Checking into Rezidor $REZT

Upfront note: Rezidor (trades in Stockholm under REZT; disclosure: long) is an international and relatively illiquid stock. Please do your own research and remember that I am often a bagholder.

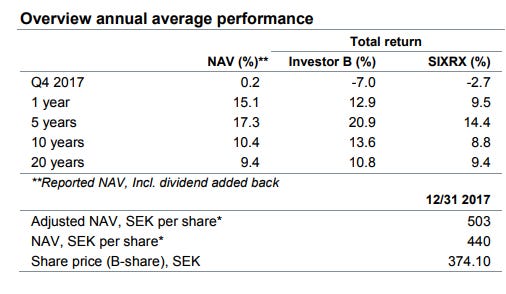

I’ve increasingly been looking internationally, specifically at Europe and Canada, for new investments. There are two particular areas in those markets I’ve found attractive. First, I’ve found smaller / more illiquid companies in those two markets can trade at substantially lower valuations than what I’ve found domestically; I would speculate that’s because the event driven / microcap investor community is less developed in Europe than in the U.S., but that’s pure speculation on my part. Second, I’ve found a bunch of the family holding companies trade at a decent discount to NAV, often despite impressive long term track records of NAV growth and attractive underlying assets. For example, Investor AB (written up here on VIC; no current position) currently trades for ~75-80% of adjusted NAV despite long term performance roughly in line with relevant benchmarks (see chart below; you can also comp to S&P 500 and find similar performance).

Anyway, today I wanted to talk about one of my favorite European ideas that falls into the quirky situation / substantially undervalued bucket: Rezidor (trades in Stockholm under REZT; disclosure: long. I thought I was the only one looking at this company but there was a recent VIC write up if you’re interested). Rezidor is part of the Carlson Rezidor hotel group (to avoid confusion, I will call Carlson Rezidor “Carlson” going forward, while Rezidor (the investable company I’m discussing) will be called Rezidor). Rezidor operates and franchises the Radisson Blu and Park Inn by Radisson brands in Europe, the Middle East, and Africa (EMEA); all of these brands are owned by Carlson but Rezidor has the exclusive local rights to operate and franchise them in EMEA.

The investment thesis in Rezidor is simple: the company is one of the cheapest, if not the cheapest, hotel companies in the world on current / trailing numbers. The slide below is from their 5 year operating plan; I’m not sure the peers they chose are the best peers but it does a nice job of getting the point across. (PS- a ton of the slides in this post are going to come from their 5 year plan, which is extremely detailed. You can find it on their IR site and I’d highly recommend downloading it / flipping through it)

In addition to being cheaper than peers, Rezidor is also a bit of a turnaround, with margins way below peers (LTM EBITDA margins are around 9% versus peers in the low double digits). Rezidor recognizes that issue; a key part of their five year plan is to boost EBITDA margins to 13-15%. If successful in expanding margins, investors could be looking at a wonderful combo of strong earnings growth from margin expansion combined with a rising multiple. If Rezidor can successfully hit their targets and trade up to a ~9x EBITDA multiple, I could easily see shares trading to ~100 SEK/share, around a 4x from today’s levels. (Note that Rezidor’s financials are presented in Euros while their share price trades in Swedish Krona (SEK); I have used Euro for all financial metrics except for share price throughout this article)

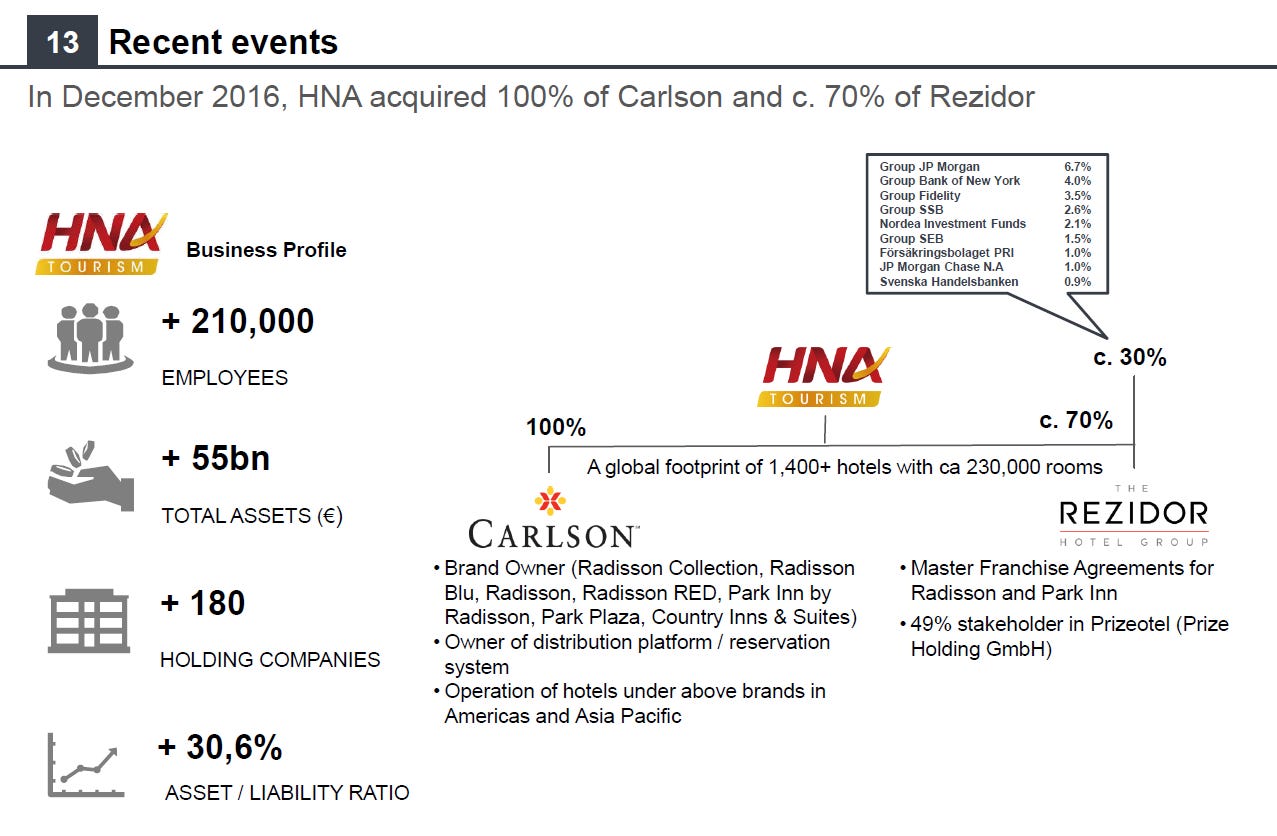

Ok, so that’s the simple investment thesis, and I’ll dive into why I think margin / multiple expansion is achievable in a second. But let’s first start with the obvious question: why does this opportunity exist? The answer to that obvious question is equally obvious: investors are terrified by Rezidor’s ownership structure / Chinese conglomerate HNA’s control of Rezidor.

Some background: while Rezidor is publicly traded, the majority of their shares have been owned by Carlson (owner of the global Radisson brand) for years. In 2016, Chinese conglomerate HNA acquired Carlson as part of an acquisition spree that saw them balloon to one of the largest conglomerates in the world. The acquisition included Carlson’s majority stake in Rezidor.

Since HNA closed the Carlson deal, rumors of liquidity issues have swirled around HNA(with their bonds yielding ~20% to maturity later this year, I’m not sure it’s fair to call them rumors at this point), and HNA pledged some of their Rezidor shares as collateral for a loan. So I think the main reason the opportunity exists is simple: investors are terrified by HNA’s presence and its possibilities (HNA asset stripping Rezidor to satisfy HNA holdco debt, HNA having their margin loans called and the calling bank dumping Rezidor shares on the open market, etc.).

All of those risks are certainly real, but I tend to think they are overstated. Rezidor is an independent company with independent management located in a European country (not China). HNA certainly could try to asset strip Rezidor without paying minority shareholders, but to do so would require complicit European managers who are willing to deceive minority shareholders and risk jail time for… what reason? To make HNA happy with them? It seems a stretch to me. If HNA needs liquidity, it seems more likely (and much simpler!) that they would look to sell down their Rezidor stake or sell off the whole company. While the share price could be temporarily depressed if they did sell all of their shares on the open market in one swoop, longer term I think either of these scenarios would alleviate the HNA concern and result in a higher Rezidor share price after the initial pressure had passed.

HNA discussion out the way for now, let’s dive a bit deeper into Rezidor. As mentioned above, Rezidor is a member of the Carlson Rezidor group and operates / franchises the Radisson Blu and Park Inn by Radisson brands in EMEA. Rezidor has ~500 hotels open or in development. With 325 hotels in Europe, they are one of the largest European hotel chains and they actually have the largest upscale brand in Europe.

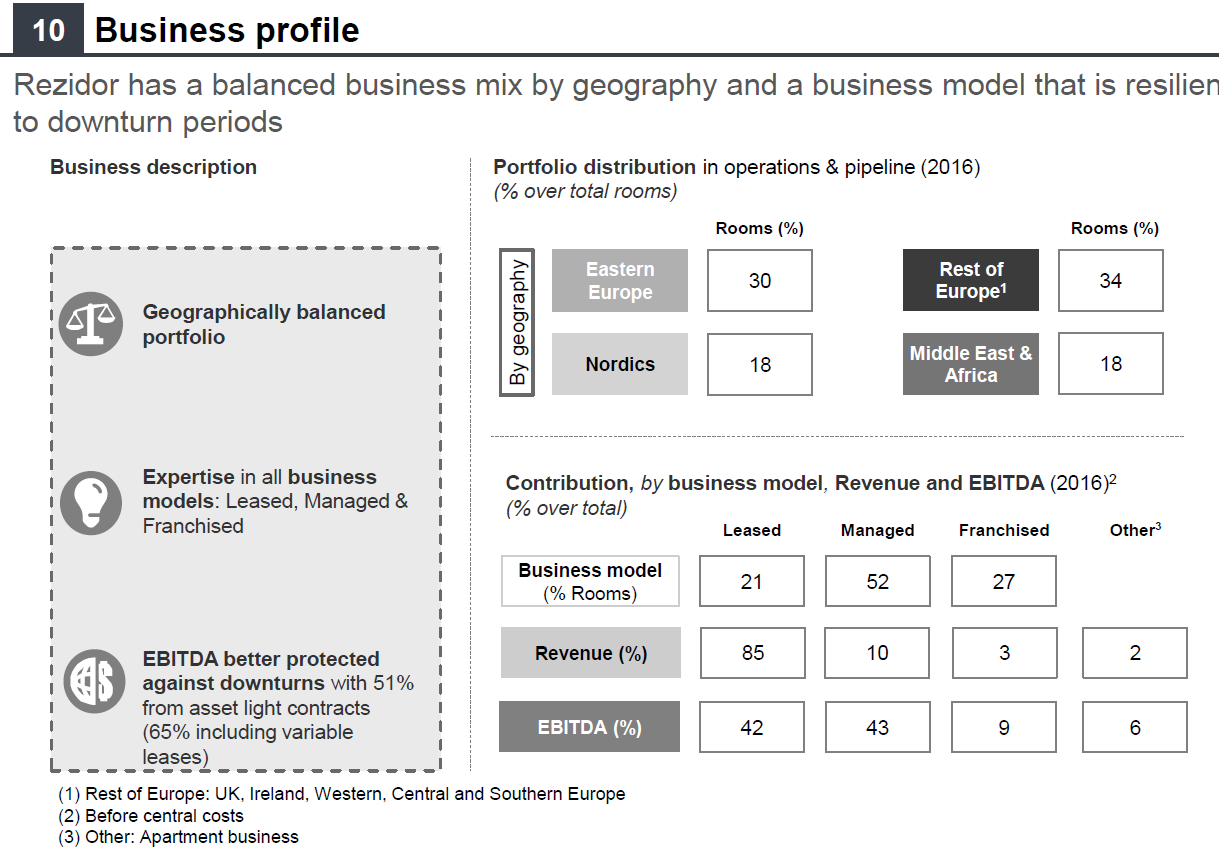

Rezidor splits their business into four geographic segments (Nordics, Rest of Western Europe, Eastern Europe, and Middle East + Africa + Other) and four different business units (Leased, Managed, Franchised, and Other). The leased business consists of hotels Rezidor leases and operates themselves. Managed business consists of hotels that someone else leases and then signs a management contract with Rezidor that has Rezidor manage / operate the hotel for them; Rezidor normally gets a cut of hotel revenue and a percent of the profits as an incentive fee in exchange for operating the hotel. Franchise business has Rezidor give out the right to use one of their brands and get marketing fees and a percent of revenue in exchange for the use of their brand; Rezidor takes no operational risk in the franchise model and the franchisee is responsible for operating their hotel. Rezidor has evolved so that Africa and Eastern Europe are generally managed while the Nordics are generally leased; the rest of Western Europe is a blend between managed, leased, and franchised. Below is a screenshot of their 2016 financials that shows clearly how Rezidor breaks up each segment; I’ve also included a slide from their 5 year plan that does a nice job laying out their geographic profile and room breakdown.

Given wildly differing economics, I tend to think of Rezidor in two segments: leased is the first and managed / franchised is the second. Leased is basically owning/operating a hotel, which is generally not a great business- it’s capital intensive, cyclical, and there’s not a huge moat to it. Hotel owners are prone to huge booms and busts- when times are good and people are travelling, hotels are full and profits are generally high. However, when markets get overbuilt or times get rough, occupancy drops, pricing wars break out, and hotels bleed money. The franchised / managed business is a generally very good one, as margins are very high and cash flow is great given the asset light nature of the business.

Because franchised businesses are generally much better than leased, they tend to trade for much higher multiples. The best way to illustrate these multiple differences is probably to highlight some recent transactions. On the franchised / managed side, Wyndham just announced the purchase of the La Quinta franchise and management business for ~17x pre-synergy EBITDA / ~12x post-synergy EBITDA. The acquisition included the multiples slide below. Investors were thrilled with the purchase and sent Wyndham’s stock up ~8% on the news.

Compare the mid-teens multiple for franchised businesses to what leased business go for. Last summer, Scandic (the #1 hotel operator in Finland and a good peer for Rezidor’s leased business) bought Restel’s hotel portfolio for just over 8x EBITDA.

I’ll admit that I’m cherry picking a bit here: comparing a major scaled American franchise like La Quinta to a smaller Finish bolt on like Restel is certainly apples to oranges. But I’m simply trying to illustrate that franchised businesses get higher multiples / have better economics.

Ok, so now we’ve got a decent idea of Rezidor’s different segments and their economics. That blends nicely into our next discussion: margins. Rezidor as a whole currently reports ~9% EBITDA margins, and the company is targeting 13-15% EBITDA margins in their five year plan. If they can hit that margin target (and grow a bit), EBITDA will more than double over the next five years.

The key question is if the margin target makes sense, and I think the answer is absolutely yes. Given every company has a different geographic mix and mix of franchising / managed / leased / owned (owned hotels get higher EBITDA margins than leased since they have no rent expense) I don’t have a perfect peer that I can definitively point to, but I think we can triangulate that Rezidor’s margin estimates are reasonable with a bit of work and comparison to peers.

Let’s start with maybe their best peer for their leased hotels: Scandic. Scandic is the largest hotel operator in the Nordic region (they were right above Rezidor in the midscale rankings earlier); they’re targeting 11% adjusted EBITDA margins long term, roughly in-line with their current EBITDA margins. Given Scandic is exclusively a hotel operator (i.e. they play in the leased segment), it makes sense that Rezidor’s long term margins should be a bit above them (driven by Rezidor’s higher margin franchised business). Either way, Scandic’s 11% EBITDA margins provide a good first cut the Rezidor’s 9% margins leave a lot of room for improvement.

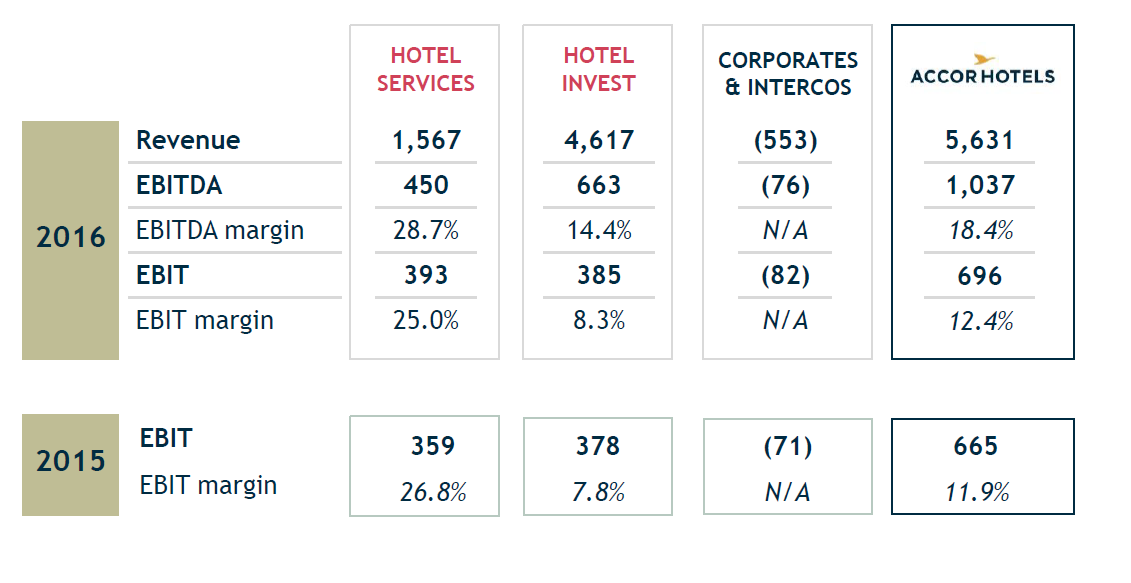

Accor Hotels is another good peer; they sold off most of their hotel operations this year so they are now mainly focused on franchising but if you go back to 2016 you can see their hotel operations were doing ~14% EBITDA margins (see slide below; you can go through their 2016 AR to get down to segment / geographic level stuff but it generally backs up that Rezidor’s hotel operations should be able to do higher margins).

NH Hotels is another good peer, particularly given HNA is involved with them as well. Just under 80% of their rooms are owned or leased, so they’re a very lease heavy company. They’re currently approaching 15% EBITDA margins, and targeting 17% longer term.

So if we put all of those companies together, the peer margins / margin targets suggests Rezidor’s 13-15% EBITDA margin target is reasonable / achievable.

How do those margins translate to cash flow? Rezidor’s 2016 earnings slides (see below) suggested 5% of sales as a normal run rate for recurring /maintenance capex. That target seems reasonable if not conservative to me; Scandic’s 2016 Capital Markets day suggested 3-4% of revenue as recurring capex, and NH Hotels’ 2017 Investor day suggested 4-5% of revenues as recurring capex. Both of those companies have less capital-light franchised / managed business than Rezidor, so I think it’s conservative to assume Rezidor’s recurring capex levels is at the highest end of their range. With 13-15% EBITDA margins and ~5% recurring capex, Rezidor’s unlevered free cash flow will come in around 8-10% of sales.

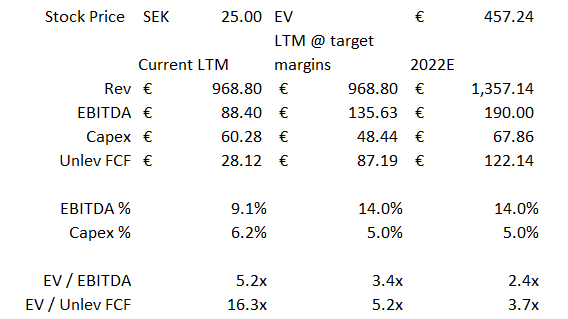

So, put it all together, and I think it’s highly defensible to say Rezidor should do ~14% EBITDA margins with ~9% unlevered FCF margins (EBITDA less recurring capex). The chart below shows what financials and valuation looks like for Rezidor on a trailing basis (left column), a trailing basis with “turnaround margins” applied (middle column), and on their 5 year plan estimates (right column) based on current share price (~25 SEK) and EV (~€450m using a currency rate of ~0.102 SEK/EUR). Note that I haven’t put any post-interest or post-tax numbers down, but Rezidor tries to run a net debt free balance sheet and they’ve guided to normalized tax rates of 25-28% (see Q4’16 slides), so EBITDA less capex should track pretty decently to levered free cash flow once you apply a normal tax rate (and the company still looks crazy cheap on a levered cash flow number).

Even on the current LTM valuation, Rezidor is one of the cheapest hotel companies in the world. However, if you really think they can hit their ~14% EBITDA margin targets and do ~€190m in EBITDA in five years, the company becomes insanely cheap on any standard. Even if they don’t grow but simply cut costs to boost their EBITDA margins to ~14%, the company is wildly cheap.

So how do I think this plays out? As mentioned above, HNA is the controlling shareholder of Rezidor and, given HNA’s financial struggles, I would not be surprised if they considered selling the whole company. HNA is looking to unload $16B of assets this year, and in the hotel sector HNA is already rumored to be investigating selling another of their European hotel assets (NH Hotels) after NH rejected a hostile takeover offer, meaning HNA is already canvasing the market for European hotel buyers.

One option in a sale scenario would be for HNA to have Carlson Hotels (which they already own / control) take out some debt and offer to buy out Rezidor. Doing so would make a ton of sense: HNA could sell their Rezidor shares to Carlson (providing HNA with cash / liquidity), minority Rezidor shareholders would get a nice premium to their current depressed share price, and Carlson could eliminate the strange Rezidor structure (Carlson owns all of the brands Rezidor operates and licenses them to Rezidor who then licenses the brands to their franchisees in the EMEA designated areas. Carlson buying Rezidor would eliminate the “middle man” and give Carlson full control of their brands globally) and likely realize decent operating synergies (at a minimum from eliminating Rezidor’s corporate overhead, but there would likely be more).

Another HNA centric option would have HNA merge NH hotels with Rezidor. I’m not sure that makes much strategic sense (there’d likely be some synergies given both are Euro companies focused on the same upscale customers, but the two operate mainly in different countries and have different hotel brands so I think the synergies would be a bit limited), but given HNA is a major shareholder in NH and controls Rezidor HNA may view a merger between the two as logical and as a means to help alleviate some HNA-specific issues (Rezidor’s CEO at the time of the HNA purchase also suggested a merger with NH was the endgame). Perhaps merging the two and declaring a big special dividend as part of the deal gets some needed cash to HNA? Alternatively, there would likely be significant synergies between merging Carlson, Rezidor, and NH. Perhaps HNA looks to structure a big three way merger?

HNA could also look to sell Rezidor to a third party. I think Rezidor would be a natural private equity target given their subpar margins, strong cash flow, and minimal leverage. Private equity could pay a significant premium to today’s price and still realize a huge return from leveraging Rezidor up, cutting costs / boosting margins, taking out big dividends as the cash poured in, and eventually re-IPO-ing the company or selling them to another strategic. An aggressive private equity fund might even look to sell off Rezidor’s leased hotels (likely using the cash from those sales to pay down a big chunk of the debt they takeout to buy Rezidor) and turn Rezidor into a pure play franchise / hotel management company.

Even if the status quo is maintained, I think Rezidor is pretty attractive as a standalone. The company is extremely cheap and has obvious levers to grow earnings. They also have a policy of paying out 1/3 of net income as a dividend. I’m generally pretty agnostic to dividends, but they can be a nice catalyst for really illiquid stocks that trade at low multiples (if you’re right and the company is set to increase earnings, the dividends will quickly cover your cost basis and/or force the shares higher). Rezidor’s policy of keeping a net debt free balance sheet is also pretty insane; there’s an outside shot they decide to lever up a bit and payout a big special dividend. Doing so would get a little (needed) liquidity up to HNA and would likely prove a bonanza for minority shareholders as well given the low valuation. Scandic targets a 2-3x net debt / EBITDA policy; if Rezidor did the same they could easily pay out their entire market cap in dividends over the next few years.

Other odds and ends

I kind of danced around it in the valuation, but the proper way to value Rezidor is probably to break the company into segments and give one multiple to the leased business and another multiple to the franchised / managed business (and you should probably dive further than that and do the same thing for each geographic segment). You can do that valuation if you want; I just didn’t think it was necessary for this post. The bottom line is Rezidor trades at 5x ~LTM EBITDA using current margins. I think their overall margins are way too low and peers on both the franchised and leased side trade for multiples well in excess of that. So if the company’s overall multiples are well below what either segment should trade for and the company’s margins are too low, why bother splitting hairs and going into a segment analysis? The investment basically comes down to “can / will HNA screw minority shareholders in some form” and “can the current results be improved upon or at least sustained”. If I’m right and the answer to the first question is no and the second is yes, the investment will be a homerun.

Another interesting thing I didn’t really touch on is the HNA tender for Rezidor. After HNA bought Carlson and took majority control of Rezidor, they were required to make a bid for the remaining outstanding Rezidor shares. HNA eventually closed the tender in October 2017 and bought an additional ~20% of Rezidor shares, taking their Rezidor stake from just over 50% to just over 70%, though they had to delay the bid several times in one of the first clues HNA was having liquidity issues. What’s most interesting to me is that Rezidor’s Board recommended shareholders reject / not tender their shares to HNA. HNA was bidding SEK 34.86/share, and that bid was before the five year plan and the recent global market run up in all things hospitality. For the board to reject that offer and suggest shareholders continue to hold an extremely illiquid stock suggests that they saw value significantly higher than the HNA tender. Maybe they were wrong or maybe things have really changed for Rezidor since then, but for them to reject the HNA offer under those circumstances suggests to me that they saw value well in excess of the bid.

I spent a lot of time talking about improving margins. One obvious area of improvement to me is the Rezidor’s overhead. Central costs (i.e. corporate overhead) at Rezidor in FY16 were ~6.5% of sales; that’s way up from just 4.9% of sales in FY14. For comparison, Scandic’s central costs run ~2.6% of sales. Comparing corporate costs across companies can be dangerous because one company might classify an expense as operating / segment level while another puts it as corporate, but based on both peers and historical rates I think there’s a decent bit of corporate cost to cut at Rezidor.

Another obvious area for improvement: shutting down loss making hotels. Rezidor’s done a good job of that recently, but if you look at the slide below they still have 14 loss making hotels costing them €15.5m/year in EBITDA. That is a huge loss against LTM EBITDA for the whole company of under €90m!

I didn’t discuss the Carlson / Rezidor master franchise contract too much in this article. Rezidor’s contract with Carlson gives them the right to develop and license Radisson Blu, Park Inn by Radisson, Radisson RED, and the Quorvus Collection in EMEA until 2052. There’s certainly some long term risk associated with this contract (i.e. Carlson fleeces Rezidor when the contract is up; in 2005 Carlson took 25% of Rezidor’s shares as part of the contract renegotiation / extension though I think part of that was for changing some other terms), but I think the super low multiple you’re buying Rezidor at today more than makes up for that risk (i.e. even if Carlson completely terminated the Rezidor relationship in 2052, you would’ve have generated multiples of today’s share price in cash if the investment thesis was correct, so terminal value isn’t hugely important to Rezidor).

I loved this article on expedia / priceline starting their own hotel brands long term, and I am somewhat bearish on the current hotel ecosystem for the exact reasons stated in that article (do we really need 40 different brands catering to every different traveler? Don’t expedia / priceline / google drive most demand and make that hyper differentiating of brands unnecessary at this point? Do hotel brands really matter if all we care about is price and reviews and maybe loyalty programs?). If we were simply buying Rezidor one turn cheaper than peers, that article / my view would concern me, but given how cheap Rezidor is selling and the margin potential I’m more than willing to take that long term brand risk.

I mentioned Accor a few times in the article. Late last year they acquired Mantra, an Austrialian focused hotel operator, in a deal that values Mantra at >12x EBITDA pre-synergies / under 10x post synergies. As another reference point for what leased hotel margins should look like, Mantra’s EBITDA margins are in the mid-teens. Australia is obviously very different than EMEA; just mention it as another example that nothing in here requires crazy margin / multiple assumptions.