The Theft of GGP: Special Situations Analysis

In my previous post (The Death of Malls and the Theft of GGP), I talked about the death of Class A malls and how I thought BPY was stealing GGP. I also mentioned that there was a serious special situations angle to the deal, which I’ll cover in this post.

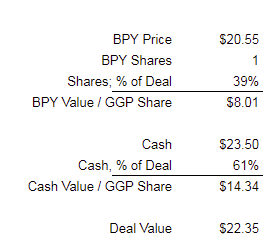

BPY (which is controlled by BAM, which I am long) is acquiring GGP (disclosure: long) for a headline price of $23.50/share. However, as so often happens in conflicted takeunders, the headline price has nothing to do with the actual value GGP shareholders will receive. GGP shareholders can actually make an election to receive either $23.50 in cash or one “BPY unit or BPR share” (I’ll discuss those shares in a second) which will be prorated so that the total consideration comes out to 61% cash and 39% equity. With BPY shares currently trading for $$20.55, the transaction is currently worth ~$22.35/share

With GGP shares currently trading for ~$21.04, the stock currently presents a very attractive spread to deal price.

(Note: BPY will pay a dividend towards the end of August; it’s unclear if the GGP deal will close before or after that dividend. I excluded it above for simplicity, but if BPY does pay the dividend before the GGP deal closes it would knock ~$0.12/share off of the BPY Value / GGP Share).

In fact, with the deal set to close next month, GGP doesn’t just present an attractive spread… GGP presents the type of return that you’d typically see in “hairy” deals (deals with some type of risk associated with them). Just to put the spread in perspective, Time Warner was trading for gross ~6% spread to their deal price the day before the government ruled in their favor in the “antitrust trial of the century”. So what “hair” is the market pricing in here?

Before I get into the “hair”, let me just emphasize I’m not a tax advisor and I’m not offering any tax advice here (as this blog’s disclaimer says, nothing on this blog should be taken seriously nor read by anyone). That said, the risk is clearly related to tax complexity in the deal, both in the form of the consideration that BPY is paying GGP and on BPY specifically.

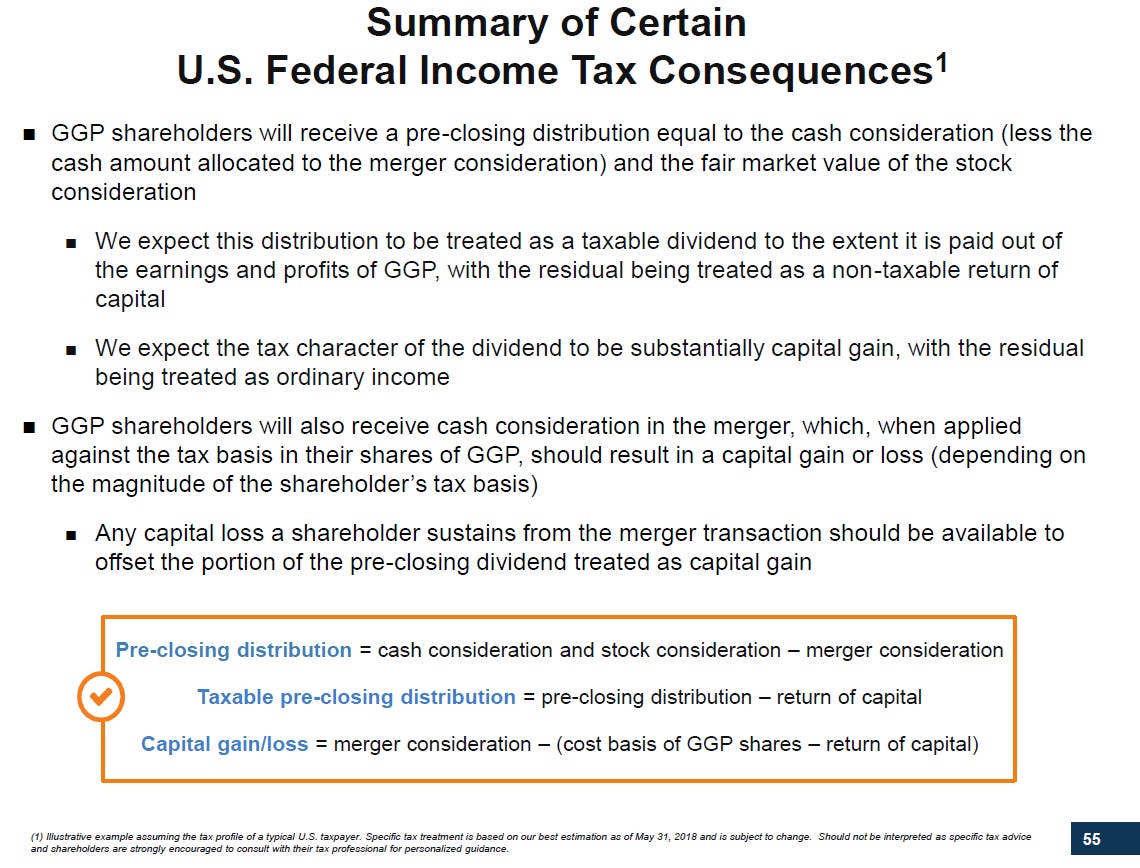

Starting with the consideration side: almost all of the cash that BPY is paying GGP shareholders as part of the merger is coming in the form of a taxable dividend. Per the BPY Q1’18 call,

“we've been getting a number of questions as it relates to that specific topic. So I'm just going to try to summarize what we've included in the proxy and of course, I'm going to end up with a caveat. But really, first off, a GGP shareholder will receive a pre-closing distribution of cash consideration and stock consideration. This is assuming proration for simplicity in this example, that will constitute a dividend to the extent that it is paid out of the earnings and profits of GGP. It is expected that this distribution will be substantially taxed as a capital gain with the balance as ordinary income. In addition, you'll receive a small amount of merger consideration, which we outlined in the proxy as part of this transaction. This merger consideration, when applied against the tax basis that GGP shareholders has in their GGP shares, will result in either a capital gain or a capital loss. Any capital loss from applying it against merger consideration can be used to offset the capital gain received as part of your pre-closing distribution. And then on a go-forward basis, your BPR or BPY units that you receive as consideration will have a basis that's equal to the fair market value at the time of the transaction close and pre-closing distribution. So I will say that certain aspects of these tax consequences of the transaction are not entirely clear, so we do urge anyone working through this to consult your tax advisers. In addition, we do have more complete discussion of these consequences in the proxy and S-4, and we would also urge everybody to reference that as well. So hopefully, that gives you a sense.”

“So when I commented that the distribution will be substantially taxed as a capital gain, it's that portion of the gain that's largely attributable to the asset sales associated with the transaction. The balance will be ordinary income.”

They included the slide below in a recent IR presentation which helps show the tax consequences of the merger as well.

Again, everyone should assess their own tax situation and I am not giving tax advice here, but I would note that the effect of that structure will vary from investor to investor from somewhere between annoying (for many investors) to borderline disastrous (for any investor subject to withholding).

So the tax complexity of the GGP payout is likely contributing to the spread. But I think some tax complexities on the BPY side are contributing to the spread as well. BPY is structured as a partnership, which means that anyone who invests in them is subject to a K-1. Again, not tax advice and I am not a tax advisor, but getting a K-1 is frustrating for many investors and can limit the potential ownership pool for a company. In cash and stock deals, most merger arbitrage players will short out the stock they are receiving (i.e. the stock of the buyer) to “lock in the spread”. Given BPY is a partnership, I wouldn’t be surprised if a lot of funds are restricted from shorting BPY in order to avoid getting hit with a K-1, which could limit the appeal of “playing” the GGP / BPY deal to most merger arb funds.

Putting it all together, there’s tax complexity on every side of this deal. For the last time, I’m not a tax advisor and this isn’t tax advice, but I think an understanding of how “tax complicated” this deal helps explain the wide spread. And I also think it helps illustrate a potential catalyst for BPY post deal.

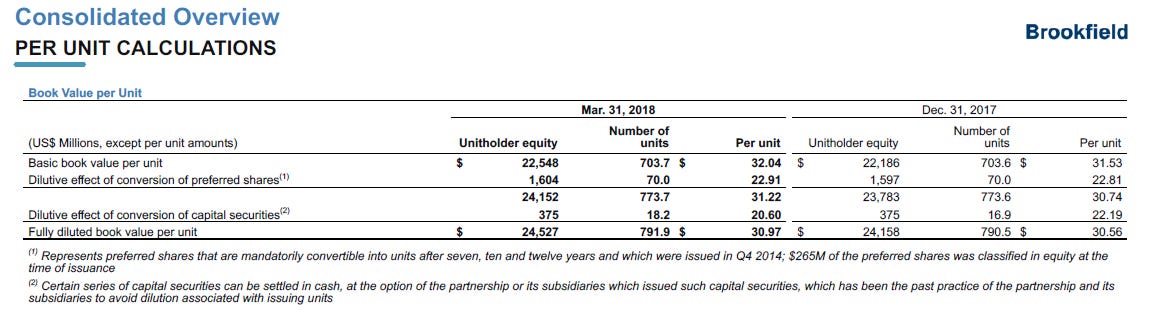

Again, at today’s price BPY trades for $20.55. As of March 31, 2018, BPY marked their diluted book value at $30.97/share (see chart below). Diving too far into BPY’s valuation is a bit beyond a focus on a special situation so I’ll just say this: I don’t think BPY deserves to trade for NAV (they’re externally managed, and you need to adjust some discount for that contract), but I think BPY’s current discount is way too wide (I’m not 100% sure how wide- my gut says BPY should trade for a ~20% discount to NAV, but BAM is a good operator and BPY has a lot of fee credits that makes the management contract pretty cheap currently so you could probably talk me into a 10%-ish discount). BAM appears to agree with me that BPY trades too cheap: they’ve consistently talked about how undervalued they think BPY, BPY is by far BAM’s largest investment, BPY has historically had a decently active share repurchase program going given how high insider ownership is, and, in my talks with IR, they’ve been pretty clear they want to step up the BPY share repurchase program after the deal closes.

I think there’s a good argument to be made that BPY’s discount is trading too wide for three reasons: BPY’s tax complexity, BPY’s overall complexity, and BAM’s high insider ownership. All of these issues will be somewhat alleviated once the deal goes through.

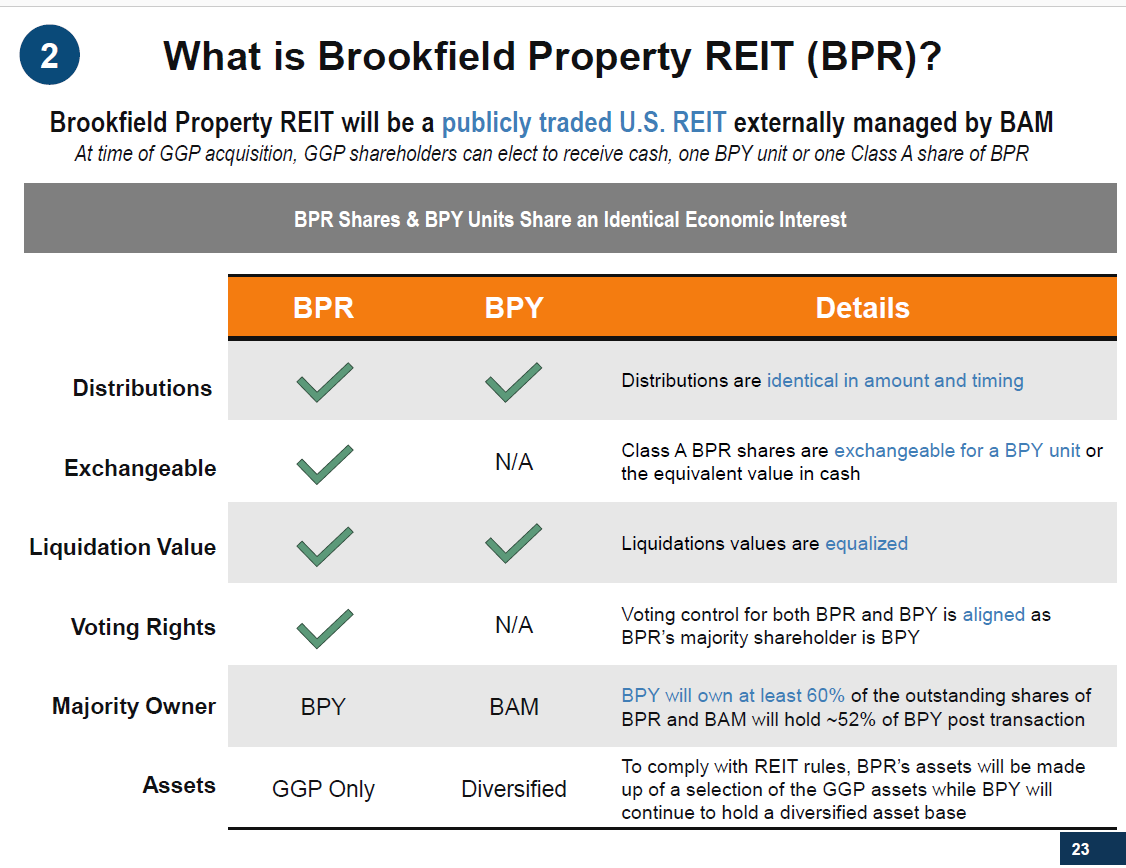

I’ve already mentioned BPY’s tax complexity (the K-1 piece) earlier, so I won’t dive into that issue here. Instead, I’ll focus on how the GGP deal could help alleviate that issue. As part of this deal, GGP shareholders can elect to receive normal BPY units or a newly created set of BPR shares. The BPR shares will qualify as a REIT for tax purposes and have the economic equivalent of a BPY unit. In other words, by investing in BPR shares, investors can dodge the “K-1 issues” associated with BPY (note that BPR shares are convertible to BPY shares and BAM is guaranteeing that conversion (you can’t convert BPY to BPR though), so while the BPR asset base is slightly different than BPY for tax reasons, I don’t think you have any risk of BPR getting asset stripped by BPY or something).

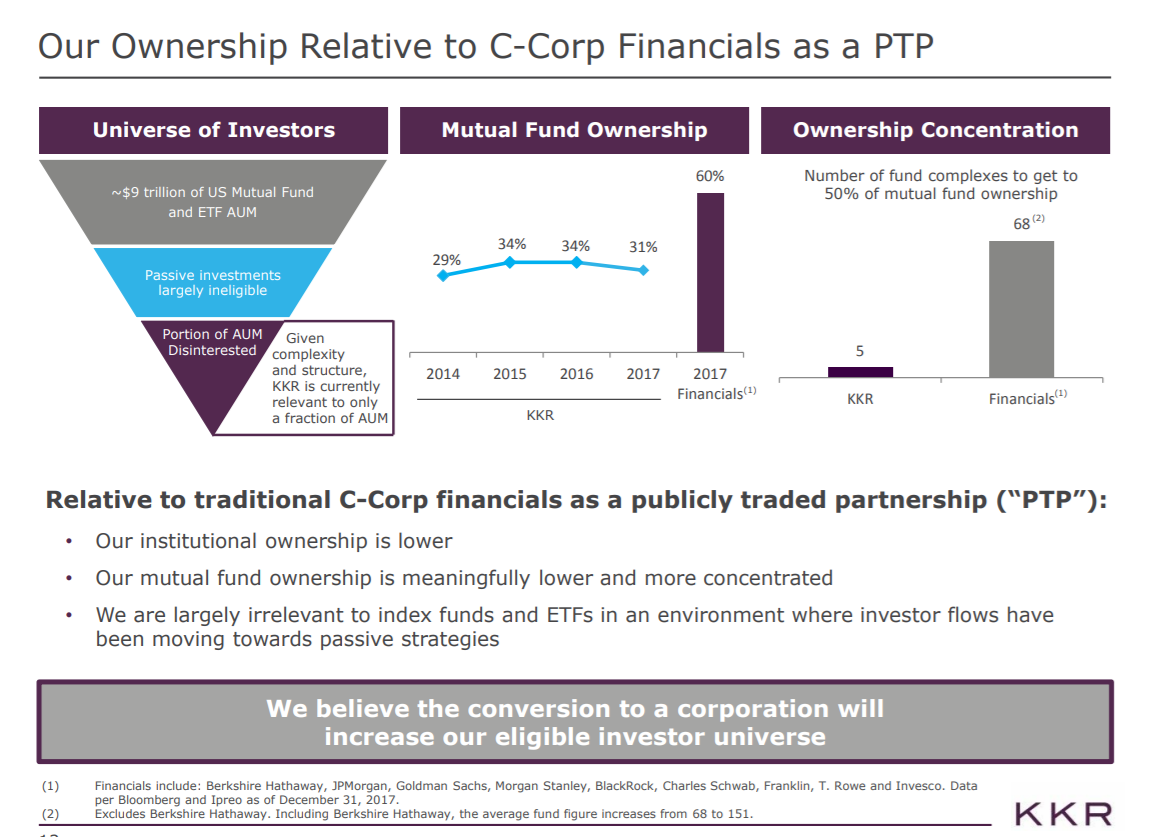

This could open up BPY / BPR to a whole new series of investors. KKR recently converted from a partnership to a C-Corp and saw their share price increase significantly; as part of the conversion, KKR provided the slide below to illustrate how under-owned they thought their shares were. I would not be surprised to see BPR shares trade up over time as the REIT shares are open the company up to a new set of investors.

I’ll quickly hit the other two issues that will be alleviated as part of this deal. BPY likely has historically been given a complexity discount, as a large piece of their asset piece consisted of large stakes in publicly traded stocks. Post GGP deal, BPY will have cleared up all of those publicly traded stakes, which should make them a cleaner story. On the ownership side, BAM currently owns >60% of BPY. Post GGP deal, BAM will own just over 50%, so insider ownership is still huge, but the slight dilution / added liquidity from the GGP will probably help BPY a bit.

Ok, just to wrap this up, a summary: GGP trades at a decent spread to its deal price, and I think that deal price is heavily discounted as BPY trades at a decent discount to their book value. Over time, I’d expect BPY’s intrinsic value to increase, driven by share repurchases and continued value add investments (BAM’s track record is fantastic), and eventually the gap between BPY’s share price and its intrinsic value should naturally close. That “gap closing” may be aided by the deal overhang from the GGP deal going away and the tax benefits of the new BPR shares.

But I want to end by bringing this post back to my original post on class A malls and BPY stealing GGP: the market doesn’t like class A malls right now, and BPY is buying a ton of them with a lot of cash (and some shareholder dilution) in this GGP deal. As the market gets over its “fear” of class A malls, I’d expect that too will help close the gap between BPY’s stock price and its intrinsic value… and, if over time, the market comes to believe (like I do) that BPY is stealing GGP, that will help drive the gap closed even faster.