Christmas Idea #2: Telecom Italia Savings Shares $TITR $TIT

Last week, I introduced this year’s Christmas Ideas series, presented some “honorable mentions,” and introduced my first "Christmas Idea," Radisson (RADH; disclosure: long). Today, I’m diving into my second Christmas Idea: Telecom Italia Savings Shares (TITR, trades in Italy. Disclosure: this is a semi-illiquid international stock which I am long; please do your own due diligence). It's been quite the eventful year for Telecom Italia (aka TIM, but I prefer to call them by their ticker, TIT, because I am a child), Italy's largest telecom company. In March, Elliott revealed a stake in Telcom Italia with an eye on shaking up their corporate governance and reducing the control of top investor Vivendi, who owned ~25% of of Telecom Italia and had effectively controlled the telecom since mid-2015. The resulting "activist on activist" battle was quite fun, and included the Italian government buying a stake in TIT to shield their "strategic interests" and plenty of flowery language and PowerPoint from both sides (Elliott claimed they were trying to "liberate" TIT from Vivendi, while Vivendi (through TIT) said Elliott's plan would result in a "radical reduction" in Telecom Italia's asset perimeter). Elliott eventually won control of the TIT board, but the excitement hasn't stopped:

In October, Telecom was the winner of a bidding war for 5G spectrum. Winning a 5G auction may not sound exciting, but I assure you at the time it was: the number was so shocking that people started talking about it helping the Italian government (who recieved the proceeds) deal with their debt problems and fulfill nationalist promises their government had made, Telecom Italia's stock fell massively during the bidding as people adjusted to just how high the price for one piece of spectrum would be, and U.S. C-Band plays threatened to go "stratospheric" as investors interpolated the price and demand for C-Band back to the U.S. market.

In June, TIT's CEO started "bashing" the Elliot directors. Naturally, directors don't like to be bashed by their CEO, and this lead to rumors the CEO would be fired. Despite denying the rumors as late as November 11th, on November 13th the board called a "surprise dawn coup" and fired the CEO while he was travelling in Asia. Making matters all the more awkward, Genish (the CEO) was set to keep his seat on the board that had just pulled a coup on him (Bonus: he found out he was about to be fired from a WhatsApp message. At the time, he was at a dinner celebrating a JV with Samsung in South Korea).

Vivendi is now seeking another shareholder meeting to try to wrest control of TIT back from Elliott.

While the TIT story so far has been exciting, it certainly hasn't been rewarding for shareholders: the stock is down ~25% YTD and ~50% over the past three years.

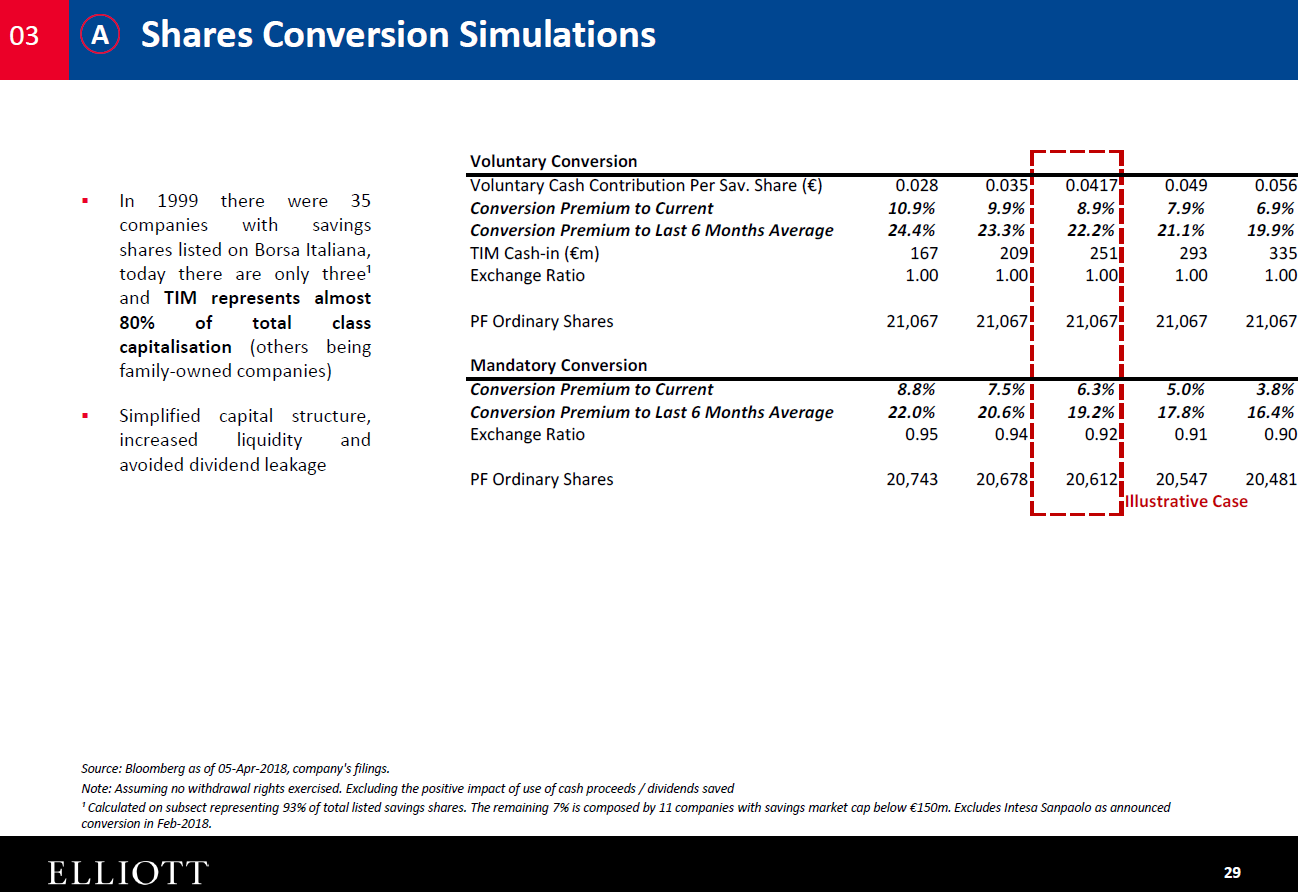

So it's been a wild ride, and, with Vivendi prodding TIT for another special meeting to try to take the board back from Elliott, who knows where it goes from here? Here's what I do know: TIT has two forms of shares: their ordinary shares (TIT, which currently trade for ~€0.56/share) and their savings shares (TITR, which currently trade for ~€0.48/share, at ~15% discount), and with Elliott currently in control, I believe it's almost guaranteed that TIT will try to take out / convert their savings shares to ordinary shares in the near future. Savings shares are an "unusual" share class in Italy. The WSJ (in 1998!) described them as roughly analogous to preferred stock in the U.S.. There are some issues with that comparison* but in general it's a good way to think of savings shares; they pay out a dividend and are equity capital but don't get a vote in (most) corporate matters. Savings shares were really popular decades ago when most Italian companies were controlled by families, as the families could issue savings shares in order to raise equity capital without diluting control, but over time most companies have taken out their savings shares (I believe for both corporate governance and cost of capital reasons; the dividend became mighty expensive when interest rates got low enough!). I'm not an expert on Italian markets, but Elliott says there are only 3 companies with a market cap >€150m that still have savings shares outstanding (see Elliott slide 29 below) so these are really quite rare at this point. So basically every other Italian company has eliminated their savings shares. That alone is interesting, as in general corporations don't like to be the only one doing something. But what's really interesting to me is this slide from Elliott's activist presentation earlier this year:

That's right; Elliott has been (unsuccessfully) trying to get TIT to take out their savings shares for almost 20 years (I've included more stuff on their history in the "odds and ends" section at the end of this post)!!!! And a core piece of their pitch to take over the TIT board today was "Vote for us and we will convert the savings shares to ordinary. Doing so will improve trading liquidity and TIT's cash flow!" In fact, they even included a slide in their deck that showed exactly how they were thinking about a conversion!

With Elliott currently in control of the board, I think an attempt to convert savings shares into ordinary shares is pending. It makes too much sense. Not only has Elliott been trying to convert savings shares for 20 years now, doing so is a great way of gaining a leg up on Vivendi in the next proxy fight, as converting savings shares would both dilute Vivendi's voting stake and provide Elliott with a set of grateful savings shareholders turned ordinary shareholders (with a vote). In fact, if Vivendi successfully gets a special meeting called, I wouldn't be surprised if Elliott tried to get a savings share conversion proposal attached to the special meeting, as Elliott could use the proposal to highlight how much better for minority shareholders they are than Vivendi (I'm pretty sure attaching a conversion proposal would be allowed under Italian law, though I could be wrong. Even if it wasn't, you could schedule a second meeting right after to highlight that difference). Outside of corporate governance / Elliott, there are other reasons for TIT to want to convert savings shares. TIT's savings shares are guaranteed a dividend of 5% of their par value of 0.55 euros / share or a dividend that is €0.011 higher than the common's dividend (see the TIT savings shares rights at the end of this post*). The common dividend is currently suspended, so the savings shares are clipping their 5%. TIT just spent a fortune on C-Band and is rather highly levered; a savings share conversion would let them maintain all of their cash to pay down their C-Band debt and eventually put them in a good spot to re-establish their common dividend. It would likely even raise cash for the company, as most conversions involve savings shareholders paying a small amount to swap their savings shares into more valuable ordinary shares (see the "voluntary cash contribution" in the Elliot slide above, or just look at TIT's last conversion attempt. It seems like Elliott, who controls the board, is eagar to swap the savings shares into ordinary shares and that a swap would be helpful to both the company and to Elliott retaining control of the company. If the stars have aligned like that, why hasn't a savings conversion already happened? Simple: under "Italian Civil Code," a savings swap must be priced at least at the "the arithmetic mean of the closing prices of the savings shares in the six months before the date of publication of the notice of the Special Meeting" (from the last conversion attempt). Soon after Elliott took control of TIT, TIT's share price fell off a cliff, which meant that the 6 month moving average of TIT's savings share price was so much higher than the current price that Italian law would require TIT to offer way to high a premium to savings shareholders for them to convert. An example might show what I'm talking about best: below is TIT's savings share price from early May (when Elliott took control) until ~today with a yellow line to show the 200 day moving average of TIT's saving share price. Look how far above the share price the moving line is. The end of September illustrates this perfectly: the savings shares were trading for ~€0.45/share, but the 200 day moving average price was ~€0.60. With that moving average, Italian law would have required TIT to offer savings shareholders a >33% premium to convert their shares into ordinary share. That massive premium made a swap uneconomic (ordinary shares would be giving savings shares way too much).

Currently, I have TIT's savings shares trading at a ~17% discount to their 200 day moving average (note: I'm just grabbing the 200 day average off Bloomberg; the Italian Code is 6 month arithmetic mean which I think is a bit different, but it's close enough that it's not worth splitting hairs), and that discount should close pretty rapidly over the next month as the really high priced trading days from May fade out of the average trading. If we assume TIT trades around its current price for the next month, TIT should be trading for a <10% discount to its moving average by mid-January (obviously it would be trading at a lower discount if shares moved higher or a bigger discount if shares went lower, but bear with me). The last time TIT tried to do a share conversion, they offered at 12.2% premium to the current savings share price. In Elliott's presentation to take the TIT board, they specifically highlighted offering savings shares an 8.9% premium to the going price. By this time next month, either of those premiums would be enough to satisfy Italian law and offer savings shareholders the chance to convert. My bottom line: by this time next month, all of the stars should be aligned for TIT to attempt a savings share conversion. The trailing price average issue will have worked itself out so that TIT could offer savings shareholders a ~10% premium (roughly in line with where Elliott discussed and what the prior conversion attempt offered) to convert. The financial logic for TIT will be there. And the incentives for Elliott (who has been trying to convert the savings shares for 20 years, who ran on converting the savings shares, and who are prepping for another battle with Vivendi that would be helped by converting the savings shares) are there. Assuming no major market selloff that presents new trailing price issues, I expect an offer to convert at a premium in the next few months. There's one more piece of TIT that I haven't really focused on that is actually important to the story: valuation. TIT savings shares are equity securities, and when and if they get converted they'll be plain vanilla equity. I'm still haunted by my HRG / SPB experience (where I got the "convert" event right but was wrong on the equity valuation and ended up with a massive write off!), so a view view on the TIT equity is important. I don't want to dive too far into the TIT story (I want the Xmas series to focus much more heavily on catalysts), as I'm by no means an expert on Italy or Italian telecom, but I will say that at a high level I think TIT is extremely cheap. I base this on:

TIT is flat out cheap. Elliot estimated the stub traded at ~5x EBITDA back in April (see below); I've got it a bit above 4x today given how far the equity has fallen. Peers have come down a bit, but TIT still trades well below them and given the significant debt at TIT investing in it creates a very interesting equity stub.

This goes along with the Sum of the Parts math / talk above, but consider this line from the Reuters story on the CEO getting fired,

"The Netco, TIM’s biggest asset, is worth up to 15 billion euros ($17 billion), according to analyst estimates. Elliott has argued that spinning it off would realize up to 7 billion euros in hidden value, attract new investors and drive a re-rating of shares. It would help TIM offload big chunks of its 25 billion euros of debt and leave behind a capex-lighter service stub. Italy plans to introduce a regulated asset base (RAB) for the merged network firm, allowing regulated returns on investments made, the draft amendment showed. “This huge change makes NetCo into the perfect infrastructure asset investors love,” one source said, adding a RAB would allow NetCo to trade at the 10-12 times EV/EBITDA multiple of RAB-regulated utilities such as Snam or Terna. TIM trades at 4.6 times, according to Refinitiv.

Just to further emphasis how valuable TIT's infrastructure could potentially be, I'd note Enel bought MetroWeb (an Italian fiber infrastructure company) for a high teens EBTIDA multiple back in 2016. Enel won MetroWeb despite a competitive bid from TIT (a bid that was TIT's second attempt to buy Metro after a failed 2015 attempt).

With no cable company in Italy, TIT owns the best network infrastructure assets in Italy. It would cost a fortune to recreate those assets. My gut tells me it would cost substantially more than today's market value. I don't have any engineering to base that on, just a feel both from the level of earnings TIT has (which suggests an asset value significantly higher than today's share price, particularly given how weak Italy's economy has been) and how expensive building any type of network asset is.

Comparing an earnings level to a replacement cost of an asset is obviously a bit apples to oranges, but that's just what my gut tells me!

One of the major risks to TIT is OpenFiber, a state backed project to build FTTH in Italy. It's certainly a risk, but the massive cost estimates show just how valuable TIT's (mostly) already established infrastructure is (the most likely outcome is OpenFiber and TIT partner on the build-out, and Elliott seems open to the plan)

Both Vivendi and Elliott are borderline battling to the death to take control of TIT. Obviously control of a national network carries some softer benefits for an owner (political power, connections, etc.), but both Vivendi and Elliott are extremely sophisticated investors with cost basses much higher than today's share price (I'd guess Vivendi's is over €1/share and Elliott's is around €0.65/share, but I could be off) and an inside view of Telecom Italia and its value (having held board seats, elected CEOs, etc.). One of the worst reasons to buy something is "because sharp investor X and Y like it" (that's giving yourself an excuse not to do work on it yourself), but it is certainly worth noting when two sharp investors are trying this hard to control an asset they have an inside view of.

Speaking of sharp investors, Steven Wood has done some really nice work on TIT,

I've done a bit more fundamental work on TIT, but at a high level I think the bullets above sum it up nicely: it's really cheap, it's a very levered equity stub with a pretty large return upside, and it's got great assets that are worth significantly more than today's share price. Yes, you're exposed to Iliad moving into Italy, Open Fiber, and just general Italian craziness (both political and economic), but at this low a multiple I think you're more than compensated for those risks. I'm happy to take the "beta" exposure of TIT equity risk while waiting for a savings conversion proposal to take us out at a premium. I don't think the wait will be long. Odds and ends

TIT generally has their shareholder meeting in May and pays out their savings dividend in June. If TIT is going to convert, I'd guess they want to do that before the next dividend (just so they can hold on to the cash). Another minor point in favor of a tight time frame to a conversion.

Here's an economist article from 2001 that talks about the pressure at TIT to convert their savings shares. You can find more about that go round (including a mention of Elliott) on p. 119 of their 2000 annual report, and here's an NYT article from 1999 that shows how Olivetti took control of TIT and could be a problem for shareholders + a 2003 article on how he tried to merge with TIT.

Here's the 2015 TIT savings conversion proposal plus a Reuters article on the move, and here's an FT article on how Vivendi (just) managed to block it.

Just to show some examples of savings share conversions, here's Pirelli converting theirs in 2016 and here's UniCredit converting theirs earlier this year.

*Below is a screenshot from TIT's 2017 20-F that shows the rights of TIT's savings shares