Some things and ideas: April 2018

Some random thoughts on articles that caught my attention in the last month. Note that I try to write notes on articles immediately after reading them, so there can be a little overlap in themes if an article grabs my attention early in the month and is similar to an article that I like later in the month.

T-Mobile is buying Sprint in a deal that’s been rumored for years.

The regulatory review is going to be fascinating for a host of reasons, but here’s one piece I’m interested in: T-Mobile is saying this deal should be approved because there are “7 or 8 big competitors” in a converging market (i.e. we don’t just compete against wireless; cable is a threat too!), but T-Mobile’s CEO has a history of saying the opposite. This post-deal tweet alone could be useful to an unfriendly regulator looking to block the deal. That tweet can be explained away, but there are plenty of others that will prove more difficult to get away with if the deal ends up in court. For example, here’s what he said about Comcast entering the wireless business in their Q4’17 earnings call, “that's kind of an admission that the MVNO contract sucks and nobody's interested in the Wi-Fi phone, and we're just going to sit on our hands and decide what to do later. But it's very irrelevant. And I would assume Charter (disclosure: long through Liberty) will be irrelevant squared.” Good luck to them explaining that quote away!

As more and more streaming services roll out, I wonder if consumers will really save money versus the old cable bundle. I don’t watch much TV, but between a Netflix and HBO subscription plus a way to watch some sports I’m personally already approaching my old cable prices without access to a bunch of stuff I would like.

I feel like this WSJ article was spot on: the old cable bundle is archaic, but there’s room for a cable company to bundle up a few video services and offer them all to you at a discounted price. Comcast (disclosure: long) bundling Netflix is one step closer to that future.

PS- I’ll probably have more to say on cable in the near future given the recent stock performance (performance being a generous term for what has been a legitimate train wreck), but I’m still wildly bullish FWIW.

HQ is endlessly fascinating to me. It’s been pretty clear that the way they would monetize it long term was through sponsorships, but the execution so far has been brilliant (for the Nike game, they teased it all day on Twitter and then rolled out a surprise game with special Nike shoes as a give away).

Will HQ ever be worth the $100m it raised? Will the advertising have a positive ROI? Who knows! But the app and partnerships show that we haven’t even begun to scratch the surface of all of the different forms of media / entertainment / monetization that will eventually emerge from smartphones.

Disclosure: I love HQ. The fiancé and I play it almost every night.

Further disclosure: I have not won yet. She has. It is a source of endless shame.

Share buybacks into awful quarters

This is a trend I’ve noticed recently: companies getting super aggressive on buybacks during disastrous quarters that will clearly impact the stock very negatively. I don’t get it; I’m all for share buybacks, but if you know the quarter is going to suck why not just wait a month and buy back lower later?

A great example: Spectrum Brands (which I’m unfortunately long through HRG). The company bought back almost 5% of their shares in a big block at the beginning of March. Less than two months later, they announce a disaster of a quarter and fire their CEO. It sounds like a lot of the weak quarter started in March, but seriously… didn’t they have some idea they might miss numbers just a tad? They couldn’t wait on the buyback so they could get shares 25% lower?

Another example: WOW (a cable overbuilder) announced a share repurchase towards the end of December and went wild repurchasing. They bought back ~4m shares (just a shade under 5% of their shares out) at ~$10/share between that announcement and announcing Q4 results in Mid-May. The Q4 results were a complete disaster, and the stock currently trades <$7/share. Why get aggressive knowing the quarter is going to suck? Just do it in Q1!

Bonus: I loved this question on the spectrum call, “Obviously this is a tough question for you but how much did your kitchen sink the guidance today and how comfortable are you that in three months we're not going to have a similar conversation?” The company obviously declined to answer, but seriously, what type of answer was the analyst expecting?

Pilot Flying J scandal

Here’s an article on some convictions in the Pilot Flying J fuel charging scandal. Investors will know that name from Berkshire’s acquisition of it last year.

The fraud happened earlier this decade (so before the Berkshire acquisition), and Berkshire clearly knew about the issues (the WSJ article mentioned the issues), so maybe this is nothing. But I’m just shocked that Buffett would get involved in a company that had a scandal this ugly (the fraud isn’t great, but the racist components of it are really nasty) that ran all the way to the top of the organization. The scandal really flies in the face of two Buffett mantras:

First, Buffett values Berkshire’s reputation above all else. This acquisition is a rounding error for Berkshire, but being associated with something that ugly has the potential to seriously ding Berkshire’s reputation. If the management team had left with the acquisition, he could just say “prior management team; issue has been resolved”, but since he kept the top management team it seems the whole thing could come back to bite Berkshire.

Second, Buffett has repeatedly said that it’s important he can trust management teams he buys from since he keeps them on after buying them (there is a quote along the lines of “we have to trust them since when we marry the daughter she continues to live with her parents”. I tried to google to find the exact quote and was unsuccessful; I would very much recommend you do not google “marry the daughter + live with the father + acquisitions” as I did; I am haunted by the results and likely now on an FBI watch list somewhere. (update- here’s a tweet w/ a screenshot of the quote; still do not recommend googling looking for it.)

NYT article on Live Nation and Live Nation / Ticketmaster’s response

I do worry that when an article over bad behavior seems to focus on complaints from the major competitor, the article is more about a “disgruntled competitor” than actual bad behavior…. but Live Nation + Ticketmaster has always raised anti-trust questions in the back of my mind (just at a 30k foot level; I’ve unfortunately never studied in depth).

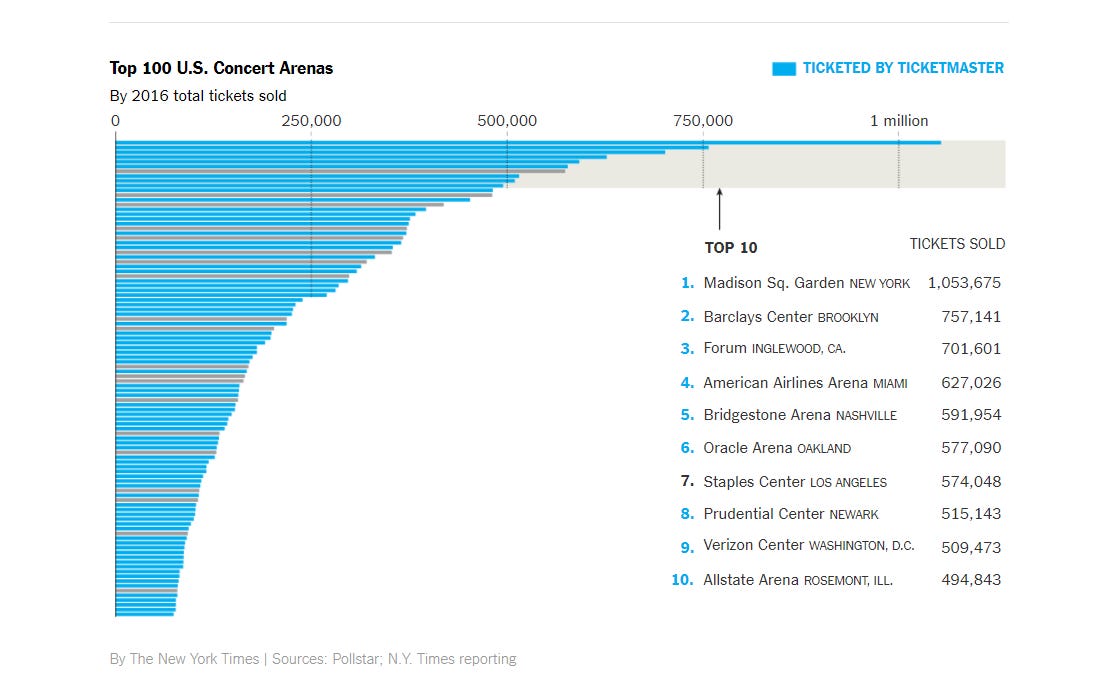

Notice the #1 and #3 concert arenas in the graph; guess who owns them? (Disclosure: long MSG).

Sports media update

A core tenant of the monthly update: continued highlights of the increasing value of sports rights (mainly because of my love of MSG (disclosure: Long)).

YouTube just struck a deal to be a presenting sponsor of the NBA Finals (similar to what they did with the MLB)

How ESPN saved $4m on its Formula One Deal (FWONA is probably the stock I agonize myself over the most; I think it’s most likely going to be a huge winner long term but I’m not super comfy with the outlook for Formula One).

Baseball is starting to turn around a bit: the demographics are finally trending younger, and fans are spending the full day at ballparks that have become destinations.

VNO released their shareholder letter. It's a nice read, but I also found it hilarious.

In one section, VNO compares themselves to some more "promotional" management teams and calls themselves "the strong silent type"… they then proceed to launch into a full page discussion of "Why Buy Vornado Shares". VERY non-promotional / strong and silent. The same "strong silent" manager goes on to call their management team the "most talented and experienced in the industry", which must be true given how non-promotional management is.

VNO calls their shares "stupid, stupid cheap" and questions why investors don't load up on "discounted public real estate"…. But VNO refuses to buy back their own shares at what they are calling a 29% discount to NAV. To be fair, later they list a bunch of reasons for not buying back shares, but it's hilarious to me that they would implore people to buy their stock but won't do so themselves (because of tax inefficiency, or wanting to build up liquidity, etc.). Maybe people are following VNO’s lead (if they won’t buyback shares, the discount must be justified by tax / selling inefficiency) in pricing the shares?

Other stuff