Quickie idea update: Alaska Communications $ALSK

This post is an update on last week's ALSK "quickie" idea. A “quickie” idea is a series I do on an irregular basis where I write up an investment specific idea that I’ve been mulling over and find interesting, but haven’t dove fully into yet. The hope is to provide the jumping off point for a discussion of an idea I find extremely interesting right now, as I suspect the opportunity could be fleeting.

I generally don't do updates on quickie ideas; however, ALSK put out Q3 earnings yesterday and there was a bunch of news since deal announcement that has made me a lot more bullish, so I figured I'd put some pen to paper.

Let me start with something that will double as both a disclaimer and one of the reasons I believe this opportunity exists: ALSK is a sub-$200m market cap company. That small size means liquidity is somewhat limited and many funds / investors can't or won't look at it. Please do your own work.

Ok, that out the way, let's dive into why I've gotten more bullish on ALSK. There are two reasons: updated valuation and sales process.

Let's start with the easier piece: sales process. One of the big questions with ALSK is how likely the go shop is to yield a better bid. I think it's likely given how cheap the deal is and how much infrastructure / telecom money is floating around. However, we don't know whether the current deal was a shopped process (i.e. ALSK ran an auction and this deal was the best deal) or an exclusive process (the current bidding group worked exclusively with ALSK on the deal). If this is a shopped process, the odds of a topping bid are much lower because bidders already had a chance to beat the current bid. If this was an exclusive process, the odds of a topping bid are much better because no one had a chance to bid yet.

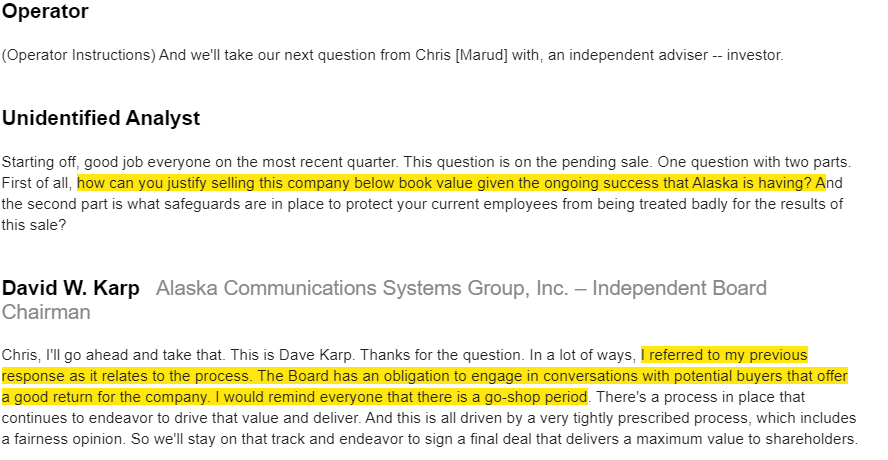

Generally, you don't know if a process was shopped or exclusive until the deal proxy comes out. However, ALSK hosted an earnings call yesterday (rare for a public company during a deal!), and during the call they were asked about the deal process multiple times. I'd encourage you to read / listen to the whole call, but the bottom line is that after being asked a few times the company basically just said, "this was an approach; we are going to engage other bidders in the go shop." That is great news for shareholders / a potential overbid! I've pasted two quotes from ALSK's earnings call below; I think they clearly show that the company did not shop themselves and they almost seem to be expecting a topping bid.

Let's turn to the other piece: valuation. Recall one of the reasons I was so bullish ALSK getting a better bid is their current $3/share deal values the company for <5x EBITDA. That's one of the cheapest telecom deals on record. The good news here is that there were two items that have come out in the past few days that make me think the deal is even cheaper than I initially modeled.

The first (and smaller) piece is ALSK's guidance. ALSK noted on their earnings call that their financial performance "remains strong" and they expect to be "at the high end of guidance." Honestly, I think that might be conservative; if you look at how they've performed so far this year, hitting their guidance would require a significant de-acceleration in Q4. That doesn't seem likely; it seems more likely management is being conservative with their guide and will end up beating numbers in Q4. Obviously, any bidder with access to ALSK's data room will know this. My valuation numbers to date have been based on the midpoint of ALSK's guide; if they hit the high point of their guide, ALSK is slightly cheaper than I've been discussing. If they beat their guide (as I suspect they will), they're even cheaper!

But the bigger piece here is actually around public company costs. Every company has costs to be public; investor relations, extra accounting costs, SEC filings, management time and headache, etc. In general, I've always pegged these costs at ~$1m/year. However, ALSK has disclosed that they expect to save $4-5m annually on public company costs. That is a lot of money for a company of ALSK's size; remember, annual EBITDA is only ~$65m, so we're talking about ALSK instantly boosting their EBITDA by >6% simply from going private! And, because this is a pure expense cut, that EBITDA increase should be a straight cash flow boost (i.e. annual cash flow should go up by $4m to match the EBITDA increase).

I would argue that public company cost savings should trade for a pretty high multiple; again, it's a direct boost to cash flow, it's 100% sustainable, and it's pretty much risk free. I'm valuing those savings at 10x; put a gun to my head and I'd say that's probably a little conservative given this should be straight, risk free cash flow increase into perpetuity and interest rates are approaching 0%, but reasonable people can disagree. At 10x EBITDA, this savings alone is worth $0.73/ALSK share.

In my initial post, I included a table that showed ALSK's share price in a deal with different multiples. However, that didn't include any value for these public company cost savings. Below, I've included a table that shows ALSK's share price with different EBITDA multiples plus the public company cost value. I continue to think ALSK is worth at least 6x EBITDA; at that value and including the public company savings, you could easily justify a topping bid over $5/share.

I realize this piece is pretty bullish, and there's a reason for that.... I'm pretty bullish! To be fair / balanced, I'll note that there was one negative to come up since my last post. ALSK filed their merger agreement, and I view it as pretty weak. While the material adverse clause excludes a lot of things, my read of the agreement is that the buyers have a "get out of jail free" card with their financing; if their debt financing fails, the buyers seem to be able to walk away with just a $7.1m fee. Now, they have committed financing, and I think they'll want to get the deal done given the value they're getting, so this is something of a tail risk, but it does appear that if they decide they have cold feet all they have to do is get a lender to pull their commitment and they can walk away pretty cleanly.

Still, I don't expect that to be the case. Worst case scenario is probably the current deal goes through. Semi-bull case, we get a topping bid in the go shop. Best case, we get a bidding war.

One last thing before wrapping this up. ALSK shares are trading through deal price, so obviously the market is implying some odds of a topping bid. That does beg one more question: what chance is the market putting into a topping bid currently?

If we don't get a topping bid, I suspect ALSK shares would trade to ~$2.88/share, representing a 4%+ annualized return to a deal close in ~October of 2021. If you think a topping bid would come in at $4.50/share, the market is currently implying <10% chances of a topping bid.

Again, I think a topping bid is likely, and I think precedent transactions could easily justify a price in excess of $4.50. To me, the market is underestimating both the odds of a topping bid and the size of a potential topping bid.

Could I be wrong? Sure! But the great thing about ALSK at the current price is you're only risking ~15 cents (to your ~$2.88/share downside) to make ~$1.50/share or more in an upside case. That's 1 down / 10 up. Given I think there's a really good chance of a topping bid, I think those are great odds!