Assured Guaranty: the bull case $AGO

Yesterday, I posted the bear case for AGO. Today, I wanted to dive into the bull cases.

Just a quick summary of the bear case before we dive in: AGO is a financial guarantor. Your big worry with AGO is that most of their guarantees are against municipalities, and municipality budgets appear stretched, yet AGO hasn't really increased their loss reserves since the beginning of the year. Given how much debt AGO insures, if AGO's reserves prove to be off by even a small percentage of their overall guarantees, AGO's shareholder equity could be quickly wiped out.

That's the bear case. I think there's some real teeth to it; AGO's management doesn't seem to agree. With that in mind, let's turn to the bull case.

Your bull case for AGO can be pretty simple: AGO trades way, way below book value and is a voracious repurchaser of their shares. Today the stock is trading for ~20% of book value; that's a mammoth discount and it means every share repurchased today is hugely accrettive (provided, of course, that you trust the book value number!).

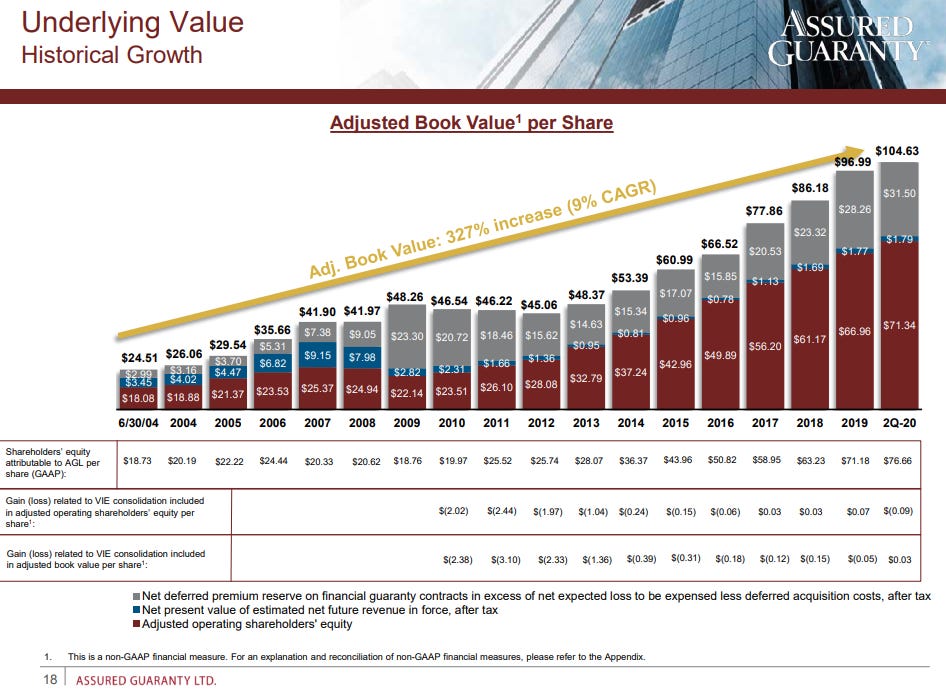

However, that might undersell AGO a bit. Below is a slide from their Q2'20 earnings that shows their book value per share over time. It shows adjusted book value has grown at a 9% CAGR over the past 15+ years.

Say AGO was just some run of the mill P&C insurer and I showed you their track record of book value compounding. What would you pay for them? Personally, I think an insurer with that track record would be worth a slight premium to book. We could argue about whether a slight premium means 1.1x book or 1.3x book, but I'd be pretty sure it was worth a little more than book. Today AGO is trading for <$20/share with a book value of >$100/share.... and we just made an argument that their track record suggests they should trade for a small premium!

So, AGO is statistically cheap and buys back shares. I think that's the best part of the bull thesis. That said, I do think you can make an argument that their is some operational value here.

Remember that AGO's business is basically using their stronger balance sheet to guarantee company/municipalities debts so that they can borrow at a lower rate. AGO charges a fee for this. I argued in yesterday's post that this was financial engineering at its worst. However, if you wanted to put rose colored glasses on, you could probably squint and see how AGO's model creates value.

The argument would probably look something like this: AGO mainly guarantees municipal debt. Municipal debt is tax free, so it's generally bought up by taxable investors (in general, individual investors). And municipalities are pretty small; in general, the market is dominated by thousands of small municipalities issuing tens of millions of dollars in debt.

The depth of the municipal market can create issues when it comes to bankruptcies and restructurings because the individual expense outweighs the benefits of participating in any one case. Say a small town in Ohio defaults on $10m in bonds. If those bonds are owned by 1000 different investors who each own $10k of the bond, none of those investors are going to have the ability or incentive to really get involved in the restructuring and ensure that the process goes smoothly. I could easily imagine a scenario where if someone really went in and fought, that bond would pay off at 80 cents, but because the time and effort is too large for any one individual to make a go of it, that bond pays off at 70 cents instead.

That's where you could argue AGO comes in: by insuring municipalities across the country, AGO becomes something of a standard bearer. If they had insured that defaulted debt we just mentioned, AGO would go in and fight hard for the best outcome. Not just because they've insured $10m of debt and having it pay off at 80 instead of 70 means they save $1m, but also because they've insured another 100 municipalities across the country just like this one and ensuring that this one plays out properly means that AGO is setting the right precedent for the other 100 in the case of financial distress.

This reminds me a little bit of microcap activism. Every investor at some point is going to consider an activist campaign at a microcap. The issue is that if you're running an activist campaign, the costs are reasonably fixed. It's going to cost you ~$100-250k regardless of whether the company is a $10m company or a $10B company. Say you own 10% of a $10m microcap, so you've got a $1m position. It can seem tempting to wage an activist battle, but if you do you're going to spend $100k on a $1m position. What's more, the company is probably going to spend a similar amount. That would be a rounding error at a larger company but for a company this small that's a devastating expense. So while microcap activism seems appealing, it quickly becomes apparent that it's simply not worth the hassle.

In some ways, municipalities are the nanocap companies here. As an insurer across the ocuntry, AGO is like Vanguard if Vanguard really cared about corporate governance and getting their hands dirty: they own so much of every company / municipality that they can spend a little more on one individual fight/position than their pure position size would dictate because it has positive carryover effects to the rest of their portfolio.

And because AGO can act as something of a protector of creditor rights, they can actually create value by writing insurance on one municipality. An AGO insured credit becomes a better credit because the recovery value is significantly higher. If town A and town B are the exact same except town B has AGO involved in some way, town B is a better credit because AGO will go in and get a much better recovery in a default. In this way, towns that would be "BBB" credits on their own become "A" credits once AGO underwrites them. AGO is not underwriting BBB credits at A prices; AGO's insurance turns BBB credits into AA credits and, after AGO's fee, AGO lets them borrow at A prices. It's a win for everyone: AGO enhances the credit and makes a profit for their skills in structuring, the town borrows cheaper, and investors get a better credit and better protection if something ever goes wrong.

Do I believe that narrative? Yeah, part of me does! But I'm not 100% convinced, and clearly the market is roughly 0% convinced given AGO trades at a fraction of a fraction of book value.

Note you could also extend that narrative a little bit to trading liquidity. If one town is issuing $10m of bonds, those bonds are going to be insanely illiquid. If you need to sell for any reason before maturity, the transaction costs will be high and you'll likely be taking a pretty low ball bid. However, adding AGO insurance to a bond should increase liquidity. A potential buyer no longer needs to do specific analysis of this one little town; instead, they can simply look at where similarly dated AGO insured bonds are trading and pay around that price. Increased liquidity means that the interest cost should go down, so again here AGO's insurance is actually creating value.

Both the liquidity argument and the "creditor rights" argument are important for another reason: scale. I argued in the bear case that a competitor could come in and win a ton of business by way undercharging for the insurance they offer. That is certainly true, but I do think that AGO's scale gives them some benefits here. If AGO insured bonds are more liquid than peer bonds, that means investors will pay more for (or demand lower interest rates for) AGO insured bonds, which gives AGO an advtange when offering insurance (to simplify: even if AGO and a peer had similar ratings, an investor might bid 5.5% for an AGO bond versus 6% for a peer insured bond because the AGO bond is more liquid. That gives AGO a huge edge when insuring business: they could charge the same issuer 40 bps per year less than the peer and still make 10 bps more of profit simply because investors give AGO a lower cost of capital thanks to their liquidity!). And if AGO insurers more bonds, they'll be able to spread out the costs of fighting for creditors' rights over more business (and issuers will be less likely to mess with AGO knowing that AGO will fight tooth and nail because it's not just about one specific fight for them; it's about protecting their overall franchise).

To sum up: The main piece of the bull case is AGO is really statistically cheap and a voracious share repurchaser. While I'm a little skeptical of the business, I think you could easily talk yourself into arguing that this business actually does create value and has some scale advantages. Combine the two and you've got the makings of a stock that could be significantly undervalued.

There are some other things to like here. I generally think management is good. Their track record is solid from an operational standpoint (again, this is the only guarantor that didn't explode during the crisis), they own a bunch of shares (see image below), and I think their incentives are reasonably well tied to what should drive shareholder value (long term equity awards are tied to growth in adjusted book value and shareholder returns beating the market; given what a discount AGO trades at, both numbers should heavily push AGO to buying back shares).

I also think there are some inorganic growth opportunities here. Every other guarnator is effectively in run off, and over the years AGO has made a bunch of deals where they basically reinsurer their former competitors books in exchange for upfront payments. These deals have proven very accrettive for AGO; the last one they did with Syncora increased book value by ~$250m (see Q2'18 earnings for final accretion number). Two major former guarantors, MBI and AMBC, are both effectively in liquidation; I wouldn't be surprised if AGO ended up reinsuring their portfolios at some point in the future and realizing a substantial book value gain from doing so. Doing so could result in significant accretion; Syncora's deal was for <$15B, but both AMBC and MBI still have ~$50B in policies in force. AGO only has ~84m shares outstanding; doing a deal with AMBC and/or MBI could easily add several dollars of book value if the Syncora deal is a guide.

Anyway, that's an overview of the bull and bear case of AGO. There's some other angles to this and I'll dive into them a little bit in the odds and ends. I think I lean pretty bullish here, but there's a lot of stuff I worry about. In particular, I worry about the black box nature of the balance sheet and the lack of reserves from the pandemic, but I do think the current price more than prices in those risks.

Odds and Ends

I tweeted this out yesterday and didn't get much of a response, but I'm curious by MBI's recent underperformance versus AMBC / AGO. The investment case for MBI (basically pure liquidation) versus AGO (continued operating business) versus AMBC (litigation + eventually an acquisition)are all actually extremely different, but they do still have a lot of underlying ties (they insure a bunch of debt and how that plays out dramatically effects intrinsic value) and it's pretty curious that one would so dramatically underperform the others. I suspect it's an opportunity but I'm not convicted.

In the bear case, I lamented several times AGO's lack of reserve increases since the pandemic, but perhaps my concern is misplaced. I don't have one great data source for this, but every muni spread or anything I check seems to indicate muni spreads remain very tight, which seems to indicate the market doesn't see any problems on the horizons. In a way, you could look at AGO as an arb: at ~20% of book value, the market is pricing in AGO like their insureds are super distressed and AGO will need to take huge reserve increases, but the credits AGO insures seem to be trading very well! AGO has also indicated that their liens can survive a lot of shenanigans, which is helpful in a bear case.

In my bear case, I worried about the precedent Detroit set (that certain creditors could be favored, and insurers would be left holding the bad in the future). The other side of that is that politically I think bailouts are increasingly becoming the norm. As long as your a state (i.e. you have senators), I think your political lobbying power for bail outs is going to be very, very strong going forward. Say Detroit went bankrupt tomorrow:I can't imagine that they wouldn't get bailed out. Michigan is a battleground state; doesn't the President step in just to generate a ton of good will and boost his election odds? Or say New York goes bankrupt tomorrow. Maybe the President doesn't care, but doesn't every New York representative and senator go on strike until they get some support? Margins for getting any legislation done are already razor thin; I would think something as big as a bailout is something a senator would be willing to break from their party from to hold up all legislation if they don't they their way.

AGO traditionally buys back ~$500m in shares every year. They've already done $300m this year at prices much higher than today's levels. Unfortunately, it seems that they're indicating that they won't be as aggressive into the back half of the year (they need a div from their subs to get the liquidity to buyback shares, and they seem to be saying they won't do that). That's disappointing and a real blow to the bull thesis in the short term; that said, next year their buyback gun will get reloaded and they'll certainly resume share repurchases. It's just sad that they don't really lean into it right now.

AGO has argued that this era of low volatility, low rates, and spread compression (i.e. the yield between and AAA and A bond is tighter than ever) is a disaster for guarantors as it limits the benefits of a guarantee. I do think there's something to that; if rates were higher and spreads a little wider I think AGO would be able to write a lot more business. Still, I'm not sure if that's a good or bad thing: AGO trades at ~20% of book value, and in recent history the company's stock price hasn't even approached book. When a company consistently trades below book, that's the markets way of saying "this is a bad business! We want cash out of the business!"; given that, I think you could argue AGO is better off just returning capital to shareholders than writing new business.

On the heels of the financial crisis, the guarantors all sued the banks for breaching their reps and warranties in underwriting RMBS securities that the guarantors guaranteed. Some of those suits are still ongoing, but for the most part the guarantors won significant settlements (here, for example, is AGO's against BoA / Countrywide). There is the possibility of some type of similar recovery from all of the Puerto Rico losses the guarantors have experienced; MBI sued several banks late last year. I believe that suit is ongoing, and while I think the odds of anything happening there are low, it would be pure upside if there was some value there.

Late last year, Assured bought Blue Mountain, an alternative asset manager, and it appears AGO wants to expand further into the business. I guess I kind of see the appeal: as a guarantor, AGO should have some expertise in credit management, but I think the synergies are loose at best and I question how much expertise they have. I'd rather they just continued to buy back shares.

There's been lots of insider buying of AGO over the past ~year. Humorously, almost all of it came from Andrew Feldstein, the head of BlueMountain who "decided to leave" the company alongside Q2'20 earnings. Some of those insider purchasers were undoubtedly part of Andrew's employment agreement (he had to buy $22.5m worth of shares over two months post deal), but it seems like some of that buying was just him buying on his own. That said, other insiders have bought a little as well, and insider ownership and shareholder alignment is pretty good here.