AMC is beating analyst estimates and taking names $AMC

I've written several times about what a mammoth bagholder I am in AMC Entertainment (AMC; disclosure: sadly long). Sure, the box office has been awful this year, but much of the company’s problems have been self-inflicted. They did three mammoth acquisitions within a year, their big U.S. acquisition (Carmike) has been a disaster, and with hindsight the multiples paid for the European businesses have gone from aggressive to downright laughable. The company just had to massively revise guidance down for the full year, and this downward revision came on the heels of radioactive Q2, which featured earnings (or, more accurately, losses) and full year guidance that analysts called "shocking" and "dramatic". Shares are down >60% YTD and probably headed lower tomorrow.

But at least shareholders can be comfortable management has their eyes on the prize. Q3 earnings (which included that huge guide down of their already shocking Q2 guide down) came out tonight, and the CEO led the call with “We are encouraged that for the third quarter, AMC exceeded consensus analyst estimates for revenue, adjusted EBITDA, and diluted EPS”. And management later suggested that shareholder’s shouldn’t be concerned by the massive guide down guide down, as consensus analyst estimates were “already below the low end of the previous guidance range.”

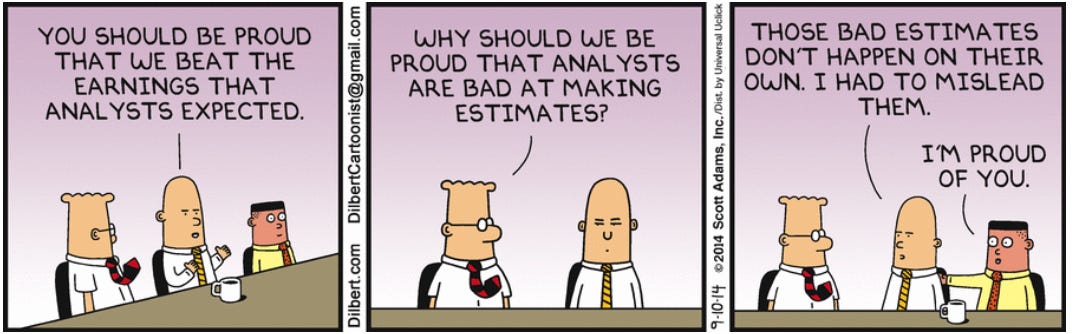

Looks like AMC is run by Dilbert’s CEO.

PS- I was going to end the post there because honestly it’s pretty perfect, but I'm too fired up and couldn’t help myself from discussing a bit more. On the call, AMC’s / Dilbert’s CEO went through a 12 item pep-talk to get his shareholders off a ledge, and item 10 included using their size as the largest U.S. exhibitor to leverage “strong studio support” for selling movie-themed merchandise at 35 of their locations next year. I couldn’t help but think of Blockbuster’s grand turnaround plan in the face of an onslaught of competition from Netflix that centered on…diversifying merchandise sales. I’m not saying adding merchandise sales to theaters as an incremental opportunity is a bad idea, but come on. It’s 2018. If the grand plan for driving growth involves in-person sales of overpriced licensed merchandise (and it’s so important that your CEO devotes time in both his earnings script and an analyst follow up), it’s probably time to give up and go home.