$CWEN too cheap on the heels of $PCG bankruptcy

In early November, it became apparent that California utility PG&E had some exposure to the California "Camp Fire" wildfires. On January 29, this exposure lead PG&E to file for bankruptcy. As a regulated utility, PG&E's bankruptcy will surely be a wild affair as a variety of constituents (regulators, politicians, creditors, equity committee, etc.) will try to weigh in, and all will have differing agendas. One of the questions that will need to be addressed is "What happens to PG&E's Power Purchase Agreements (PPAs)?" Clearway Energy (CWEN or CWEN.A, disclosure: long both) gets ~23% of its revenue and ~33% of its CAFD (cash available for distribution) from PG&E via PPAs, so the answer to that question will have more than a little impact on CWEN. The market clearly believes the answer will be very negative for CWEN; since early November, CWEN shares are down ~25%, pricing in substantial value loss from the PG&E contracts. It's my belief that the market is overreacting to the uncertainty here, and in most reasonable scenarios CWEN will be made roughly whole on their PPA agreements (whether from PG&E accepting the contracts, or from CWEN getting becoming an unsecured creditor and getting paid out in full). As the PG&E bankruptcy proceeds and it becomes clear CWEN will be made whole on their PPAs, I expect CWEN shares will appreciate substantially (pre-Camp Fire, they traded for ~$20/share (versus today's ~$15/share price), which I think is a reasonable estimate of fair value).

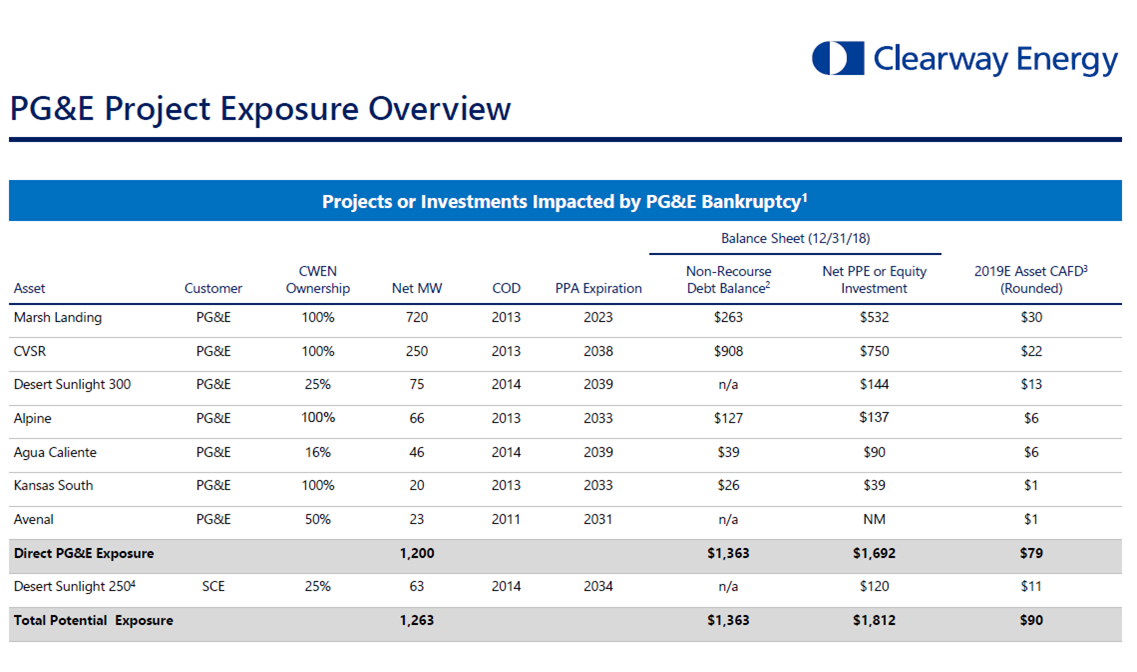

Let's start with some background, as it helps think through why this company exists. Clearway used to be NRG Yield where it served as NRG's Yield Co (it was very uncreatively named). Yield Cos were a popular structure a few years ago. Investors were desperate for dividends, and energy / development companies like NRG had assets like utility scale solar (large solar plants that are plugged into the transmission grid) that had long lives and predictable cash flows through long term PPAs with investment grade utility buyers. The development company could set up a Yield Co that paid out the majority of its cash as a dividend and promised continued rapid dividend growth. Investors would value the company based on their growing dividend stream, creating an extremely low cost of equity capital, which the Yield Co could then use to issue equity and fund more growth projects, thereby continuing to grow the dividend and creating a virtuous cycle of equity raises and dividend growth (a simplified way of explaining it: dividend investors bid the companies way above NAV, so the companies could issue equity at above NAV to fund growth projects and constantly grow the dividend). The model generally looked something like this: Yield Cos would pay out most of their cash as dividends and promise high single digit annual dividend growth. Investors would price their equity at a ~4% yield, and the Yield Co would issue equity at that level to buy energy projects with long term contracts at ~10% levered yields. Rinse and repeat and the company could grow their dividend forever. The energy development company (the Yield Co's "sponsor") also benefited: they would get an attractive price for the assets they would sell ("drop down") into the yield co, they knew they had a buyer waiting in the wings for any project they developed, and they had massive upside from Incentive Distribution Rights ("IDRs") that let them keep a percentage of any increase in the Yield Co's dividend/share (p. 148 of TERP's 2017 10-K has a great example of how IDRs work, so I won't walk through it here). As happens to all "crazes", the Yield Co craze eventually ended. The catalyst for Yield Cos falling out of favor was SunEdison's bankruptcy. SunEdison had been a major sponsor of Yield Cos (sponsoring both TerraForm (TERP) and TerraForm Global)), and its collapse (combined with lower oil and gas prices, which lowered the viability of solar and wind projects that were a major portion of the yield co growth engine, along with a slight rise in interest rates somewhat cooling the dividend growth craze) brought some fear to the sector. Once the Yield Cos stock prices went too low, they could no longer issue equity at prices that would allow for accretive growth and the "virtuous" cycle stopped. Still, as far as crazes go, the Yield Co mania had a fairly decent ending: the assets the company had bought were real and backed by real cash flow, so while investors suffered losses as the dividend growth investors fled and the equity prices collapsed from above NAV to relatively fairly valued (or even undervalued!), the losses weren't the complete shellackings that generally come with crazes collapsing. TERP, for example, generally traded for ~$35-40/share at the height of the Yield Co craze in early 2015 (while paying ~$1.30/share annual dividend and generating CAFD/share of ~$1.35) and today trades for ~$12.50/share (while paying ~$0.75/share dividend and maybe $0.90/share in annual CAFD (CAFD = Cash Available For Distribution)), and TERP was among the biggest losers in the group from peak to trough. In the wake of the Yield Co collapse, the Yield Cos were left without much purpose. Without the ability to issue equity, they couldn't really grow as high dividend payouts / IDRs consumed all of their cash. Some savvy investors saw the Yield Cos had been left for dead and swooped in to buy them at rather attractive (IMO) prices (this article lists several of the deals). Under pressure from some activists, NRG shopped their Yield Co (NYLD at the time; renamed CWEN post deal) and renewable development arm and eventually sold them to Global Infrastructure Partners (GIP) in early 2018 (note that the deal appears to have been pretty competitive). GIP hosted a call right after they closed the CWEN deal where they pretty clearly laid out their investment thesis: organically grow CWEN's CAFD through performance improvements and cost cutting while using the company as a platform to buy more assets at attractive prices. GIP also noted that the deal made them a major CWEN shareholder, and, given the lack of IDRs at CWEN, the way GIP would profit from their business plan was through growing the value of CWEN's shares (again, many of the initial Yield Co's IDR structure rewarded sponsors for dividend growth at basically any price, so GIP benefiting mainly from improving CWEN's share price results in unusual alignment for this sector).

It's worth noting that GIP is a very knowledgeable sponsor for CWEN. GIP is an infrastructure focused fund with >$50B in AUM, and they have plenty of experience with renewable energy, Yield Cos, and development platforms.

Of particular interest when considering CWEN is GIP's investment in Terra-Gen and GIP's sponsorship of Saeta Yield. Terra-Gen is a major domestic renewable energy developer / operator with significant exposure to renewable in California that GIP bought in 2009 and sold in 2015. Saeta was a renewable Yield Co focused on solar and wind in Spain. GIP bought a stake in Saeta in early 2015 and then took a portion of the company public. TERP bought Saeta for a large premium in 2018 (see stock chart below). I mention these investments just to highlight that GIP is not a vanilla private equity sponsor who bought a stake in CWEN simply because they saw a good price; GIP has significant industry experience and was clearly knowledgeable on the workings / valuations of renewable YieldCos from their time with Saeta (interestingly, they announced the sale of Saeta the same day they announced their investment in CWEN) and with the California renewable energy space (from their Terra-Gen investment).

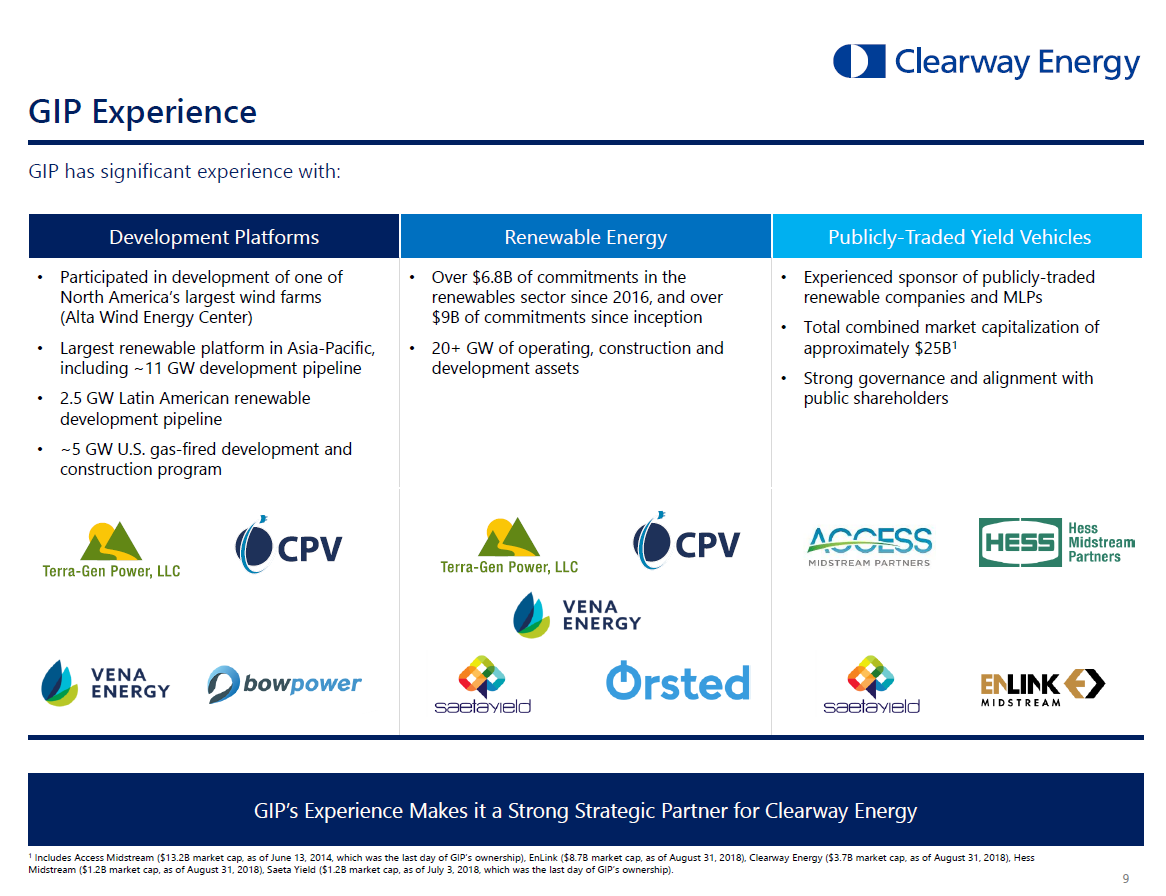

Ok, that brings us pretty much up to speed. GIP closed their investment in CWEN in September. As recently as CWEN's Q3'18 earnings call on November 6th, CWEN and GIP were talking about using CWEN as a growth platform and all of the profitable drop down and acquisition opportunities they had. Then PG&E / Camp Fire happened. What effect does PG&E's bankruptcy have on CWEN? PG&E is CWEN's second largest customer, representing 23% of CWEN's revenue in 2018 (as well as 16% of their accounts receivable at year end, though AR is small and the 10-K notes they've already collected). CWEN is projecting ~$270m in CAFD in 2019 (~$1.40/share) and ~$995m of EBITDA, of which PG&E represents $90m of CAFD (~$0.47/share) and ~$280m in EBITDA. PG&E buys energy from CWEN under long term PPAs, and CWEN makes clear that these PPAs are "higher than currently estimated market prices" (see p. 16). It's easy to see why the market would panic over losing the PG&E revenues: in a disaster case where PG&E rejects the PPAs and CWEN has zero recovery, a cursory look at CWEN's balance sheet (which carries ~$6B of debt) would suggest that CWEN is going bankrupt. I think that's way too simplistic for a bunch of reasons.

First, CWEN is a holding company, and most of their debt is held at the project level and is non-recourse to the parent. Only $1.6B of CWEN's debt is recourse to the holdco, and in a disaster scenario where all of the PG&E projects are worth zero, CWEN could simply hand their lenders the keys to the projects and walk away from the ~$1.4B in debt attached to the projects and equity holders would be left with the rest of CWEN's portfolio (generating ~$0.93/share in CAFD this year).

In this scenario, it's also 100% possible that some of the projects would be worth less than their debt, but some of the projects would have some equity value / could sign up new PPAs that would allow them to continue to generate value for CWEN. So the disaster scenario where all PG&E projects are worth 0 is a truly remote scenario.

Second (and moving on from the huge disaster scenario), there is precedent for PPAs getting accepted in bankruptcy ("in broad terms, 'the PPAs were upheld in that bankruptcy'"). I think the base case here is that precedent is upheld and PG&E accepts CWEN's PPAs in bankruptcy.

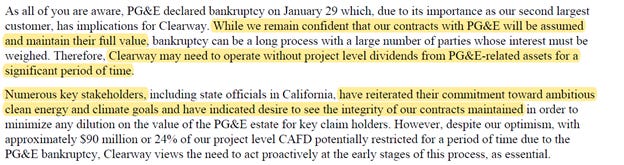

It's worth noting that, in addition to the historical precedent that PPAs get upheld in bankruptcy, there will likely be a significant political push for the PPAs to be upheld. California clearly has big goals with clean / renewable energy, and a huge reason developers can develop renewable projects is they can feel comfortable in the returns they are generating given the long term PPAs they enter into upfront. If California sets the precedent of PPAs getting rejected in bankruptcy, then they could see a freeze in renewable development which would go against both the state's goals and the politicians' relections chances. (The quote below is from CWEN's Feb. 2019 PG&E bankruptcy call)

In addition to the (likely) political support for keeping the PPAs in place, it appears that there will be regulatory support for keeping them as well: in late February, FERC (after heavy lobbying from independent power generators) asserted that it had jurisdiction over the PPAs and said a bankruptcy court could not unilaterally invalidate them.

Another thing suggest PG&E will accept the PPAs in bankruptcy: so far PG&E is making payments on the PPAs (from CWEN's Q4'18 earnings call). Obviously, PG&E could pay now and try to reject the PPAs later, but given the PPAs were above market I would think they'd try to recut the deals early and save some money if they did plan on rejecting the PPAs.

Finally, what would happen if PG&E did reject the PPAs? The most likely scenario is that CWEN would get an unsecured claim on PG&E. The recovery on this claim would probably be pretty high: PG&E's bonds are currently trading for ~90 cents on the dollar, and they maintain a market cap of ~$10B (the stock trades under PCG). Obviously a lot of the equity value comes from the "call" option associated with it and the ultimate recovery for unsecured creditors could vary widely based on a bunch of variables (most notably, how much of the liabilities PG&E will be allowed to pass on to consumers and what PG&E's ultimate liabilities are), but the fact so much of PG&E capital structure is holding in suggests that ultimate recovery will be very good for unsecured claims. So, even if PG&E rejects the PPAs, I'd expect CWEN to see a significant recovery through their unsecured claims, and they could then go and try to sign up a new PPA with a different utility (or PG&E's successor). Either way, I expect CWEN's PG&E assets will ultimately have substantial equity value for CWEN. (Quotes below from CWEN's Feb. 2019 PG&E call)

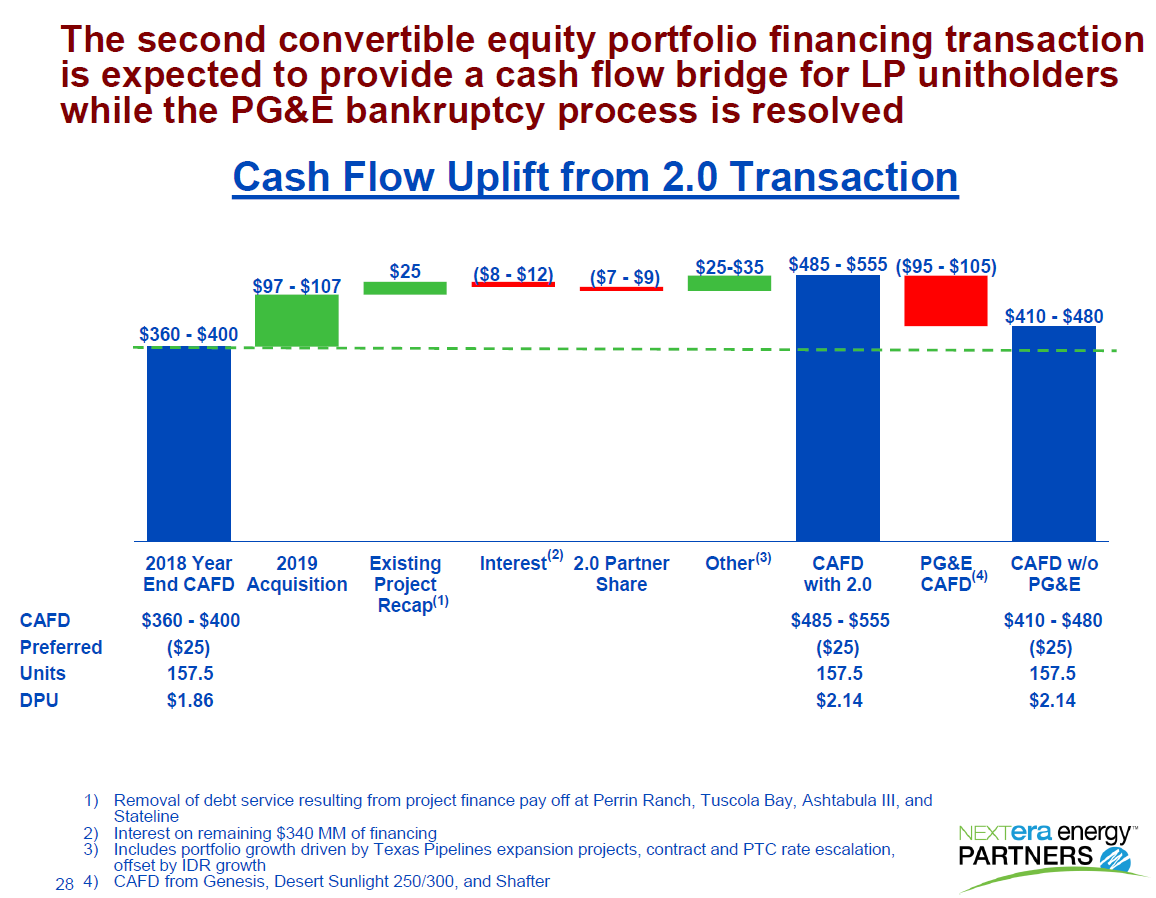

It's worth noting that Apollo seems to share the view laid out above (that CWEN's PPAs are likely to be accepted and, if not, they'll probably become unsecured creditors with a very high recovery on their claim) as Apollo bought ~6% of the stock in the wake of the PG&E bankruptcy fall out (here's their 13G). Normally I wouldn't care what other investors are buying / selling a stock, but I actually think it's meaningful here: Apollo is an extremely sophisticated distressed investor, and PG&E's filings show that Apollo owns ~$350m of PG&E's debt (~$125m in DIP TL, $35m in revolver loans, and ~$220m in senior notes) in addition to the ~$125m investment in CWEN's stock. Obviously an investor can be wrong, but given the size of the investment I would guess Apollo did significant legal due diligence on PG&E and how creditors and PPAs will be treated and seems to have come up with a conclusion similar to the one above (that, heads or tails, CWEN will probably come up ok). In addition, given Apollo's scale, I would not be surprised if they had access to some private data (PPA contracts, plant level operating expenses, etc.) that gives them better insight into what CWEN's portfolio is worth in a downside scenario (i.e. the valuation of the assets without the PG&E PPAs). Consider this: Apollo just bought $1B of renewable energy investments from GE Capital; I would guess they had a mammoth legal due diligence bill for that purchase, and I wouldn't be surprised if some of the data that came with that purchase (or other similar investments) included data that would give them much better insight into what CWEN's portfolio is worth and the legal protections in their PPAs. Again, take all that for whatever it's worth (which may be nothing!), but in this specific case I think having a distressed investor with a near unlimited due diligence budget confirming the thesis is a significant boost. Anyway, let's talk valuation. CWEN is guiding to $270m in CAFD for 2019 ($1.40/share), which includes $90m from their PG&E projects (~$0.47/share). I think the proper way to think about value is to seperate the CAFD into two buckets: the non-PG&E side (which will earn ~$0.93/share in 2019) and the PG&E side. It's impossible to value either of these without a detailed look at the individual PPA agreements so we can know how far above market they are and start to estimate what the plants will reasonably be able to earn after the PPAs expire. However, I think we can ballpark a multiple.

There are a few publicly traded peers (TERP, PEGI, AY, NEP) left. None of them are perfect for a variety of reasons (moving parts due to acquisitions, different asset types, varying length of PPA exposure, different IDR structures, etc.), but they also generally trade for strong multiples (TERP, for example, trades at >10.5x 2022E CAFD, and PEGI trades at ~12x trailing CAFD). Probably the most instructive peer to look at is NEP (NextEra Energy Partners). NEP is Nextera's Yield Co and they match up very similarly to CWEN; similar PPA life (17 year CAFD weighted average for NEP versus 15 for CWEN), similar exposure (wind and solar focus), mainly domestic exposure (TERP and PEGI have a lot of international), etc. In addition, NEP gets ~20% of its CAFD from PG&E, so it has a bit of a PG&E overhang just like CWEN. At today's prices ~$45/share, NEP trades at ~15x it's 2019E CAFD/share (17x if you zero out the PG&E exposure) and a 4.7% dividend yield. Using a similar multiple for CWEN's non-PG&E CAFD of $0.93/share would suggest we're creating CWEN's PG&E exposure for free (or close to it) at today's prices of ~$15/share.

I would actually suggest CWEN deserves a higher multiple than NEP if you ignore the PG&E noise. While NEP probably has a better growth profile, NEP is deep into the money on their IDRs, so 25% of their dividend growth going forward belongs to their sponsor, not NEP shareholders (see p. 38); that is a hefty fee! CWEN's structure (with no IDR where the sponsor's fortunes rise and fall in tandem with minority shareholders) probably deserves a significant premium to NEP.

The slide below shows NEP's CAFD and how much of it comes from PG&E (from their March 2019 investor presentation).

We can also look at precedent transactions to try to ballpark CWEN's value. Brookfield acquired majority control of TERP in 2017, and 8Point3 sold to Capital Dynamics in early 2018. The proxy for both deals suggested fair CAFD multiples in the ~12x range (see p. 80 of TERP proxy or p. 60 of 8point3 proxy). Applying that multiple to CWEN's non-PG&E exposure suggests we're buying the P&E exposure for ~8x CAFD, which is cheap but not astonishingly so.

Again, I'd emphasize here that most peers have an IDR structure, so CWEN should probably trade at a premium to them given minority shareholders are much better aligned with management / sponsors and get to keep all of the company's growth.

I'm not saying CAFD is a perfect proxy for fair valuation. It's a nice metric for distributable cash flow to equity, but it can be gamed in a variety of ways. For example, CWEN structures its assets so that the amortization on their project level debt roughly fully amortizes the debt by the time the project's PPAs roll off; a more aggressive company could increase CAFD simply by reducing the amortization of the project level debt. So CAFD isn't perfect, but using it probably puts us in the right ball park for what CWEN is worth. For example, 8Point3's proxy includes an EV / EBITDA analysis that suggests precedent deals happen at 10-12x EBITDA. That seems reasonable (renewables like wind and solar have limited ongoing capex requirements, so a 10x EV / EBITDA multiple equates to roughly 10x cash flow; a lot depends on your tax rate (CWEN won't pay taxes for 10 years, see p. 64 of 10-K), leverage, and terminal value assumptions, but it doesn't take crazy aggressive numbers to get to ~double digit levered IRRs with that multiple) and consistent with deals we're currently seeing; for example, NEP just announced a $1.02B deal at ~10x EBITDA (the underlying projects had a weighted averaged PPA life of 15 years, similar to CWEN). Using a 10 EV / EBITDA multiple (and assuming all non-recourse debt), I come up with a valuation of ~$18/share (~$10/share from the Non-PG&E assets (assuming all holdco debt is applied against them) with $8/share from the PG&E assets), which seems broadly consistent with the numbers above. (Note: you can find assets that go for below 10x if you look; for example, this NEP deal seems to be at ~7.5x EBITDA. But it seems like that deal had some complications, and both the financials of CWEN and the overall flow of deals I've seen suggest the multiples I'm using are in the right ball park). Anyway, every asset is unique and without more details on the PPAs it's tough to get super specific on valuation. However, based on all of the comps, I think it's fair to suggest that fair value for CWEN is somewhere between $18-20/share before assigning a PG&E discount. Interestingly, $20/share is right where CWEN was trading before the PG&E / Camp Fire issues flared up, suggesting that the market has knocked ~$5/share off CWEN's value for PG&E, which is roughly consistent with where I think fair value for those assets are (i.e. the market is zeroing the PG&E assets). Bottom line: I think today's price represents fair value for CWEN's non-PG&E assets and we get the PG&E assets (which I expect CWEN will be made whole on, one way or the other) for free. How do I think this will all play out? I think CWEN will be in a bit of a holding pattern until they get more clarity on what happens with the PG&E assets. CWEN already cut their dividend to ~$0.20/quarter in response the PG&E's bankruptcy, so they'll continue to pay out most of their non-PG&E CAFD to shareholders in dividends (likely pursuing deleveraging and maybe some small bolt ons with the extra cash flow) while waiting on clarity on PG&E. The PG&E bankruptcy will be long and drawn out (it will likely take more than a year); given how long it will take, it's difficult to estimate exactly when the PPAs will be fully addressed / settled. But, at some point, PG&E will likely assume the PPAs as is, and I'd expect CWEN to make a big special dividend to pay out the cash that their PG&E projects have built up while waiting for clarity (the PG&E assets are in default of their asset level loans while PG&E is in default, so cash builds at the operating level and cannot be dividended up to the CWEN holdco until the default is cured / PG&E emerges from bankruptcy). At that point, I expect CWEN shares to be approaching fair value of ~$20/share, and GIP will likely resume dropping assets in CWEN and looking to use the company as a platform for buying smaller assets. Odds and ends

One thing I didn't address in the write up: how above market are the PG&E PPAs? Credit Suisse estimated they were 3-5x higher than today's energy contracts, which seems in the right ballpark. That math would suggest that, if the PG&E contracts were cut to market price today, as a whole they would be CAFD breakeven to slightly CAFD positive. Despite not generating much CAFD, they would retain a decent bit of equity value since CAFD includes debt principal amortization and they would have a useful life beyond their PPAs (which they'd exit with no asset level debt left thanks to that amortization).

This of course ignores any recovery on the unsecured claim CWEN would get on PG&E if their PPAs were rejected.

A lot of the value for all Yield Cos (including CWEN) comes from the guaranteed cash flows from their PPAs (which are often above market prices for electricity). That makes comparing across companies tough as different PPA lengths / contract certainty can really effect value; I've done the best I could with the information given, but the Yield Cos generally only give high level details (counterparty and length of PPA). Quirks in structures / PPAs could make for huge valuation issues; for example, you could have a 20 year PPA structured with $20/year of cash flow for the first three years and $1/year of cash flow for the last 17 years to juice early financials, or simply a way above market PPA that is in the last year of its life so cash flow will dive next year. The structure of the contracts is also key (i.e. a PPA with an out or a reset would obviously be worth a lot less than a PPA without those features). That's why I think GIP's investment in CWEN last year is such a support; sure, we know CWEN has a 15 year weighted average life for their PPAs, but GIP actually got to look under the hood at those contracts (full data room access) and was comfortable enough with what they saw to buy a huge slug of the company at prices above today's levels. Between that "contract validation" and the lack of IDRs at CWEN, I think it's reasonable to think that CWEN should trade for at least a peer multiple and perhaps a premium (ignoring any overhang from PG&E).

Speaking of GIP, the GIP / NRG deal that gave GIP control had several pieces to it, so I'm not sure it's fair to compare how that deal valued CWEN to CWEN's fair value today. However, FWIW, it appears the deal valued CWEN at just under $16/share.

Clearway has two publicly traded share classes: the A shares (CWEN.A) and the C shares (CWEN). Despite having more voting power, the A shares generally trade at a slight discount to the C shares because the C shares are more liquid. I personally prefer the A shares given the slight discount, but they are pretty much equivalent given GIP has voting control.

Given that, it will not surprise you that GIP is a risk as well; they control the company and operate most of the assets, so they could try to loot the company in a downside scenario. I think they'll treat minority shareholders fairly, but anytime you have a controlling shareholder there is some shenanigans risk.

One lingering risk: while PG&E is the only customer currently effected by wildfires, the bulk of CWEN's portfolio is in California and it's possible their other customers are hit by fires or some other calamity in the future. Moody's just downgraded several of CWEN's customers on a similar thesis. Ultimately the PPAs probably get upheld even if everyone goes bankrupt, but obviously this can create some noise / lingering overhang.

CWEN's assets are already operating / in place, so they're more resistant to changes in the tax code than a new build renewable project that depends on tax credits... but tax changes will still have a significant effect on CWEN. If all of CWEN's PPAs expire and states are offering mammoth bonuses (tax credits, improved rates, etc.) for using renewables versus conventional power production, that's going to be great for the rates CWEN can sign new PPAs at. If there are no bonuses, CWEN is probably going to be signing PPAs well below even what current rates would suggest.

You could also be exposed to changes in the tax code that effect CWEN's existign tax assets. That was a big worry with the 2017 tax cuts, but CWEN appears to have emerged unscathed. Given we literally just did tax reform, I doubt this is a risk until the next administration at the earliest, but certainly worth keeping in mind for the medium / long term.

Related, some of CWEN's assets are conventional nat gas plants, and it's possible legislation is passed to discourage generation at those facilities before CWEN's PPAs expire, which would hit hard the rates those could sell their power at in the future. Guessing future energy policy or future power prices is a fool's game (most of these agreements are expiring towards the end of next decade or later; good luck calling that market!), but something to keep in mind.