2019 halfway point letter and WOW investment thesis $WOW

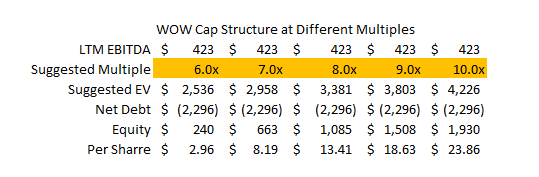

Below is an excerpt from our H1'19 letter. While the below excerpt is the majority of the letter, we pulled out some sections discussing our returns and portfolio sizing due to #compliance (we did the same for our 2018 annual letter); you can contact my colleague Rob (his email is rsterner@rangeleycapital.com) if you’re interested in seeing the whole letter or learning more about us. Despite the strong year to date returns, we remain very bullish on our opportunity set and anticipate the fund will continue to deliver strong returns regardless of what the market does over the medium to long term. Why do we believe those two things? We believe our portfolio is positioned to generate strong returns because we’re generally invested in companies that are undervalued largely due to a variety of structural factors (lack of liquidity, not being included in indices, screens poorly due to accounting complexity, etc.). We think we’ll perform well regardless of what the market does over the medium to long term because, in general, our investments have some combination of limited cyclicality (people don’t cut their internet just because of a recession), a form of catalyst (spinning off a hidden asset, index inclusion, etc.), or the ability to invest their capital at attractive rates of return going forward (which will generate profitable growth that the market will eventually be forced to recognize). I’m a huge reader, and one rule of good storytelling is “Show, don’t tell.” Given this is our semi-annual letter, I thought I’d stop “telling” you about how excited we are about our portfolio and instead “show” you an example of a current investment with the hope that doing so both highlights why we’re so bullish on our current investment set and expands on some of the thoughts we touched on both above and in our annual letter (in particular, the piece on searching for alpha in an increasingly computerized and indexed world). The company I want to touch on is Wide Open West (WOW), as I think it highlights the unique nature of some of our investments, especially the interesting risk/reward dynamic that we are finding in today’s market (though WOW is still a small position for the portfolio because of three specific risks that I will touch upon later). WOW is one of the ten largest cable companies in the U.S. As you probably know, our largest position, by far, is our holding in Charter Communications through a position in various securities in the Liberty complex, so we have significant experience investing in and looking at cable companies. However, WOW differs slightly from “normal” cable companies in that they’re an overbuilder. An overbuilder can effectively be thought of as the second cable company in town: they come into a city, build a second cable network, and try to take customers from the legacy cable companies. For example, WOW’s ~10th largest market is Augusta, Georgia, where they compete with Xfinity (Comcast). Given the overbuilder faces competition from the legacy cable company in all of their markets (while the legacy cable company only faces cable competition in overbuilt markets, and often starts with a huge lead in those markets since they already have most customers and the overbuilder needs to pry those customers away), an overbuilder is nowhere near as good a business as a legacy cable company (like Charter or Comcast). Still, once the network has been built, an overbuilder is a decent business for all of the reasons we’ve talked about with legacy cable companies: providing broadband is a high margin, recession resistant business, and (in WOW’s markets) it should basically be a duopoly between the legacy provider and WOW, which should allow for reasonable returns and pricing power over time. The first reason we’re interested in WOW is it’s really cheap. The company trades for <7x EBITDA while most peers are around 10x. WOW is also significantly leveraged, with net debt >5x EBITDA. The combination means the equity / share price is extremely sensitive to WOW’s multiple. A slight rise in WOW’s multiple would drive a massive change in share price; if WOW were to trade up to peer multiples, the stock would more than triple from here.

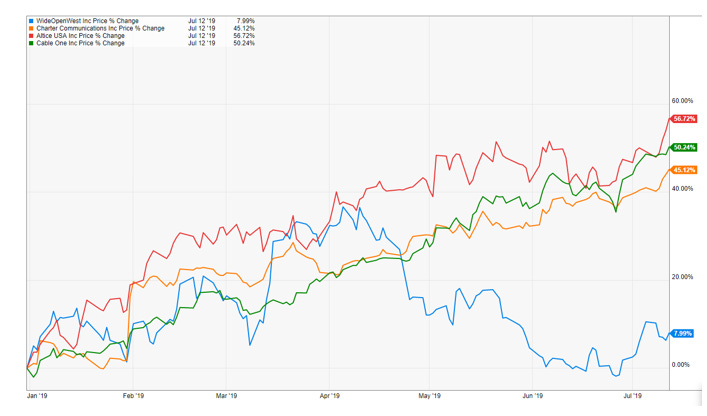

I’ll caveat this analysis by noting it is much too simplistic. WOW does not deserve the same EBITDA multiple as its peers because it’s not as good of a business. Again, WOW is an overbuilder, and it currently has lower margins and higher capital intensity (capital expenditure as a % of sales) than peers. However, I wanted to use EBITDA here just to highlight how cheap WOW is and how quickly the stock could go up if the company got rerated. I believe the stock is worth ~$15/share, but given the leverage the range is pretty wide and if you got a drink or three in me you could talk me into the low-$20s/share for WOW’s intrinsic value. So WOW is really cheap and really levered. That’s interesting but not worth an investment on its own. After all, the company could be really cheap and overlevered / heading to bankruptcy. Or maybe the business simply isn’t a good one, so it should trade for a “really cheap” multiple. Mere cheapness / leverage is not enough for us to make an investment. As we discussed in our annual letter, investing based on cheapness has generally been picked over by computers and quant strategies; I don’t think there’s any “alpha” left for humans trying to invest on mere cheapness in a market flush with liquidity. Still, it is an interesting combo. It’s particularly interesting to note that WOW’s stock has dramatically trailed peers so far this year despite a massive bull market for cable stocks. In addition to WOW, there are only three other publicly traded pure play American cable stocks: CABO, CHTR, and ATUS. Below is their year to date stock price performance.

Remember that WOW is more levered than its peers (often dramatically so). Given that leverage, you’d expect WOW’s stock to rise more than peers when cable stocks are going up and fall more than peers when they are going down. Yet in this year’s massive cable bull market, WOW has trailed significantly. Similar to WOW’s cheapness, WOW’s year to date underperformance is interesting but not necessarily a reason to invest. Perhaps the stock has underperformed because it was overvalued on the way in (it wasn’t). Or perhaps the company has posted way worse results than their peers (they haven’t). But the underperformance is another interesting factor to consider. At this point, hopefully I’ve shown that WOW is cheap, it’s got a lot of upside as that cheapness normalizes, and the stock has really underperformed peers. Let’s talk about why it’s all of those things. WOW went public ~2 years ago. Before that, it was owned by two private equity firms (Crestview and Avista), and those two firms continue to own ~70% of WOW’s equity (split roughly evenly). With those two firms still owning so much, WOW’s free float is <$200m, and shares are relatively illiquid (only ~50k shares, or <$400k, trade each day). With such a “small” free float, WOW is ineligible for a variety of indices, and many funds and institutional investors can’t or won’t invest in WOW (note that the illiquidity really isn’t a problem for us; we could be running >20x the amount of money we currently run and, given our smaller sizing, we could still easily invest in WOW’s stock). On top of that illiquidity and small free float, Avista has been in WOW’s equity for almost 15 years at this point, and a persistent worry among investors I talk to about WOW is “what happens if Avista dumps their stake? I don’t want to take a strange mark to market hit because Avista is forced to sell a huge block on the market”. This is a combination we love. We’re happy to take illiquidity risk in order to buy a dramatically undervalued security, and we love to get paid to take the risk that Avista is forced to dump their stake on the open market and pressure the share price (and thus one of the three reasons for our smaller sizing: we want to be nimble in case a real forced seller comes along. The other two risks? We already have significant cable exposure through Charter, and the massive debt load means we have to keep this a smaller position than we’d otherwise prefer). There are lots of other things we like about WOW. For example,

The company’s new CEO (hired late 2017) has a history of dramatically improving operations of the telecoms she’s run in the past.

WOW’s trailing numbers are depressed by some near-term investments that should significantly improve profits over the long term (despite those investments, recent results have been solid).

One of these investments is “edge outs,” where the company spends capex to pass more homes. The company believes these edge outs have very good returns; the great thing about them is these investments will either significantly improve earnings over the medium term or the company can rapidly stop edging out and apply the edge out cash to paying down debt or repurchasing shares. Either way, at today’s low prices, it seems the market is pricing this “edge out expense” as a permanent expense with no corresponding return.

Because of our deep work on the cable sector from Charter, we think we understand the cord cutting phenomenon better than most, and we can’t help but wonder if cord cutting is good for overbuilders. A large player like Comcast has a massive pricing advantage when it comes to offering video products: their ~20m video subs let them negotiate substantially better deals with content providers (think ESPN or FOX) than WOW’s <400k subs would, so Comcast can undercut WOW on video pricing and still be more profitable. As legacy video products increasingly go away, Comcast and WOW are both offering essentially the same product: reliable, high speed broadband with essentially the same cost structure. That change could help WOW compete and pick up a bit of market share.

Note: by no means are we underwriting this as a base case. However, it seems like a reasonable outcome, and it’s not currently priced into the stock. It’s also an example of how we look for interesting investment ideas. We spend a lot of time thinking about a specific risk or component of an investment, and that leads to asking a number of new questions about other tangential areas that can lead us to smaller and quirkier companies.

To the extent possible given the small float, the most important people in the company (the CEO, Crestview, and the company itself) have been buying the company’s stock through significant insider purchases and/or repurchasing shares, often at prices well higher than we are currently paying.

WOW has substantial tax shields and shouldn’t pay any taxes until ~2023, which also meaningfully improves cash flow.

How do I think this will play out? I expect WOW will generate at least $1/share of free cash flow (earnings after capex, interest, and taxes, though the NOLs mean taxes don’t exist!) every year going forward. At today’s share price of <$8/share, that’s a pretty hefty cash flow to equity. The company could use that free cash flow to pay down debt, continue to expand their network (and increase earnings), or to figure out a way to repurchase shares. Any of those options should continue to boost the company’s value. Eventually, the market will be forced to recognize WOW’s value, either because Avista figures out a way to unload their stake and WOW becomes eligible for a variety of indices / institutional funds, or because WOW’s cheap price attracts an acquirer (either financial or strategic). WOW is one of my favorite opportunities in the market right now, but it’s by no means completely unique. Across the board, we are finding opportunities to buy interesting companies that don’t screen well because of some weird structure or have some type of overhang that prevents most investors from getting involved. I know this write up was a bit longer / more in the weeds than my typical letter, but (as I mentioned upfront) my hope is that by “showing” you the type of overhangs and structural issues we look to take advantage of, it’ll help you understand what we’re “telling” you when we talk about the opportunities we are seeing in the future. As always, we appreciate your continued investment in the Fund and confidence in our team. We welcome all the new investors for July 1st. Please don’t hesitate to reach out to Rob Sterner, rsterner@rangeleycapital.com, or myself with any questions or if you’d like to make an additional investment. Also, if you know of other like-minded investors that may be interested in speaking to us about our research or the investment partnership, please let us know and we’d be happy to meet them. Sincerely, Andrew P. Walker, CFA