Bagholding with $NYRT

Upfront note: this post is long and dives into the weeds a bit. If you want the Twitter version, it’s 1) NYRT’s trading at a huge discount to their last reported NAV of $9.21, 2) that NAV is almost certainly overstated, 3) despite that overstatement, even using a set of pretty conservative assumptions it’s tough to come up with a NAV that isn’t a good deal higher than today’s price, 4) I’m very bullish on the remaining WW piece and think it could create significant value. Full post below.

It’s an unfortunate fact of life as an investor: every now and then, you’re going to be a bag holder. And perhaps no stock this year turned as many event driven investors into bagholders as New York REIT (NYRT; disclosure: long, sadly); I count 5 long pitches on sumzero alone in addition to the bizarre Q1’17 earnings call (when they first revealed their NAV would be way under what most of us were projecting; I was a part of that call but hopefully didn’t come off too bag holder-y!).

Anyway, one of my favorite posts of all time is this Bronte post on averaging down. At the time I read it, I only had ~a year of portfolio management under my belt but that post helped push me to something that I had slowly started to realize on my own: as a portfolio manager, averaging down is perhaps the most dangerous thing you can do. And recently, I’ve been averaging down a bit into my NYRT position, so that post has been top of mind for me.

Given how many write ups there are on NYRT, I’m not going to provide a ton of details on the background, but I will give a brief overview. NYRT was historically managed by an external management company with a long track record of shareholder value destruction and sometimes outright fraud. Michael Ashner ran (and won) a proxy fight late last year to take over NYRT’s external management and put the company into liquidation. Unfortunately, the liquidation has been a disappointment, driven primarily by a valuation for the company’s key asset (WorldWide Plaza (WW)) dramatically lower than investors’ expectations (to use myself as a baseline, I thought WW was worth >$2B versus the actual sale price of $1.725B; the difference between those numbers is worth ~$2/share in NAV).

Let’s fast forward to today. NYRT’s liquidation is quietly entering its final stages, and while I think there are signs that NYRT isn’t going to hit its NAV target, even after making some pretty conservative adjustments NYRT’s shares present an interesting risk reward with a pretty tight timeframe.

As a reminder, NYRT’s most recent NAV was for 6/30/17 and came in at $9.21/share. Below is a copy of their balance sheet at June 30:

Today, shares trade for $7.55, so clearly investors are discounting that NAV number quite a bit. The biggest news announced since the quarter closed was the sale of WW, so the most logical thing to think is that investors are just adjusting for a disappointing WW price. Management was quick to note on their WW sales call that the “based on the deal that we’ve just announced, the NAV number will not go down as a result of Worldwide Plaza”, but, despite those reassurances, suspicion over WW’s effect on NAV is almost certainly where most of the doubt / discount is coming from.

I personally tend to agree with the market’s hesitation on WW: NYRT openly admitted that the sale process for NYRT resulted in a net price to them lower than what they had planned for in the NAV, so I can’t understand how their NAV estimates could stay constant without estimating significant value accretion from the new WW stake (i.e. assuming the building is worth more in the future), which seems pretty aggressive for liquidation accounting (one liquidation I used to follow, Gyrodyne, was so conservative that they actually wrote off all capital investments to improve their properties despite thinking the rate of return on those investments would be attractive, so NYRT seems to be at the most aggressive end of the spectrum if they are assuming capital improvements compound value in their liquidation accounting). I’m also worried there are potential signs that the rest of the portfolio is going to come in significantly below current NAV estimates. However, I’ve been adding my position for two reasons: first, I do think the WW JV can create significant value. Second, while I don’t think the rest of WW’s marks are what they’ll ultimately receive by any means, even a very pessimistic look at the rest of the portfolio suggests that today’s price is well below what NYRT could reasonably achieve, and that the combo of the two means shares today offer a very attractive risk/reward on a relatively tight timeline.

Let’s start with the second point: there are signs of deterioration in the rest of the portfolio, but today’s price more than overcompensates for that. The rest of the portfolio includes all assets outside of WW, and these can be divided into two groups. The first are the “POL” Loan properties, a group of ~12 buildings which are grouped together and encumbered by a $750m of mortgage as of 6/30/17. The second group is the non-POL loan properties, four buildings that each have individual mortgages on them. By far the biggest of these non-POL assets is 1440 Broadway.

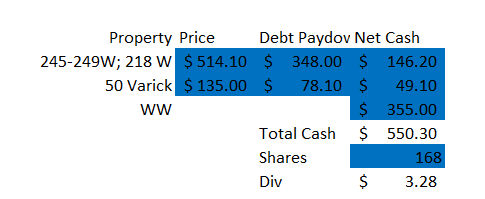

Outside of the WW deal, NYRT has sold 3 POL properties since the liquidation was announced: 50 Varick (see p. 32), 245-249 W 17th, and 218 W 18th (both announced here). After each sale, NYRT lists how much cash it received from the sale, how much debt it paid down, and how much debt remains outstanding on the POL loans. I’ve put the results in a table below.

Well that’s pretty interesting! Just adding the cash that they’ve announced receiving since quarter end brings us the $3.28/share, more than 40% of today’s share price, just sitting on NYRT’s balance sheet. And the good news is there doesn’t appear to be anything in NYRT’s loans that would prevent them from dividend-ing out that money.

So that’s the good news. However, I do think there’s some bad news. All three of the properties sold were POL properties, and if you’re willing to do some digging you can get a lot of information on the POL properties, and that info contains some hints that they are selling properties below NAV.

The trick is to start with the POL debt documents themselves. These are huge documents, but the most important things to me are the “allocated loan amounts” schedules at the very bottom and the “release of individual property” sections (see p. 56). To simplify, these two sections in the POL loans basically say the following: NYRT, we are lending you $750m in total and using all of the POL properties as collateral. In the event you sell one of these properties, we will allow the corporate holdco to claim / use that cash provided that you pay down the POL loans by at least the “allocated loan amount” for the property you sold and the remaining properties have a debt yield (LTM NOI / POL) of at least 6.75%. I’ve pasted the “allocated loan amounts” tables for both the senior and mezz debt below.

A quick note on the table above: bizarrely, the mezz table in NYRT’s debt docs doesn’t include the Twitter building’s mezz debt. While that probably raises some questions on the company’s documentation / finance team, you can back into how much mezz debt is on the building ($76m) in two ways. First, we know there’s $760m of POL loans, and putting in $76m for Twitter’s mezz debt brigns the total to $760m. Second, every other building has senior debt / mezz at 1.92x, and putting $76m for Twitter’s mezz debt fits that ratio $76m fits the 1.92x ratio of senior : mezz talked about earlier. Given $76m hits both of those criteria, I’m pretty confident that’s the Twitter mezz debt number.

There’s one other interesting note in the debt docs: it notes that the debt could be extended for one more year (so expire in December 2018 instead of 2017) if the debt yield is 7.25% or greater (along with a few other things).

Ok, using all of that info plus the $333.9m in POL balance remaining as of October 11, we can come up with a minimum NOI number for the remaining POL buildings. Given NYRT was allowed to receive $146.2m in proceeds after debt paydown, we know that the remaining POL assets must earn at least $22.54m/year (6.75% * $333.9m). I would venture that NYRT would want to keep the flexibility to roll the POL loans over when the extension date comes in December, so it’s probably ok to use the extension yield number of 7.25% and assume these buildings earn at least $24.2m/year in NOI.

With a minimum earnings number and a debt number, if we chose a cap rate we can now estimate a minimum equity value of these buildings. New York office space has generally traded for <5% cap rates over the past few years; the market is a bit softer now but commentary from SLG’s conference call suggested financing was still very loose and 5% sounded about right. Using that 5% cap rate, we know the remaining POL buildings are worth a minimum of $484m ($24.2m minimum earnings divided by our 5% cap rate); after debt of $333.9m, that would leave $150m left over for equity. I would again stress that is a minimum for how much these buildings are worth to the equity.

So we’ve established how much cash NYRT has gotten from their sales so far and a minimum value for their remaining POL buildings. What we haven’t done is figured out if the most recent POL sales of the Twitter + Red Bull buildings were done close to NAV, and the bad news is that if we dig a bit deeper and make a few more assumptions, I see some signs that those sales may have been done well below NAV, which would be both a negative sign for the rest of the portfolio and just pretty negative for NYRT overall given these two buildings alone represent ~43% of the POL portfolio’s value (and POL is a significant piece of NYRT’s asset base).

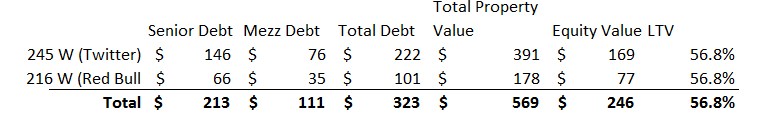

The key assumption here is based on 50 Varick Street. The company sold the building for $135m versus an assumed liquidation value of $137.5m at March 31, 2017. If we go back to the POL debt docs, we can see Varick was allocated ~$78.1m in total for the debt ($51.36m of value for the senior loans and $26.7m of value for the mezzanine loans). This matches up perfectly with the disclosure on NYRT’s 10-Q that they paid down $78.1m of POL debt when they sold Varick. If we assume that NYRT’s liquidation value at March 31, 2017 matched the value the banks ascribed Varick when lending to the building in late December, then we know that the banks were lending with an LTV of 56.8% ($78.1m of debt divided by $137.5m valuation at March 31, 2017) for the POL pool.

Now, this is a pretty big assumption. Liquidation accounting and lending fair value are different animals. The loans were taken out under a different management team. And three likely yielded a very different market for selling given the shift in the New York market. In other words, it’s possible that the liquidation accounting numbers are vastly different than the lending fair value numbers. Still, it’s not a crazy assumption to assume that the liquidation number and the buildings fair value for the lending docs were pretty close to each other. And, if it’s close to on the mark, the knowledge that POL was lending at 56.8% LTV is very powerful information to have. Why? Because the bank docs specifically allow for NYRT’s holdco receiving the excess cash from each property sale after their allocated debt is paid down. That means that the banks are comfortable that the equity in the rest of the portfolio is enough to cover the remaining debt. With all that (and a bit of reading through the debt docs), we can make a pretty solid guess that the banks did a property by property valuation and gave debt worth 56.8% of LTV to each property. So, using the allocation chart, we now have a property by property valuation! I’ve provided the results of that property by property valuation below.

Ok, so now we’ve got enough for a property by property valuation of most of the POL buildings. Again, I’m going to stress that the “liquidation value = bank lending value” assumption was a big one, particularly because the levered nature of the portfolio means small changes in LTV can make big changes to equity. But the chart above convinces me that I’m not too crazy for two reasons. First, NYRT’s 10-K includes enough info to do a property by property valuation. While I get some results higher and some results lower than the above number, the overall results are close enough to suggest that these numbers are realistic. Second, and probably more importantly, NYRT recently sold two more buildings. Those sales are great for us because we can use them both to check our table above and, assuming that table is correct, we can use the sales to confirm that NYRT is selling properties close to NAV.

The most recent sales were of the Twitter Building (245-249 W 17th) and Red Bull Building (218 W 18th). Below I’ve broken out just those two properties from our building by building valuation above.

NYRT’s sale notes that they sold the two buildings for $514.1m. They paid down $348m of debt and received $146.2m in cash after paying down all fees, so if you wanted to be a real pessimist you could say that the actual realized price to equity was just $494m. I’ve been burned on NYRT several times, so I do feel like being a pessimist so let’s use that lower number.

If we use the $494m number, we can tell three very important things:

The $494m is close enough to our property by property valuation to help confirm that, directionally, it’s probably decently close

NYRT sold these two buildings for 86.8% ($494 / $569) of what we had estimated their value at in their debt docs

NYRT received ~$100m less in equity ($146.2m) than our LTV analysis would have suggested (~$246m). That $100m would come straight out of NYRT’s NAV.

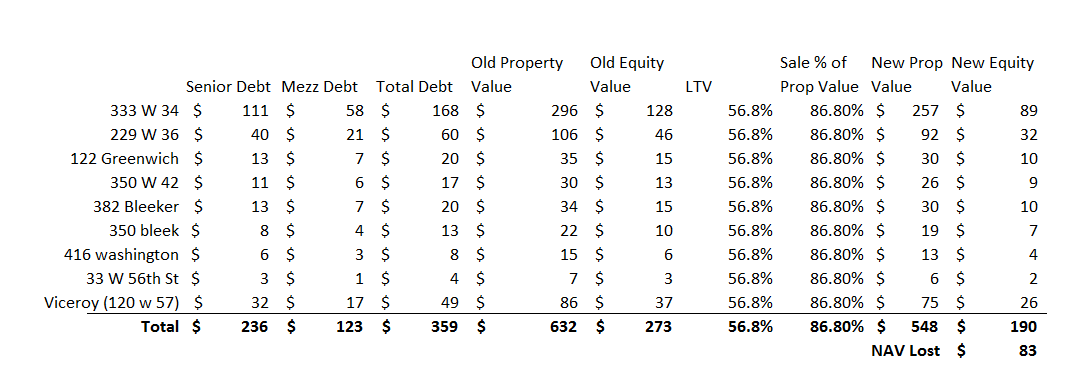

The table below takes all of the remaining POL buildings, assumes they were valued at 56.8% of LTV in the last NAV, and then assumes that they’re actually worth 86.8% of that NAV price. The result is that NYRT would lose another $83m in equity value.

Again, I can’t stress enough how many assumptions just got made. We’re basing all of this off of really one data point (the Twitter / Red Bull sales), and maybe those buildings were just faced with particularly soft markets. Or maybe a few of the other buildings have actually gained value. Or maybe this whole LTV analysis was just off. But it seems reasonable to me as a check given what we know about NYRT so far. If this analysis is close to accurate, it would suggest that NYRT’s NAV is tracking $183m, or $1.09/share, below their last reported NAV. This change alone would drop NAV from $9.21/share to $8.12. Not great. But, it’s also worth noting, this is probably as close to as low as the valuation could go- remember, the POL debt docs suggest that there has to be a minimum of $150m of value here assuming a 5% blended cap rate Given we are estimating these buildings are worth just $190m, it’s doubtful there’s much downside to these numbers, so any surprises / errors would likely surprise to the upside.

Note- as a further check on those numbers, this Real Deal article suggests that they are about to sell 256 W 38th St and 229 W 36th St for $155m in total, or $580/SQF. 229 W is probably worth a bit more per SWF because it gets a bit higher rent and has higher occupancy (from the last numbers we had in NYRT’s 10-K), but if assume that they are both worth $580/SQF for now and simply applied that to 229 W 36th St (which has ~150k SQF), we’d get a value of $87m for the building versus the $92m we estimated above, which again suggests we’re in the realm of reasonableness. (256 W is a non-POL property that will be discussed in a second; this estimate would value them at $68m ($155m total price less $87m for 229 W 36th), close to the $60m valuation I assign them in my base case. Given my base case calls for the two buildings to be worth $152m in total w/ a bit more value coming from 229 W, I think the model looks decently accurate here).

Ok, this post is getting pretty long, so let’s do a quick summary of where we sit currently and then quickly wrap up the other assets. So far, we’ve valued two things for NYRT: the value of the cash they’ve received from Q3 property sales ($550m) and the value of the POL pool, net of mortgages and assuming it goes for 86.8% of my assumed LTV ($190M). If we throw in the $40m in cash on NYRT’s balance sheet, so far we’ve found $4.64/share of value for NYRT.

What else does NYRT own? Outside of WW and the POL buildings, NYRT has 4 buildings that have an individual mortgage. Of these four buildings, really the only one that really needs to be focused is 1440 Broadway as the other three buildings are pretty small. NYRT bought 1440 for $529m in 2013. We also know that the company refi’d the building with a $325m loan in 2015. The company is rumored to be looking for $580m for the building, which seems reasonable- when I use the numbers in the 10-k to value it, I get valuations of ~$600m. I assume the company nets $550m from the building for conservatism. I feel pretty good that number is on the conservative side- it’s below what the real deal article is leaking (and they’ve been decent at calling the prices of NYRT properties) and it’s barely above what they paid for the building in 2010.

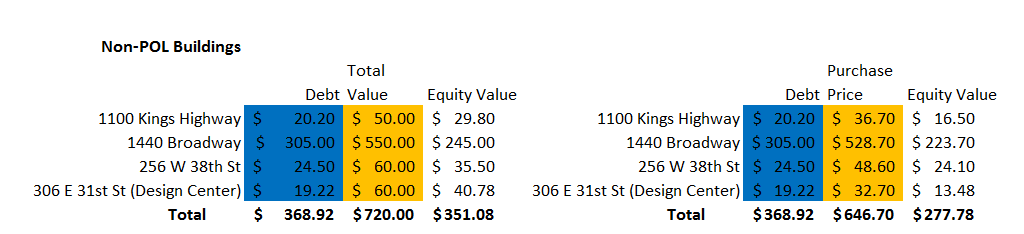

This post is long and the other buildings don’t swing the valuation too much, so I’m just going to skip ahead and say I value all of the non-POL buildings at $720m in total. This isn’t that far above the price NYRT paid for the buildings years ago (Broadway and 256 W 38th were purchased in 2013, 1100 Kings Highway purchased in 2012, Design purchased in 2010), so I’ll just present the table below that shows my per building valuation and move on. Gun to my head I’d guess these valuations prove conservative.

Ok, the final piece of the puzzle is what the remaining WW stake is worth. Remember, NYRT kept 50% of WW ownership, which they can sell whenever they want. They also put $91m into a capital reserve account to fund any needed tenant improvements going forward since they wouldn’t be able to meet capital calls as a liquidating trust.

I am hugely bullish on their remaining WW piece, and I’ll go into why in a second. But, to wrap up our valuation, note that NYRT retains 50.1% ownership of WW. The sale valued WW at $1.725B and the building now has $1.2B of debt on it; that implies NYRT’s remaining stake is worth $263m (($1.725B - $1.2B) * 50.1%) . NYRT has also funded a $91m capital reserve account to fund future building improvements; I value that at cost though I am very bullish on those improvements creating value.

Below I’ve included all of the different valuation pieces; my final per share value comes out to $8.39. I’ve also assumed additional liquidation costs of $75m; NYRT included a net liquidation cost number of $139.1m at June 30th but given a lot of it related to WW’s sale (which is half done) and the 3 PL buildings already sold represents another nice chunk of that value, I think $75m represents a good estimate of the net liquidation costs to be incurred.

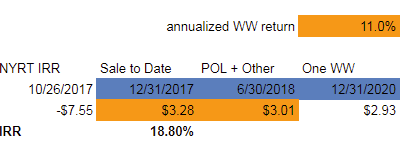

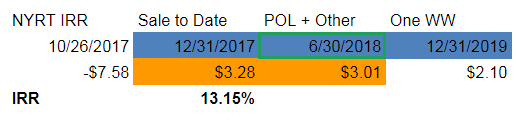

Again, I feel this is pretty conservative on a bunch of different fronts, and I’m bullish on WW generating significant value. But even with those conservative assumptions, the end result looks pretty attractive versus today’s price of $7.55. And it looks even more attractive when considered on an IRR basis- I would guess the company pays out the majority of the cash on their balance sheet by year end and sells the rest of their non-WW assets and sells the rest of their non-WW buildings /pays the rest of cash out by the midpoint of next year. The end result is a pretty attractive IR, even if you assume WW is just sold for today’s value in a few years.

Admittedly, the above is a bit “fun with numbers” to come up with the IRR- a lot of the high return rests on assuming a big portion of cash is coming back quickly. But given how much cash is on the balance sheet, I don’t think that’s a bad assumption; and assuming NAV is ~$8.40 and the bulk of it is coming back in the next year, the IRR is always going to be pretty decent from today’s price of ~$7.55. In other words, it’s the discount to NAV and the fact that the cash is coming back quickly that drives most of the IRR, not that the cash is coming back in December versus February or something.

Ok, let’s quickly discuss why I’m so bullish on WW. First, I’d note that the property was bought and will be managed by a JV between RXR and SLG. My friends in real estate speak pretty highly of SLG management. And SLG’s management certainly seems bullish on WW during their Q3 earnings call. Some highlights below.

“The relatively low price per square foot and significant future upside due to average in-place rents that are well below market, made this opportunity highly appealing to us”

“Levered return should be certainly in the position we're in, because we only took 25% in the deal and our returns are fee enhanced double-digit returns. I think, it's a high cash-on-cash going-in yield”

“We believe it's a great asset with a great return profile, with embedded rents that are below market, great tenant roster, and we think we'll be able to create value because that's what we do”

I also think it’s worth thinking about from NYRT’s standpoint. This liquidation has been a disaster, and based on management commentary and tone it seems like they want to wrap this up quickly and move on. And given the strike on their incentive fees was set at $11/share versus the last NAV at $9.21, it probably makes sense for them to want to move on quickly. Putting all that together, in a lot of ways they were probably incentivized to take a lower offer that would allow them to end this liquidation faster. Instead, they went with a more complex route that will drag this liquidation out and require more time / attention. Given making this deal probably went against their “get this thing wrapped up” incentives, I would guess they / the board had to be awfully bullish on the value creation potential here to choose this structure versus a straight sale. If you assume that WW’s investment will compound at 11% (the low end of the double digit returns SLG talked about) and that they’ll sell it around the end of 2020, the return from today’s price look really interesting given the discount you’re buying the WW stub at.