Some thoughts on the LaGuardia of gyms, New York Sports Club $CLUB

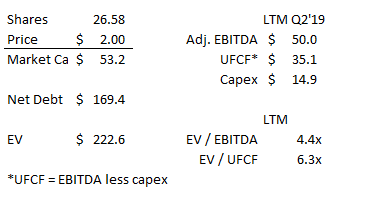

Last week, I got an email from New York Sports Club (CLUB; disclosure: long a tracking position) that they were raising the price of my all-access membership by $20/month (from $80 to $100). Given the CEO / second largest shareholder had just bought a big block of shares a week earlier and I think I have some differentiated insights into the business, I figured I might as well put some pen to paper on CLUB. A quick overview: CLUB operates fitness centers, primarily in the Northeast. If you live in NYC / Philly / Washington / Boston, you're probably familiar with their New York / Boston / Washington / Philadelphia sports club monikers (note: I go to New York Sports Club, aka NYSC, and I'll be referring to the company interchangeably as CLUB and NYSC going forward). Operating a fitness center is never going to be mistaken for a great business, but you could see how owning the largest chain of clubs in a market could generate a bit of a competitive advantage. Having the most number of clubs in a location allows you to spread your fixed marketing cost over a larger base as well as letting you offer all access deals that single location clubs can't match (i.e. charge an extra $10/month so someone can access all of your clubs; great for people who want to have access to a gym by their office and by their apartment). A fitness center chain should also be relatively stable and economically resistant (people pay for their membership upfront and get autobilled). From an investor's standpoint, the appeal of CLUB is pretty simple: it's really darn cheap on an overall basis, even cheaper when you look at how levered it is through the equity, and the CEO / Chairman is a large shareholder and buying shares on the open market, so he should be reasonably incentivized to maximize shareholder value (he writes a nice shareholder letter too, and the letter certainly hits all the boxes for "CEO who won't actively destroy value").

The potential price raises could be a game changer for the company's fiances. My prices are going from $80 to $100/month, and I spoke to a few of my friends who are on single club memberships and their prices are going up by ~$10/month (from $60-70/month to $70-80). I don't want to generalize the "anecdata" of myself and a few friends having our prices raised, but I've spot checked a few different clubs on NYSC's website and it does appear like prices have been raised across the board (I also don't want to generalize New York Sports Club raising prices as all of CLUB raising prices, but given NYSC makes up >50% of Club's locations even if it's just NYSC raising prices that would have a big effect on the company's bottom line). Anyway, let's say that CLUB is raising membership prices across the board and that the price raise is successful (i.e. they don't cause people to instantly quit the gym en masse). If so, that's huge for CLUB's equity. CLUB is relatively levered from both a financial standpoint (net debt >3x market cap) and operational standpoint (the vast majority of costs for operating a gym, particularly rent, are fixed, so any revenue increases or decreases should fall pretty hard through to the bottom line), so a price raise would cause a huge boost in cash flow for CLUB, and given the levered nature of the equity stub, it could make the equity look screamingly cheap. CLUB did ~$340m in membership revenue in 2018. Let's assume that the current price raises successfully increase membership revenue by 10%; that would be an extra ~$34m in revenue that would drop straight through to CLUB's bottom line next year. CLUB's current market cap is hovering at ~$50m; that price raise alone would result in more than 50% of CLUB's market cap in cash flow next year. You can play around with the numbers however you want, but the bottom line is a successful price raise is a home run for CLUB. Will the CLUB price raise be successful? I'm not sure. I would lean towards yes in the short term; CLUB isn't giving a lot of warning on the price raise, and it's notoriously difficult to cancel a gym membership at NYSC. I would guess most current members are going to suck it up and eat the price raise in the short term, and CLUB's financials are going to look pretty good in the near term (the price raise seems to kick in in October for existing members, so Q4'19 and Q1'20 should show a lot of growth). But I wonder if it's the right strategy in the longer term. I live in the NYC area, and if you live here I'd encourage you to do this simple test: walk into the nearest NYSC, then walk into the nearest Equinox and Blink fitness (each of the gyms generally have a location every eight blocks or so). Equinox memberships cost $150-200/month, NYSC membership costs ~$100/month, and Blink memberships cost ~$25/month. Here's my guarantee: the Equinox location will be, by far, the nicest: best equipment, best showers, super clean, etc. The Blink location will be nice: it'll have a lot less frills than the Equinox, but it'll be generally clean and everything will be working. The NYSC will remind you of Laguardia airport: it will be dirty, rundown, and half the equipment will be broken. If you go in the afternoon, there will be a 50/50 shot that the location has run out of towels for the day. Want to watch TV while you bike? Too bad, the TV is almost certainly broken. Want to hop on wifi? It's going to be slower than dial up internet. If NYSC was charging a third of the price of Blink and a tenth of the price of equinox, that might be ok.... but NYSC is charging ~3x what Blink charges. An inferior product at significantly higher prices isn't a viable long term business model. I realize that the paragraph above is based on a lot of personal experience and verges into "have you driven one bro" territory, but I've done that experiment with maybe 7 different NYSC locations pretty consistently over the past four years, and across both location and time I've consistently found the NYSC location worse than peers. So my longer term worry with NYSC is twofold.

First, I worry that they're getting squeezed on both ends (this is not a new trend; this article mentions them getting squeezed four years ago). If you want to pay premium prices, you'll pay up for equinox (or boutique fitness classes; crossfit, soulcycle, etc.). If you want to save money, you'll go with a discount membership like Blink, Planet Fitness, or something along those lines. NYSC's cost leaves them caught in the uncomfortable middle.

Second, I worry that the company fell into the underinvestment trap. This is the trap that sometimes happens when a financially sophisticated buyer takes over a struggling business with recurring revenues. The temptation is to boost cash flow by skimping on capex and investment; this can work in the short term but kills the company in the long term (a classic example of this is Sears / Eddie Lampert). Sure enough, if we look at CLUB's financials, from FY16-18 the company recorded ~$42m in capex versus ~$122m in D&A. That's a lot of under-investment, and the result of that under-investment is the Laguradia like conditions of the NYSC's that I visited: equipment broken for months on end, outdated centers that look dirty constantly, etc.

If both of those concerns are right (and I suspect they are), than CLUB's recent price raises are going to do wonders for their financials in the short term. However, in the medium to long term, they are raising prices on an already inferior product. Churn is going to continue to tick up, and customer additions are going to continue to go down as customers favor cheaper alternatives with better experiences (in addition, former NYSC customers are going to remember how poor their club was and be less likely to sign up for NYSCs in the future). Eventually, NYSC will hit a negative inflection point where their fixed costs start to overwhelm the revenue their dwindling subscriber base provides, and they'll need some combination of restructuring and capital investment into their stores to reboot the company, get their costs more inline with their competitors, and invest into their deteriorating store base. But that's just my perspective! I'd guess I bring more knowledge than most to CLUB / NYSC since I've been to so many of their locations and enjoy #fitness so much, but it's entirely possible I'm too biased by the sample size of the stores I've been to and that the other CLUB locations (particularly those outside of NYSC) are in a lot better shape than what I'm seeing. Maybe the price raises are going to be a screaming success (heck, maybe I'm wrong and the price increase was only for my membership and not a broader thing, though I don't think that would invalidate any of my longer term concerns); the CEO certainly thinks the company is in a good position, as the insider buying here has been really aggressive recently given the small float and limited trading window. The company has also been buying a bunch of clubs recently (25 in 2018, another 6 so far in 2019); we don't have a lot of info on those purchases, but the shareholder letter certainly seems bullish on them and it's entirely possible that CLUB has some strategic benefits and skills in acquisitions that will let them transform the company over time (for example, maybe CLUB's strategy is to milk their old stores while acquiring a bunch of new stores at accrettive multiples. In this scenario, the old stores work as cash cows, the news stores are their future, and they could continue to benefit from the local area network effects as members could access both old and new stores. I think it's a tough needle to thread, but perhaps that strategy or something close to it is the endgame). In the near term, I would guess CLUB does really well as those price increases bleed through and the super low multiple on the equity stub probably doesn't require much good news for the stock to do a bit better. In the longer term, though, I think the company is in a really tough position. Some other thoughts

CLUB's term loan expires in November 2020. Given the cash flow here (particularly post potential price increases) and the current lending environment, I would guess they are able to refi this pretty easily but obviously there's a huge risk if they're unable to roll or refi the loan.

This post probably came off pretty negative. There is plenty to like about CLUB:

The insider buying and low multiple is a huge plus.

A lot of their leases are up for renewal in the next few years. Perhaps there are a few real duds in there, and being ableu to close those locations will significantly enhance CLUB's financials.

We don't have a lot of info on the acquisitions, but the CEO seems bulled up on them and given the network effects of the business it seems reasonable they create value.

I haven't fully explored this, but they have a holdco structure and cash at the holdco that should create some optionality / downside protection for shareholders even in pretty draconian scenarios for the core business.

CLUB has a lot of tax liabilities from state audits that they haven't reserved anything for (see p. 25 of their 10-Q for more); I haven't factored any liabilities into the valuation and I don't think it's a huge needle mover but given how levered the company is it's possible there's some type of liquidity stress if they have to make some big block payments.