$ZAYO for sale

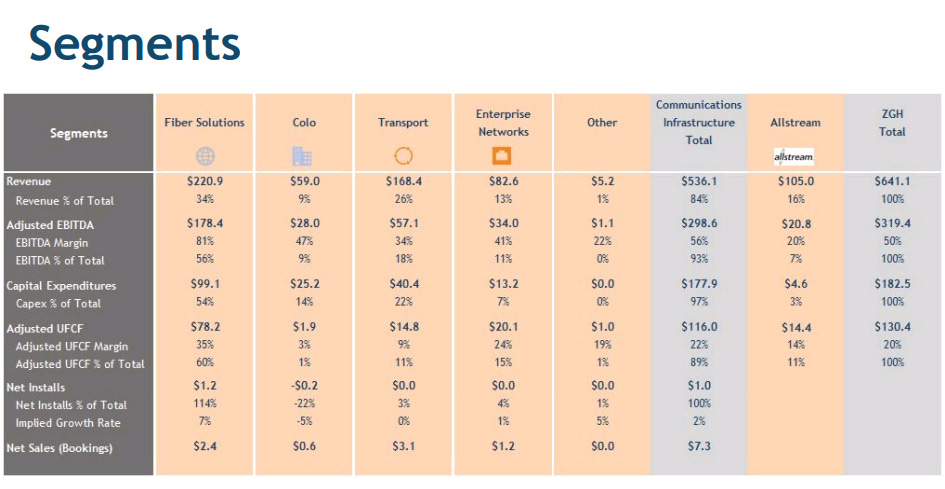

One of my New Year's Resolution was to post more "work in progress" articles: articles on companies where I think there could be something interesting happening but I've still got a lot of open questions. Often, I'll have smaller positions in these stocks because, while I have open questions, my preliminary work is telling me the situation has an interesting risk / reward. My goal in posting these articles is to (hopefully) elicit some discussion / feedback from people who are more knowledgeable on the company / industry / situation than me. Anyway, today is the first of those posts. Zayo (ZAYO; disclosure: long) is a bandwidth infrastructure provider. They provide a range of bandwidth infrastructure, but the majority of their value comes from their fiber network. Fiber is the basic backbone to the internet (basically, all data transmission is done by beaming light down a fiber-optic cable that runs from city to city / data center to data center, etc.), so Zayo's dense fiber network forms part of the backbone of the internet. Zayo's interesting because the stock plunged in early November when the company announced earnings well below expectations plus a plan to split into two public companies. On the heels of that announcement, Bloomberg reported a group of private equity funds (lead by Blackstone) were interested in taking Zayo private. All was quiet until last week, when CTFN reported Zayo had received an offer at >$30/share and dealReporter followed that up with a report the private equity group was talking to banks about financing w/ an eye towards closing a deal over the next few weeks. My thesis here is simple: I think there's a decent chance a sale happens, and if it does, I think it'll be in the low to mid-$30s, presenting the opportunity for a pretty solid return from today's price of ~$27. Why low to mid $30s? At that price, I think the PE buyers could realize a strong return (both from buying Zayo at a slight discount from its intrinsic value and especially from using Zayo as a platform for future synergistic acquisitions) and the management team could claim victory for their shareholders on a lot of different fronts. If a sale doesn't happen, I'm sure the stock would suffer in the near term, but I think Zayo is ultimately undervalued at today's levels and there would be a lot of different routes for value creation over the medium term (on top of improved financial performance, following through on the REIT split, an activist investor, or continued share buybacks are all within play). Let's start with the basics: what's Zayo worth? That's a somewhat difficult question to answer, as Zayo reports six different segments that all have vastly different economics (growth rates, margins, capex requirements, etc.) and thus deserve vastly different multiples (the table below, from their Q1'19 earnings slides, highlights this).

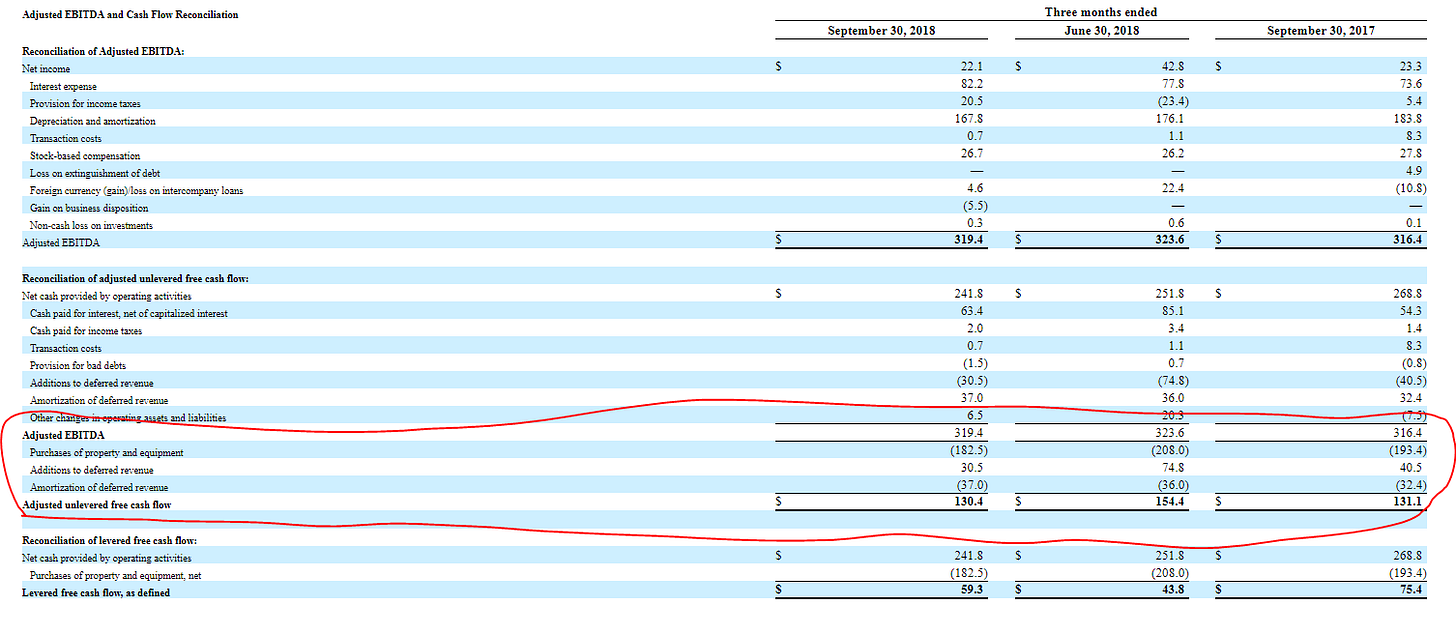

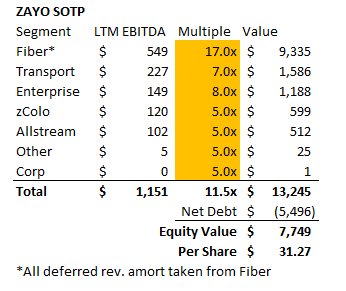

Fortunately for us, Zayo has provided us with suggested comps in the recent past. In March 2017, the company published an investor deck that walked through each segment and whole they thought the best comps would be. So we can simply take the LTM EBITDA for each segment, assign a multiple to it, and then figure out ZAYO's sum of the parts (SOTP) that way. Before we do that, a quick note. Zayo's EBITDA numbers probably deserve an asterisk or three as their adjusted EBITDA definition includes "amortization of deferred revenue". Amortization of revenue comes when a customer gives Zayo cash upfront; because Zayo can't immediately book that revenue, they set up a "deferred revenue" liability against that cash on their balance sheet and then slowly bleed that deferred revenue liability down as they recognize the revenue from the customer. Adding this amortization back inflates Zayo's EBITDA: Zayo took in the cash from this add-back months / years ago, so by adding that amortization back Zayo's adjusted EBITDA is higher than their "cash EBITDA." This add-back doesn't make a huge difference as long as Zayo is growing / adding to their deferred revenue account (so cash build from new deferred revenue offsets that add-back), but when valuing Zayo on a steady state basis it means the adjusted EBITDA number they present is probably too high.

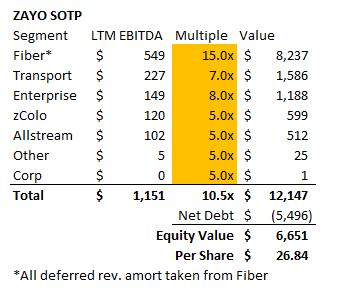

Because "amortization of deferred revenue" is about as empty of an earnings add back as there can be, I've removed the number from Zayo's Adjusted EBITDA calculation for valuation purposes. On an LTM basis, Zayo has done ~$1.3B in adjusted EBITDA and ~$140m in deferred revenue amortization, so LTM "cash EBITDA" is ~$1.15B . The table below shows the adjusted EBITDA on a segment by segment basis, along with a potential multiple for each segment, in order to come up with a first crack at a SOTP for ZAYO.

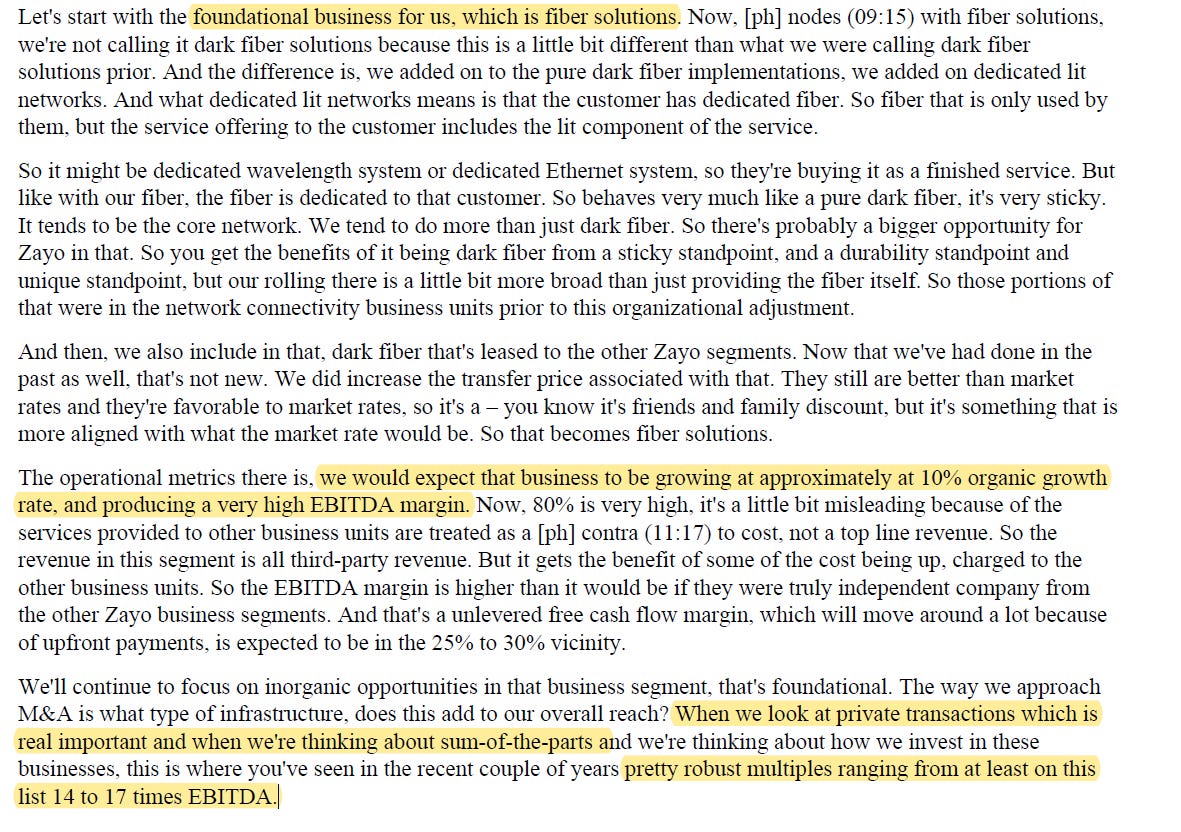

Don't focus too much on the specifics of that chart for now (though, FWIW, that valuation results in a wholeco value of 10.5x EBITDA; there are no perfect comps for Zayo but Level 3 was probably a good one; CTL bought Level 3 for ~12.5x EBITDA and their proxy listed Zayo, CCOI (trades for ~13.5x EBITDA), and Lumos (taken out at just shy of 10x EBITDA) as their best peers. In addition, p. 44 of Zayo's proxy suggests they value the company at 10x EBITDA though I think that's just a low ball estimate to enrich management for growing the company). I think the multiples are directionally correct but you could flex any of them up or down a turn or three and I wouldn't have huge arguments, and you could rightly protest the ~$100m in annual stock comp Zayo gives out is a very real expense that isn't picked up by the adjusted EBITDA number. Countering this, I've probably been too conservative assigning all deferred revenue amortization to the Fiber segment (their most valuable segment), but I haven't found any clear breakouts in Zayo's financials so far so figured I'd just lump it in there since it accounts for the majority anyway. So don't focus too much on the specifics of the SOTP; I just wanted to put that SOTP together to highlight one thing: the majority of Zayo's earnings and the vast majority of Zayo's value comes from their Fiber segment (that's what happens when one segment account for ~half your earnings and deserves a multiple double the rest of your businesses!), so we should probably spend the bulk of our time thinking about that segment. What is the Fiber business and why do I think it's worth such a high (mid-teens) multiple? I think the quote below (from Zayo's March 2017 investor deck) helps frame it

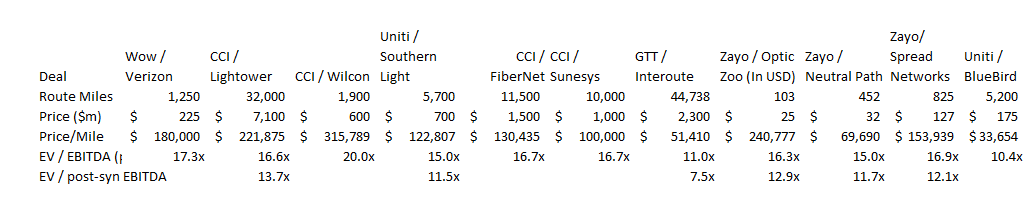

The big question is if that valuation makes sense, and I think it does. I tracked down 10 different "fiber" deals (Wow / Verizon, CCI / Lightower, CCI / Wilcon, Uniti / Southern Light, CCI / FiberNet, CCI / Sunesys, GTT / Interoute, Uniti / BlueBird, Zayo / Optic Zoo, Zayo / Neutral Path, and Zayo / Spread Networks); I'm sure there are plenty more fiber transactions and would be open to suggestions if you know of any. Below I've pasted the basic deal stats for those ten fiber deals (note that for some of these the numbers were not laid out perfectly, so I may have made some assumptions based on what was given in the PR but these should all be directionally correct).

Are any of these perfect comps for Zayo's Fiber business? No. These are generally bolt on acquisitions, the price of fiber is very dependent on its quality (how dense it is, how attractive the region it's in is, etc.), and some of the deals have very specific quirks (Uniti / Bluebird, for example, has a headline price of ~10x EBTIDA but included the seller prepaying >5 years worth of rent, so the effective price is probably much higher, and the GTT / Interoute deal was a European deal (Europe makes up a small portion of Zayo's value)). So the table certainly has some serious limitations, but it does serve as a nice starting point for thinking about value. On average, the pre-synergy multiple paid for Fiber is ~15.6x (16.7x if we takeout out Uniti and GTT, which are the least comparable), and the average price per route mile is approaching $150k. The SOTP I used above valued fiber at 15x LTM EBITDA and ~$63k/route mile, so I don't think it's a crazy valuation by any stretch.

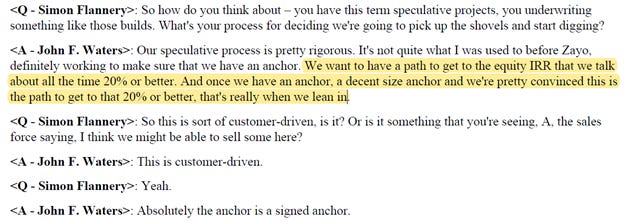

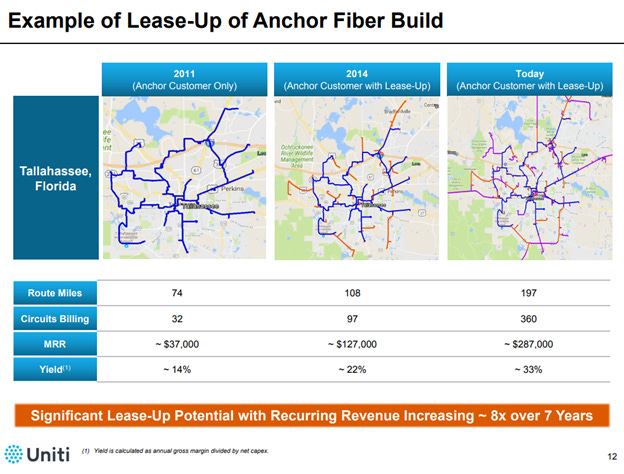

Again, I'm not saying these are perfect comps (and I doubt Fiber is going for the $150k/route mile average value mentioned above!), but I am just using this as a sanity check. I would not be shocked to see Zayo's Fiber trade for a premium multiple to where those comps were traded for two reasons. First, it's tough to know the value of fiber without looking under the hood (i.e. seeing exactly where all the fiber is, how dense it is, and the customer demand in those locations), but Zayo consistently suggests that their fiber is among the deepest / densest / most unique in the industry (here's one more quote for good measure). I always take a company's view of their own asset value with a grain of salt or three, but my understanding based on reading up on the industry / listening to competitors seems to suggest that Zayo's base is of at least above average quality. Second, those acquisitions were generally of "bolt on" size. Zayo is much bigger than those deal comps, so a buyer could look at Zayo as a "platform" that they could use to roll up a still very fragmented industry. That makes a difference for, say, a private equity / infrastructure fund looking to get into the space and deploy capital at an attractive ROI. Say fair value for fiber assets is 15x: if you're a private equity company, you need to pay less than fair value so you can get a juicy IRR for your fund.... but you could convince yourself to pay 15x (i.e. full and fair value) for the "platform" and then pay 12x for a bunch of bolt-ons that, after synergies, you'll effectively have bought for 8x. Double a company's size through those bolt ons and you'll have achieved a very nice IRR on a very large pot of money (important for giant funds looking to deploy all their dry powder! Also apparently the strategy EQT is pursuing at the company formerly known as Lumos.). Speaking of bolt on acquisitions, one of the really interesting things about Zayo (and any fiber asset in general) is the ability to leverage an initial fiber investment by adding new customers to an already built fiber line (note that this is not unique to Zayo; for example, AT&T talked about how they are using AI to improve their fiber build out ROI). That dynamic presents pretty interesting growth dynamics for Zayo; in general, when they lay a new fiber route, they have an anchor investor committed to the route that will allow them to already achieve an attractive ROI. If they can then sign up more customers to that route, the incremental cost is minimal and the ROI is huge. Below are two screenshots: the first is a quote from Zayo talking about how they think they can do 20% equity IRRs given this dynamic. The second is a screenshot from a UNIT investor presentation that I think does a really nice job of illustrating exactly how a fiber build out works and how strong the IRR can be. It's also interesting to think about that "anchor fiber buildout" dynamic in light of coming 5G investments (5G will require lots of new small cell, and the ability to quickly and easily hook up a small cell to an existing fiber branch should present huge incremental growth opportunities for fiber providers).

I'm saying Fiber is worth at least a mid-double digit EBITDA multiple, so these profitable growth opportunities are largely captured by the high valuation I've given Fiber (profitable reinvestment opportunties are generally baked into above average EBITDA multiples). Still, I highlight that anchor fiber buildout opportunity for two reasons. First, a lot of people will read "Fiber valued at 15x EBITDA" and get a bit of a nosebleed from the multiple, so I wanted to highlight (one reason) why the business deserves a high multiple. Second, it seems like Zayo is in talks to get bought by infrastructure private equity funds, and these type of high IRR reinvestment opportunities are catnip to infrastructure private equity funds (it lets them put more money to work, and given they'll use an aggressive debt structure they can do so at very high IRRs). Anyway, my bottom line is that Zayo's fiber segment is very valuable. My earlier SOTP used 15x LTM EBITDA but that's likely too conservative. Comps have generally traded for at least that level, and it appears Zayo's assets are both better on a standalone basis than those comps and offer more growth / platform potential than comps. If Fiber was worth 17x instead of 15x and all other segments were worth what I estimated them at earlier, Zayo would be worth ~$31/share.

There's a lot of assumptions in that SOTP, chief among them that Fiber is worth a small premium to recent transactions and that all of the other segments are worth the multiples I've given them. I'm comfortable with both those assumptions: I walked through why I think Zayo's Fiber is worth a premium above, and you can compare the multiples I'm giving Zayo's other segments to the comps from Zayo's March 2017 investor deck and see that my multiples are likely pretty conservative (though some conservatism is warranted; for example, in that 2017 presentation Zayo wants their Colo segment valued like CyrusOne (CONE) but Cyrus is growing at mid-double digits while zColo is shrinking). Ultimately, it doesn't make a huge different to the Zayo case: flexing the non-Fiber multiples up or down a bit doesn't move the needle close to as much as small changes in the Fiber multiple, so I'd rather be conservative on the former and focus on the later. Another reason to believe that ZAYO's SOTP is significantly higher than today's share price? Management's capital allocation. Over the past two years, management has been a voracious buyer of shares when they trade into the mid-to-low $30s. In FY18, the company bought back ~$94m of shares @ $34.02 (~1% of shares out; see p. f-40), and then in October / November of 2018 the company bought back $400m of shares (~5% of shares outstanding; see p. 33). Over time, I've increasingly come to discount share repurchases as a "value signal" (I've seen too many companies buy back a huge chunk of shares before reporting a complete disaster of a quarter and ending up over-leveraged with a way lower share price (very similar to Zayo buying back 5% of the company at >$30 before barfing a quarter and seeing their shares trade to the low $20s!)) unless I really respect the management team's capital allocation chops, but I do think there is some signal to Zayo's share repurchases. As mentioned in the Fiber section, a big piece of Fiber's value is a bit of a black box. How well situated is the Fiber? If they've got tons of untapped fiber in rapidly growing metro areas, that's obviously way more valuable then if most of their fiber is currently being used and generally sits in shrinking rural areas. The only people who can really know where Zayo's fiber sits on that spectrum is the management team, and for them to be buying shares up pretty aggressively in the low $30s suggests that the Fiber is very solidly positioned / that they see a SOTP for Zayo at the high end of what I'm projecting. I'm going to largely wrap this article up here. Again, this is a more speculative position. Would I feel more comfortable buying this at $22 than $27? Duh. But my gut is telling me that Zayo's intrinsic value is higher than today's share price, and I think there's a very decent chance that private equity takes Zayo out in the near future. If Zayo isn't taken out, shares will probably be volatile in the short term but given the increasing strategic value of fiber and Zayo's positioning, I think in the long run shares would do well from here. Other odds and ends

If Zayo is bought out by private equity, note it wouldn't be the first company to announce a separation of legacy assets from fiber assets but then get bought out before that separation could take place. In November 2016, Lumos announced it was looking to split its fiber business from its LEC business; they announced a sale to EQT ~3 months later (and well before the split could happen).

Humorously, Lumos announced a split in November and then a sale in February. If Zayo is sold, I think it would follow a similar timeline.

Why am I so high on a deal taking place here? I think it makes sense for all sides. Zayo shareholders are frustrated and probably willing to sell for a premium. Frustrated shareholders makes for vulnerable management teams, and Zayo has attracted activist interest before. Selling to private equity now would let management avoid a potential activist battle and claim victory (if Zayo sells in the low to mid $30s, the IRR from their IPO to their sale would be low to mid-double digits. The management team constantly talks up equity IRR and shareholder value creation, so hitting a decent IRR to a sale might hold some value to them). Private equity infrastructure funds would get Zayo at a very attractive price and, importantly, put a lot of money to work in one fell swoop. Private equity has raised mammoth infrastructure funds (Blackstone, who appears to be leading the charge here, raised a $40B fund with a $20B commitment from the Saudis). Putting all that dry powder to work requires mammoth deals, and a Zayo deal would likely involve a $5B+ equity check. Combine the chance to invest a large equity check with attractive roll up options, a "sexy" pitch to LPs (we're buying the backbone of the internet!), a business model tailor made for leverage (super high visibility, low maintenance capital needs, high IRR on growth capex), and a variety of exit options (slowly carve up Zayo over time and sell each piece to the highest bidder, get the growth story back on track and re-IPO, or try to lure in a strategic bidder (a variety, including wireless players and big cable, have been rumored Zayo buyers before) and I think Zayo represents a really attractive opportunity for private equity. Of course, the price has to make sense for private equity, but given the combination of all those factors I could definitely see them talking themselves into a bid closer to fair value than they would for a generic private equity target.

Still, there are reasons to believe there could be a decent bid ask spread between Zayo and private equity companies. My SOTP estimated value a bit over $30. It was probably conservative but private equity is generally in the business of paying less than full price for assets. I'm not sure how much room above the low to mid $30s a PE group would have to bid. Would management take a low $30s bid? It might be tough for them; the stock was trading close to $40 last summer (many management teams seem to think all buyouts must be done at a premium to their all time highest stock price) and the company repurchased just shy of $100m in shares at $34 last summer (suggesting management thinks value is at least $34 if not above). And Zayo seems a bit of a wreck right now- sales force turnover is high, the company is missing numbers, and a bunch of execs just left. Does a potential bidder want the chance to install a new management team, and if so would Zayo's current management be willing to sell if they knew there wasn't a job waiting for them on the other side? Who knows. Of course, Zayo has been owned by private equity before under this management team, so maybe a private equity company is comfy buying Zayo and keeping the current team largely in place.

I didn't talk a lot about the spin off in the write up because I'm pretty sure Zayo is getting sold. If it's not sold and the spin-off ends up happening, I'm pretty meh on the spin plan. On one hand, the spin will let them get the "good" infrastructure assets into a REIT structure in the near future, and the good infra company which will likely trade at a very strong multiple and perhaps give a bit more visibility into the underlying value of Zayo. On the other hand, the spin seems pretty operationally complex. The two businesses are connected to each other and will need to be governed by what seem like pretty complex intra-company agreements; in general, spins work best when two businesses can be cleanly split from each other and that doesn't seem to be the case here, and it doesn't lend a lot of credence to the spin plan that it seems like private equity would prefer the whole company be kept together (as the reporting on a potential deal suggests, and note that private equity bought Lumos whole instead of split up a few years ago). Reasonable people can disagree though; I've had several people smarter than me tell me the spin is a good thing just because it gets the infrastructure side to where it needs to be (a REIT).

There are absolutely risks here. The biggest is Zayo is a roll up and seems a bit of a mess right now. Sales force turnover seems high and last quarter was quite disappointing, continuing a string of bad quarters (companies can have bad quarters, but this should be a pretty predictable business and it dings management credibility to miss by that much when constantly talking up the quarter). The CEO is way more promotional than I'd like (his owner manual constantly references Buffet, which is humorous for a company that goes to so many conferences and constantly pitches its segments at nose bleed multiples). Zayo is a roll up, so both the historical financials (in particular, all the IRRs they tout) and the overall value of the company (the scarcity / location / value of their fiber) have somewhat of a blackbox component to them. Generally the combination of roll up + blackbox financials / valuation + high management turnover is a huge red flag. Despite that, something in my gut is telling me this is a real company with real value. Again, it's a smaller spec play, and the risks are absolutely worth considering, but I think this is getting sold.

Another semi-obvious risk: financing markets shut down. Zayo would be fine if that happened, but if markets get rocky and financing market are shut down, there's no way private equity will be able to bid here. Taking Zayo out would require raising or refinancing ~$7B in debt, and that's not going to happen if markets are rocky (the reporting so far has suggested that's one of the issues that's caused the deal process to drag on).