Quickie idea: Alaska Communications $ALSK

This post is another in a series I do on an irregular basis. A “quickie” idea is an investment specific idea that I’ve been mulling over and find interesting, but haven’t dove fully into yet. The hope is to provide the jumping off point for a discussion of an idea I find extremely interesting right now, as I suspect the opportunity could be fleeting.

The idea? Buy Alaska Communications (ALSK; disclosure: long. And this is somewhat small and illiquid, so do your own work / nothing on here is investing advice) on the chances for an overbid.

The idea is actually pretty simple. ALSK announced a buyout this morning for $3/share in cash. The deal is expected to close in the second half of 2021 and includes a 30 day go-shop.

Alaska is trading for roughly $3/share as I write this, so you effectively get a free roll on the go-shop producing a higher bid. If there's no higher bid, shares probably drift down slightly to the low ~$2.90s (to account for the time value of money). If there is a higher bid, you could get a bidding war that ends up in a huge premium. Heads (no competing bids), you lose only a percent or two; tails (competing bids), you make a big premium.

So the question is what are the odds of a topping bid or (even better) a bidding war? I think pretty good! I think this for two reason: I think ALSK is cheap, and there's a history of bidding wars in the space.

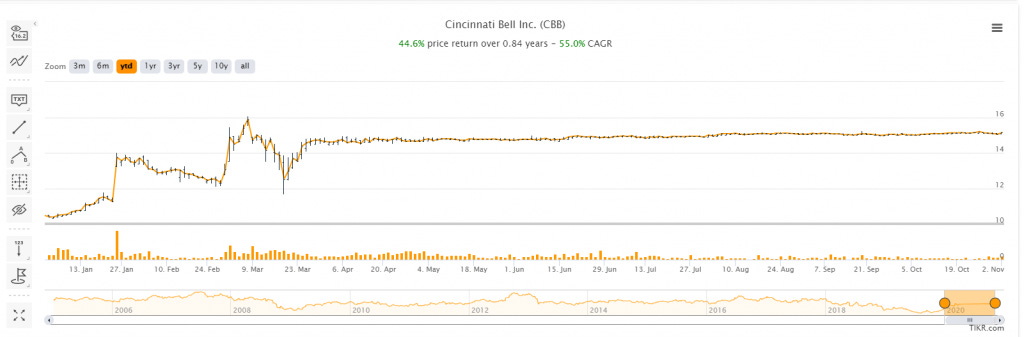

Let me start with the later point: bidding wars in the space. Earlier this year, Cincinnati Bell (CBB) had a wild bidding war. It started when Brookfield Infrastructure agreed to buy them for $10.50/share (a 36% premium to their closing price and an 84% premium to their 60-day VWAP). It ended with Macquarie Infrastructure agreeing to acquire them for $15.50/share (a 101% premium to their December closing price and a 172% premium to their 60 day VWAP); in addition, CBB had to pay Brookfield ~$29m in breakup fees (representing another ~$0.60/share of value).

Now, CBB is not a perfect comp for ALSK. But it's not an awful comp either! And it shouldn't be lost on anyone that the winning bidder for CBB was Macquirie, who is also part of the group currently looking to acquire ALSK!

So yes, n of 1, but we do have examples of assets in this space and bidding groups involved into the current bid getting involved in mammoth bidding wars that resulted in huge premiums to the standalone stock price and initial deal price. A lot of people might look at the ALSK premium (~50% greater than standalone price) and say that it can't attract a topping bid; CBB suggests otherwise.

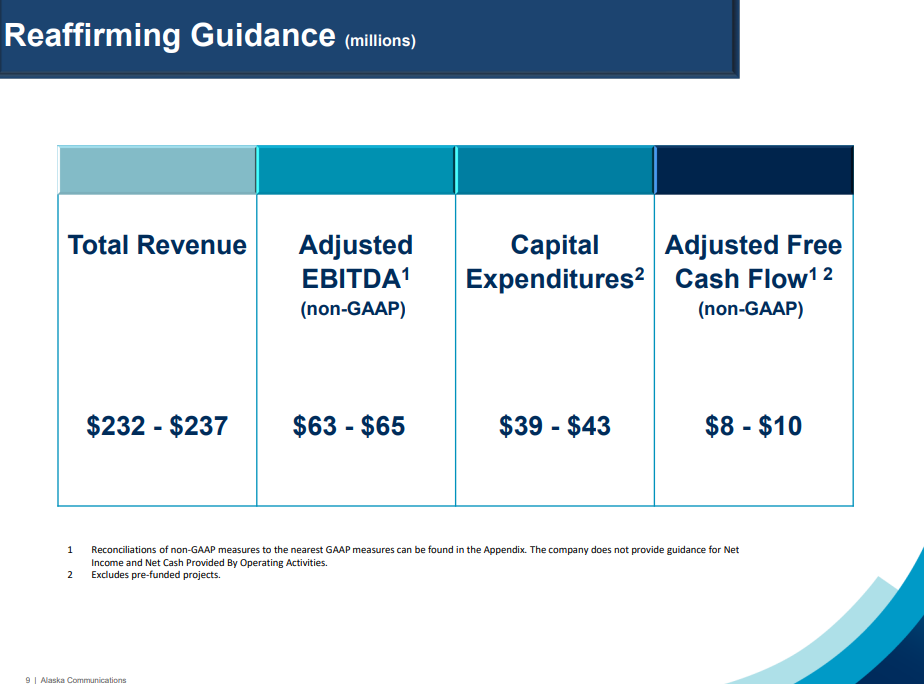

Let's turn to the second point: at deal price, ALSK is cheap. The current deal values ALSK at a $300m EV. The company was guiding to ~$64m in EV (per their Q2'20 slides; see below), so we're talking about a ~4.5x EBITDA multiple.

My first thought when I see a <5x EBITDA multiple is "woah, that's cheap! Nothing goes for 5x these days!". But must rural telecom providers actually do go for that low a multiple. The huge CBB bidding war resulted in CBB going for ~7x EBITDA. OTEL is currently getting bought out for ~5x EBITDA (though, humorously, their EBITDA numbers on p. 33 of their proxy appear laughably below what they report to public markets; if anyone has looked at them and has thoughts on what's going on with their numbers I'm all ears!). So while the multiple looks cheap, it's probably not crazily so.

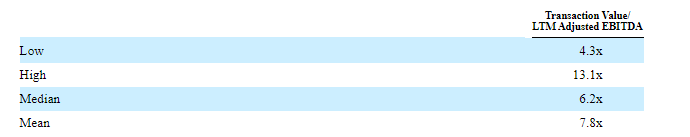

Still, I suspect there is upside. ALSK is listed as a peer in OTEL's proxy, and OTEL's proxy includes the table below on precedent deal comps (see p. 39).

(Note: this is a quickie idea. ALSK actually gets the majority of their revenue from business services, and they rely a lot more on subsidies than peers like OTEL or CBB. I'm still working through / thinking about how that should change their multiple; I'm open to suggestions)

At ~4.5x EBITDA, ALSK's deal would be pushing for the lowest multiple deal in the space. A sponsor doesn't have to be too bold to look at the ALSK deal and think to themselves "heck, why don't we bid 5.5x?" Remember, there's a ton of infrastructure money out there, and there are a ton of deals in the space currently (CBB, OTEL, Astound, etc.). With interest rates near zero, tons of money floating around, and a near all-time low multiple, I think the odds are pretty good of a topping bid.

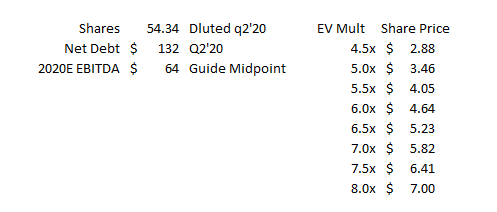

If there is a topping bid, it doesn't take much for ALSK to start to get really spicy. As mentioned above, the current deal value ALSK at ~$300m EV. ALSK has ~$130m in net debt, so small increases in the enterprise value / multiple actually have a pretty meaningful effect on the final price for ALSK. If you believe (like I do) that the odds are decent of a private equity sponsor talking themselves into paying 5.5x EBITDA for ALSK, that would get you to >$4/share. Not bad!

FWIW, I've included a table below that shows ALSK's share price assuming different EBITDA multiples. Remember, OTEL went for 5x and CBB went for 7x; I'm betting that the ultimate outcome here ends up somewhere between those two (though I'd happily take a larger multiple).

I've still got work to do on ALSK. Their business mix is a lot different than their "peers", and Alaska overall has regulatory / economic environment that is dramatically different than it would be for a telecom company located in the contiguous 48 states. But I wanted to post this now because I think the idea is interesting and I'd love to hear from other people looking at it!