Some things and ideas, January 2018

Some internet links and ideas I've liked or found interesting so far this month.

Brooklyn Investor on Bitcoin and Barnes & Nobles (BKS)

I love every word of this post.

Bitcoin: His thoughts on bitcoin and the “value” fund managers long it mirror my own. It’s no surprise that the most famous fund managers who are long bitcoin tend to be the ones who blew up in the crisis / downturns: they are generally quite smart, good/great at identifying assets with big potential upside, and abject failures at risk management and limiting downside.

Many of the fund managers long bitcoin were shown in the crisis to be what I'm calling an “average downer” (thanks to the linked Bronte piece, which may be my favorite blog post of all time): someone who buys more of their stocks continuously as they go down. While that process can create a spectacular track record in the short, medium, or even semi-long term (particularly when aided by the tail wind of a huge bull market), over the very long term it inevitably leads to a blow up (the first time you are truly wrong on a space / opportunity will be your end because you keep adding to the position). It’s a failure of risk management and a hallmark of many of the fund managers who are long bitcoin and other coin plays (killer returns from recognizing the upside early, but no risk management control on sizing the position). While having a position that started out at a ~5% position blow out to a 50% position within a year or so is awesome, I'd say the mindset that lets you get there / let so much of a speculative position run is probably the same mindset likely to lead to a failure of risk management.

Then again, I am a no coiner so maybe my personal failures are writing this piece!

Barnes and Nobles: I’m currently finalizing my annual letter (I’ll probably share a portion of it on here next week), and a large piece of it discusses how I try to invest in things with value that quantitative / computer models could not pick up; what I love about the BKS piece of this post is that almost every idea in there is simple and obvious (in hindsight / once pointed out) but could only be obtained from a physical store visit and thinking deeply about the store. There’s no chance a quantitative computer model could pick up on any of it (maybe they could get hints of it from showing margins are below peers or something, but they could never pick up on a lot of these opportunities nor identify ways to fix them). Things like these observations are one of the reasons I have some hope that us traditional value investors will be around even once deep learning computers / artificial intelligence fully invades the investing field.

It’s also a reason why I think private equity is never going away and is actually likely to continue to grow over the long term. The ability to do deep work on a company and inspect their operations, buy them and apply best practices to the business, and then sell once operations turn around is never going away.

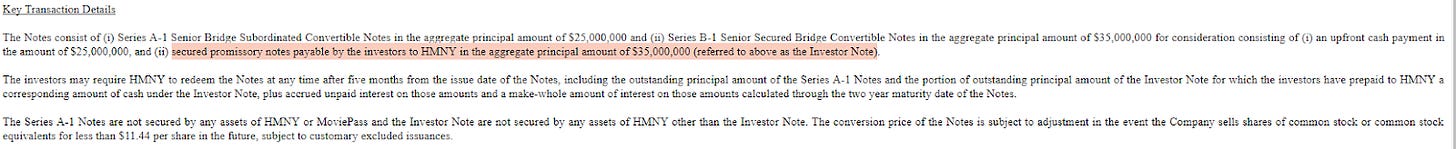

Helios and Matheson / MoviePass loan: This may be the strangest transaction I’ve ever seen. HMNY issues $60m in convertible debt in exchange for $25m in cash and a $35m secured note. Basically they issued debt in exchange for debt. It makes no sense.

Interestingly, the investor note carries interest at just 0.61% annually while the portion of the note Helios is issuing to the investor that is tied to that note pays 5.25% annually (see the 8-k and look up restricted principal). It’s confusing, I know, but basically Helios is net paying ~4.5% interest annually for $35m of cash they haven’t received yet.

If MoviePass were to go bankrupt, this transaction is going to raise some pretty crazy issues. HMNY will need to go after the investor to collect that $35m note at the same time the investor is a creditor in their reorg and trying to collect on the convertible notes. It will get very silly very quickly.

CVS / AET merger filings (disclosure: Long AET; short CVS): I mentioned this on twitter but I found it so funny I figured I’d share it here too. The CVS merger filings are getting really strange. The company has to publicly disclose any news articles they share with their employees on the merger, and at this point it seem like they’re just sharing anything that gets written semi-positively on the merger. Last night’s filing lead with a Seeking Alpha article from a contributor who has written 7 articles, has 50 followers, and appears to be a teenage economics student in Venezuela. The day before included an article “How Medicare Makes Rite Aid A Buyout Target”, which seems awkward for CVS (a Rite Aid competitor) to highlight. Last week’s filing was simply a two paragraph Dow Jones release that appears to be completely computer generated.

Tax reform / MSGN (disclosure: long): I mentioned before that I think a lot of the benefits of taxes get competed away over the long run. Not immediately (prices to be a bit sticky in the short term but adjust in the long run), but over a 3-5 year period I think even a big corporate tax cut doesn't change the average profitability of, say, your generic steelmaker; all of the tax cut gets competed away in lower steel pricing and maybe higher wages to worker. Don't believe me? Here's a famous article on inflation from Warren Buffett which discusses low double digit return on equity across decades for a host of companies; note the article was written in the 1970s when the corporate tax rate was ~48%. To keep the data set constant, here's an article on the Forbes 500 from 2012 which notes the year had a "record" ROE of 14.3%; far above the "historical norm of 12%". So, despite the corporate rate dropping from 48% to 35% over that time period, return on equity basically didn't budge.

Why do I bring this all up? Because the more I think about it, the more bullish I am on the corporate tax cut for businesses with serious competitive advantages. I’m not full out saying all stocks haven’t baked in tax cuts yet, but when I look at businesses that will benefit the most from tax cuts (because they pay a full tax rate and are great businesses) I tend to agree with Buffett / Tepper that the tax cut isn’t fully baked in yet.

Let's turn back to the example I mentioned last time I talked about corporate taxes: MSGN (Disclosure: long). The last time I mentioned them, I talked about how MSGN will be a beneficiary of lower taxes simply because they paid a full 35% corporate tax rate last year and the savings from cutting that to 21% will flow straight through to their bottom line given their competitive advantage (if you want to watch local Knicks games, they are the only game in town for the next ~two decades) and long term contracts with their cable customers. That's certainly the main piece of the benefit for MSGN, but I actually think it understates just how big the tax cut will be for them. MSGN's main customers are the cable providers (i.e. Cablevision) who pay them a fee for every sub that subscribes to a video package that includes MSGN, and given the tax cut immediately boosts the provider’s bottom line, I would think MSGN could capture a bit of a price increase as their contracts come up for renewal.

A simplified example might show this point best: assume that the provider prices cable so that each customer yields them a $10/month profit after taxes and that the provider’s only cost is paying cable channels like MSGN. So, in our example, if a provider negotiates contracts with their channel providers that cost them $85/month in total, the provider would charge customers $100/month. This charge would net them $15/month before taxes; after paying a 35% tax rate the provider has hit their ~$10/month target after tax profitability. Suddenly the provider’s tax rate has dropped from 35% to 21% and that customer who used to yield ~$10/month after tax is yielding the provider ~$12/month after tax (net $2/month in increased profits). Who keeps that extra profit? In the short term, the cable company probably keeps almost all of it given most cable companies operate in monopolistic or oligopolistic type markets and prices tend to be pretty stick. But the next time a contract negotiation comes up, the provider can give the video provider a little bit more of a price increase simply because the provider is over earning their old profitability targets. My guess is that must have programming (like sports) takes the lion share of those price increases, and that over time that $2/month increased profitability is split up in some form between the cable company, the video providers, and the consumer (i.e. maybe the consumers' cost goes down to $99/month, the total video costs go up to $85.50/month, and the cable company makes just under $11/month/customer). So the whole ecosystem has gotten richer from the tax cut.

My bottom line here: not only will MSGN be able to keep the majority of the tax cuts in the short term. In the long term, their underlying profitability probably goes up as their core customers are suddenly over earnings and MSGN should be able to capture some of those profits.

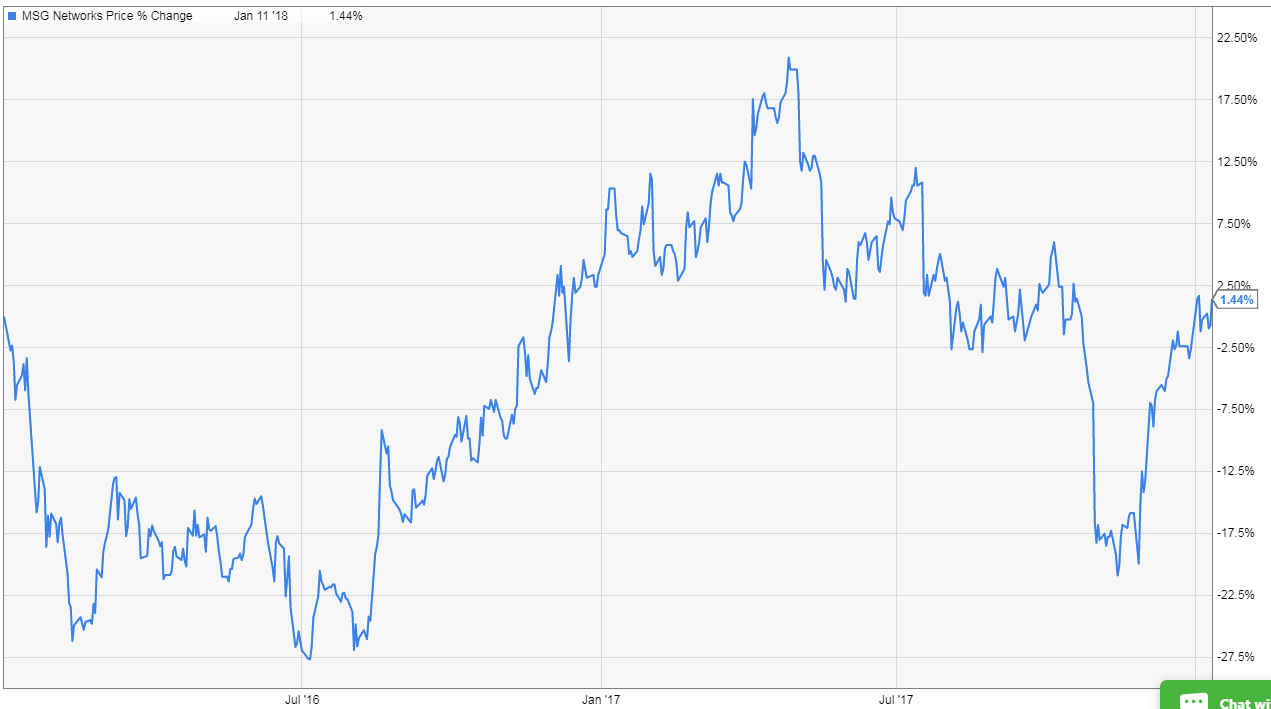

Again, I get I’m not exactly breaking new ground by saying “tax cuts are good for businesses!” or “tax cuts can spur growth”. But here’s the two year stock chart for MSGN, a fully U.S. business that pays a full tax rate, spits off tons of cash (they’ve paid down ~$200m of net debt in the past two years, or ~$2.67/share), and has a huge competitive advantage (a long term sports rights contract) that should let them take a bit of extra growth from tax reform. You tell me if tax reform benefits are baked into MSGN’s share price.

Sports rights: I can’t talk about MSGN without mentioning MSG (disclosure: long). I think the future remains bright for sports franchises, and 2018 could see a lot of positive news flow.

We mentioned this briefly on our podcast last night, but 2018 could be the year sports betting is legalized nationwide, either by court case or through some type of regulation passing. Adam Silver (the nba commissioner) described legalized sports betting as “inevitable”, and when it does pass it’s going to drive massive new revenue streams for sports franchises and result in a huge increase in fan engagement.

I continue to see evidence that the big internet players will make a move into sports rights. Amazon bid on the Premier League and Facebook’s bid for cricket is what drove Fox and Disney together. Combining sports rights draw (engaged fan base and lots of eyeballs in real time) with the data and targeting capabilities of the big tech companies is going to result in an advertising gold mine; I expect them to compete fiercely with the legacy TV channels when sports deals come up for renewal.

Somewhat related: Twitch (owned by Amazon) is paying Overwatch $90m for two seasons of exclusive rights; it’s a bit apples to oranges but if Twitch is willing to pay that for an unproven startup league imagine what they’d pay for the near guaranteed huge eyeball numbers that established sports leagues can draw.

One thing that I think continues to be underrated about MSG: basketball is in a huge upswing. Domestic viewership is soaring and I think the league is by far the best positioned to grow globally. The company trades for a huge discount to the sum of their parts, but one thing that I think is underappreciated is that the part’s value will continue to grow / compound at an attractive clip over time.