Some thoughts on getting screwed by Dell $DVMT

Yesterday, Dell announced a reverse merger into their tracking stock (DVMT, disclosure: long). The tracker was already a very popular position among more event value investors; combine that popularity with the new deal’s complicated structure, huge leverage at the Dell stubco, and the potential for an activist to step into the current merger, and I have a feeling the finance internet is about to be flooded with takes on the Dell tracker/ merger (indeed, Clarkstreetvalue published on it last night, and the VIC message boards are already going crazy discussing it).

I was tempted not to add my take on the deal / stock, but given the Dell tracker was one of my three ideas for the New Year and the big risk I discussed in that post was “Dell screws you” risk and Dell has now properly screwed us, I ultimately caved and decided I needed to throw some thoughts into the void.

Editor's note: After some reflection, I realized some of my conclusions in this post were slightly off and published an update here. While the update didn't change any of the takeaways here, I wanted to highlight that update. The rest of this post is unedited from its original form.

Let’s start with the obvious: Dell is screwing us / stealing the tracker. Dell’s press release focuses on the 29% premium to DVMT’s closing share price, but that’s complete bullshit for a host of reasons. The two major ones are 1) that premium values the shares of Dell that DVMT shareholders will receive at $109/share, and, with shares trading in the low $90s, the market is clearly not subscribing that value to the Dell shares and 2) given share repurchases, DVMT today owns ~1.016 shares of VMW (disclosure: short a small bit against the DVMT long) for every share of DVMT, which would be worth ~$165/share at today’s prices (with VMW at ~$163, though some of that is driven by the ~10% rally in VMW shares after news they wouldn’t be taken out).

That brings us to the second most obvious point: I think there’s a huge opportunity for an activist to step in and get a better deal. The deal requires approval from DVMT minority shareholders, and we already know there are two great activists in the tracker (per Bloomberg, Elliot is the third largest holder and owns ~4% of the tracker, and Carl Icahn owns both VMW and DVMT). Remember, Dell had to (modestly) bump his offer to take Dell private, so he has a semi-history of boosting bids, and Icahn has a history of screwing with people who have messed with him in the past; given Icahn’s experience with the prior Dell take private, Icahn may get big in DVMT and push for a bump (in an incredibly lazy piece of journalism, the NYPost is reporting he’s “considering ” a VMW play) just for the hell of it.

The way I look at it is this: DVMT’s “unaffected” price was ~$85 against an “unaffected” VMW price of ~$145, so there was ~$60/share of value to be captured. Dell’s $109 offer gives ~$24/share of that value to DVMT shareholders while keeping ~$36/share for themselves. Dell is also going to point out that their offer is a 29% premium to DVMT’s “unaffected” price, and that Dell had the option to IPO and then force convert DVMT shares into Dell shares at a 10-20% premium (see p. 27, but basically they would need to pay a 20% premium in first year after IPO dropping to 10% premium more than two years after), so shareholders should be happy with their 29% premium.

I think minority shareholders have a lot to push back on there.

The most obvious point of pushback is on the premium paid. As mentioned earlier, DVMT shares are trading in the low $90s (let’s call it $94/share to make the math easy), so DVMT shareholders can push back on Dell and say that they are only getting $9/share of value while Dell is getting ~$51/share. DVMT shareholders can also point out that both DVMT and VMW shares blew up (in a negative way) when it became public that Dell was considering taking them out; DVMT shareholders can (rightly, in my mind) argue that the premium is on an artificially wide spread to VMW’s artificially depressed price (i.e. without Dell, DVMT shares would trade tighter to VMW and VMW would trade higher; VMW shares were up ~10% on the news they’d remain independent so I think there’s a lot working for shareholders here).

So I think shareholders are going to push back that Dell is getting too much in this deal. And I think they’ll have a lot of leverage to force Dell to go higher. Why? Dell always had two big sticks over DVMT shareholders: the first was the forced conversion option, and the second was the “doomsday” option (for DVMT shareholders) of Dell taking VMW private while leaving DVMT out. Now that Michael Dell did not get what he really wanted, that doomsday scenario seems off the table.

With the doomsday scenario gone, it comes down to Dell threatening shareholders “take this deal, or I’ll IPO and force convert you at a lower price.” And given how the market has responded to Dell’s attempts to go public, I think that’s a hallow threat at best.

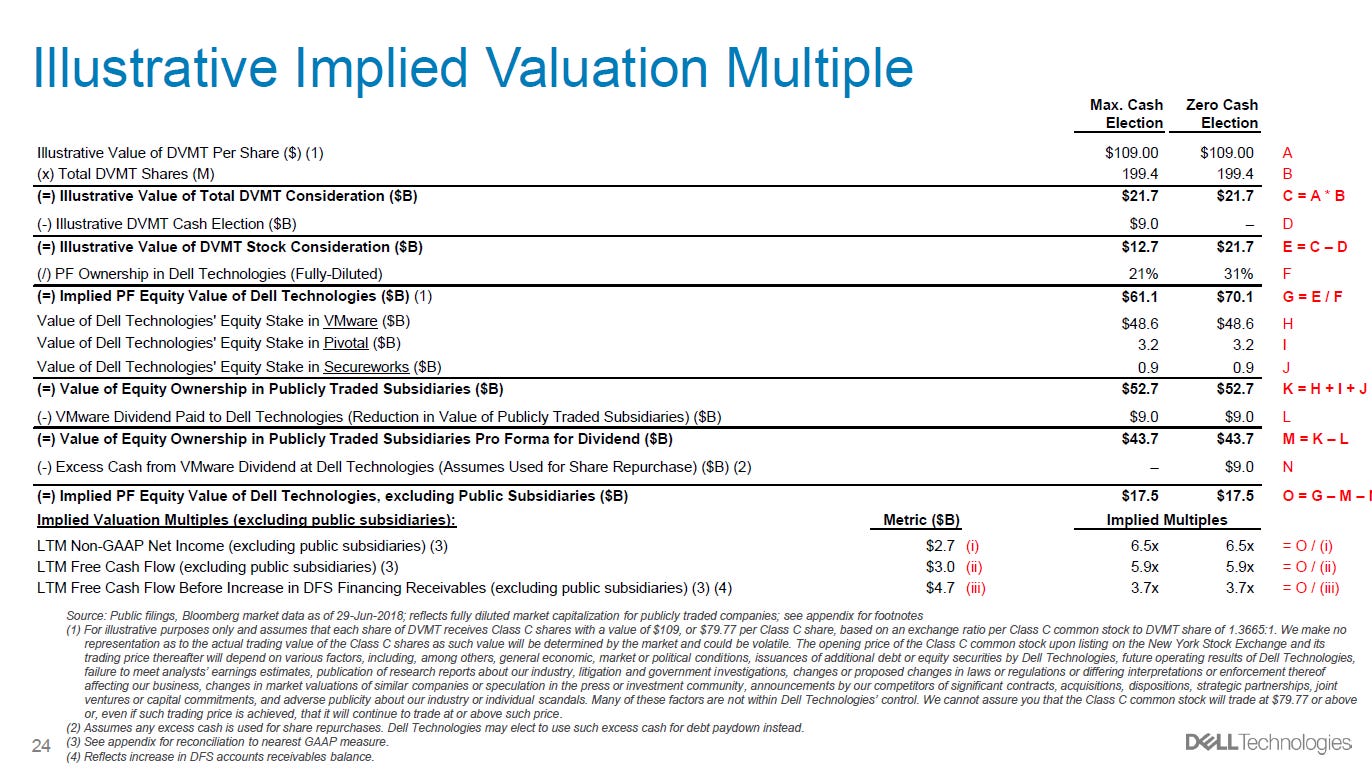

Consider how the market is currently valuing Dell in the DVMT deal. Getting to “core Dell’s” valuation is a bit complex, given they own a huge stake in VMW (as well as stakes in Pivotal and Secureworks), but Dell was kind enough to provide an illustrated look through valuation in the merger deck.

Core Dell is very levered, with ~$31.7B of “net core debt” (see slide 28 of the DVMT presentation), so a better way to look at it is probably on an EV / EBITDA basis. With $6.9B in “core” adjusted EBITDA (see slide 17), Core Dell’s EV / EBTIDA would be ~7x at Dell’s valuation.

Of course, the market isn’t valuing DVMT at $109/share; it’s valuing DVMT at ~$94/share. Dropping in $94/share into the table Dell provided gives a “Dell Stub” value of ~$3B (assuming the cash consideration maxes out).

At that valuation, core Dell is valued at ~5x EBITDA.

Even that’s probably not enough adjustment though. A ton of Dell’s value is coming from their publicly traded stakes (particularly VMW), and you need to make two adjustments there. First, VMW’s stock went up ~10% as the market rejoiced that Dell wouldn’t steal the company (plus gave them a little credit for leveraging up). Second, most companies with big stakes in other companies will trade at a discount to the value of those stakes, as the market adjusts for potential tax drag on a sale or simply assigns a conglomerate discount (IAC, for example, has long been a favorite of mine (disclosure: long IAC) and persistently trades at a discount to the value of their cash and publicly traded stakes despite a history of creating value for shareholders (a history Dell lacks)); it’s likely the market would put a heavy discount on Dell’s publicly traded stakes given Dell’s leverage and history of self-dealing.

In the table below, I’ve adjusted Dell’s publicly traded stakes value to take into account VMW’s share price increase and assigned a 25% “equity drag” to the value of their stake. Doing all of this takes their net equity value (after the VMW dividend) from the $44B they presented on slide 24 to $36B.

Putting it all together, if we adjust DVMT’s share price from the $109/share given on slide 24 to the current price of ~$94 while pulling down the equity stake value from $44B to $36B, we can see the market is valuing Dell stub at ~$10B (assuming everyone takes cash)

At $10B equity value, core Dell’s EV is ~$42B, and the company is valued at ~6x EV / EBITDA.

Honestly, that multiple seems in the realm of reasonableness. I’m no expert in the space, but IBM, HPQ, and HPE seem like decent comps (I’m just pulling from slide 13 of the merger deck); those are all valued at 6-8x EBITDA. Given Dell’s way higher leverage, you could make an argument they should trade at the low end of that range (fear of distress) or at the higher end of that range (more equity upside / levered cash flow). I would probably tend towards the higher end of that range given Dell seems to be performing a bit better than peers, but I’d leave the ultimate determination to people who know the sector better than me.

So why bother to walk through that whole valuation exercise? With VMW at ~$160 and DVMT at ~$94 and 200m DVMT shares out, Dell is stealing ~$13B of value from DVMT shareholders ($160 minus $94 times 200m shares). The market is currently valuing the PF Dell equity (i.e. after the DVMT deal) at $10B or less, meaning that without stealing DVMT the market is assigning a negative value to core Dell’s equity.

With Dell’s “stub” value trading negative before any value from DVMT shareholders, DVMT holders can rightly push back on any argument from Dell that he’ll IPO and force a conversion on DVMT. There’s no market for an IPO of something with negative value. (UPDATE- I was a bit off in saying this and published an update here; for the most part my new thoughts don't change anything but I wanted to highlight that. The rest of this post is unchanged).

That’s not to say Dell has no leverage. DVMT is a controlled tracker, so it probably deserves some discount, and Dell has the benefit of time (DVMT isn’t going anywhere without him, and maybe the market won’t give Dell equity value today, but perhaps they would after more debt paydown in a year? Or two years?). At some point DVMT shareholders will have to play ball w/ Dell, and since he’s put DVMT in play it’s likely going to be today.

One other point of leverage for DVMT shareholders- it seems Dell put DVMT in play because the tax code changes messed with the tax deductibility of Dell’s massive debt load. Taking out DVMT gets Dell cleaner access to DVMT’s cash. So, in many ways, while Dell can argue “take this deal or I’ll wait you out”, DVMT shareholders can counter “you need this deal today, not tomorrow.”

Ultimately, I think Dell comes back with a bid bump. Another $10/share is probably enough to get shareholder to begrudgingly accept, though personally I would hold out for $15-20/share (which would be a ~$30/share premium to DVMT’s unaffected stock price and split the ~$60/share discount DVMT traded at evenly between Dell and DVMT). Most people I know who think a bump’s coming think it will be a bump in equity (i.e. hold the cash figure constant but give DVMT more of Dell’s equity). I disagree because there seems to be a valuation mismatch (the market thinks Dell’s equity is worth nothing while Dell thinks it has a lot of value). That type of value mismatch creates a very difficult dynamic for getting everyone on the same page in a negotiation, particularly when you consider the leverage at Dell would involve massive amounts of dilution to bridge a $10-20/share gap. Better to use cash to make up the difference; I know it seems crazy to suggest a company as levered as Dell should send out cash, but Dell has ~$8b in cash and investments on their balance sheet and could lean on VMW to increase their special dividend if they needed more cash to pay off DVMT shareholders.

Anyway, my bottom line is I think this initial Dell bid is just an opening salvo. Dell is taking too much value from DVMT shareholders for them to let this bid stand. I’d expect to see several activists stepping into the process and forcing Dell back to the table, and Dell should happily give them a bump in order to capture ~$10B of value and get a public stock.

PS- the deal is barely 24 hours old and the proxy is several months out. Perhaps both the market and I are undervaluing core Dell and a proxy will show that. Perhaps there's some quirks to the deal I haven't noticed yet. I'm very open to feedback here or the possibility that some of my thinking is off (this was written rather quickly!); feel free to drop me a line if you'd like to discuss further!