Quickie idea / what am I missing: $PCG on bankruptcy emergence

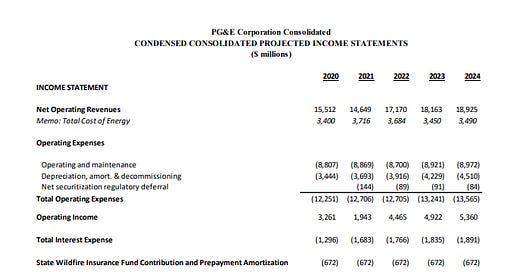

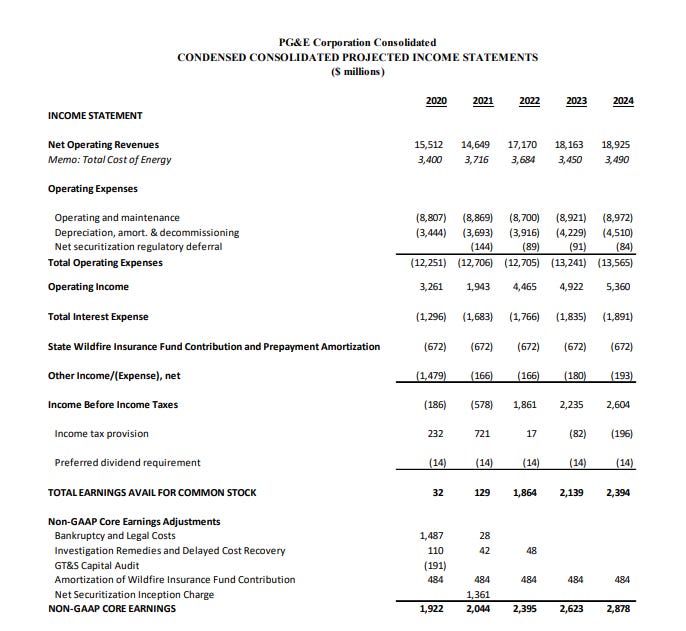

This post is another in a series I plan do on an irregular basis. A “quickie” idea is an investment specific idea that I’ve been mulling over and find interesting, but haven’t dove fully into yet. The hope with this particular idea is to provide the jumping off point for a discussion of an idea I find extremely interesting right now, as I suspect the opportunity could be fleeting but it's liquid enough that just about anyone could participate at any size. The idea? Buying PG&E (PCG) as it prepares to emerge from bankruptcy. Some quick background: PGE owns California's largest electric utility. They filed for bankruptcy in early 2019 due to huge liabilities related to California wildfire victims. Fast forward to today, and the company is prepping to emerge from bankruptcy in July (I believe July 1 is the exact date). The basic thought here is that, as part of their bankruptcy filings, PG&E provided forward financial projections. Basically, ignoring bankruptcy costs, they plan to earn >$2B in 2021. After all of their equity raises as part of the bankruptcy filing, PCG will have 2.15B shares outstanding (see p. 2), so EPS will be ~$1/share and (hopefully!) growing. At today's share price of ~$9/share, that puts PCG at ~9x P/E.

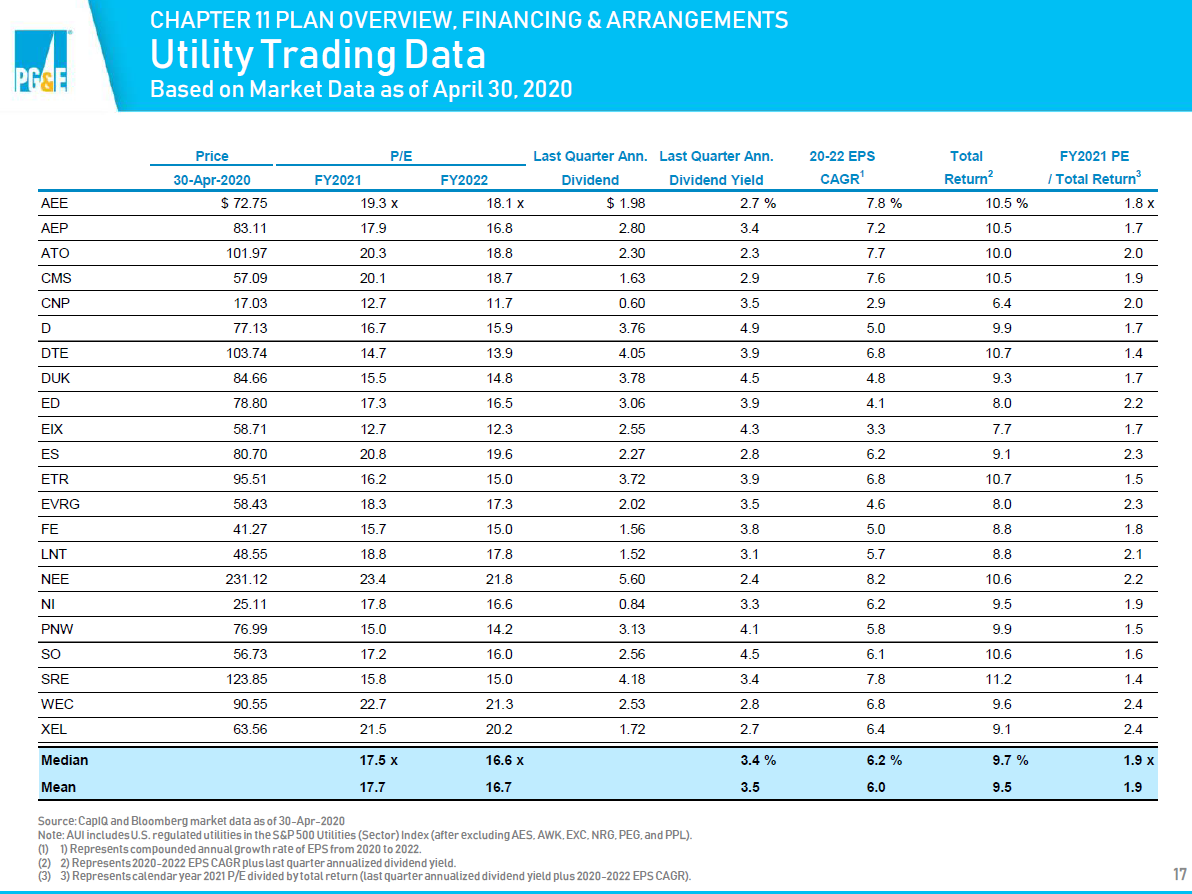

That's far, far below peer utilities. Regulated utilities are a pretty predictable business. They're natural monopolies, and state regulators set what they can earn. So while I'm normally hesitant to give credit to a company's projections, there's a reasonably strong chance that PCG's projections are grounded in reality and will get hit. Because these are natural monopoly businesses with regulated returns, utilities are generally regarded as "safe" investments and beloved by investors looking for stable investments. Most regulated utility company trade for a high teens P/E (take a look at the components of the XLU, or just see the utility data below from PCG's May 2020 Chapter 11 pres), a huge premium to where PCG trades. A big part of the appeal of utilities is their stable / steady dividend; as part of their bankruptcy, PCG agreed not to pay dividends until they earn $6.2B in non-GAAP core earnings (see p. S-34). Their financial projections don't have them paying a common dividend until 2023.

The investment thesis here is simple: PCG is currently in bankruptcy, out of all the indices, and not paying a dividend (a huge draw for utilities!). After PCG emerges, it'll slowly get added back to indices, and over time its multiple will revert to around peer multiples. If and when that happens, shares will roughly double. Maybe that reversion takes a year. Maybe it takes a little longer and requires us getting a little closer to dividend reinstatement. But, either way, you're buying a regulated business at a far below peer multiple. Economic sensitivity should be reasonably low, so this should be a reasonably uncorrelated investment with a natural catalyst (getting added back to indices post-bankruptcy / dividend reinstatement). You can also take a little comfort in "cheating" on the price some informed parties paid: as part of the bankruptcy emergence, Appaloosa, Third Point, Zimmer, and Fidelity agreed to buy $3.25B of PCG stock at up to $10.50/share or 95% the price of a public equity issuance (here's the 8-k that lays it all out). The public equity issuance eventually took place at $9.50/share, so I believe the Appaloosa / Third Point shares ultimately priced at ~$9.03/share. So, at today's share price of ~$9/share, you're paying roughly what those investors were willing to pay in the backstop. Normally I don't like to "cheat" and reference the price a good investor paid, but as I'm still ramping up here I'm just using it to signal the price here is reasonably interesting. It was also a rather large commitment; while they could be right or wrong on the attractiveness of PCG at these levels, I do generally take some comfort when big investors write checks into a bankruptcy because it at least means they've generally done work and feel comfortable that the BK has put prior legal issues / complications behind the company. Anyway, my question is simple: what am I missing? I'm trying to ramp up on this quickly as the company emerges from bankruptcy in the next few days and bankruptcy emergence could bring a mini-wave of buying. I can think of a thousand of things that could go wrong, but at first blush it seems like the price is more than cheap enough to account for a lot of those. Feel free to leave a comment or slide into my DMs if you've done work on PCG and think I'm missing something (either on the upside or downside). Other stuff of interest