The curious case of $PSTH's options

The write up below is long and a little winding. So I'm going to break it up into five "chapters":

A disclosure

Define a "DVMT" (for option purposes)

A shorter version of the thesis

A request

Finally, the full write up.

"Chapter" 1: Disclosure: We are long PSTH and short PSTH puts. Nothing on here is investment advice. Options in particular can be risky, so don't rely on anything on here for advice! True story: a few years ago, when my (now) wife moved in with me, I got "her" some "before-you-go" poo-pourri as a joke gift. Six months later, she caught me getting "ready to go" by spraying the poo-pourri in the air. Yes, that's right: I thought it was like Febreeze and you sprayed it in the air, so for six months I had been spraying oils into the air on a near daily basis for no reason (poo-pourri goes in the water; who knew?) and she'd been wondering why the floors were always so oily. So ask yourself: is the guy who doesn't even know how to use poo-pourri really someone you want to be taking advice from? No, probably not. I just can't emphasis enough how much nothing on here is investing advice or a recommendation.

"Chapter" 2: Defining a DVMT: a few years ago, Dell screwed over minority DVMT shareholders by offering them $120/cash or shares of Dell stock in exchange for their tracking stock. The market was valuing the shares of stock at significantly less than the cash, so rational shareholders would elect to take all cash. However, for options purposes, the OCC decided that the options would be deemed non-electing, so they would get significantly more shares than cash (go see memo 44332 on the OCC site). This was a gift to anyone who owned / had bought puts that expired after the election date, as they could put the options at the suboptimal price. So a "DVMT" (for our purposes) would be something that creates a bonanza for people who own puts; a "reverse DVMT" would be something that creates a bonanza for people who have written puts.

"Chapter" 3: Shorter Thesis: With an implied volatility approaching Tesla's, I think PSTH's options are wildly mispriced. In particular, I think the puts look appealing to write: there's a bull upside case where they get "reversed DVMT'd" and the underlying deliverable changes substantially in option writers' favor. Even in a base case without the reverse DVMT, the implied volatility is so high that you can collect substantial premium writing these at PSTH's trust value ($20/share); in order to lose money, PSTH would need to complete a deal before these expire and subsequently see their stock trade significantly below trust value. Seems unlikely; remember, shareholders get to vote on a deal, so for it to trade below trust value they'd need to vote on a deal that subsequently trades below the cash they could have gotten. Plus, you get the upside of additional downside protection if a "reverse DVMT" comes to pass. As I write this, June $20 puts are trading for ~$2/share; you're collecting 10% notional (approaching 20% annualized) on your money to make that bet; again, nothing here is investing advice, but that's a lot of premium and a lot of annualized return for simply underwriting insurance that PSTH's deal isn't a disaster.

"Chapter" 4: The request: Tell me what I'm missing. I've talked to multiple options desks about PSTH. None of them have been able to give me a definitive answer to how PSTH options will be treated if a deal goes through: some have said the options will be adjusted (similar to how options adjust for special dividends), some have said the OCC will decide at deal time (they may treat them as a special dividend, or they may give option holders a "reverse DVMT"). None have suggested that you get "DVMT'd" here, and I don't see any mechanic where that would be the case. Still, it's always nice to have a check. If you have a precedent situation you can point to that suggests how these will be treated, let me know.

"Chapter" 5: Full write up below:

A general rule I've tried to follow is that when something in the financial markets is completely unique, it's worth digging in on it. Things that are unique or one off are often undercovered because they don't fit neatly into any box that a large investment firm can uncover.

An example might show this best: if you're an analyst and you get up to speed on an automaker like GM, you can take what you learn there and apply it to the other 5-7 automakers plus all of their publicly traded suppliers. That's a great return on your time! If you instead decide to go cover MSGS (which owns the Knicks and Rangers)... well there's not a lot of related stuff you can leverage that work on to cover. Yes, you could maybe cover BATRA (which owns the Braves), but beyond that there's not much in the way of publicly traded sports teams (and the BATRA thesis is materially different than MSGS due to tiny things like being in different sports, owning a ton of real estate, and having an owner who isn't this guy).

So I generally like to find things that are "one off" or have no easy comps for that reason: they're often unfollowed, or they can create strange situations that no one knows how to handle.

Which is why I've been tracking Ackman's SPAC, Pershing Square Tontine Holdings (PSTH), since it came out. It's a completely unique structure (a tontine that rewards shareholders who stay through the deal with extra warrants), and unique structures can present opportunity. However, I wasn't sure what that opportunity was until a friend tweeted out about the huge implied volatility on PSTH's options.

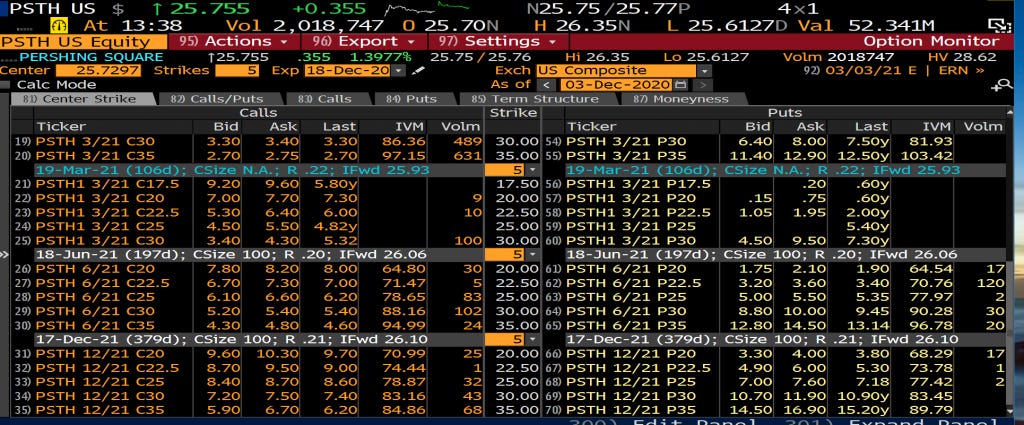

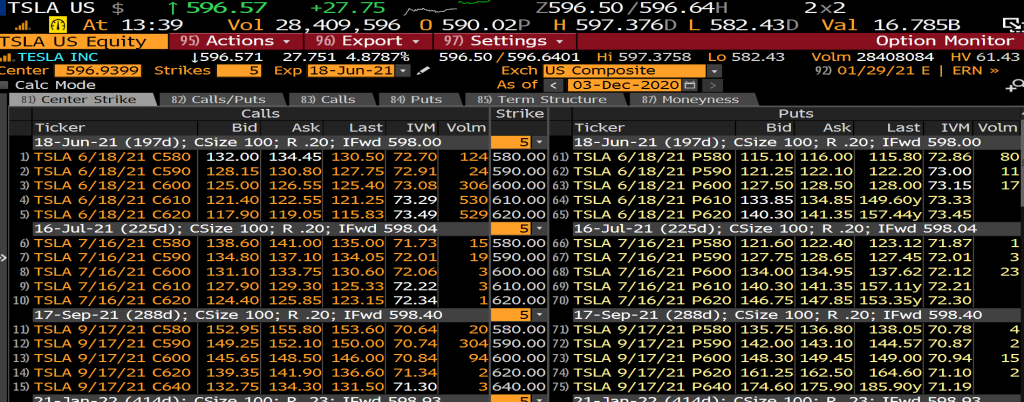

Remember, PSTH is currently a SPAC shell (with $20/share in trust value) waiting for a deal. That implied volatility number for a cash shell is absolutely insane; it's approaching the implied volatility of Tesla (see below).

My first thought on seeing that implied volatility was that the market was picking up something in PSTH's Tontine structure that would cause some funkiness with the options. There was precedent for something similar happening: a few years ago, Dell screwed over minority DVMT shareholders by offering them $120/cash or shares of Dell stock in exchange for their tracking stock. However, the market was valuing the shares of stock at significantly less than the cash, so rational shareholders would elect to take all cash. However, for options purposes, the OCC decided that the options would be deemed non-electing, so they would get significantly more shares than cash (go see memo 44332 on the OCC site). So anyone who owned put options that expired after the election / merger date was given a huge gift, as the options were priced at sub-optimal election prices and worth a ton of money.

I thought it was possible something similar would happen with PSTH. The tontine structure of the SPAC gives shareholders who hold their shares through the deal extra warrants; was it possible that the options were pricing in the tontine warrants impacting the options for some reason?

I'm pretty sure the answer is no. In fact, I think there's a chance that the tontine warrants getting released to non-redeeming shareholders represents something of a bonanza for people who have written puts or bought calls on PSTH. This is the scenario I'm calling "the reverse DVMT".

That scenario would look like this: when a company pays out a special dividend, their options chain adjusts for the special dividend. So if you had bought a call at $100 and the company pays out a $15/share dividend, the strike price of that call is adjusted down to $85.

In the reverse DVMT, when the PSTH deal goes through and the warrants are distributed to remaining shareholders, the OCC rules these warrants are a special dividend, and the deliverable for the options contract adjusts down by a similar amount. As I write this, PSTH-W are trading for ~$9.30; so the ~2/9ths warrants tontine shareholders get would be worth ~$2/share (they'll likely be worth more if/when the deal is announced as the risk of liquidation without a deal drops, but let's ignore that for a second). So, once the deal is completed, the remaining PSTH shareholders recieve warrants worth $2/share. In this scenario, the strike price of PSTH options would drop by $2/share. So, if you sold a $20/share put today and the deal went through, it becomes an $18/share put in this scenario.

Now, normally I wouldn't care about a change of strike like this. But, remember, the warrant is pricing in a lot of volatility, and PSTH has a trust value of $20/share. In this scenario, the deemed dividend of the warrants and the high volatility has pushed your strike price well below the trust value of the deal. By selling the put, you're basically betting that shareholders won't vote for a deal that immediately trades substantially below trust value.

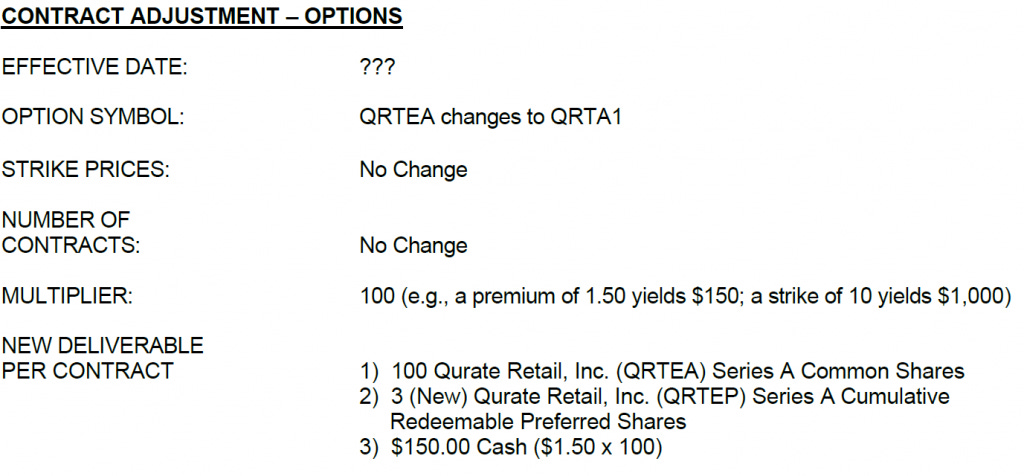

There are other ways to win here too. If you sell that put and PSTH doesn't complete a deal between now and option expiration, the put will expire worthless. Or there's an even more bullish "reverse DVMT" where the OCC simply changes the deliverable for a PSTH option from 100 shares of PSTH to 100 shares of PSTH plus 2/9 of a warrant (similar to what I believe they did for QRTEA; see OCC memo 47458 pasted below).

Anyway, what I like about selling PSTH options is the implied volatility seems way too high, it doesn't seem like there are a ton of ways to lose, and it seems like there are multiple things that could break my way that would make my strike price effectively far, far lower than the market thinks.

To recap, the way I lose by selling puts are:

I'm wrong, and the options get DVMT'd

Ackman announces a deal, and the deal closes before the options expire. My focus is on the $20 puts (which is the trust value), so to lose shares would need to trade below trust value after the deal closes (meaning shareholders voted for a deal that was valued lower than trust). Seems unlikely (though you could imagine a scenario where shareholders approve a deal, it trades way above trust, but then there's a big market crash and the stock trades below the old trust value).

Note that to lose here, I would have to assume my "reverse DVMT" upside scenarios did not play out.

To win, I need one of the following things to happen

PSTH doesn't close a deal before these expire (they'll expire worthless if that's the case; PSTH isn't trading below trust value)

If PSTH does close a deal, I need the stock not to trade below trust value between now and option expiration. The stock is currently trading at >$25, a 25% premium to trust value without a deal being announced. I struggle to see a scenario where shareholders are this excited for PSTH before deal announcement but then lose that excitement post announcement and trade this below trust while voting a deal through

Not necessary, but get added upside from my "reverse DVMT" scenarios.

Which options do I like? Well, as I write this, the March $20 puts are selling for ~$0.60/share, the June are selling for ~$2/share, and the December 2021 puts are trading for ~$3.50/share.

I think there's almost no chance PSTH can get a deal done before the March options expire, so those are near certain to expire worthless. PSTH hasn't announced a deal yet. It generally takes ~90 days between a SPAC announcing a deal and the deal closing. If PSTH announced a deal tomorrow, they'd be looking at closing the deal in early March. That timeline might be a little extended because we're approaching the holidays. If PSTH doesn't announce a deal by early next week, there's almost no chance they could announce and close a deal before those March options expire.

The June options are a little trickier. I'd bet PSTH is able to announce and close a deal before then. So you are taking some market risk here. But given the possibility from benefitting from a reverse DVMT and how excited I think the market will be by a PSTH deal (and that I can't see the market voting for a PSTH deal that they then trade through trust this quickly), I think the June options are a good bet as well.

I would guess that Ackman has a deal done before December 2021, so those puts are certainly taking in the risk of how the market receives the deal by then (though there is some chance there's no deal!). You're also exposed to more market risk here; if PSTH closes a deal in June or July, there's a lot of time between then and the option expiration for a big market correction or something to trade the company below SPAC value. But, on the other hand, you are getting a lot of premium by writing these, which provides some downside protection, and you get the reverse DVMT option on top of that.

One other note: in a "reverse DVMT" scenario, the calls would have the same strike changes as the puts. Again, not investing advice (seriously, nothing on this blog is), but if you're betting on a reverse DVMT, you would benefit from this by being short puts or long calls. If you wanted to get a little bit out there on the risk spectrum, you could buy calls and bet that the market will be pumped by whatever deal Ackman announces plus maybe you benefit from a reverse tailwind. That's fine, and I'm sure some people will go that path. For me, I like the downside protection of writing puts at trust value; if there's no reverse DVMT, I'm still protected by the bet that investors won't trade whatever deal Ackman announces below trust value. Writing puts also "wins" if there's no deal announced by option expiration, while buying calls would suffer from decay in that scenario.

Anyway, I realize this was a bit of a tricky idea. But I think it's worth noodling over. The June puts are >20% out of the money, offering a premium of 10% of notional, and imply a ~20% annualized return. I think selling volatility that high would be interesting on any SPAC / cash shell; to do it on a SPAC backed by Ackman seems like a gift to me.

PS- Ackman has apparently already approached Bloomberg and Airbnb, though he was turned down by both. Everyone thinks Stripe is his target; the market would probably go crazy for that merger but stratechery has said "with a high degree of confidence" they won't be pursuing a SPAC merger so who knows? Ackman will almost certainly get a deal done before expiration, but the SPAC doesn't expire till ~July 2022, so there's no reason a deal needs to be done or even announced by this summer.