Senvest could be hitting an inflection point $SVCTF

Small upfront disclaimer: Despite a ~$500m market cap, the company this write up will ultimately focus on, Senvest (SVCTF in the US; SEC in Canada; disclosure; long the US shares), is on the illiquid side (~1k shares trade a day) as insiders own ~50% of shares. Be aware of that illiquidity, and (as always) do your own due diligence.

Brookfield’s (BAM) Q4’17 shareholder letter includes a very interesting line on their asset management “franchise”. I’ve quoted it below

“We also believe that if we continue to invest the capital entrusted to us wisely, create products that match our investors’ needs, and provide superior service, our business will continue to grow rapidly both in terms of the operating results and the underlying value. To illustrate this point, simply deducting the value of our invested capital (most of which is publicly listed) yields an implied value for our asset management franchise of $16 billion.

This business is currently generating $2.5 billion of annualized fees and target carry, and we expect this to increase substantially in the coming years as we complete fundraising for our next series of flagship private funds, in addition to a number of newer investment strategies. We believe that even by applying relatively conservative multiples to these earnings streams the resultant franchise value is substantially higher than $16 billion, and should continue to expand rapidly.

It is also worth noting that we believe most of the other large alternative investment managers are similarly undervalued, but we have one additional factor to note: our franchise, while large today, is not as mature as others. In particular, we do not have many large funds nearing their end-of-life phase over the next five years, and our successor funds are still growing at a substantial rate. This means that we are stacking ever larger new funds on top of existing funds, without the corresponding return of capital to investors. In seven to 10 years, we will be in the same place as the others and distributing greater amounts of capital – but in the interim, our growth rate is much faster.”

I tend to agree with Brookfield’s assessment there. In general, I think most of the big private equity shops have built enduring franchises that have been consistently underrated / undervalued by the market.

Anyway, the reason I bring that story up is because it reminds me a lot of the stock I want to talk about today, Senvest Capital. Senvest is a publicly traded hedge fund with a very attractive historical track record (since inception in April 1997 through year end 2017, the Senvest master fund has annualized returns at ~17% after fees versus the S&P around 5%). Despite that attractive record, the company trades for just ~0.67x book value (today’s share price on the Canadian SEC shares is ~$228 CAD versus a book value of >$350 CAD). On the surface, that’s pretty attractive. However, I think it’s even more attractive than that discount would suggest because Senvest’s book value ascribes no value to their asset management franchise (i.e. the hedge fund’s GP), and I think the company is about to hit a catalyst where Senvest’s asset management business gets increasingly valuable. In addition, I think there’s a shorter term market catalyst that could provide an added boost to the company / stock price.

Before I can get to those catalysts, it’s important to understand a bit about Senvest’s accounting, because it’s critical to the catalyst proposition and why I think the market may be missing the catalyst. A typical hedge fund / private equity fund is structured something like this: there’s a general partner (GP) who manages the fund in return for a management fee and a cut of the profits, and then there are limited partners (LPs) who provide the capital the GP invests (GPs often provide some of the capital that is invested too, so they make money both from management and incentive fees as well as from a return on their invested capital if they do well). Senvest has a similar GP / LP structure, and their accounting requires them to consolidate both the GP and the LP interests despite the fact the LP money belongs to the LPs, not Senvest. You can see what I’m talking about in the screenshot of their balance sheet below; I’ve highlighted the LP interest in the “Liability for redeemable units” line.

When looking at Senvest’s balance sheet, this consolidation is not really an issue. It doesn’t change the shareholder equity number, and it’s really easy to pull out the LP interest (just subtract $932m from their assets and $932m from their liabilities and you see what your investment looks like) if you want to get a look at what the GP’s balance sheet actually looks like.

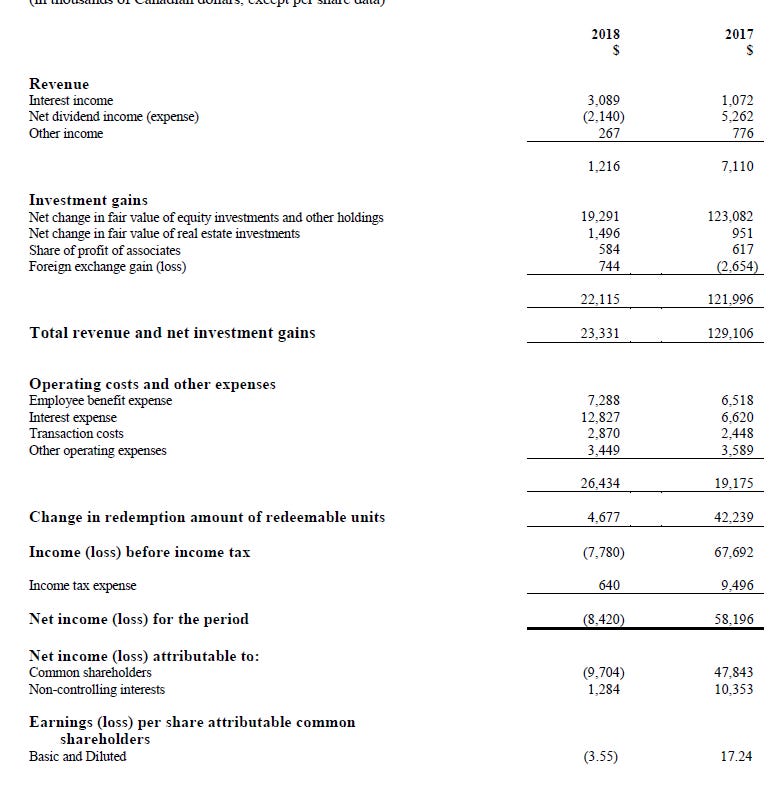

However, this consolidation is an issue when it comes to looking at Senvest’s income statement (screenshot below).

Notice what’s missing from Senvest’s income statement? The company reports basically no revenue! The company charges money to manage outside capital (1.5% management fee; 20% incentive fee), but that gets eliminated in consolidation due to the LP being consolidated. Instead of reporting fees as revenue, all of the management fee and the incentive fees that Senvest earns show up in the investment gains lines. A simple example may be the best way to show this: say Senvest is managing $1m of LP money with 1.5 & 20 terms and assume the fund earns 10% before fees. In this scenario, Senvest would get $15k of management fees per year ($1m * 1.5%) and $20k of incentive fees ($1m * 10% annual return * 20% incentive fee) for a total of $35k in GP fees that year. The whole enterprise would end the year worth $1.1m, of which LPs would own ~$1.065m and the GP would own $35k. In this scenario, Senvest’s consolidated income statement would show $35k of investment gains and $65k in “change in redemption amount of redeemable units”.

Aside from not reporting revenue, Senvest has one other quirk that makes it extremely difficult to look at their financials. The GP is set up as a “structured entity” that Richard Mashaal owns. The GP receives the fees and passes 60% of them to Senvest, which then uses that 60% to cover all overhead / employee expenses (Mashaal keeps the other 40%). Mashaal’s interest in the GP / structured entity is reported in the “non-controlling interest” lines.

Ok, I get that was a long winded introduction to Senvest’s accounting but it had to be done. The core thesis here is that an investment in Senvest today allows you to buy an interest in Senvest at ~0.67x of book, which is attractive in and of itself given book value consist largely of Senvest’s investments in their own funds (there are some small real estate investment thrown in as well). However, I think that simple undervaluation thesis understates the case, as I think there is a short term catalyst that will drive book value higher and a longer term catalyst that will reveal the value of Senvest’s GP stake.

The first catalyst would come from a rapid appreciation in book value that the market hasn’t picked up on yet. If you go to Senvest’s website, go to the Canadian public company side, and click “other financial information”, you can find the monthly returns for Senvest’s funds. And it turns out April was a very good month for Senvest, as their Master fund was up >7% on the month and their Isreal fund was up 0.69%.

Those are really big numbers, and they’re going to drive strong gains for Senvest. Given currency swings (the company reports in CAD but most assets are in USD) and multiple funds, it’s tough to say exactly how big an impact those gains will have on Senvest’s book value, but I would guess Senvest’s book value is up ~4% from where it was at the start of the quarter (to check that 4% figure isn’t crazy, it’s helpful to look at a quarter that had similar returns. In Q2’17, the master fund was up 4% on the quarter and the Isreal fund was up 5% and the company’s book value grew by ~4%, which backs up my estimates here). Given Senvest shares started the quarter trading for ~$240 CAD/share and they’re currently going for ~$228, the market doesn’t appear have factored in the intra-quarter growth in Senvest’s book value.

Of course, the quarter isn’t over yet, and Senvest is a volatile fund, so it’s possible they give back some of those gains before the quarter ends and they release their new book value. Paramount Resources (POU in Canada) is one of their largest holdings and is down ~20% in May, so perhaps the market has already picked up on the good April and is preparing for a poor May. I’d guess the fund will be down a bit in May, but I still think the fund will be showing nice gains for the quarter and the market hasn’t reflected that boost yet.

The bottom line here is that Senvest is trading significantly below book value, and Q2 seems to have gotten off to a nice start that will put Senvest even further below book value.

That first catalyst (increased book value during quarter) is a bit more market / trade oriented than I normally like. However, it plays a bit into my second catalyst: operating leverage on their stake in the Senvest fund manager.

Senvest’s book value does not assign any value to their 60% ownership of the GP. Historically, that hasn’t been a huge deal- as part of their deal with the structured entity, Senvest gets 60% of management / incentive fees but covered all operating costs, and given most of Senvest’s capital has been internally managed, that fee stream wasn’t huge.

However, over time, their externally managed capital has grown significantly. They first started breaking out liability for redeemable units (which should serve as a proxy for external capital) for the year ended 2011; you can see how that liability has grown over time in the chart below.

With Senvest charging 1.5% and 20%, as their externally managed capital has grown their fee stream has grown significantly as well. With ~$150m at YE2011, Senvest’s GP was getting just over $2m in management fees and Senvest was keeping 60% of that (so ~$1.5m). It’s tough to estimate a baseline fixed cost level because Senvest’s major expense line is employee benefit and a big piece of that rises with incentive comp in good years, but I would estimate Senvest’s fixed expense level was running ~$20m/year in 2011. With that small level of external capital, there was simply no way Senvest’s GP stake would ever cover the fixed costs of running the business, so Senvest shareholders were bearing a very heavy fee to cover the operating expenses of the business and invest in Senvest. Given the fantastic gains Senvest put up over the past few years, that trade off actually worked out well for Senvest shareholders, but there’s no denying it came with a heavy price (in 2011, shareholder equity was just $263m, so in effect Senvest shareholders were paying a fixed >7% of their capital (~$20m in annual fixed costs / $263m in shareholder equity) to cover the company’s operating expenses (and that’s before employee incentive fees kicked in!). Given how strong Senvest’s returns were (and aided somewhat by the incentive fees from the GP they received on those strong returns), that worked out pretty well for Senvest shareholders, but it was clearly a hefty burden to bear).

Fast forward to today, and the situation looks much different. Fixed cost level/year has probably risen to $25-30m annually, but the company is managing much more external capital (Redeemable Liability has risen to $932m at Q1’18; ~$100m of this is non-fee paying capital from employees but for simplicity I’ll ignore that). So today Senvest’s share of management fees probably comes in at ~$8m annually ($930m * 1.5% * 60%), and the annual cost the equity has to cover has fallen to $18m ($25m in annual fixed costs less the $8m in management fee that flows through to Senvest), and as a percentage of equity the fixed cost has fallen from ~7% to ~1.7% given equity has grown from ~$263m to $957m. That’s an enormous decrease on a percentage basis, and remember all of that is before Senvest earns any incentive fees (which, given their historical returns, can be pretty hefty. I estimate that, with their current outside capital levels, at ~20% annual returns Senvest’s share of the management fee + incentive fee covers fixed costs. 20% is obviously a big number, but given their returns through April it’s within the realm of possibilities for this year and it’s within their historical return profile).

I realize there were tons of numbers thrown out there and I may not have done the best job of explaining it, so I’ve included a chart below that shows how the management fee stream and growth in equity is driving down the fixed cost as a % of shareholder equity over time. For each year since 2011, the chart shows the redeemable unit liability and shareholder equity on the balance sheet. It then assumes fixed costs of $25m annually, a management fee of 1.5% of the redeemable liability, and that Senvest’s gets a share of 60% of fees. The chart then takes Senvest’s share of the management fee stream and subtracts it from the fixed cost base to get the remaining fixed cost and then show what that cost is as a % of Senvest’s equity. You can see from this model that the fixed cost as a % of equity has come down from 9% in 2011 to just 1.7% currently.

The increase in externally managed capital has another added benefit for minority shareholders: incentive fees matter now. Given most capital was historically internally managed, even in fantastic years incentive fees barely budged the needle for minority shareholders. Consider, for example, 2012. The company had $190m in redeemable units versus $331m in equity before NCI. They proceeded to put up a >40% gain in their Isreal fund and an almost 80% up year in their Master fund. Despite that incredible performance, I calculate that minority shareholders share of the incentive fees for that year was ~$15m. Basically, Senvest reported a legendary year of hedge fund returns, and minority shareholders share of the management fees + incentive fees didn’t even cover their fixed cost structure.

Fast forward to today, and that’s no longer the case. Outside capital has grown significantly and now almost equals Senvest’s own capital. Given the growth in outside capital and the leveraging of fixed cost discussed above, minority shareholder’s share of the incentive fee will have a big impact on the bottom line in strong up years going forward. Obviously shares would be a rocket ship in a +80% year, but even in a “vanilla” plus 20% year incentive fees would add a decent bit to the bottom line (~$20m), and that amount will continue to grow over time as their externally managed capital increases.

I know this post has been long and more than a bit complex, so I’ll wrap it up by boiling the thesis down to its most simple. Senvest is a hedge fund trading at a big discount to its book value. With solid returns and a huge increase in capital, Senvest appears on the verge of an inflection point where their fees on externally managed capital increasingly cover their fixed cost base (which will continue to come down as a % of shareholders equity due to compounding of the equity base).

Obviously there are risks here. The two biggest / most obvious are market risk and control risk.

For market risk, this is obviously a volatile fund. The FT wrote an article on the fund a few years ago that noted “Senvest has repeatedly lost more than 40 per cent over multiyear stretches”. Senvest runs a levered book, so those types of drawdowns are to some extent inevitable, and the mark to market is likely not going to look pretty for Senvest in a big bear market. The leverage should also shade a bit how you look at their track record; while it’s easy to say “I’m buying into a manager who has beat the pants off the S&P at a discount,” some of that return was driven by running a levered book in a period when equities were generally rising. So yes, there’s definitely risk here, but ultimately I do think this is a team that has invested with some alpha and I’m happy to buy them at a fraction of book and take the risk that we run into a huge bear market and the mark to market on their book / the position in them isn’t pretty (also, to some extent the risk here could be hedged out by pairing a long position in Senvest with a short in the Russell 2000 or a basket of indices).

There’s also some control / key man risk here. I see that coming in two forms. First, in the shorter term, you’re exposed to the good graces of the Mashaal family. They control and run Senvest, and if they decide they want to try to keep even more of / all of the economics of the company / investment team for themselves, there’s probably not a whole lot minority shareholders can do. You could see a logical explanation for this too- the current contract was originally structured when the company wasn’t running a ton of excess capital in a way so that Senvest minority shareholder’s bore the brunt of the company’s operating costs; given the growth in externally managed capital, minority shareholders today increasingly get the Senvest investing team for free, which was not the original "bargain". I take comfort here that Senvest hasn’t shown an appetite to change this contract over the past few years- they haven’t changed the current set up since at least FY2005 (as far back as I went to look). Thinking longer term, there’s also the risk of what happens once the Mashaal’s aren’t with the company. That’s probably a very long term risk, as the key guy (Richard) is in his early 50s, but it is an open question of what happens to the company after he retires / dies. Would they liquidate and return all the funds the shareholders? Will they just hand the reigns to the next generation? If so, does Senvest become something of a public investment in a family office (similar to a lot of the diversified family holding companies we see in Europe)?

Odds and ends

There’s obviously a lot of analysis here, but a big piece of this investment comes down to one thing: how much credit do you give to Senvest for their 20+ year track record / how do you think they will perform going forward? If you think the future will look anything like their past trach record, this will obviously be a home run. If you think they got lucky running a levered strategy in a time that was decent for their strategy, this will probably turn out poorly when their luck runs out. And if you think they’re good but not spectacular and will do about average (or maybe a bit better) over time, this will probably turn out pretty well for you given the low starting valuation.

One unfortunate thing here: given Senvest only owns 60% of the GP, the upside from GP growth isn’t quite the same as at Brookfield or other big asset management “franchises” as a decent bit will be captured by Mashaal.

In addition to the GP share, there’s a bonus pool that provides up to 7% of pre-tax income to the executive committee (mainly the Mashaals), with about half of that tied to the investment portfolio exceeding the “benchmark” return of a basket of indices by at least 35%. All in, this isn’t a huge drag but it is something else to consider.

Here’s an interview with Senvest’s CIOs on BB in early 2017 that’s decently wide ranging (investment thesis, some stock picks, firm beginnings, etc.)

The company does have a share repurchase program; it’s nothing heroic given the illiquidity of the stock (~2-3% of shares/year), but with no share dilution (no stock options issued in the past decade or so) and the shares trading at a fraction of book the share repurchase program does add up over time.

Right now we’re only valuing the GP as a manager of their two current funds. Funds with good track records tend to have the ability to expand into new places (almost every major PE fund now has a credit arm, a VC arm, etc.). Given Senvest’s track record, I wouldn’t be surprised if they were able to launch a new strategy in the future, which presents an interesting source of upside optionality.

Related to the above: one reason fixed cost has gone up over time: investment in US biz. In their 2016 annual report, the company started noting: “The Company has made significant investments in its US operations, primarily in people, systems, technology and office space. This investment represents a significant effort in a short amount of time to raise the quality of its infrastructure and personnel. As a result, the Company’s operating costs have been increasing in the recent past from historical levels.” Perhaps this investment is a prelude to a significant fund raise or a new launching a new verticle (real estate / private equity / etc.).