Liberty Ventures GCI merger set to unlock significant value $LVNTA $GNCMA

Liberty Ventures (LVNTA) trades at a deep discount to net asset value (NAV)

NAV is certainly understated

After the GCI deal goes through, LVNTA should become a share repurchase machine and will likely be acquired at a nice premium in the next few years

On April 4, Liberty Ventures (AKA Ventures; ticker: LVNTA / LVNTA; disclosure: long) announced a deal to merge with General Communications (AKA GCI; ticker: GNCMA; disclosure: long) and form a new company known as GCI Liberty. It’s my belief that, over the next few years, share repurchases and underlying NAV growth will drive massive shareholder returns, and that the merger will serve as the first in a series of steps that will see the new GCI ultimately be acquired by Charter for a large premium.

Let’s start with some basics. Ventures is, of course, part of the John Malone Liberty complex. You can find tons of background on how the company came to its current state by searching through the Malone fanboy site also known as Valueinvestorsclub.com, so I won’t go into a detailed background on its history. The basic background is that Ventures was formed to hold a grab bag of public stocks and other investments. Over time, Ventures spun out most of those interests and played a major role in funding the Charter / Time Warner Cable deal, and rapid appreciation in Charter’s share price post deal resulted in most of Venture’s NAV coming from Charter. The GCI deal will give Ventures an operating business that will allow them to shift from a tracking stock to an asset based company and give them a bit of diversification from their massive Charter position.

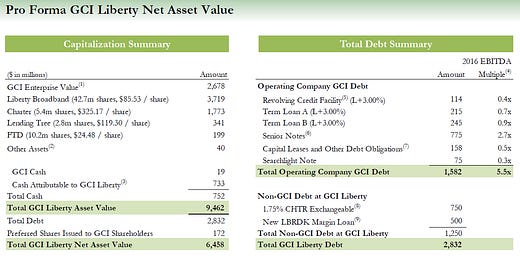

Post GCI deal close, Ventures will consist of 4 main assets: 100% ownership of GCI (the operating business), 42.7m shares of Liberty Broadband (ticker: LBRDK), 5.4m shares of Charter (ticker: CHTR), and ~$500m worth of two other stocks (2.8m shares of Lending Tree; 10.2m shares of FTD). Their investor presentation does a nice job of breaking out all of their different assets and liabilities.

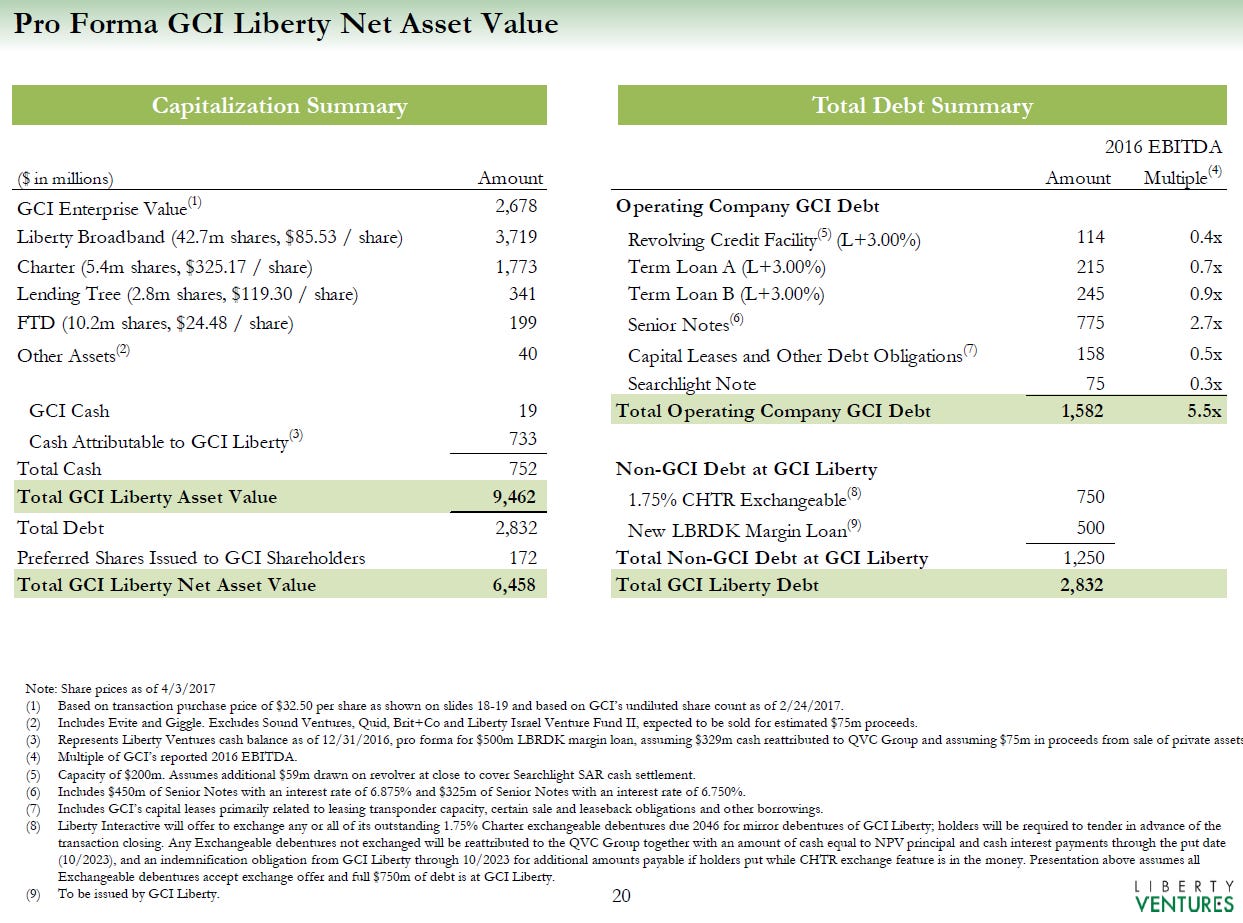

With ~107m shares outstanding post GCI close and adjusting for the share price movement of their underlying stocks (mainly TREE appreciating to ~$178/share and CHTR to ~$340/share), Ventures today would have a NAV/share of ~$63 (assuming deal close and that GCI is worth their $2.7B valuation). With shares today trading just around $52.50, investors are looking at ~20% upside for LVNTA to hit its NAV. Below you can find an updated NAV table for share prices as of 6/29/17.

That ~20% discount alone is attractive, and Liberty / Malone have a history of collapsing discounts at opportune moments so investors can feel reasonably confident that the discount will close when it makes the most sense to do so. However, I think that Ventures is significantly more interesting than a “mere” 20% discount as that discount to NAV fails to capture three things:

The NAV discount is actually slightly bigger than advertised due to a discount to NAV at Liberty Broadband and a bargain purchase of GCI.

Ventures is, effectively a levered bet on GCI and Charter, and both are poised to drive sustained above average NAV growth for years.

After the deal, Ventures will turn into a share repurchase machine, and Ventures is a clear takeout target that will likely be bought at a premium to NAV in the next ~3 years.

Point #1- discount to NAV is understated

While I think the second point is the most important, I’m going to start with the first because it’s the simplest: Ventures’ NAV discount is understated due to a bargain purchase of GCI and a discount at Liberty Broadband, and as those discounts close Ventures NAV will increase.

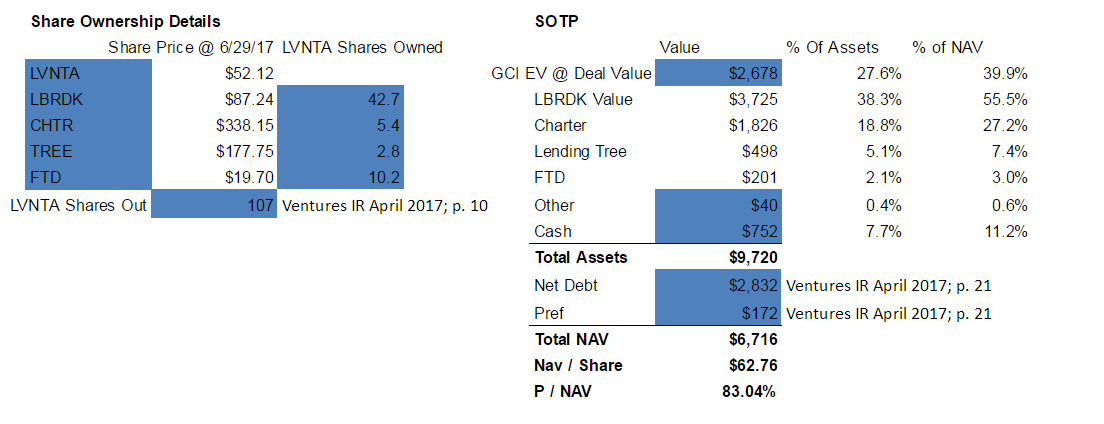

The simplest discount to understand is Liberty Broadband. Liberty Broadband is yet another Liberty tracking stock. It is effectively a pure and slightly levered play on Charter stock (see the slide below from their November investor day; Charter has run up quite a bit since then but the discount has remained similar and the asset base is the same). Management has been extremely clear that at some point they will collapse Liberty Broadband into Charter, either because Charter is bought out (perhaps by Verizon) or because Charter and Broadband do a share exchange deal that collapses the discount. Here’s what management said at the Morgan Stanley Tech Conference in March, “What ultimately will lead to that collapse is the day we merge Broadband into Charter or Charter gets bought. But I think the first is more likely than the second. And I suspect we will be able to collapse it absolutely then. In the interim, hopefully, we may decide, hey we've got a lot of borrowing capacity at Broadband. Let's take advantage of that discount. If you are a shareholder of us or anyone else, buying Broadband seems like a pretty good play compared to buying Charter. And so we may take advantage of that ourselves. We've done that before.”

So, eventually, Liberty Broadband will be collapsed and the discount will disappear. At today’s prices, Broadband trades for a >10% discount to NAV. Collapsing that discount would add just under $4/share, or >6% boost, to Ventures NAV; I feel extremely confident that discount will collapse when the time is right.

The second reason I believe Ventures’ NAV is undervalued is GCI itself. Ventures’ NAV valued GCI at ~$2.7B, or the headline price of their acquisition. However, over the next few years, I expect it to become apparent that Liberty bought GCI at an attractive price and that GCI is worth substantially more than the number that they are presenting for NAV.

Now, it might sound strange to suggest GCI is undervalued at $2.7B. After all, the deal to buy GCI was struck at a headline price of $32.50/share, which was a pretty hefty premium (~50%) to GCI’s day before share price. So why do I think GCI is undervalued?

First, I’d note that GCI is pretty heavily levered, so while the headline equity premium of ~50% seems pretty large, the premium on an enterprise basis was below 20%.

GCI purchase price out of the way, let’s turn to some fundamentals. GCI is the largest communications provider in Alaska. They’re a true quad play, offering cable, phone, and TV (their cable passes >90% of Alaskan households and Liberty estimates they have 60-75% share of cable in Alaska) as well as wireless (they’re the #2 player with ~1/3 market share).

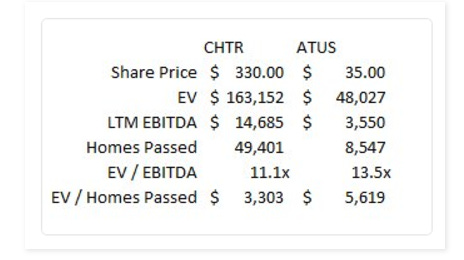

Simply on its face, GCI looks cheap versus peers. 2016 EBTIDA was $288m, and the company is forecasting $313m (midpoint of forecast) in 2017 EBITDA. At LVNTA’s $2.68B valuation, that implies GCI is going for ~9x EBITDA. That’s well below where cable peers trade at: pure plays Charter (CHTR) and Cable One (CABO) both trade for 10-11x EBITDA, and Altice’s recent IPO values it in the low teens. Those may not be perfect peers given GCI’s exposure to Alaska (whose economy is in recession), subsidies (discussed in the risks section), and GCI’s quad play nature, but they are decent ones, and Ventures is buying / valuing GCI for well below them. Greg Maffei (Liberty’s CEO, Charter board member, and John Malone’s right hand man) was clearly pretty bullish on getting GCI at this price as well. Here are some quotes from him in the M&A call announcing the deal:

“We are also very bullish on GCI”

“Now, some of you may question the issuance of Liberty Ventures shares at this price with the perception that there's a discount. But we can tell you that we spent a long time thinking about the long-term value of this deal. And, driven by the tax efficient growth of GCI and the opportunities opened up, we are very bullish that this will more than offset any value through the dilution of the issuance of these Liberty Ventures shares.”

“We're very excited about GCI's strategic plan and the one they have in place to increase their cash flows and improve their margin”

Let’s dig a bit deeper into that margin opportunity, because I think it shows how the headline EBITDA valuation might not fully capture how cheap GCI is. GCI’s EBITDA margins dropped from ~36% in 2014 to 31% in 2016, and there are several reasons to believe that margins will tick back toward the mid to high 30s over time. That margin increase will drive GCI’s purchase multiple lower and will ultimately increase NAV.

Why did margins drop over the past few years? It was driven by a variety of factors, but the two main ones were an Alaskan recession driven by falling oil / commodity prices and a renegotiation of their Verizon wireless roaming contract in 2016 (to simplify, Verizon pays GCI to utilize their spectrum / network in Alaska, and in 2016 GCI and Verizon renegotiated that deal for lower annual payments but with guaranteed payments over a longer period of time. Per the M&A call, “2016 was our very first year of setback or reduced revenue and EBITDA and that was as a result of a long-term contract that we entered into with one of our major roaming partners, which reduced revenues by $50 million on an annual run rate basis – annual accounting basis, but actually improved cash flow above that”). So what gives me confidence that margins will revert higher over time?

First, until this quarter (Q1’17), GCI reported in two segments: wireless and wireline. The segment names were a bit misleading because the wireline business included their consumer wireless business, but bear with me. The wireless business offered wholesale wireless services to other carriers. The wireline business is the quad play cable / wireless telephone company. In 2016, the wireline business had 22% EBITDA margins, down from 26% in 2014. I cannot find a single telecom company with EBITDA margins that low, and given GCI is basically a monopoly cable player in Alaska, it’s shocking their margins would be so far below peers. For example, Shentel (SHEN) has a small regional cable offering and that segment does low 30% EBITDA margins. Cable One (CABO) is a regional cable provider with 44% EBITDA margins. There’s no reason for GCI’s margins to be so far below peers long term. Over time, margins should revert towards to low 30s in this segment, driving a significant earnings increase

Why are margins so low? A big piece of it is that GCI is effectively a roll up of different Alaskan telecom companies, and the integration of all the different units hasn’t finished. For example, until Q4’16, the company was operating four different billing platforms. The consolidation of those billing platforms will save the company $5m/year plus simplicity “for both our customers and the hundreds of front-line employees that used them.”

Again, quoting from the M&A call could be helpful here; here’s GCI’s CEO (note that the margins he’s referring to are companywide, not segment specific as I focused on above):

“We've put together a large collection of different technologies in a race to grow the company over the last 20 years and we're now going to streamline that and extract efficiencies by simplifying the network, simplifying our operations, implementing a new billing system and increasing the margins. Today, our margins are on the low end of what the industry does in the low-30s. We think there's lots of room for margin growth. Our capital intensity is declining, so there's an opportunity for free cash flow growth beyond that, and we're delighted to be able to do that within the ambit of the new GCI Liberty venture.”

“I think the primary theme for GCI over the next two or three years is simplification and streamlining. We built the company very rapidly, deployed a tremendous amount of assets over the last 10 years. We got into the wireless business by acquiring multiple entities and multiple technologies. In addition to being the only cable operator in wireless, we may be the only wireless company in the country that operates every single wireless technology in existence. We are now phasing down to a single network, rationalizing all of that on LTE technology, and simplifying the network going forward. We're coming off of a 20-year legacy billing platform and a history of company silos and reorganizing around a common set of technologies, not just within wireless but also software-defined networks and smart technology throughout our core network. We see lots of opportunity to streamline the way we do business. Our success in the marketplace led us to go very fast. We're now taking the opportunity to clean up. There will be continued revenue growth. It won't be as strong as the revenue growth that has been in the past, but I think the EBITDA growth will actually pick up over the next several years as we implement our streamlining measures, simplify the company, and reform our processes. Lots of opportunity there, as we said, low-30% margins today, every point of margin is worth about $9 million a year and certainly ought to be able to move the margins a lot closer to conventional cable industry margins.”

In addition to growing margins, the company should have a long path to growing overall revenues. Their main competitors on the video side are satellite companies like DirecTV and Dish, and on the internet side the competition is generally telephone companies with things like DSL. Both of those are far inferior products to a cable offering, and, over time, I’d expect penetration to increase significantly, which will drive serious margin improvements given the largely fixed cost nature of a cable company.

Ok, so that does it for the NAV is understated point. Let’s turn to the second and most important point: Ventures is poised for above average NAV growth for the next few years, driven by increases at both Charter and GCI.

Point #2- GCI and Charter will drive above average NAV growth

First, it’s important to clarify what Ventures actually is. Post GCI deal, Ventures will have ~27% of its asset value come from its GCI ownership (valued at deal price) while ~57% of its asset value will come from Charter (through its Liberty Broadband and Charter share ownership). Given the company will also have some leverage (debt / asset value of ~30%), GCI will actually account for 40% of NAV while Charter will account for 80%+. So while Ventures will change its name to GCI after the deal closes and GCI will be an important driver, Ventures can really be looked at more as a levered bet on Charter with GCI’s upside thrown in as well.

However, I think that levered exposure is a good thing, as I’m massively bullish on both GCI and Charter ability to drive continued growth. I discussed GCI and its avenues for growth / margin enhancement above, so I won’t dive into it again here. Instead, let’s focus on Charter. I think the upside here is massive; I covered it in a previous write up (“Charter: A levered return of capital story for the ages”) and I’d encourage you to read that for full background, but I’ll sum it up in three points below:

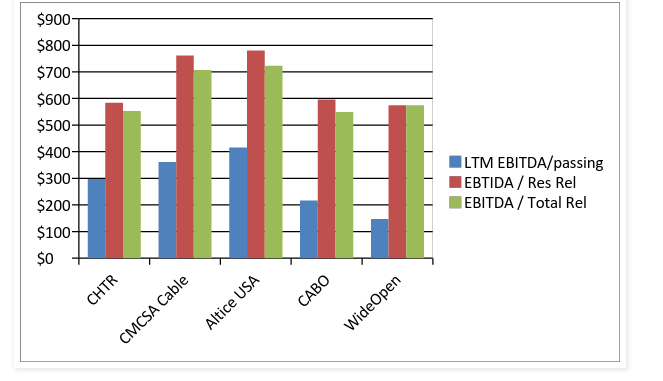

Charter is now the second largest cable company, yet margins and profitability are more in line with much smaller regional players. Cable is a game of scale, and as Charter fully integrates its recent Time Warner acquisition, margins should improve to peer levels (CMCSA / ATUS in chart below), driving massive earnings increases.

Despite the likelihood of sustained earnings growth driven by margin increases, Charter currently trades for a valuation at or below peer levels

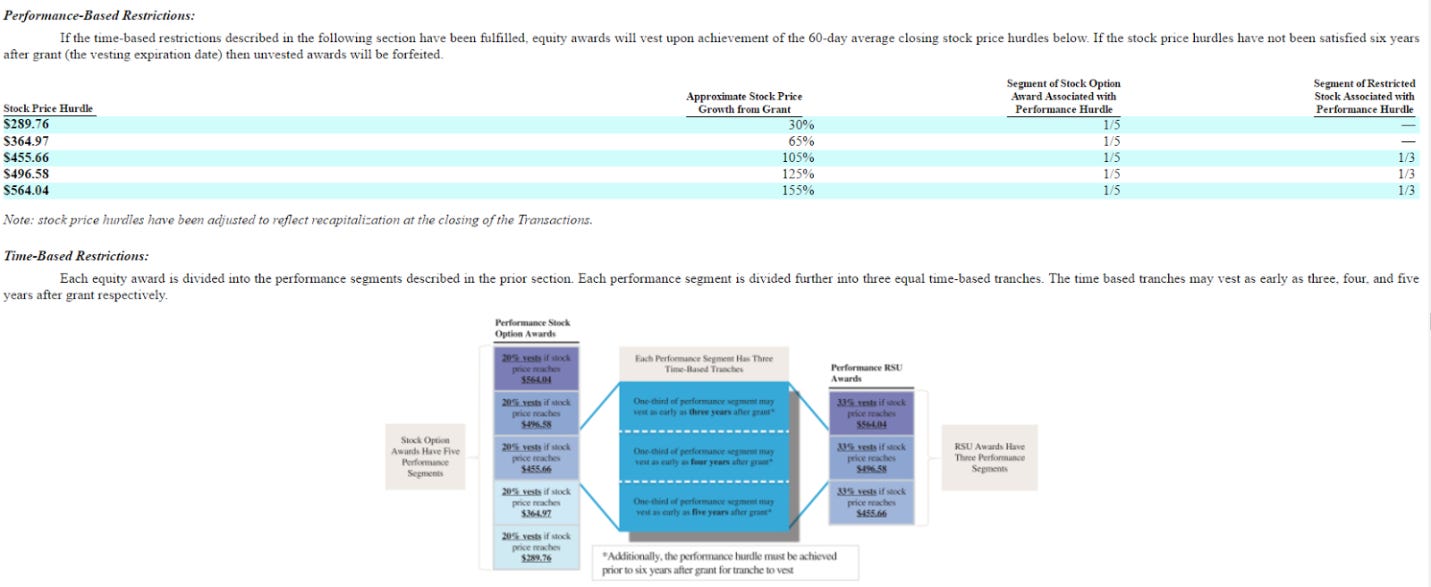

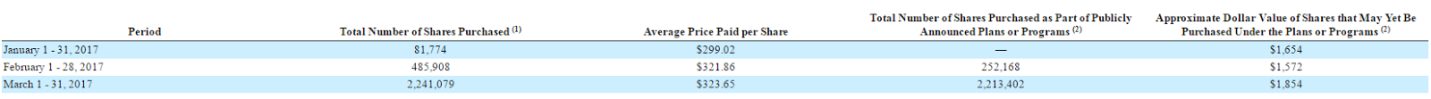

Charter’s management is clearly massively bullish on Charter. Greg Maffei recently discussed how bullish he is, Charter’s CEO has options that don’t vest until the share price start with a “$4” or “$5”, and buried within the company’s filings are hints that they have recently ramped up their share repurchase program to a level that would imply repurchasing >10% of their shares outstanding this year and possibly more than 5% of their shares in Q2 alone (it’s a complicated story that involves digging through a lot of filings, so I would again encourage you to read the original post to fully understand that one). Given the degree of undervaluation, buying back shares that rapidly should drive rapid appreciation for the remaining shares.

That concludes point #2 (Charter and GCI to drive above average NAV growth). Let’s now turn to point #3.

Point #3- Ventures is poised to become a share buyback machine and will likely be taken out at a premium in the next few years.

While I think #2 is perhaps the most important point, point #3 is the most exciting point if you really believe in the long term upside of Ventures / GCI / Charter. As soon as the deal closes, I expect Ventures to become a rapid share repurchaser, which will drive significant NAV / share growth for the remaining shares given the discount they’ll be done at, and I expect Ventures to be acquired at a nice premium (almost certainly by Charter) in the next few years.

Let’s start with the share repurchase point. Once Ventures closes on the GCI deal, Ventures will begin retiring shares at what I believe will be an impressive clip. Share repurchases will be driven by both GCI cash flow (GCI should generate $100m+ in after tax FCF and growing as their capital intensity declines post a big capex project (project TERRA) they are concluding / as margins improve) and disposal of Ventures non-core assets like FTD and TREE. Management confirmed both of these points on their M&A call (“Now that we've set the direction for GCI Liberty in a clear and crisp fashion and we've identified non-core corporate assets such as FTD, we can use those to fuel future buyback. And in addition, the acquisition of GCI will have high free cash flow generating assets can also be used for future buyback. As I said, we anticipate using both streams to repurchase shares.”).

While Ventures becoming a large share repurchaser will not exactly come as a surprise to people who follow anything in the Liberty complex, as they’ve generally all been pretty strong share repurchasers when shares trade below NAV, it’s still an important part of the story. Again, Ventures is a levered play on value creation at Charter and GCI trading at a discount to underlying NAV. If Charter and GCI can deliver on their margin improvement / value creation opportunities, Ventures share repurchases at a discount today will be unbelievably accretive to the remaining shares in a few years.

Looking longer term, I’d expect Ventures to eventually be acquired at a nice premium to today’s share price. Clearly the most obvious acquirer is Charter, as an acquisition between the two would have massive synergies (Charter can cut significant costs by putting GCI onto their video programming schedule and using their scale to pressure GCI’s suppliers) and a clear financial rationale (Charter could retire all of their shares Ventures owns, which would make for a fantastic share buyback). Interestingly, Charter has been a frequently rumored target of Verizon, and GCI would have clear natural synergies with Verizon as well (Verizon uses GCI’s network in Alaska). So whether Charter remains a standalone company or eventually gets acquired by Verizon (or someone else), I expect longer term GCI will represent a very accretive and natural target for Charter. Of course, it helps that all of the Liberty team sits on Charter’s board, and it’s already been rumored in the press that Malone is buying GCI with an eye towards eventually flipping it to Charter.

Key risks

Deal break: If the deal were to break for some reason, GCI shares would probably collapse. I doubt there’s too much serious downside in Ventures- they trade for ~85% of their no deal NAV, so while they’d probably be volatile in a deal break, I doubt they’d go down too much.

Deal breaks odds are incredibly low. They need FCC approval (given the wireless component) and approval from some Alaska regulatory bodies; I can’t see any reason why they wouldn’t get them given Ventures is basically just a holding company (no anti-trust), the deal significantly improves GCI’s balance sheet, and both companies have been very clear that they want to continue investing / growing the business.

Further Alaskan economy dip: GCI is a pure play Alaska telecom company, so further dips in the Alaskan economy wouldn’t be great for it. They’ve been pretty clear on their calls that the Alaskan economy is in recession and the recession hasn’t been great for them.

I think this could be a source of upside as well. At some point, the economy will improve (I’ve seen some economists say it should do so in late 2018 / 2019, but who knows?), and when it does GCI should have some pricing power / see increased household formation increase their homes passes.

Government subsidies: Roughly 24% of GCI’s revenue comes from the Universal Service Fund. Basically, these are subsidies for connecting rural hospitals, schools, libraries, etc. Any cuts to these programs would have outsized impacts on GCI.

Obviously 24% of revenue coming from a government subsidy is a scary number; I don’t believe any peers come close to this level of exposure. However, most of this revenue comes from the FCC’s Alaska High Cost Order, which they updated in late 2016 with a schedule through 2026. That schedule should give some clarity to the levels of subsidies (the Alaska Telecom lobbying arm celebrated the plan as bringing “10 years of predictable federal support).

Overestimated GCI margin improvement ability: perhaps I’m wrong and GCI doesn’t have much of a margin expansion opportunity. GCI is a different beast than most U.S. telecom companies (again, it’s the only quad play company so it’s got a mix of wireless and cable margins that no one else has, their wireless backhaul business is unique as well, and they’ve got a heavier subsidy mix), so maybe I’m wrong that margins can expand. In addition, Verizon started making a move into the Alaskan wireless market a few years ago, which could pressure share, and the reintroduction of unlimited wireless plans by AT&T and VZ in the past year could further pressure GCI’s margins.

It’s entirely possible I’m wrong here. The only thing I will say is none of these issues are new and GCI’s management had been forecasting margin expansion for a long time before the Ventures deal, and the Liberty team is probably the best in the world at assessing cable assets (particularly U.S. ones) and they clearly thought there was a margin opportunity here. I feel comfy being on the same side as them on this bet.

Verizon contract risk: A significant amount of their revenue comes from providing roaming services to other mobile operators in Alaska. Verizon is a particularly large partner of theirs, and a renegotiation of their agreement in 2016 lead to a drop in revenues and profits (as discussed earlier). While this is a long term agreement so it’s unlikely to see any material changes, there is certainly some risk here if Verizon decides to break the agreement for some reason.

Tax inefficiency: Perhaps Ventures can’t find a tax efficient way to dispose of their Charter shares and pays a huge tax bill given their huge appreciation, justifying the NAV discount.

I literally laugh out loud at this risk. Come on. Malone vehicles don’t pay taxes on appreciated shares. The man has built an empire on avoiding taxes on massive appreciation by swapping shares of companies.

If you wanted to take this risk seriously for some reason, you’d have to think the government completely cracks down on the tax free nature of share for share exchanges (a Charter / Ventures deal would almost certainly have a heavy share component) and on spin offs. Even then, I think the tax efficiency issues could be avoided simply by structuring a deal where GCI and Broadband combined to buy out all of Charter in a big “fish swallows the whale” type deal with big support from a Malone / Malone hedge fund fan boy (of which I am one) led equity raise.

Odds and ends

Some of Ventures’ debt effectively functions as a call option sold on some of their Charter shares that is struck at $341; I have not adjusted for that in the NAV above but it results in a pretty small swing until Charter starts to hit $400 or $500/share; at that point, Ventures’ NAV is up so much that the adjustment really doesn’t make a difference for investors at today’s prices. Worth keeping in mind if you are looking to hedge a piece of this by shorting CHTR out though.

GCI’s debt currently carries pretty high interest rates for today’s environment; after the deal closes, their credit will be significantly enhanced given all the Charter shares / Ventures assets coming their way. I’d expect them to move to refinance pretty quickly, and it should drive some incremental FCF generation through reduced interest payments.

GCI has $272m in NOLs; normally I would think they wouldn’t survive the merger but given Liberty’s history with tax structuring I wouldn’t be surprised if they managed to retain some value.

While the merger is pending, GCI is shut out from share buybacks, and I am 95% sure Ventures is as well (we’ll find out for sure once Q2 results are reported). In the meantime, cash will go to deleveraging / accruing on the balance sheet. I would expect the company to rapidly repurchase shares the moment the deal closes if they continue to trade at this deep a discount.