Preferred dislocation opportunity example: $BPYPP

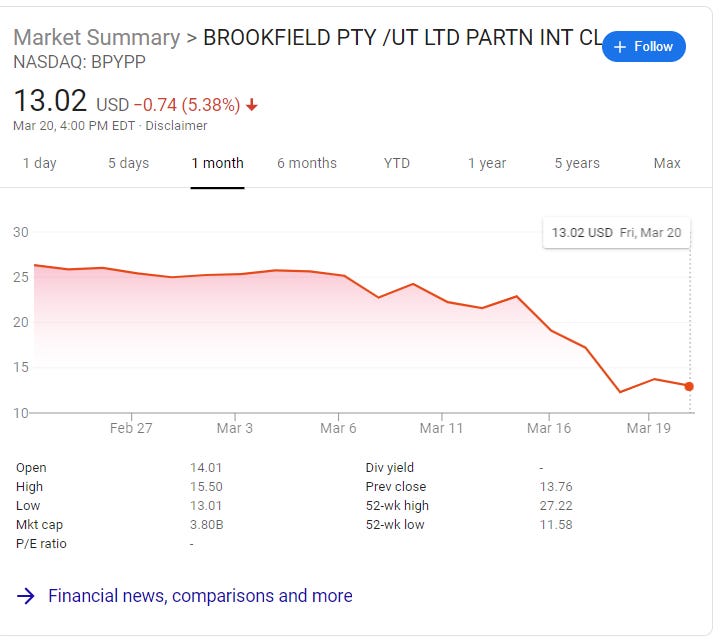

I mentioned on twitter that I was seeing a lot of dislocations in preferred stocks. The tweet got a lot of engagement, so I wanted to expand on it a little bit with an example here. Before I dive in, let me note something upfront: my DMs are very open for ideas or for critiques of this idea (and ones like it). I've looked through a lot of preferreds over the weekend, and I think there are some real opportunities. Searching through them is a bit time consuming; if you have thoughts on interesting ones, please shoot them over to me and I'm happy to swap ideas. Personally, I find the idea is easiest if you can 1) provide a summary of the idea and 2) a link to the prospectus of the preferred (similar what I've tried to do in this post), but I realize that is asking for a bit... Anyway, on to the preferred opportunity. Basically, I'm pretty sure that a preferred fund or three blew up, because last week basically every preferred instrument out there got hammered. That's presented opportunities. Sure, some preferreds are likely toast, but some of them seem like good bets. It's important to note that the quality of preferreds is wide ranging. Some of the preferreds are bond like instruments with nice covenants. Some of them were designed to take advantage of a reach for yield and have no covenants. The later could get you killed if an aggressive management team decides to take advantage of you. In general, when I'm looking for preferred, I want to see preferred that are cumulative, restrict distributions to the equity if they aren't paying pref dividends, and have other types of goodies to encourage management teams to respect them. So let me go through one example of an interesting preferred I saw this weekend. I'm highlighting because I think it's an above average opportunity in preferred land, though it isn't my favorite. The preferred is BPY's preferred units. I'll focus on BPYPP on this note; this is their 6.5% cumulative class A preferred issued in 2019 (prospectus here), but there are a few other preferred series that are pari with this class. BPYPP's share price has been roughly cut in half since the beginning of the month. At $13, it's trading for just over 50% of par value and current yield of ~12.5%.

Again, this is just an example of the opportunities, so I'm going to just bullet out what I like and don't like about these specific preferreds. What I like (aside from the cheap price!)

While BPY (the parent) is rather levered, the vast majority of the debt is non-recourse to BPY. Recourse leverage through the prefs is actually quite low (the company has $2B of corporate debt plus ~$5B in preferred equities against $30B in book value of common equity). BPY's financials are notoriously something of a black box, but you can run some high level stress tests on them and it's pretty tough to come up with a scenario where the preferreds are impaired down to 50% of face value. In fact, it takes some pretty draconian assumptions to believe that the preferreds aren't well covered at par.

As discussed in a second, to me the bigger risk than current asset value being low enough to impair the preferreds is that the preferred documents are loose and BPY could try to shift value from the preferreds over time.

Dividends on the preferreds are cumulative.

Distributions to the common are excluded if dividends on the preferreds are turned off. BPY's management contract pays their manager a percentage of the distribution they make to common shareholders. So the manager is going to be incentivized to keep common distributions on (or get them back up as quickly as possibly if they need to turn them off), and to do so they need to make preferred distributions.

What I'm neutral on

BPY is externally managed. External management is generally really bad for common shareholders; for preferreds, it can go either way. For example, as mentioned above, BPY's manager is incentivized to make common distributions, which is good for keeping the preferred distribution on. However, on the negative end, external managers are generally incentivized to take lots of risks (heads, I win; tails, you lose), and the external management contract creates a lot of fees that lowers the value for the rest of stakeholders.

What I don't like

The preferred docs are very loose. In the event of a change of control, BPY is not forced to call the preferreds (though the dividend does go up substantially if there's a change of control and they don't call them). There's no fixed cover charge and not restrictions on distributions to common shareholders as long as the preferreds are current on their dividend. In the event that dividends are turned off, I don't believe preferred shareholders have any recourse (i.e. most prefs get some board seats if they don't pay dividends for a while; I don't see that clause in BPY's prefs).

BPY is probably trading too cheaply. Management certainly believes that; they published a shareholder note Friday noting that they have a strong balance sheet and have been actively buying back shares. That's great, and probably the right decision for common shareholders. But, as a preferred, you'd rather they were preserving liquidity or retiring preferreds at half of face value.

BPY invests into real estate funds, and has some capital calls they've yet to fund. Again, they probably have plenty of liquidity for it, but that is another potential future liability (whihc will hopefully turn into a future asset!) that comes in front of preferreds

BPY owns a bunch of malls and office buildings. I think there come out the other side alright, but obviously the near term is pretty bleak for them.

Anyway, just wanted to post this as a high level overview / example of some of the opportunities out there. Three weeks ago, I wouldn't have thought BPY's prefs could ever trade at this level, and if they had I would have thought they were a crazy good opportunity. Today, I still think they're a good opportunity, but I think there are a couple of other preferreds out there with similar upside and better structures. I may post a few in the coming days. If you see any or have any more thoughts on these, my DMs are always open!