Some things and ideas: June 2018

Some random thoughts on articles that caught my attention in the last month. Note that I try to write notes on articles immediately after reading them, so there can be a little overlap in themes if an article grabs my attention early in the month and is similar to an article that I like later in the month.

I don’t agree with the article for a host of reasons, but it’s certainly thought provoking.

One reason I don’t agree- a key piece of the article seems to center on “people don’t want ads.” That’s probably true, but advertisers want to reach people, and websites are incentivized to let them since ads are generally what pay the bills. If enough people install ad blockers, websites are going to take drastic counter measures to make sure the bills still get paid (I’ve already seen sites that won’t let you access them with an adblocker installed).

Another piece I don’t agree with- the article leads by citing amazon passing search engines as the first place you start when looking for a product as part of the death of Google story. While Google would certainly prefer product searches starting with them, the vast majority of searches are information based (“what type of tax return should I file if I’m a consultant”) and advertising can often benefit both the advertiser and a searcher in that transaction (in my tax return example, a tax prep company could advertise to the searcher, and the searcher very well might want to hire the tax company).

Michael Lewis’s next book is straight to audio

“Audible, the biggest player with more than 425,000 titles in its online store, has an enormous advantage in this increasingly crowded arena. Amazon has been pushing audiobooks on its platform, listing them as “free” with a trial Audible membership, which costs $15 a month, and includes a book each month”

It is borderline insane how many times I think to myself, “man, that area of the market is going to be huge” and it turns out Amazon is by far the leader in said area. AWS for cloud computing is obviously one, but the list runs on and on: video game streaming (Twitch, which dominates video game streaming), audiobooks (audible), in-home assistants (alexa), etc.

Asset managers

I’ve been spending a lot of time looking at the asset managers (particularly the private equity / alternative asset managers; I linked to BAM’s (disclosure: long) letter in my Senvest (disclosure: long) post).

One of the most difficult things for me to do is value the management fee and incentive fee streams. Most people slap ~5x on a normalized incentive fee stream and a low teen multiple on the management stream (higher valuation for mgmt. fees given they’re much more consistent; see page 67 of the FIG proxy for an example of this multiples analysis in action). I guess that valuation is fine, but if you think about the benefits of compounding (just say the firm breaks even at fund raising and their current assets compound at ~equity rates), that multiple dramatically undervalues the asset management franchise's growth potential. If you think the managers have any skill / alpha generation ability (or simply think they’ll grow assets faster despite having no skill thanks to their use of leverage), they’ll do even better. If you believe in that “compounding AUM” story, than the multiples these franchises deserve are very high (BAM, for example, discloses in their supplement they think fee revenue should trade for 20x and carried interest for 10x. Of course, they may be speaking their own book!).

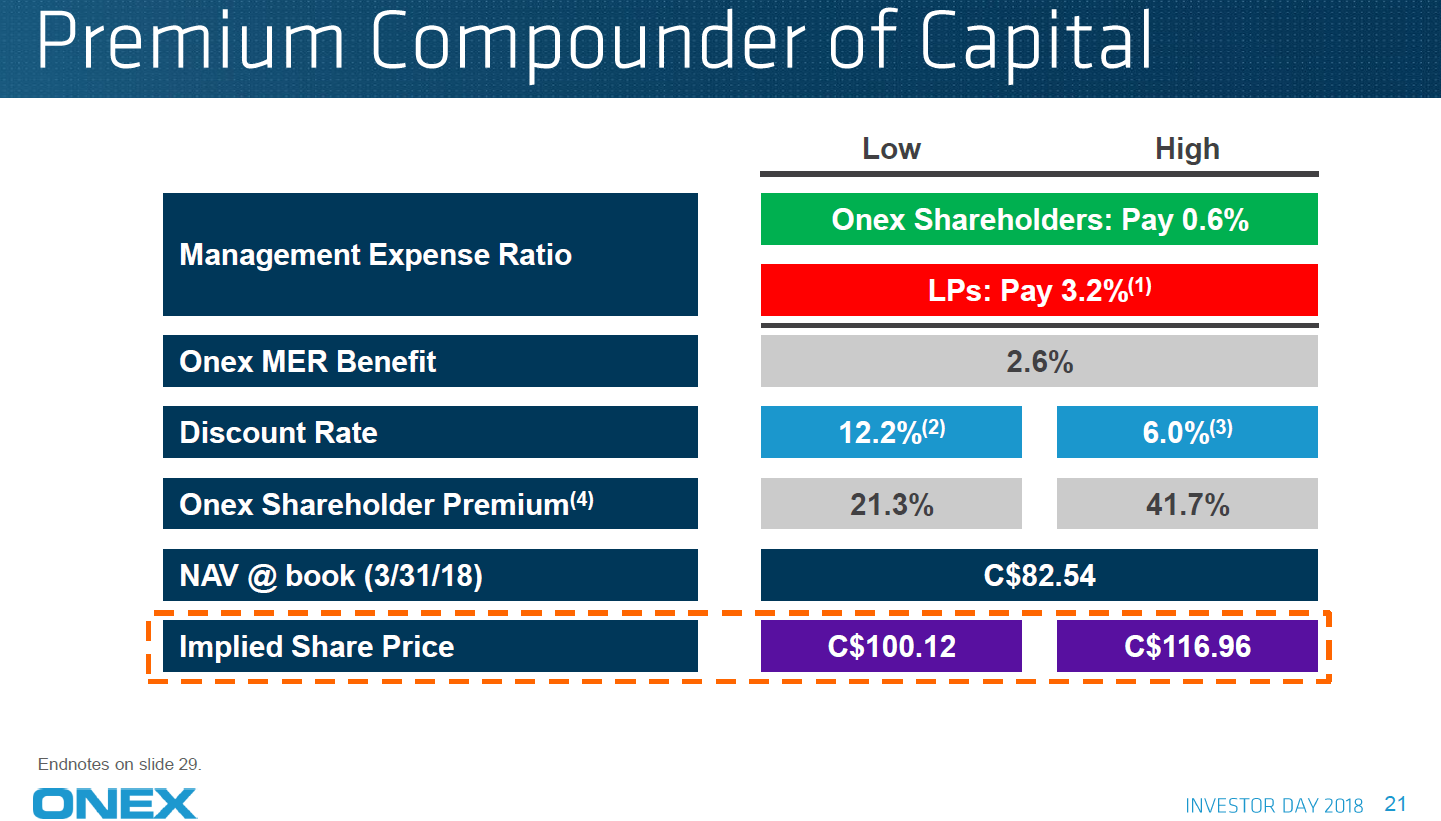

ONEX’s investor day included an interesting alternative way to value them: treat the asset management stream as a reduction of fees (versus what an LP would pay), and then use that to back into the type of premium you should pay for the company / balance sheet. This valuation only works for asset managers with big balance sheets, but it’s very interesting!

Paying a premium to book value for an LP stake probably sounds crazy to a lot of readers. With that in mind, check out this WSJ article (Private equity: So Hot Even Second-Hand Funds can Sell at a Premium). Read that article and then think about if it’s crazy to pay a premium for LP stakes with significantly lower fees.

I’m still working through how I want to think about this / value the asset managers, so unfortunately I have no takeaways here. But the Onex slide and overall discussion were interesting enough I wanted to share; feel free to “slide into my DMs” if you want to discuss the asset managers and/or valuing them a bit further.

The business of escape rooms

I am a completely unabashed lover of escape rooms (I have done well over 50, including almost all of the rooms in the articles I’m about to link), so I had to link to some recent press on the business of escape rooms

Breaking Into the Boom in Escape Rooms: What Entrepreneurs Need to Know

If you like escape rooms or have never tried one but are curious, I’d recommend an escape the crate subscription. That’s not a referral link or anything; I’ve simply been a subscriber for ~a year and love them.

Media Mogul Malone Questions Mergers of Apples and Oranges

Tough to disagree with anything the man says!

I’m surprised he mentioned RSNs as a possibility for Charter in here; Charter (through Time Warner) owns SportsNet in LA and I believe it has not been a pleasant experience, and I talked to their IR recently and asked them about RSNs and they seemed to suggest they’d be more focused on local news type content. But if Charter wants to take MSGN (disclosure: long) off my hands….

Sports media update:

A core tenant of the monthly update: continued highlights of the increasing value of sports rights (mainly because of my love of MSG (disclosure: Long)).

The Bucks signed a new TV deal- 7 years at ~$30m/year. I think the deal highlights just how cheap MSGN's (disclosure: long) deal w/ the Knicks is (they pay low $100ms for their rights and rise LSD for the next ~17 years); consider that the Milwaukee metro area has ~1.6m people versus >20m for NYC.

Delaware became the first state to offer "las Vegas-style' sports betting earlier this month

A conversation w/ ESPN executive who oversees rights acquisitions

Major league baseball sees a sharp drop in attendance

I’m including this separately from my sports media update because I wanted to briefly discuss some things in the article.

First, the big worry for anyone long baseball (which I am through BATRA) is that the game gets less popular over time. It’s tough to argue that baseball is not the most boring of the big 4 sports, and I worry that as the population ages a new generation will prefer Fortnite to baseball. Longer term, you could see how that worry would extend to any and all sports.

Second, a worry that all sports leagues with a draft model will have to deal with: as teams get more sophisticates, they have realized the best way to win in the future is to lose now (tanking). While that’s great when it works out, it’s a complete disaster for the product teams put on the field now. At its core, sports is entertainment, and if half the league is purposely trying to lose than that sports league is offering a pretty poor entertainment product.

Podcast

Who will catch FOX: Disney or Comcast (disclosure: long FOX + CMCSA; short DIS)

Other things I liked

MSG exploring spin (disclosure: long MSG; I very much liked this)

Star Wars Fatigue is a Myth (but Disney’s Mistakes were Real) (Disclosure: short a small amount of DIS)

16 years late, $13B short, but optimistic: where growth will take the music biz

Here’s what the internet actually looks like

Lies, China, And Putin: Solving the Mystery of Wilbur Ross’ Missing Fortune

GS’s CEO-in-waiting just released his first electronic dance single

SKAM the radical teen drama that unfolds one post at a time: can’t believe it’s taken this long for people to really experiment with incorporating social into “tv shows” / entertainment.