Quickie idea: renting some $RESI

This post is another in a series I plan do on an irregular basis. A “quickie” idea is an investment specific idea that I’ve been mulling over and find interesting, but haven’t dove fully into yet. Today's quickie idea is Front Yard Residential (RESI) on the heels of their merger with Amherst breaking. Front Yard (RESI) is an externally managed REIT focused on single-family rentals (SFR). On the heels of an activist campaign last year, the company started a strategic review that eventually culminated in an agreement be bought by Amherst for $12.50/share in February. That deal was called off this week due to the current crisis. Shares are currently trading for ~$7/share; I suspect the share price is heavily influenced by arb investors dumping shares in the wake of the break. While it's tough to predict the near term, today's share price values RESI at a substantial discount to its NAV, and in the medium to longer term I expect to see RESI getting taken private at a similar (or higher) price to the deal that just broke. The crux of the thesis is simple: post merger break, RESI is trading significantly below asset value because of the arb selling. I expect the company will look to unlock that value in a new sale once the environment stabilizes. Why? RESI already lost a proxy battle last year, and the two directors who were named to the board as part of the battle's settlement remain (in fact, one of the directors wrote up RESI on sumzero arguing the company should be sold). So I expect RESI will be a very motivated seller once the country starts to open back up. In the meantime, RESI should have plenty of liquidity, as the Amherst break included a $25m break fee, $55m in equity (priced at $12.50/share), and a $20m loan, and SFR should perform well even in a pretty bad environment (RESI's deal break release noted March was their best ever moth for lease percentage, and April rent collection were >99% of their LTM average; peer AMH has released similarly promising stats for rent collections in the wake of COVID, and INVH had earnings this morning that matched what AMH / RESI said). Ok, that's the thesis. Let's dive a little deeper. RESI focuses on SFR. Publicly traded peers include INVH and AMH. Each is much larger and better run than RESI, and they sport premium valuations to match. The big issue for RESI is simply that they are subscale; peers run with NOI margins in the mid-60s, while RESI's NOI margin is in the 50s.

While RESI's homes are a little lower end then their peers (average monthly rent of ~$1.3k versus peers in the $1.6-$1.8k range), there doesn't appear to be any reason why RESI's margins couldn't approach their peers. Indeed, RESI's Q1'19 earnings deck including a year end target of 66% NOI (see below).

The other big issue with RESI is their G&A is much too high. We can argue whether that's because RESI is subscale or simply inefficient (I think some combination of both), but the fact is RESI's G&A is running at multiples of its better run peers (the slide below is from one of the activist's decks last year; you can cut it a bunch of different ways but however you do RESI is running with G&A way above peers even without adjusting for their external management agreement).

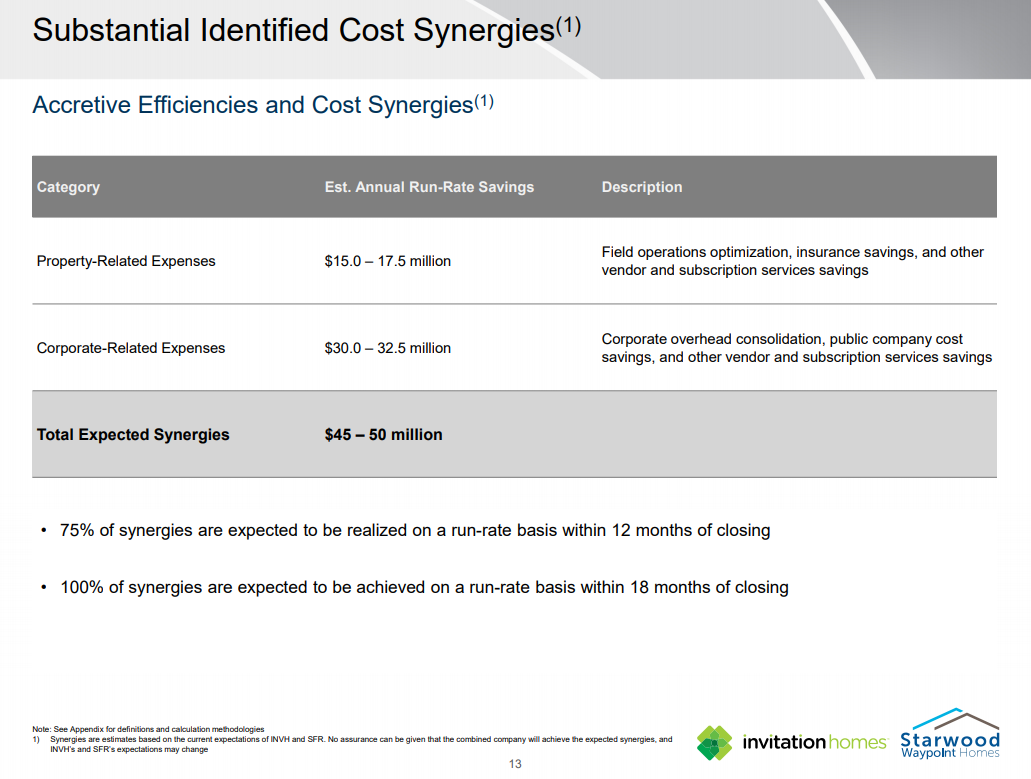

The combination of lower NOI margins and higher G&A is never ideal, but it's particularly harmful for a SFR operator like RESI because they employ so much leverage (as would anyone in the SFR space!). Book value of debt was >$1.6B at the end of 2020 versus just $311m in book value of equity. With that much leverage, having NOI margins almost 10% below peers and G&A levels well in excess of peers is the difference between RESI generating significant cash flow for shareholders and RESI barely breaking even (as they currently are). For example, if you assumed RESI could do NOI margins in the low 60s while getting G&A levels in line with peers, core FFO would go up $15-20m/year, or >$0.15/share. Peers are currently trading for mid to high teens FFO multiples; apply that multiple to the low end $0.15/share increase in FFO and you get almost $3/share in value creation from normalizing G&A / margins. Pretty significant against a $7 stock. The solution to RESI's problems are pretty simple: sell the company to a larger operator with scale. The synergies from a larger player buying a smaller platform can be pretty large, as almost all of the target company's SG&A can be cut out as a synergy. For example, INVH bought SFR in 2017, and they saw ~$50m in synergies from the deal with >$30m coming from G&A. Given SFR was running ~$55m/year in corporate overhead (see p. 62), that's a pretty substantial chunk of SG&A synergies! I'd expect similar or larger synergies if RESI was bought out by a larger player (note that Amherst explicitly said scale was the driving force behind their desire to buy RESI).

So I think a sale makes total sense for RESI: it both solves their scale problem and placates their restless shareholder base / activist board members. The question is would there be a buyer for RESI if they tried to sell themselves again, and I think there the answer is yes as well. The background section of RESI's deal proxy (see p. ~30) reveals significant financial interest in acquiring RESI, with 7 bidders delivering initial indications of interest (five interested in the whole company, two interested in buying certain assets). Obviously I don't think today's environment is ideal for a sale, but with interest rates significantly lower today than late last year and the system likely to remain flooded with liquidity and capital looking to park in relatively stable / safe spots (which SFR should be), I think RESI will be an obvious deal target for a variety of buyers once things start to stabilize. Here's a simple way to look at it: last year, a variety of bidders offered ~$12/share to buy RESI. Since then, the ten year has dropped from just under 2% to ~0.7%, so financing for RESI should be significantly cheaper. In addition, thanks to the cash from Amherst plus some internal cash flow, RESI has generated >$1/share in net cash. With cheaper financing and less net debt, RESI is substantially cheaper to a buyer than it was when they ran their deal process last year. Obviously today's operating environment is just a bit different than the one last summer, but it would take a very bearish outlook to think SFR is going to take a permanent hit large enough to counter RESI getting almost 10% of their market cap in cash since that last bid plus a decrease in financing costs. The big worry here is Amherst struck a deal to buy RESI for $12.50/share, and when it came time to close the deal, they decided to write RESI a check for ~$100m ($55m in equity at deal price which is worth ~$30m as I write this, a $25m breakup fee, and a $20m loan) instead of closing a deal that valued RESI's equity at <$700m. That's certainly worrying, but Amherst struck this deal in February and was asked to close in early May. The world had materially changed in the intervening few months, and while the equity check was reasonably small versus the break fee Amherst paid, the overall deal was quite large given RESI's debt. It's entirely possible that Amherst's financing sources had changed materially or disappeared given the scale of the crisis. So while Amherst walking away is concerning, overall I think that concern is more than made up for by today's share price and the discount to NAV. Note that the general logic for Amherst buying RESI still holds, and Amherst will be very involved in the company given their equity (~8% of the company) and debt stakes post breakup. It would not surprise me if Amherst eventually agreed to buyout RESI again once markets stabilize. One other kicker before I wrap this post up: RESI's proxy includes managements projections for the next few years. It includes the tables below, which shows Core FFO and AFFO/share significantly ahead of analyst estimates. Management deal projections should always be taken with a grain of salt, but if they are even close to correct than "the Street" is likely significantly underestimating RESI's near term earnings potential. I also think this lends some support to a "no deal" scenario: even without a deal, at today's prices RESI trades for multiples below where their peers trade, and RESI has an easy path to increasing their multiple simply by cutting costs so that their cost structure and margins align with their best peers.

There a lot of other things to consider with RESI: their external management agreement (awful, but breakable), the markets they're in (pretty solid; mainly southern focused with good demographics), liquidity (was a worry before the deal broke; RESI had ~$140m in debt due in Q2'20, but they can easily pay that off with Amherst money), etc. I'm happy to discuss any and alll of them in the comments below. But given the volatility in shares post break and a pretty large discount to fair / takeout value (and the likelihood of a takeout in the medium term!), I wanted to get this post out quickly (and before the company holds their earnings call May 11).