Some updated thoughts on Charter post earnings $CHTR

In general, I don’t like to write follow up pieces on the blog. It’s way more fun to research and write about new companies / situation / ideas, and I think it’s more fun for you (the reader) to read about new things as well. So I tend to avoid follow up pieces unless I think I’m putting out something that’s dramatically different to what I’ve been thinking or if I’m putting out something that I don’t think many people have picked up on yet (like with the Braves (disclosure: long) and the focus on their real estate last week).

But despite writing about / following a bunch of different companies, at core I run a pretty concentrated portfolio with cable companies (the vast majority Charter through the Liberty complex (disclosure: long), but small positions in a few others) and sports teams (the vast majority MSG (disclosure: long), but a bit in the Braves too) making up ~half my portfolio. Because of that concentration, it’s pretty easy to get excited when Charter reports nice earnings and sees their stock do this:

Similar to what I talked about in my July links post on tech companies, it's easy to get too focused on a nice short term move / earnings report and have it influence your thoughts on a company. In fact, Charter's stock is still down YTD!

In the long run, neither the super short term move up yesterday nor the somewhat longer (but still pretty short term) move down YTD make much a difference to me. But I like writing and Charter's been pretty top of mind for the past couple of days, so I figured I’d bend my “no follow up” rule for my largest position and provide an update on Charter / a slightly more model / numbers focused way of looking at them. My bottom line is I stand by what I said last year: Charter today is a once in a lifetime opportunity to buy a strategic asset w/ minimal economic sensitivity at an inflection point right before their financials make it blindingly obvious how cheap the company is.

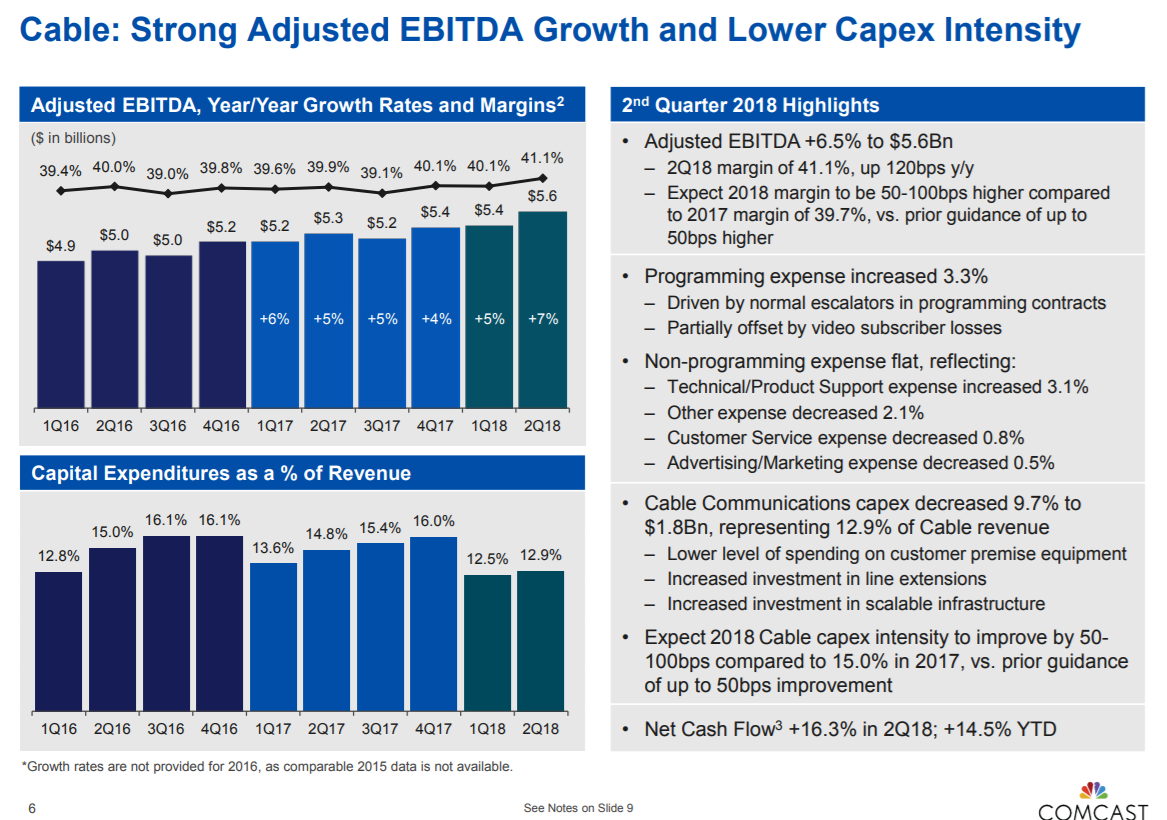

I’m not big on “modelling”, but it’s pretty easy to see that Charter is really hard to model. You have a massive integration of two different companies (TWC and BH) happening (so trailing costs, capex, etc. are really messy) at the same time that the cord cutting trend is wreaking havoc on the income statement (while video isn’t a big profit driver, it’s responsible for ~40% of revenue so it is a big revenue driver). Put those two together (and throw in a complicated corporate structure, buybacks, etc.), and Charter is really difficult to model… which is funny because I think at its core an investment in Charter is pretty simple. Charter is going through a massive integration right now, and they’re dramatically under earning because of it. The best comp for Charter is Comcast (disclosure: long, but in much smaller size than Charter). Looking at trailing numbers, Comcast gets ~15% more EBITDA and 85% more unlevered free cash flow per home passed than Charter does.

Is there a reason Charter can’t achieve Comcast’s level of earnings and free cash flow once they’re finished their integration? Absolutely not; in fact, Charter probably has a better footprint than Comcast in terms of competition so it wouldn’t surprise me if they could out earn Comcast longer term.

Comcast is currently doing ~$360 EBITDA/homes passed and growing that at mid-single digits per year. At the same time, capex is coming down materially now that the DOCSIS 3.1 rollout is completed. Assuming the same trends hold, it’s not crazy to think Comcast could be doing ~$425 EBITDA / home passed with capex / home passed barely over $100 in a few years.

Assume Charter closes most of the gap between them and Comcast by ~2021, so if Comcast is going to be at ~$425 EBITDA / home passed and ~$100 capex / home passed, then let’s say Charter can get to ~$400 EBITDA / home passed and ~$120 capex / home passed. Charter currently passes 50m homes, and homes passed grow 1-2%/year (driven by household growth and some expansion), so let’s say 3 years out Charter will pass 52m homes. With those assumptions, we can build a simple income statement.

Let’s not stop there though. We know Charter targets 4.0-4.5x EBITDA leverage, so we know that with $20.8B in EBITDA (what they'd hit with the homes passed target and EBITDA / home passed used earlier) they’d target ~$83B in debt (on the low end). Assume capex = depreciation and amortization, a 5% interest rate on their debt, and a 23% tax rate (21% federal plus a bit for state and local), and we can come up with a hypothetical Charter net income number of over $30/share.

I would guess Charter would trade at ~15x multiple (that’s probably conservative; I see no reason the company wouldn’t continue to grow mid-single digits for a long time but let’s go with it); assuming it did, Charter would be worth ~$450/share. That's a future number, so you'd need to discount back to today but with shares currently at $300 you'd do really well from here.

Ok, hopefully you’re still with me. Were there a few assumptions in there? Absolutely. But honestly I don’t think any of them are too controversial- Charter tells you what their leverage targets are, we’re forecasting capex basically in line with where Comcast is now, we know the federal tax rate with decent certainty, etc. The biggest assumptions are probably the EBITDA / homes passed number and the ending P/E multiple. I’ve included a chart below that shows the end share price using different assumptions for those two key variables while holding all of the other assumptions constant. I think it shows that even if you use assumptions less bullish than mine (and I think mine were pretty conservative!), you still probably do all right from here.

But wait… there’s more! Between now and the end of 2020, Charter will generate ~$15B in after tax free cash flow (could be lower or higher depending on glide path of earnings and capex, but that’s in the right neighborhood). In addition, Charter currently only has ~$72B in debt, and we’re assuming they take leverage to $83B in that model, so Charter will have $11B in incremental debt capacity. Combined, that’s ~$25B of value, or around $95/share, of cash that Charter would have sitting on their balance sheet in our model. Put those together, and Charter would be worth over $550/share by the end of 2020.

Again, plenty of assumptions in here, but I don’t think any of them were aggressive. I’d note there’s plenty of upside possibilities that I haven’t incorporated here. In particular, Charter is beginning to invest into a wireless business that they think will be significantly NPV positive, and I’ve given them no credit for that investment (I’m personally probably the most bullish person I know on cable’s entry into wireless as I think their fixed asset base gives them a mammoth advantage to capture customers, but that’s another discussion). Charter also redirects most of their cash flow to share repurchases, and to the extent they continue to do so aggressively at today’s levels that’ll be wildly value accretive to the future valuation. And Charter maintains significant tax assets and benefits that I’ve only given them partial credit for (I included them in the near term free cash flow but assumed they were exhausted by the end of the period).

Are there risks? Of course. I’ve highlighted many of them on the blog before (in particular, I’ve highlighted the cord cutting risk so many times I don’t feel like adding more here; CHTR admits video is no longer a standalone product and go look at CABO to see what happens when you completely eschew video… it’s not a bad life!). The biggest risks are probably “fixed wireless” (wireless companies rolling out broadband services over a wireless network) and “wireless substitution” (people dropping broadband services completely and simply using their mobile phone to power everything). The fixed wireless risk in particular is top of mind as Verizon is rolling it out to five cities this year. All of these risks are, of course, scary, but I’ve done lots of research on them and think the chances of any of them seriously impacting broadband are small. Data usage / demand is simply exploding at too fast a rate for wireless networks to handle all the data without cable handling the bulk of the load. I can point to a lot of things that suggest cable is going to be very strong for years to come, but I think the best thing to point out is that these threats are not new and have a long history of failing. AT&T talked about rolling out WiMax as a substitute for wired broadband as far back as 2006 (that experiment ended poorly), and Verizon tried a LTE fixed broadband to take on Comcast and AT&T back in 2011. One more point on Verizon’s fixed broadband product: I think it’s noteworthy that almost every competitor has said that the economics of Verizon’s fixed broadband doesn’t make sense, including Charter (who compared it to the failed Google Fiber product on last night’s earning call) and all of VZ’s mobile competitors (Sprint, T-Mobile, and AT&T have all said the economics of fixed broadband don’t work and they would not pursue a similar investment*).

*Sprint and T-Mobile both said they wouldn’t pursue a mobile when they were standalone companies (T-Mobile actively mocked Verizon’s plans). They changed their tune once they announced their merger, but that’s almost certainly political posturing / trying to get their merger approved, not the two actually thinking the investment made sense!

Alright, this post is running long, but I’ll wrap it up with one more screen shot from Charter’s earnings deck. In less than two years, Charter’s repurchased almost 17% of their shares outstanding at an average price ~10% higher than today’s prices. Was their timing bad? Definitely. Could the company have been wildly mistaken on their intrinsic value? Sure! But if you look at the history of both all of the players involved with Charter and the cable industry in general, betting on this type of levered return of capital story has worked out very well in the long run. At today’s prices, I’m willing to bet it works out again.