Does the Astound deal show cable is too cheap? (Spoiler: Yes, particularly $ATUS)

This weekend, news broke that Stonepeak is buying Astound for $8.1B. Bloomberg reports that the deal values Astound at ~$8k/broadband sub; based on my math, I think the deal values Astound at ~13x EBITDA but I have not seen the financials personally and I could be a turn or three off.

The deal is interesting for a few reasons, but the bottom line is I think it's wildly bullish for all of the publicly traded cable operators. Long time readers will know that I'm a mammoth cable bull, so I am very much talking my own book here! Still, I wanted to put some thoughts to paper here because 1) as Astound isn't a publicly traded company, it's easy to miss this deal if you're exclusively focused on public companies (which most of my readers are!) and 2) with the hailmary hope that someone who has seen Astound's financials will see this article and reach out to give me some more insight!

So why is the deal so bullish for publicly traded cable companies?

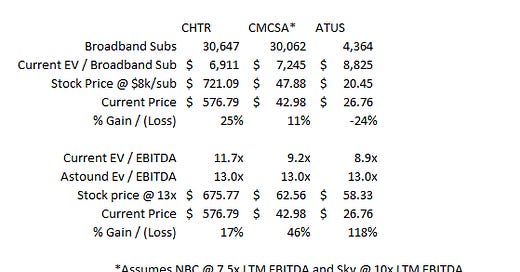

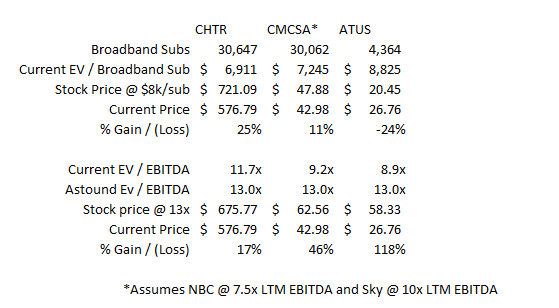

Again, Astound is getting valued at ~$8k/sub and ~13x EBITDA. If you put a similar multiple on the publicly traded cable companies, you'd get a pretty good amount of upside (update: the original version for the chart didn't account for NBC / Sky. I've fixed it in the update below and on twitter. Fortunately, my failure to drag a cell down in excel resulted in a slight misvaluation of Comcast and not my recommending a global macro policy that steered the world to the abyss).

However, I think that undersells just how bullish the Astound deal is for cable companies. Again, I don't have Astound's financials, so it's tough for me to parse out the details here, but a significant portion of Astound's value comes from RCN / Grande. Those are two cable overbuilders. Cable overbuilding is a much worse business than being a "normal" cable provider. Remember, being a normal cable provider is a monopoly. Being a cable overbuilder is a duopoly where you have to go door to door trying to poach customers from the incumbent. That doesn't mean that cable overbuilding is a bad business (though, traditionally, the returns from being an overbuilder have been quite poor!); it just means it's a dramatically worse business than being a normal cable company (which is the majority of their "peers" value).

Comparing Astound's multiple to the public cable companies isn't quite apples to oranges. It's more comparing a near expired green apple (yuck!) to a perfectly ripe honey crisp apple (delicious!). Yes, they're technically the same fruit, but you'd pay a lot more for one than the other. And, in the case of the public companies, the vast, vast majority of their value comes from their cable franchises where the only competition they face is legacy DSL (which, in effect, is no competition). The public companies deserve a higher multiple than Astound, and that suggests even more upside for their stocks.

That actually brings me to something else I've been meaning to discuss with the cable companies: why aren't we seeing any M&A from them? Pretty much all of them are clear they love the cable business and that M&A would be really accrettive, so why don't we see some deals?

Some of the lack of M&A is driven by the fact the cable sector is reasonably consolidated; there's simply not a lot of M&A to be done. But I think a large part of it is driven by the multiple discrepancy. Say you're Altice and you currently trade for ~9x EBITDA. If you go to a reasonable sized cable operator and say "why don't we buy you?", their first ask is going to be for a better multiple than Astound got. After all, they're a better business than Astound! So now Altice is faced with the option of buying a smaller cable company for ~15x EBITDA (pre-synergies!) or just going out and buying their own stock back for ~9x EBITDA.

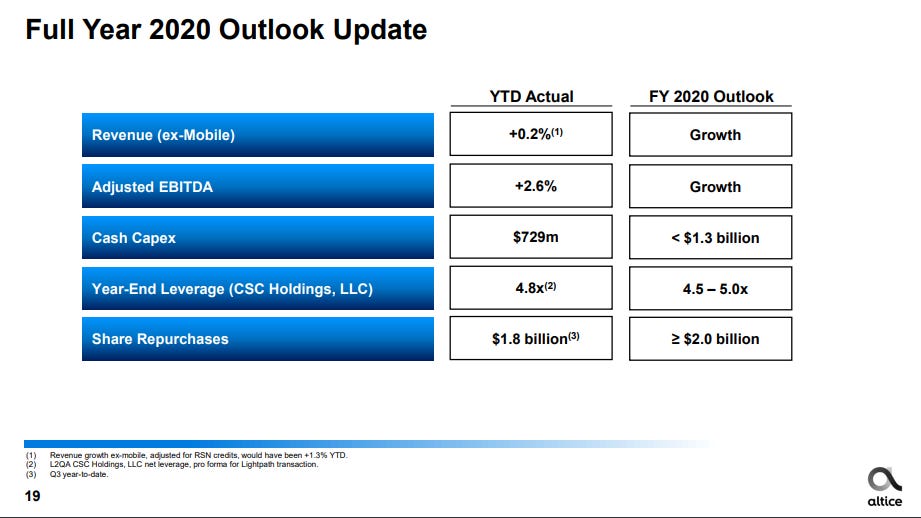

I think Altice is currently making a rational decision: they're buying back their stock at an absolutely furious pace. While I'm sure they'd prefer to do M&A, they can always do M&A in a year or three if/when the market gives them an appropriate multiple. Until then, they can take advantage of the multiple discrepancy by buying back their stock. And they're doing that very aggressively: their current guidance calls for repurchasing >$2B of stock this year versus a current market cap of <$16B. I would bet next year calls for similarly aggressive repurchases, particularly as they get cash in from their Lightpath sale.

Speaking of Altice, long time readers will know that Charter has long been my favorite cable company. That's been a good call so far, but I'm increasingly tempted to switch my horse and go to Altice. Yes, Charter is a better business and management is better (IMO), but Altice is much more aggressive with both their share repurchases and their leverage. Given Altice's valuation, I think the combination could be really powerful in driving share prices higher over the next few years.

So far this year, Altice's shares have slightly underperformed the indices and dramatically underperformed Charter:

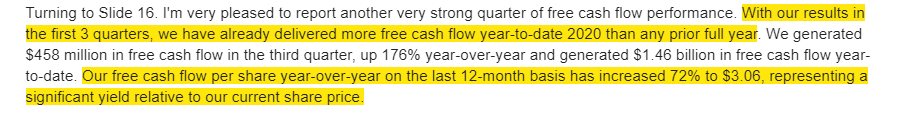

That underperformance comes despite Altice performing an incredibly aggressive buyback, reaching an agreement to sell Lightpath at a very accrettive price, and just generally outperforming expectations at the start of the year. Honestly, if you had shown me Charter's share performance this year and Altice's financials and asked me to guess Altice's share price, I would have guessed Altice would be trading for ~$40/share (maybe higher). That really wouldn't have been aggressive; take a look at the quote below (from their Q3'20 earnings call). Is it crazy to think a company that just reported more FCF in 9 months then they've ever done in a full year and is seeing their growth accelerate should trade for 13x free cash flow to equity (as they would at my suggested $40/share price)?

The current price of ~$27/share is <9x FCF to equity. Yes, Altice has some more existential questions than Charter (and the LTM FCF numbers that I've been using include an abnormally low tax rate that will certainly rise going forward), but that price seems like a gift. Altice's risk / reward seems super skewed in shareholder's favor today.