Buying into the timeshares $HGV $WYND $VAC

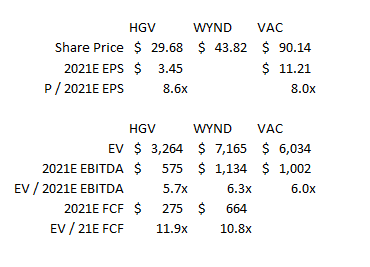

I've been spending a lot of time on the three major publicly traded timeshare companies (HGV, WYND, VAC. Disclsoure: Long HGV) recently. At its core, the time share business is pretty simple (you lure a bunch of tourists in with the promise of a cheap vacation, you put them into a high pressure sales situation, and ~15% of them will buy a "lifetime vacation package" for ~$20k; I am simplifying / slightly mocking them, but only slightly), but as an investor the timeshare companies are actually difficult to look at: their accounting is complex (mainly due to the financing from their timeshare receivables), valuation is a bit difficult because each of them have slightly different revenue streams, their inventory position / investments can depress their cash flow but present different growth opportunities, and the strength of the "parent brands" (i.e. Hilton for HGV) probably needs to be considered as well. So I figured I'd throw up some thoughts on the time share companies, and if anyone has done any work on them and has different views or anything to add on them I'd love to see / hear them. Normally when I write something up I try to review lots of industry basics / background, but I was a bit all over the place in writing this post so instead I'm just going to dive right into the things I wanted to hit. I'll note the timeshare companies are very generous in their investor communication, so if you're not familiar with them and want to get up to speed I would suggest reading HGV's 10-K and the transcript from their December 2018 investor day (flip through their investor day slides too). That should give you a very good overview of the industry. Yes, it'll be a HGV biased overview, but it's a great launching point. Anyway, why am I interested in the timeshare industry? There are a lot of reasons, but the main reason is simple: the timeshare companies are cheap. I think the best way to see how cheap the timeshare companies are is to look at their forward guidance. I've always thought that all forward guidance should be taken with a grain or three of salt, but for our purposes it's a nice jumping off point because it strips out some noise that all of the timeshare companies have in their financials currently (merger related noise for VAC, spin related noise for WYND, inventory investment noise for HGV, and accounting change noise for all of them). All three of the timeshare companies have given 2021 guidance in one form or another (VAC effectively gave it on p. 99 of their ILG merger proxy, HGV gave it at their December 2018 investor day, WYND in their November 2018 investor pres). They don't all provide the same info in the same format (for example, WYND doesn't given an EPS estimate), so it's not a perfect apples to apples comparison across companies, but it's close enough. In the table below I've tried to standardize the info across companies for a valuation comparison:

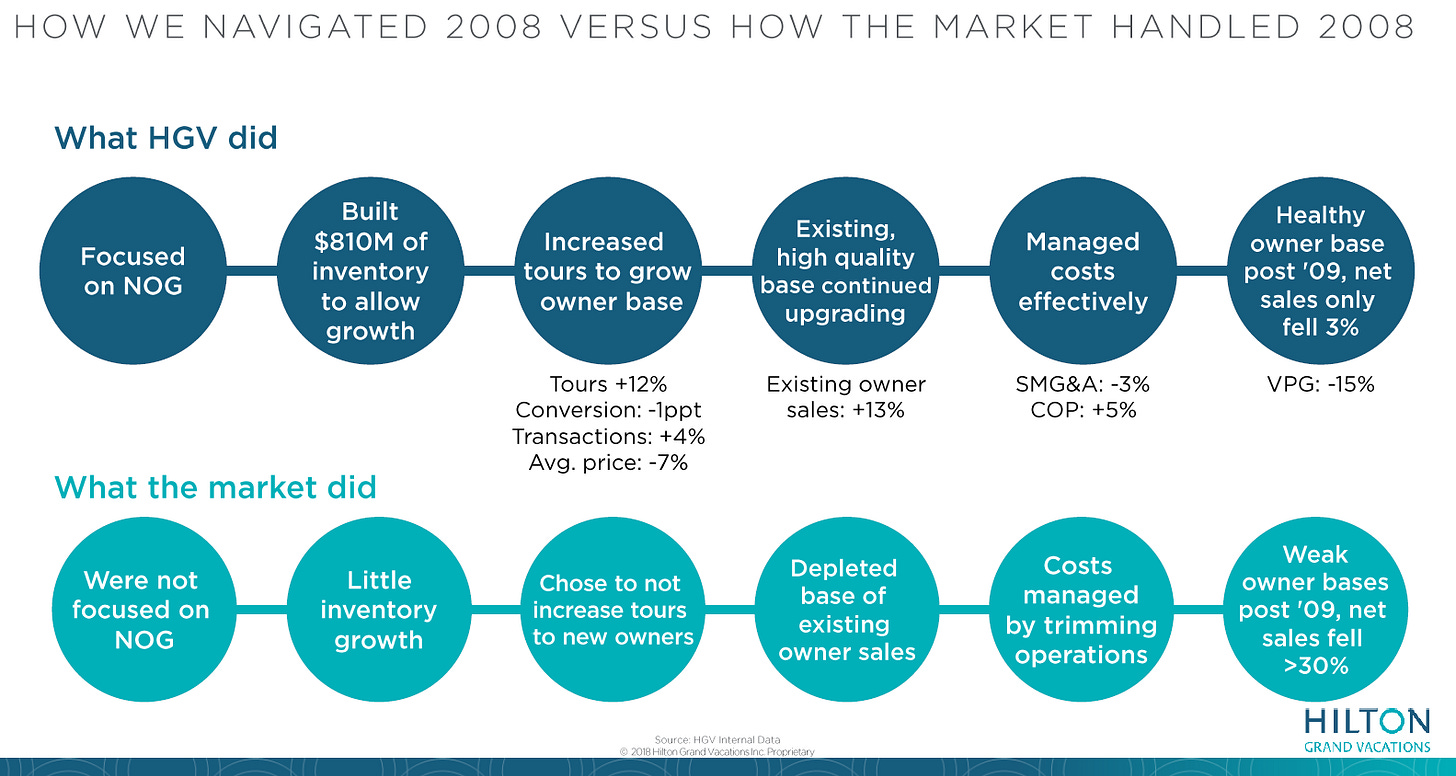

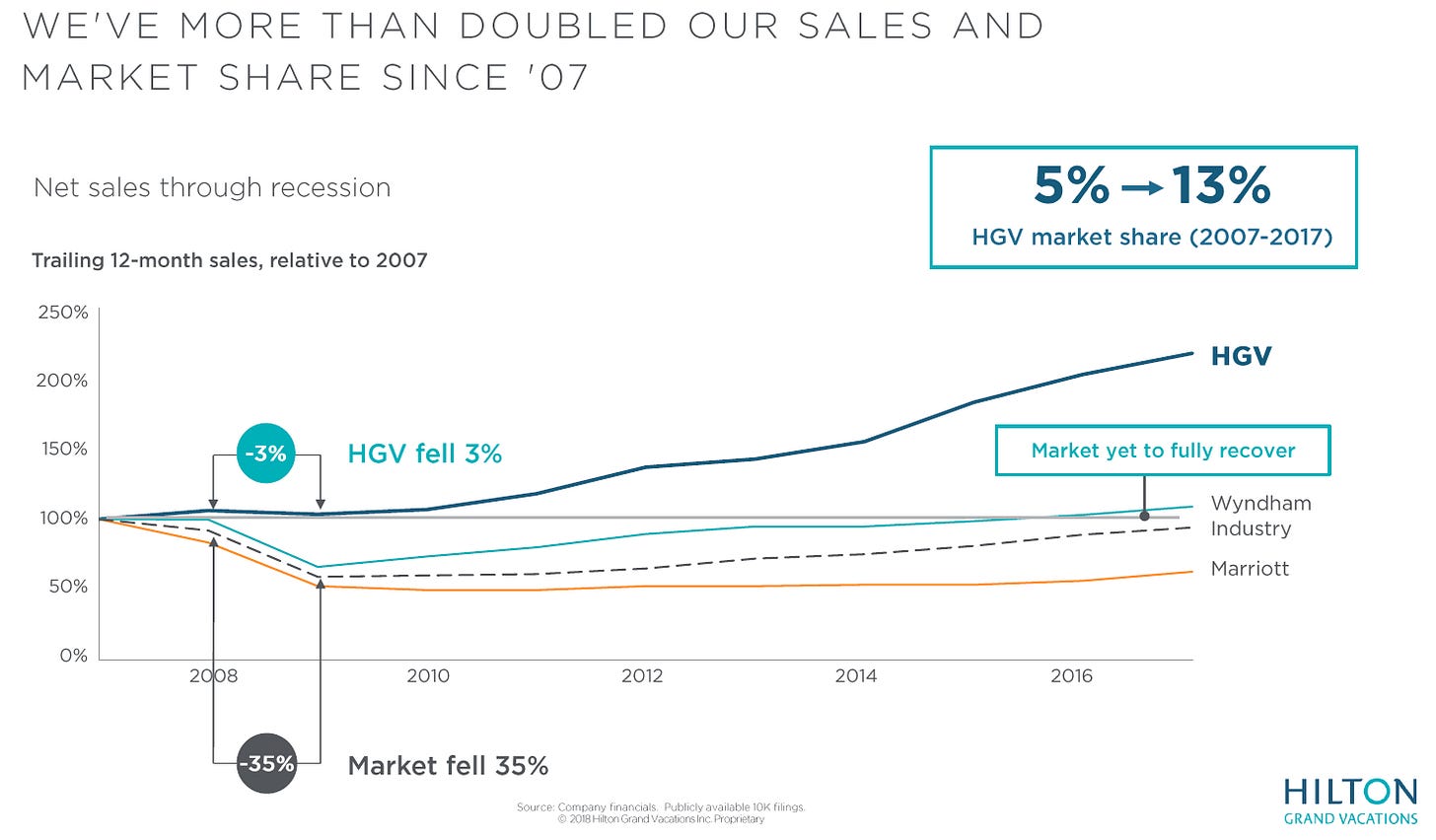

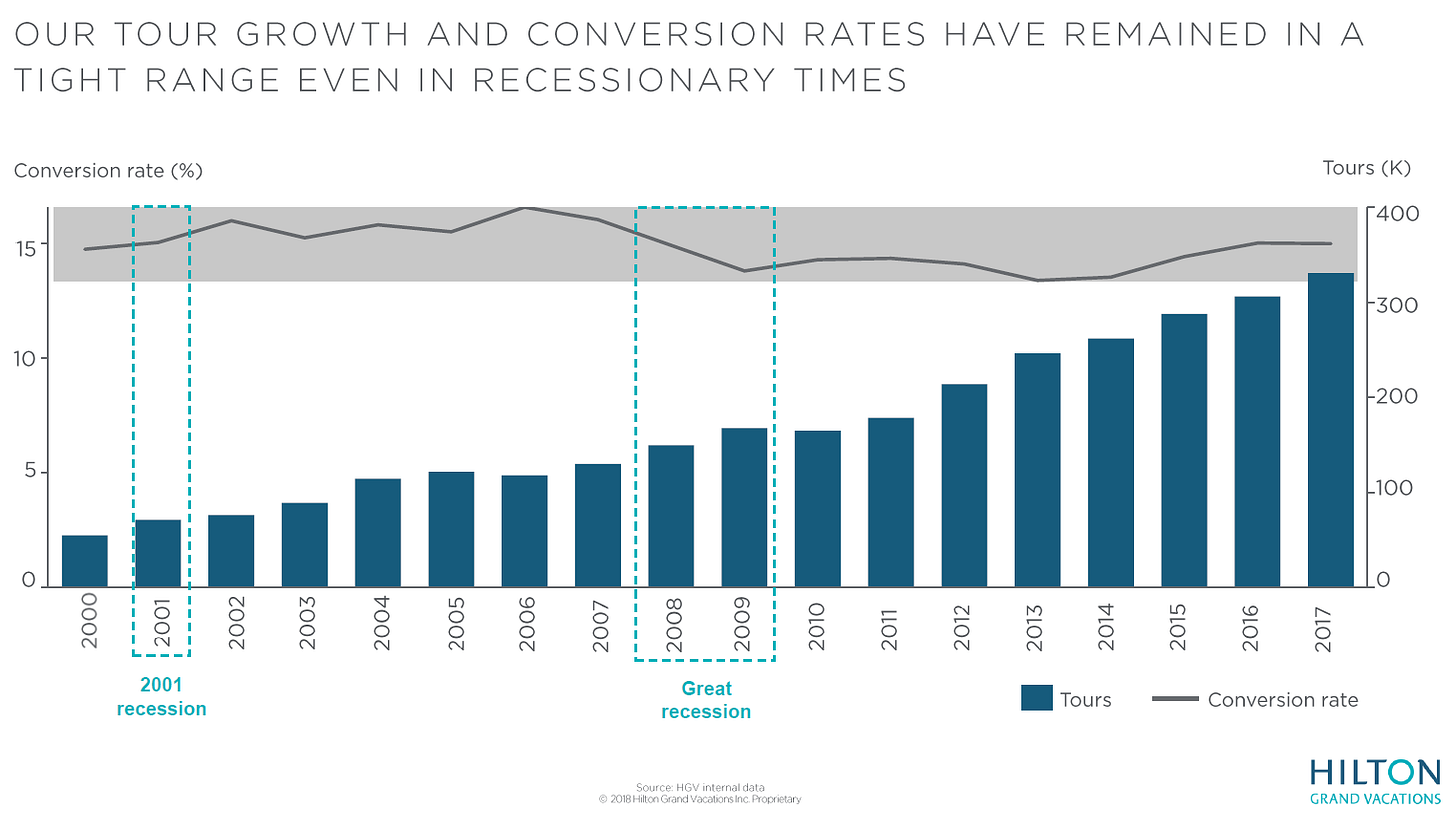

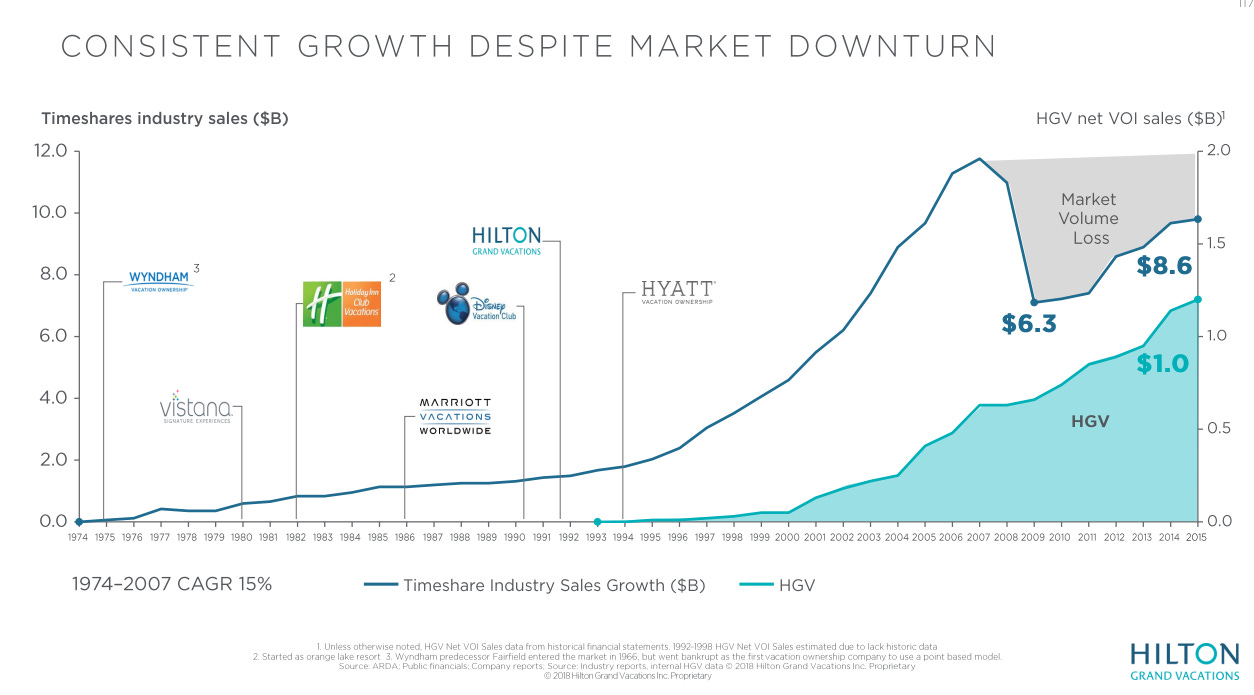

So, on those forecasts, all of the timeshare companies are pretty cheap. In addition, the timeshare companies throw off pretty decent cash flow, and most of them either have a history of repurchasing shares or have promised to repurchase shares in the near future; if they do so at these valuation levels, the time share companies would look even cheaper on their out year earnings. Of course, one of the worries with a forward earnings forecast is that the company might be baking in some super high / unrealistic growth assumptions ("we trade at 10x 2022 earnings if you assume we grow 75% annually for the next three years!"). That's not the case here: the timeshare companies are rather cheap even on today's numbers (I really only used the forward numbers to remove the near term noise); most of them are trading at ~10x near term earnings per share (Wynd is forecasting ~$4.80/share in EPS for 2018, so at <$45 it's <10x; HGV is forecasting ~$3/share, so at today's price it's right at 10x). Again, those near term numbers do have some noise in them, but my bottom line is that whether you're looking to out years or on today's numbers, these companies are cheap. Ok, so the timeshares are cheap. But why are they so cheap? I suspect a good piece of their cheapness stems from how most investors view these companies: as highly cyclical consumer discretionary businesses. On some level, that viewpoint makes a lot of sense. A timeshare is both very expensive and a very discretionary consumer purchase. In a recession, the first thing to get dropped from budgets is often vacations, and vacations are a huge source of the "tours" that timeshares companies rely on to sell new consumers. Even if vacation rates don't fall in a recession, it seems reasonable to think that timeshare sales will take a hit as consumer's wallets are pinched / consumers feel a bit less confident and less willing to shell out thousands of dollars on vacations. The industry was absolutely rocked during the Financial Crisis; the slide below (from HGV's investor day) shows industry wide sales getting cut almost in half from 2006 to ~2009, and they still haven't fully recovered.

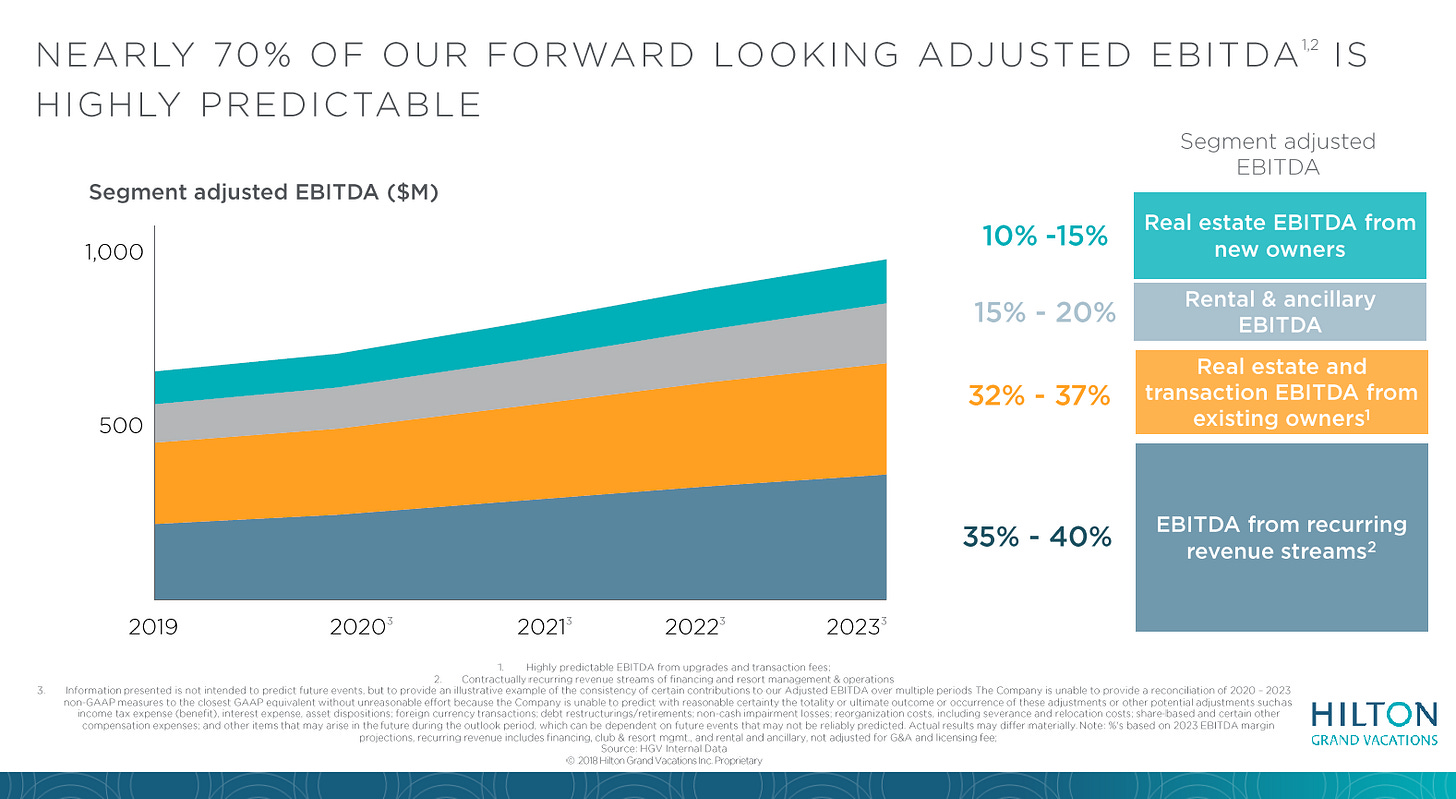

But it's not just new timeshare sales that would suffer in a (hypothetical) recession. Building a new timeshare property is expensive (in effect, you're building a nice hotel), so in a financial crisis a timeshare company could get hit with the double whammy of sales / profits declining while getting stuffed with unsold timeshare inventory / newbuild timeshares that they're investing cash into. So sales are falling while cash is going out the door; never a good combo. And, actually, given many of the timeshares are financed with consumer loans, it wouldn't be "just" a double whammy of falling sales and needing to put out cash for inventory they can't sell; it very well could be a triple whammy where a financial crisis also causes consumer defaults on their loans to rise, so the timeshare companies are sending cash out the door for new-builds while sales are stalling out and consumers are defaulting on their loans en masse, causing huge credit write offs. Put those three together and it's easy to think that every timeshare company will go bust or at least be on life support as soon as a recession strikes. Still, I'm not sure that "timeshares are super cyclical and will be rocked in a recession view" is correct. Let's start by looking at timeshare companies' earnings. The worry is that a recession will see new timeshare sales plunge, so profits will plunge as well. However, a large piece of timeshare companies' earnings actually comes from "highly predictable" earnings these days, so I think earnings would be more resilient than the market seems to be forecasting. The slide below is from HGV's investor day and suggests ~70% of their forward EBITDA estimates are from highly predictable earnings.

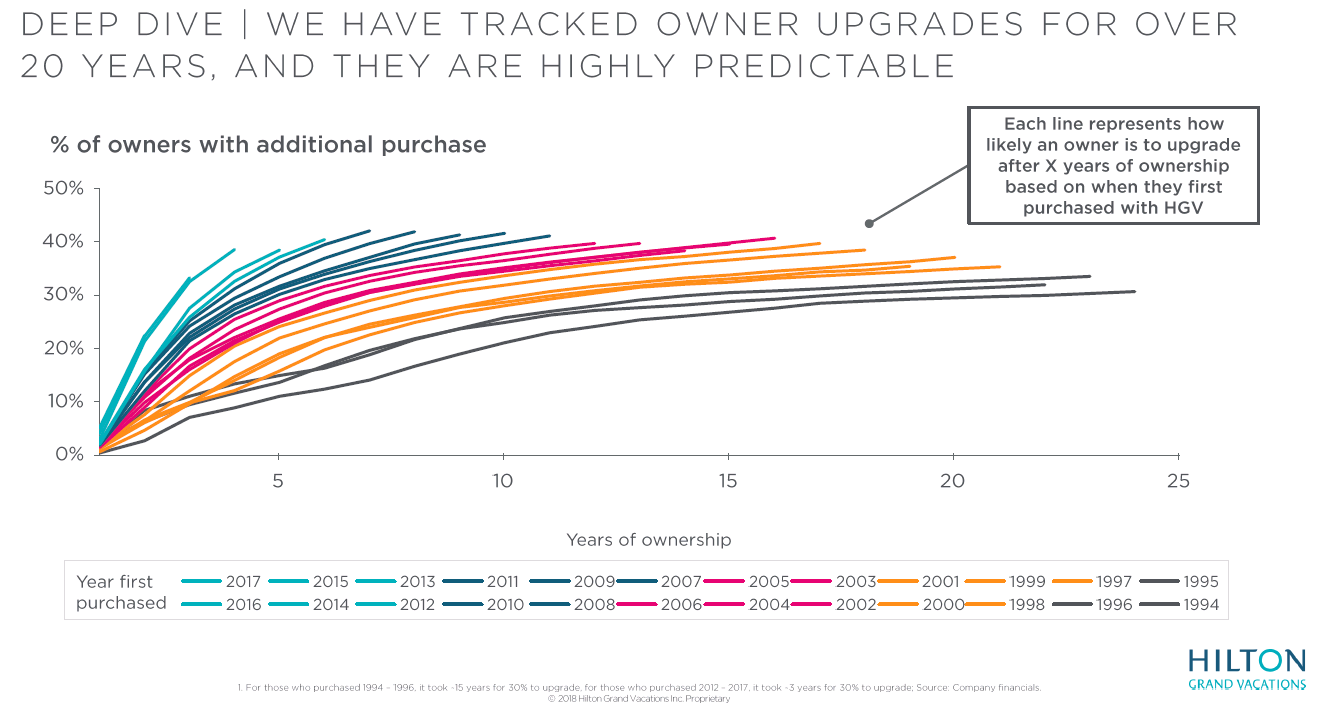

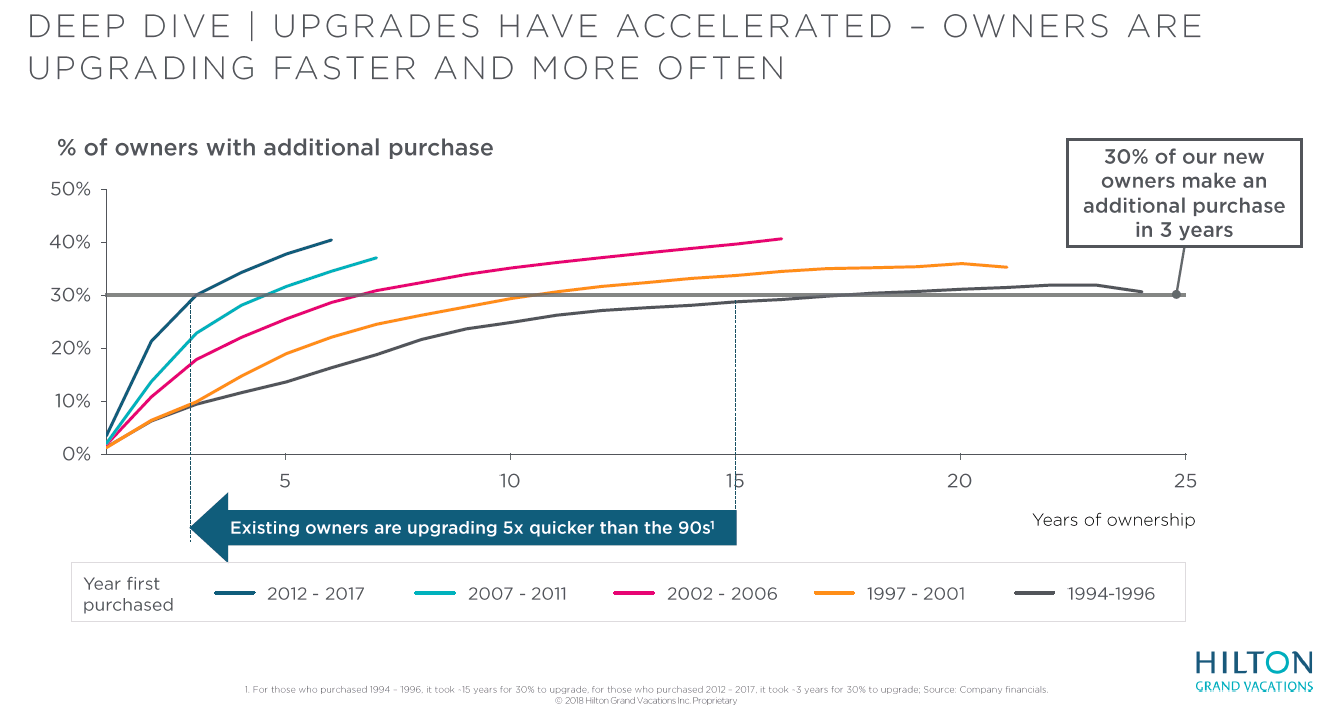

HGV's argument (and similar logic would apply to all timeshare companies, not just HGV) is that ~70% of their earnings comes from the "existing owner" bucket and the "recurring revenue" bucket; each of those are highly predictable / borderline contracted, and that highly predictable nature makes the business much less recession sensitive than you might expect at first. I think there's some logic here. If you read the footnotes, the EBITDA from recurring revenue streams consists of financing and resort management fees. The resort management fees are annual fees charged to timeshare owners; if they don't pay those fees, they'll lose their timeshare. These fees run at ~$1500/year/member (~$500 goes to HGV; the other $1k are annual maintenance fees that HGV equity holders don't get access to- they're required to be put back into the properties to keep them spruced up); given a timeshare package costs ~$20k upfront and gets you access to ~a week of vacation at a luxury-hotel esque property (which would probably cost at least twice as much as the annual fee if you tried to buy on the open market), I doubt owners are going to be defaulting on that annual resort fee unless they are in a really tight spot, so it probably does make sense to treat this stream as contractually locked in. On the financing fees, they are technically locked in but if you're really worried about a recession you're worried about consumers defaulting en masse on these loans. Certainly a worry, though I take some comfort in the credit quality of the book (HGV's average FICO score is 748 as of Q3'18, and the other players are in the same ballpark). Could you see a crazy default wave? Sure, but given the down payment, the high credit scores, and that the annual cost of the timeshare is lower than going on vacation (ignoring the sunk cost of the upfront payment), I think it's unlikely. The EBITDA from existing owner bucket consists mainly of up selling existing owners to larger packages ("ooohhhh, your current package only gets you 3 days in Hawaii every year. Why not spend $5k and upgrade to a package that gets you 5 days in Hawaii every year?"). HGV's argument is they have (literally) decades of data that shows these owner upgrades are highly predictable; in fact, their data shows that the rate of owner upgrade is increasing over time.

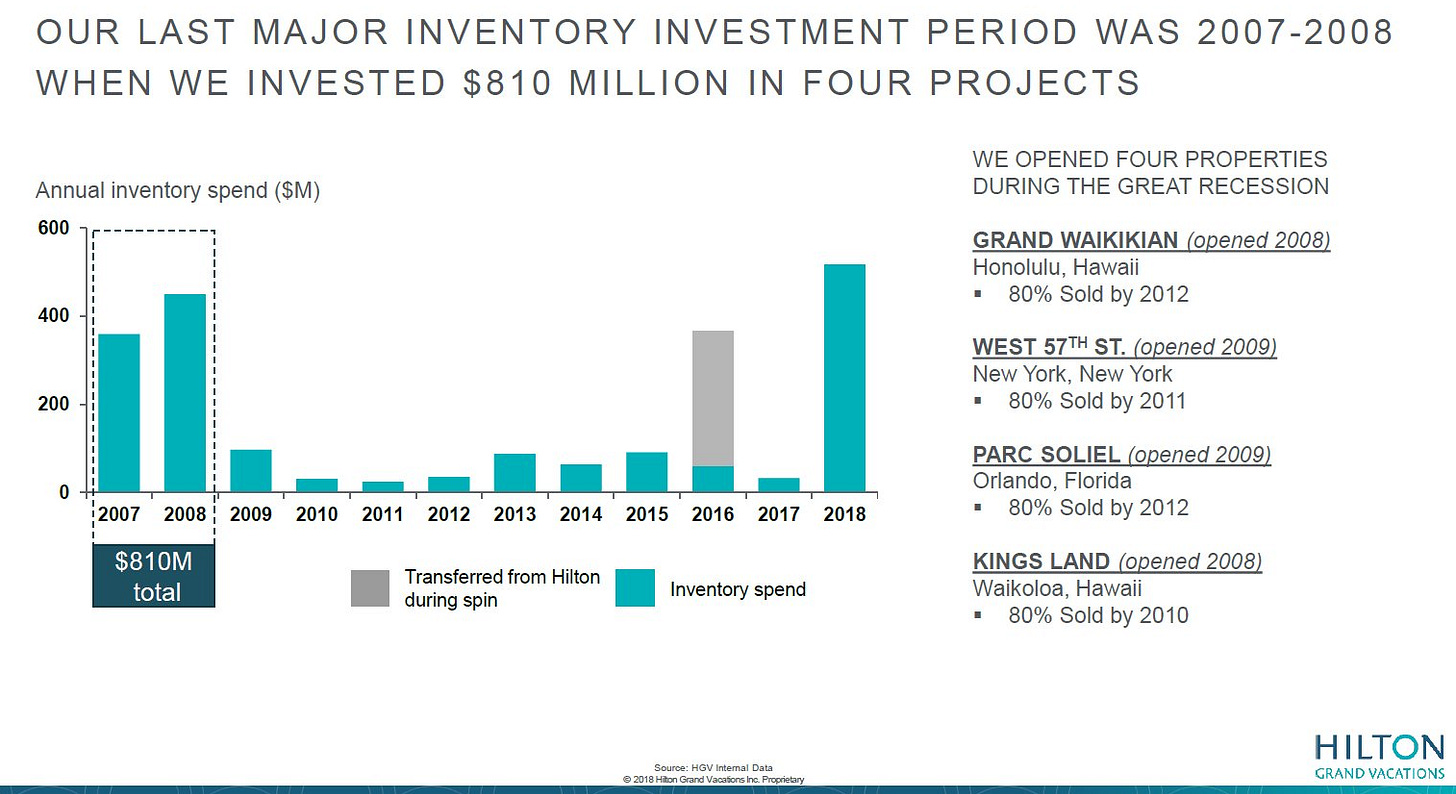

If you've spent any time looking at SaaS companies, those graphs probably look pretty familiar. SaaS companies use those cohort analysis charts all the time, and equity analysts use them to model future growth. There are plenty of reasons that the SaaS cohort analysis isn't comparable to HGV's. In particular, the SaaS companies cohort analysis is on very sticky, recurring revenue, while HGV's cohort analysis represents upgrade spending (which is a one-time payment, though it does carry an increase in annual club fees too). So I'm not arguing that HGV deserves to trade at 10x revenue (where a typical SaaS company with decent organic growth and a cohort analysis that looked like HGV's would probably trade), but I am suggesting that HGV's cohort analysis suggests the company's growth / recurring revenue / forecasts are much more predictable than the market is giving them credit for at <10x EPS. I think the other big worry about timeshare companies is they'll get stuffed with a ton of growth capex when a downturn hits. HGV, for example, is making a big investment into opening new properties / timeshare inventory over the next few years, and their investor presentations frequently include the chart below where they say, "Hey, we need to invest in inventory... we haven't done it since a big investment all the way back in 2007!".

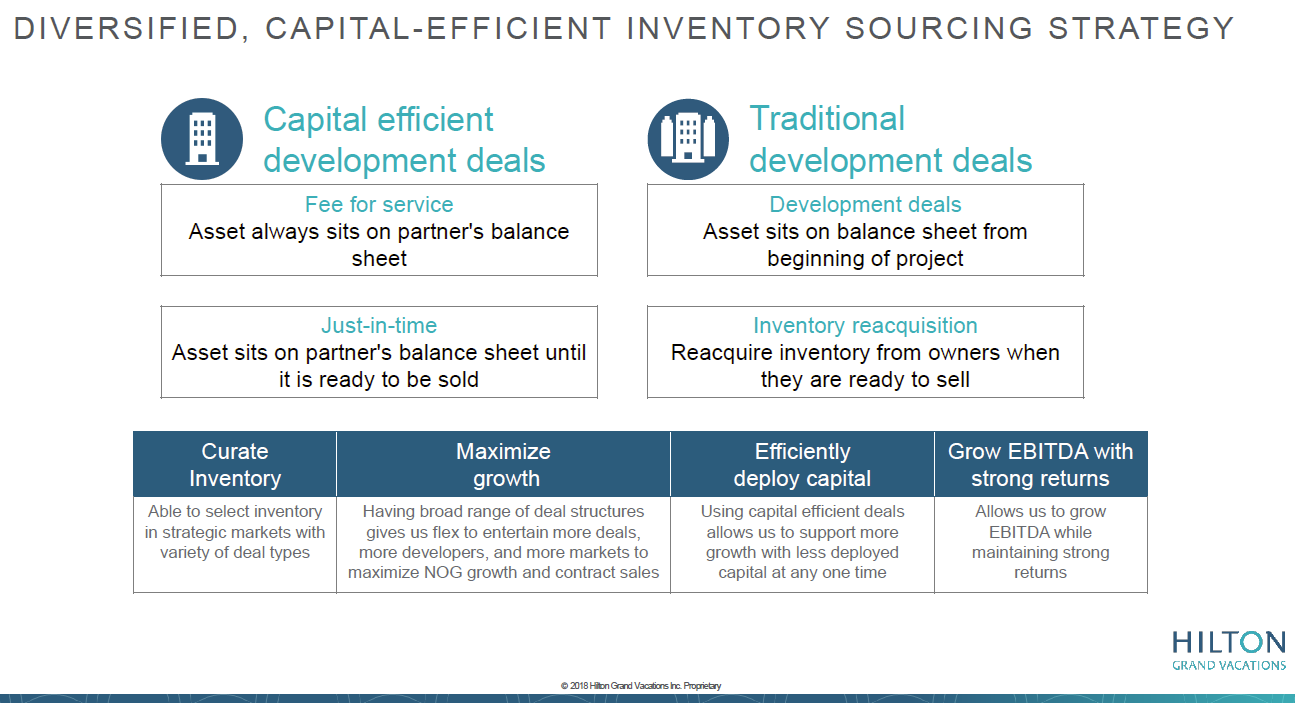

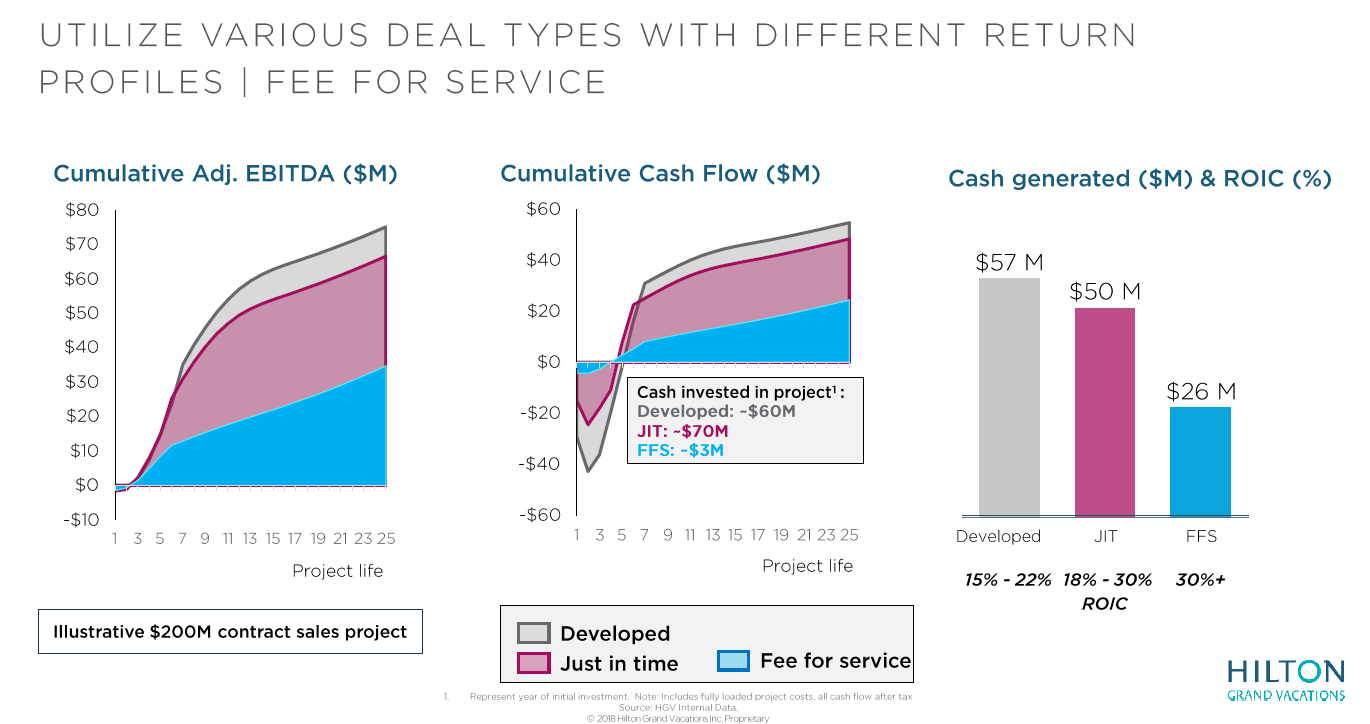

Personally, I wouldn't ever go out to investors and boast, "hey, the last time we made a big capex investment was right before the global financial crisis, and we think the time is right to do it again!", but that's just me. Anyway, the inventory investment is a concern, but I don't think it's a huge one. The industry has a reputation of making huge capex investments for growth (similar to the hotel lodging space), but these days most investment is done through capital efficient development deals, which requires much lower upfront cash investment from the timeshare company because their partner bears a lot of the development cost. Yes, there's still some risk here, but I think it's dramatically lower than most people think about when they think about new-build timeshares / hotels.

Ok, that was a lot of charts. To sum up the overall thesis for the timeshare companies: they are cheap, and they are likely much less cyclical than the market appears to give them credit for. In general, at these prices, I'm bullish on the timeshare companies. So why buy HGV over WYND or VAC? There are a variety of reasons, but I'll just bullet them here

HGV is probably the purest timeshare play. WYND and VAC both have exchange and rental businesses, which are fine businesses that spit off tons of cash, but I think they are growth challenged (as the branded timeshare companies grow, they can operate their own internal exchange networks) and I'd rather just bet on the timeshare piece.

I like HGV's focus on Net Owner Growth (NOG in the slide below). I'm sure all of the timeshare companies would love to grow their owner base, but HGV has the best history of actually doing that. Growing their owner base should result in higher growth / more predictable future growth over time (see cohort analysis from earlier), which argues HGV should trade at a higher multiple than peers.

To some extent, a bet on a branded timeshare is a bet on the overarching corporate brand (i.e. a bet on HGV is a bet on Hilton) because so much of their potential growth comes from selling into the corporate brand's rewards program base. I think Hilton is probably the best brand to bet on at this point: it's already one of the largest worldwide, it's growing the fastest, and it doesn't have any of the merger integration risks that could come from the Marriott / SPG merger.

Speaking of merger challenges, VAC just did a massive merger with ILG. So VAC has their parent company loyalty programs (Marriott + SPG) merging while at the same time undergoing a big merger of their own. Obviously there's huge upside if both merger integrations are successful.... but VAC has a decent deal of leverage and there's huge downside if either merger isn't well executed. The timeshare companies are all really cheap; is it really worth adding the risk of betting on a merger integration? In addition, while it looks like VAC is willing to repurchase shares post merger (per their Q3 earnings release, they bought back $17.5m from the end of Q3 through early November), I would guess VAC is going to be more focused on debt paydown while WYND and HGV's lower leverage / lack of integration focus means they can be more aggressive buying back shares at lower levels (WYND has been pretty aggressive on repurchases since they were spun off, and based on how they were talking at their analyst day, I expect HGV will be reasonably aggressive on repurchases as well).

Odds and ends

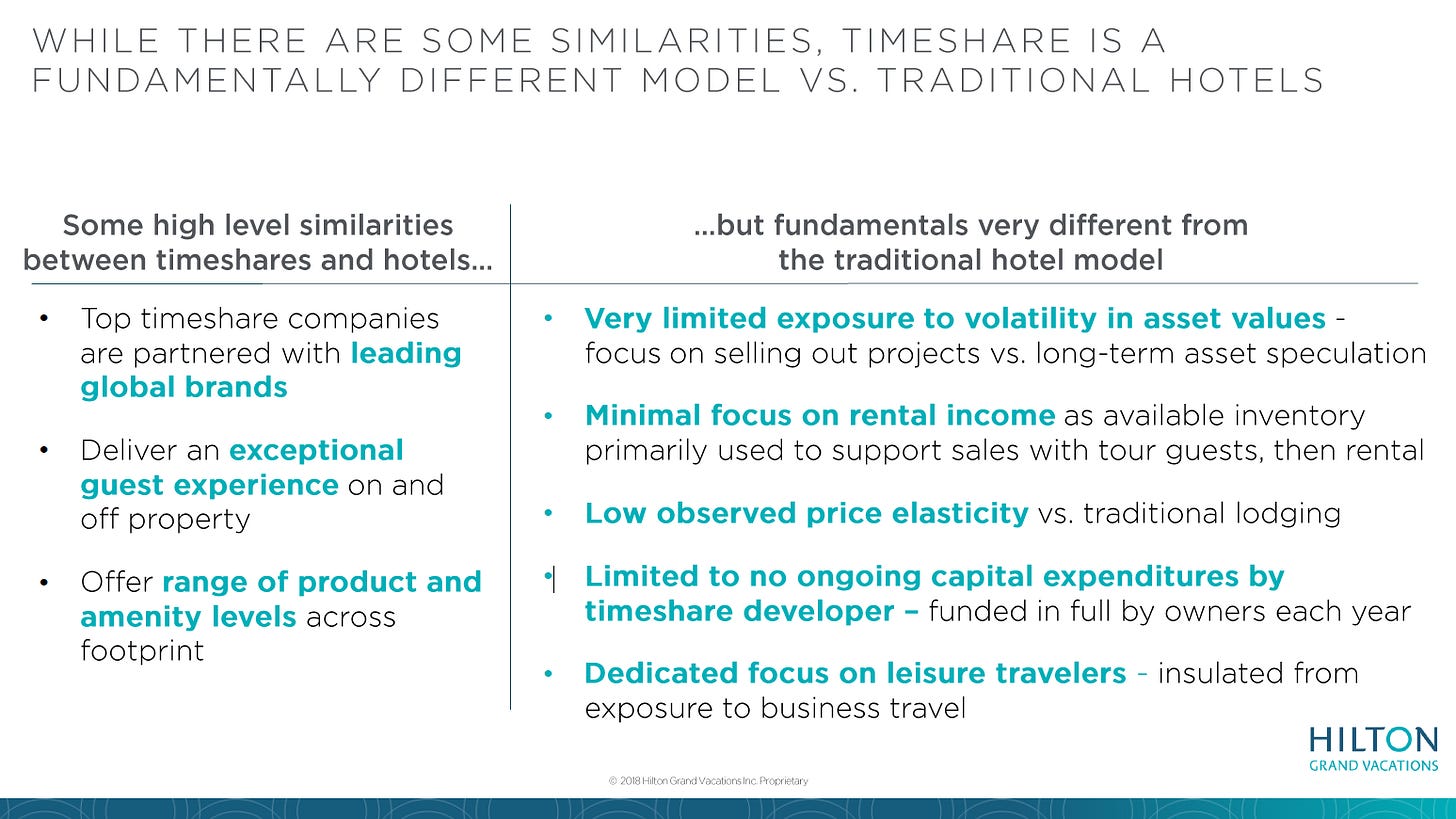

The line below is from HGV's presentation at Hilton's spin day (all the way back in December 2016). It's a bit silly, but it did stick with me and furthered my views that there could be some misconception in how investors view timeshares.

One thing I didn't super differentiate between in the write up is that I'm bullish on the branded timeshare industry (i.e. the Hilton / Marriott / Wyndham timeshare companies), not the industry in general (the one-off timeshare builds, or the smaller players like BXG that don't have a larger hotel brand attached to them). Why the branded timeshare industry?

I'm generally bullish on the major hotel chains / brands; I think they continue to take share for a variety of reasons that are probably too long to get into here but include the need for scale to push back against OTA fees and the occupancy / cost benefits that come from having a huge loyalty program. If you believe that the big hotel chains will continue to get bigger, that's incredible for the branded hotel timeshare companies. HGV, for example, will benefit as Hilton grows, as more Hilton loyalty members = more potential customers for HGV to sell to. Here's HGV talking about how their relationship w/ Hilton and Hilton's growth benefits them

Given the above, I think the branded timeshare companies just have a huge advantage in sourcing new customers / servicing current ones. In addition, the size of their timeshare networks / membership base should make them much less cyclical / volatile / exposed to a natural disaster in one area than the smaller companies. So, in general, I just think the branded timeshare companies are better than smaller or one off properties. That advantage also probably means there's accretive M&A to be done: the branded companies can buy one-off properties and realize large synergies from plugging the acquired property into their larger selling

Timeshares are an "event" (loosely defining a vacation as an event) product that's sold through a hard sell. That combo actually creates a ton of tailwinds for them. I generally don't love "consumers are shifting their budgets" arguments, but there's no doubt that consumers are increasingly willing to spend on events like Instagram-able vacations; timeshares fit squarely in there (in fact, as Instagram ready vacations gain in popularity, that probably makes the timeshare sale even easier as they can sell consumers on the dream of hitting a new spot every year). Timeshares are certainly not "amazonable" given the hard sell process / event nature. If you view timeshares as simply luring people in with cheap vacations and then hitting them with a hard sell, they're really not exposed to Airbnb risk either.

All of the timeshare companies offer some form of financing; in general, they offer consumer loans at low double digit interest rates. These are rather attractive loans, and they can generally be packaged up and sold into the ABS market at mid-single digit rates of returns. As of Q3'18, most of the timeshare companies had ~10% of their enterprise values invested into financing receivables that they hadn't sold into the ABS market yet. I don't think it's appropriate to pull those receivable investments from the timeshare companies' enterprise valuation calculations since they're generally valued on an EBITDA calculation that includes earnings from those loans, but I could see an argument for why they should be deducted from their EV calculation (i.e. treated as a cash equivalent). Doing so would make the timeshare companies even cheaper.

One other thing I like about HGV in particular: HGV appears to have handled the financial crisis much better than some peers. The same management team that took them through the recession is still in place; I would guess HGV would do better than peers if we had another recession.