exactly an ideal place to find a premium. If a process that poor results in a 19% premium, imagine what a full process could have gotten.

So, Mariners aside, why do I think teams will sell for massive premiums? There is simply no supply of sports teams and the demand is high, driven by a decade long bull market and increasing accumulation of wealth by the top 1%. Again, look at that chart of sales premiums. There was one sale in 2015 (the Hawks, who were sold after an inflammatory email sparked controversy) and one in 2016. Given the Mariners weren’t really shopped widely, there was effectively one team that hit the open market in the past two years, and that was only because their owners’ hands were forced.

If we drop the Mariners and Clippers both from the average (the Mariners because they weren’t really shopped and the Clippers because the valuation was so high), then the average of the four most recent teams sold is ~60%. Most of those teams were sold under pretty desperate circumstances (the Clippers had the infamous Sterling scandal, the Hawks had an email scandal of their own, and the Kings owners had lost a ton of money; see end notes for more), but obviously a ~60% premium would be nice for any Braves shareholder today.

This "larger premium" point is further backed up by what’s happening with the Marlins right now. The Marlins are currently in late stage talks to be sold. Three groups are circling the team with a ~$1.2B valuation. The Marlins were valued by Forbes at $940m, so that 27% premium is no big deal, right?

A deeper dive shows the premium to an “unadjusted” number is actually significantly higher. The Marlins were the 2nd least valuable team (according to Forbes) in 2016 at $675m. Forbes took their valuation way up in 2017 because the Marlins had a handshake deal to sell themselves for $1.6B that fell through because the soon to be owner was named the ambassador to France. The average MLB’s team value increased by 19% in 2017 (a figure slightly raised by the Marlins ~40% jump, but not enough to quibble with), so if we assume the Marlins would’ve increased by a similar amount absent the $1.6B deal, the current $1.2B is a ~50% premium to the Marlins “baseline” value of ~$800m (2016 valuation of $675m increased by 19%).

Ok, so hopefully I’ve hammered my point home by now: the Forbes valuations and “30%” premium analysis lots of analysts like to use massively undervalues sports franchises in general. Now let’s turn to my second point: the Braves themselves are undervalued.

Let’s just start with a simple comparison: Marlins to Braves. There’s no doubt the Braves should be worth significantly more than the Marlins. The most recent Forbes valuation had the Braves valued at $1.5B as the 12th most valuable team in baseball, while the Marlins at $940m were the 25th most valuable. The Braves have the largest radio affiliate group in the MLB (147 local radio stations across the southeast) and a deep history with a national fan base dating back to when they were the only team that was nationally broadcast consistently when they were on TBS. So if the Marlins are having a bidding (during an auction described as “a star-studded group of bidders pushing up the price on a last-place team in a middling market for pro sports”) war in the ~$1.2B range, I would feel pretty comfy the Braves would see plenty of demand in the ~$2B range. (Here’s what management had to say on the Braves versus Marlins debate on the Q4 call “I would posit as a proud owner that the Atlanta Braves, one of the most storied and longest franchises in baseball, frankly in professional sports in the U.S. would be far more valuable than the Marlins, given their fan base, given their opportunity, given the new stadium, given the potential TV revenue ahead, given the breadth of the radio coverage, many, many factors that we would be more valuable than the Marlins, whatever prices they eventually printed if it is.”)

Moving past a simple comparison, I think the Braves in particular are undervalued. Forbes values teams on a revenue multiple, and the Braves’ revenue is depressed from a few angles currently.

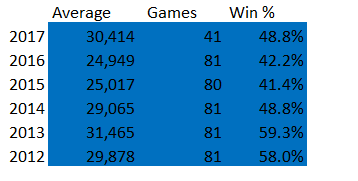

New stadium: The Forbes valuation is based on last season’s revenue. The Braves moved into a new stadium this season. In their spin off presentation, Liberty noted that the average team saw a 19% increase in the first year after building a stadium. I would guess the Braves are going to see a significantly higher increase, as YTD attendance is up 22% (through the All Star Game). That increase in revenue should drive a nice boost to next year’s Forbes value, and as the Braves get better I’d expect attendance to continue to improve. If the old stadium was averaging ~30k+ in attendance when the Braves were good, I wouldn’t be surprised to see this stadium get to 33-35k as the Braves start to turn around. In addition, the new stadium has more premium seating, so the revenue at a constant level of attendance should be higher, and I would guess the per head for ancillaries (food, drinks, etc.) are better at the new stadium, which should further boost revenue given constant attendance.

Farm system / Future is bright: The Braves are currently pretty bad. They won 41-42% of their games in the 2015 and 2016 seasons, and they currently sit just below a 50% winning percentage (though their more advanced statistics suggests they are over performing a bit right now). The Braves made a purposefully step back over the past few years to build out one of the best farm teams in baseball (ESPN has them #1 this year; bleacher report put them as #2 but basically said they were tied w/ the Yankees). As that farm system matures, their performance should increase, drawing improved attendance, revenue, and prestige.

TV deals undervalued: Both the Braves regional TV deal and the MLB national TV deal are undervalued.

Regional deal: The Braves signed a 20 year regional TV deal in 2007. It’s been recognized for years this was a bad deal that was intentionally below market and signed as part of the sales process to Liberty. We don’t know exact numbers, but it’s rumored the Braves currently get $10-20m/year from their deal; for comparison, the Yankees got $85m/year with 5% annual increases in 2012 and the Mariners got $2B over 17 years in 2013 (~$117m/year, though unsure of how that is spread out). Sports deals have risen in value significantly since the Yankees / Mariners struck their deals in 2012/13 (and particularly since the Braves deal was struck in 2007). If their contract were to end now, I would bet the Braves could sign a new deal tomorrow that would get them >$100m/year for 10+ years.

Fox’s (who owns the Braves regional sports network) Q1’17 earnings call was on May 8th, so we’re not talking about a ton of games, but they noted “Atlanta Braves ratings are up over 54% this season so far.” Maybe FOX was playing games with the numbers (I would guess the ratings for the last couple of games of a season after a team’s been eliminated from the playoffs are dreadful, so maybe we’re talking about a bit of an apples to oranges comparison), or maybe there was a small spike due to the new stadium opening. Who knows? But a ratings spike that significant further highlights what a steal the Braves current TV deal is.

National deal: The MLB’s current national deal was struck in 2012, and the value of sports rights have increased significantly since then. Remember, Forbes generally values teams on a revenue multiple, and when the last national TV deal kicked in it resulted in a 48% jump in the average value of an MLB team, so it’s possible the whole of the MLB is undervalued right now and that undervaluation will be revealed when the next TV deal is signed.

I’ll list the risks in bullet form below and wrap the write up itself here with a quick note: there aren’t many opportunities in the public markets to own professional sports teams (I can only think of three), and given the lack of direct comps and the fact most of the value of a sports team comes from capital appreciation and not actual operating income, I think a sports team is exactly the type of asset that can get undervalued in the public markets. The Braves today are at an inflection point: the team will get better, the new stadium will boost revenue, and eventually new TV deals will drive revenue much higher. Today’s share price reflects none of that.

Risks

Franchise values decline: Of all the major sports, I think football is the worst positioned long term (given the concussion issues), but baseball isn’t far behind given the snail’s pace of the game. Let’s be frank: baseball was designed by people who had literally nothing better to entertain them. Today we have smartphones and Netflix; I couldn’t see someone starting from scratch and creating a game this slow.

Esports is interesting to think about here. I do think kids today are less interested in sports than previous generations. Is that just because some marginal fans are sucked away by other avenues for entertainment? Or is the future of competition in things that little kids can relate to much faster like video games / esports?

Labor issues: There could be a strike, though that would be a little bit away as the current MLB player contract runs through 2021.

TV Deal renewal: The TV bundle which has supported regional sports networks and the giant national contracts is coming unbundled. If ESPN is on the decline, will the next deal be smaller than the current one?

I doubt it. I actually think there will be more bidders; Twitter, Netflix, Amazon, Apple, Snapchat, and Facebook could all see strategic value in something that captures this many eyeballs. I’m not saying any of those are likely, but I think the value of unique content that needs to be consumer live will continue to increase significantly.

Taxes: buying a sports team carries massive tax breaks for the buyer currently. If there’s true tax reform, that could change.

“Most of the value of a sports team comes from capital appreciation and not actual operating income”: How can someone say that? Isn’t the long term value of a business determined by its cash flow? Absolutely, but in the case of sports teams, there’s a simple trade off: you can turn them into a cash flow machine if you want by running a bare-bones operations and fielding an awful team. History has proven that’s penny wise and pound foolish: if you pour most of the team’s revenue back into the team to make the team better, you’re rewarded with higher ticket prices, more prestige, more leverage when negotiating TV deals / sponsorships, and ultimately a much better sales price when you decide to sell the team.

Odds and ends

Greg, seriously, if you’re reading this: let me race the Freeze at the next shareholder meeting. I’m ready to begin training tomorrow.

More seriously on the freeze: a ton of people are talking about him. Listen to this interview, “People will buy tickets to the Braves to watch the Freeze or race the Freeze.” This Sacramento local news network spent more time talking about the Freeze then they spent on any other sports segment; Sacramento doesn’t even have a baseball team! And the MLB had the Freeze at the MLB All Star Game in Miami early this week. Obviously the Freeze doesn’t drive franchise valuation, but I think he does bring incremental fans / eyeballs / brand prestige / merchandise movement, and just thinking him up / having him / marketing him this well is probably indicative of a well-run baseball operations team

I already discussed the Mariners and Hawks getting sold, but let’s dive into the other recent sports team sales. The Bucks and Clippers were both sold in 2014. The Clippers were infamously force sold by the league after racist rants from Donald Sterling came out, the Bucks were sold by Senator Herb Kohl who demanded that the team remain in Milwaukee and that the new owners needed to build an arena. The Kings were sold a year earlier because their owners were facing a liquidity crunch (and after a sale at a larger valuation that would’ve moved the team was blocked by the league).

My overall takeaway (as mentioned in the article): team sales are few and far between these days, and for a team to genuinely be sold on the owners’ timetable (instead of in a forced sale) and through a full process (which the Braves will run if and when they sell) is incredibly rare. The Marlins were probably the first straight sale in the past five years and they got a mammoth premium. I’d expect the same to happen if and when the Braves are sold.

This is a Liberty entity, so I have no doubt it will be sold for a full price when the time is right. However, I think that day is a long way from today for a variety of reasons.

From a premium standpoint, the Braves probably want to wait to sell until their farm system is maturing / the team is good again. It also probably makes sense to wait for the next national TV deal if you think it’s going to increase a good deal, and honestly it probably makes sense to wait even longer until the awful regional deal is at least on the horizon for renewal.

From the Liberty standpoint, I believe the Braves are their only active business right now so for tax reasons they can’t be sold in the near future. Everything should be worked out in time, but this is not a “buy and flip” type investment. I think you really need to believe in the long term story to be comfortable here. I’m fine doing that in all my investments, but it’s a bit strange to say that about a Liberty company since they generally have such definitive sale catalysts!

Also somewhat different than the typical Liberty story: I don’t think return of capital is the end game here. As the Braves improve, I would guess profit / cash flow increases go into payroll for the team. Maybe after they ramp payroll up they consider a share buyback, but I wouldn’t be surprised if they found other investments / more interesting things to do.