Premium post: Another worthy play (paywall)

My 2021 state of the markets was entitled “speculative excess and opportunity everywhere.” No where is that speculative excess more exuberant than in the SPAC market…. but that excess is creating incredible opportunities in tangential plays.

Consider, for example, my post last year on Worthington (WOR; (July 2020 idea; substack / blog); closed September 2020 (substack / blog)). The basic thesis was simple: WOR had hit an absolute grand slam through their investment in NKLA. The market was giving them almost no credit for that investment even though it had grown in size to be worth ~50% of WOR’s market cap. That discrepancy simply couldn’t last; WOR had valuable business of their own and a history of repurchasing stock; eventually, they would monetize their NKLA stock and take advantage of their own shares.

Today’s idea runs in a similar vein. The idea? Buy CURO given it’s discounted valuation thanks to its investment in FSRV.

I will provide more updates on this going forward, but given how crazy the market is right now I figured it was better to get the idea out now with the main points in it than to do an insanely deep dive. As always, please feel free to reach out with questions.

The overall idea is pretty simple: CURO had a major investment in Katapult, which is merging with FSRV (a SPAC). CURO is going to see a huge payday from that investment: $125m in cash and $240m in equity at FSRV trust value (more on this in a second). Not bad for an investment that, in total, Curo had put $27.5m into!

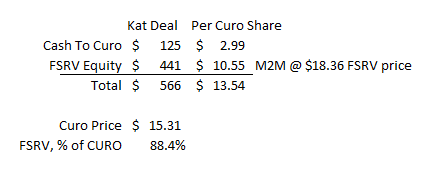

That equity component is important: it’s based on FSRV’s trust value of $10/share. However, FSRV’s share price has been an absolute rocket since the announcement; as I write this, their stock is trading for >$18/share. Marked to market, CURO will receive $125m in cash and ~$425m in FSRV equity for a total consideration of $550m.

That’s an enormous number. CURO has ~42m shares outstanding; at their current price of ~$15.30, CURO’s market cap is ~$640m. CURO’s investment in FSRV represents ~90% of their market cap at these levels.

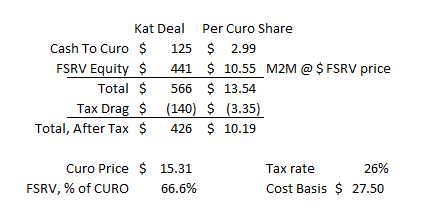

As mentioned, CURO’s cost basis in Katapult is ~$27.5m. Their tax rate is ~26%; if you wanted to be really conservative, you could fully tax their gains on Katapult. I think this is too conservative: they have some NOLs, and they’ll be able to defer a lot of these gains given they are taking equity, but given the size of the Katapult gain it’s worth thinking about the eventual tax hit here. If we do that, CURO’s net gain from their Katapult investment is ~$10/share

Now, the market clearly is somewhat wise to this. CURO’s stock has gone from ~$8.70/share before the FSRV announcement to today’s price of $15.30. That’s a big move…. but it’s not big enough given how much money CURO has made off FSRV. If you look through the FSRV stake, the market is currently pricing core CURO at 1.0x-2.5x LTM EPS. That’s insanely cheap, and EPS is actually down this year (From $2.03/share in the first nine months of 2019 to $1.58/share in the first nine months this year) as the company tightened up credit standards and had some write offs in the wake of COVID, so you could argue that you’re paying a low single digit multiple of slightly depressed earnings.

So the key piece of the thesis here is simple: the company hit the jackpot with Katapult, and you’re almost buying the rest of the business for free if you look through that investment.

However, I do think there are a few other angles here.

The first is that management has a history of aggressive share repurchases. In 2019, they bought back ~5.6m shares for an average price of $12.89/share. That was >10% of their shares outstanding at the time. They continued to buy another ~500k in Q1’20 before pausing the program to maintain liquidity as COVID plunged the country into crisis.

I like that share repurchase program. It shows management thought their business was cheap last year at prices around today’s (before Katapult exploded), and it shows management won’t be scared to aggressively retire shares if they remain cheap once the Katapult deal closes.

The second angle is FSRV / Katapult itself. Let me be clear: I’m not making a call one way or the other on Katapult. That said, I do think effectively creating exposure to FSRV on the cheap through CURO is interesting. I’d encourage you to check out the investor deck that they posted as part of the deal. This is a real growth company that is coming public with real investors (Tiger Global, Neuberger Berman) pumping $150m through a PIPE. FSRV has been on a big run this week because Affirm went public and saw a massive IPO pop. If you comp Katapult to Affirm or any of their other peers, it’s still probably too cheap even after this run. Is that a fair comp? I’m not sure. Clearly Tiger Global is making that bet, and I have some friends who specialize in financials who think so…. but I also have other financials focused friends who think that Katapult is riding a wave with their focus on non-prime and the whole thing will end in tears if the cycle turns a little. I’m not convinced either way; I’d probably lean a little bullish but the nice thing about buying CURO is that the discount is so large that even if Katapult comes down a lot you’re reasonably protected.

The third angle I’d point out is that CURO’s investment in Katapult was, obviously, a homerun; they started investing in 2017 and have turned a total of a $27.5m investment into a 20x in ~3 years. CURO was also clearly a believer in Katapult; they first invested in 2017 and they were increasing their position by investing into uprounds and even buying out other investors for the last several years. For example, in 2020, CURO invested another ~$11.1m to increase their stake in Catapult from 43.8% to 46.6% (at a ~$400m valuation versus a ~$1b value in the SPAC deal and >$2B valuation now once you adjust for the warrants). I highlight that because that level of conviction and success gives a management team some credence that the rest of their portfolio or any other growthy / VC investments they’re making might have a lot of upside. CURO does have two of those: Revolve Finance and Verge Credit (see image below from this investor pres). Obviously it’s unlikely either of those turn out to be a Katapult like homerun, but there’s no reason these couldn’t grow to be significant value opportunities. CURO’s November investor deck noted that revolve peers are getting valued at $500-$1,000/account. With 35k accounts, Revolve would be worth almost $20m at the low end of that range…. and that valuation could prove conservative, as money is cheap currently and Revolve is growing really quickly (their September investor deck (slide 24) noted Revolve had 33k accounts at July 2020; at that pace, it’s not crazy to think they’re at >40k accounts the next time they report). Interestingly, I listened to their CEO at the William Blair conference in June; several times through the conference, he went through all of the company’s growth opportunities and he actually seemed equally excited about the Verge/Stride opportunity as he was Katapult. Take that FWIW; I could be misinterpreting or imaging it, but I think it’s interesting and it’s a free-ish growth opportunity (also interesting, none of their conference appearances have transcripts on any of the major services as far as I’m aware of, so you need to listen to the actual audio to hear what they’re saying / thinking. Perhaps a mini-edge there?)

One other note while I’m here. While CURO has had a strong run since the FSRV / Katapult announcement, their peers have enjoyed nice runs as well. GSY, the best comp for their Canadian business, is up ~10%, while ELVT and ENVA, the best comps for CURO’s U.S. business, are up ~40% and ~20%, respectively. So yes, CURO is up ~80% since the Katapult deal…. but peers suggest CURO would have been up strongly even without it!

Let me just discuss risk real quick. There are risks to CURO’s core business (it’s basically payday lending), but I tend to think they’re overblown given the super low multiple we’re paying. These businesses have survived ages, while earnings might go up and down based on regulatory changes, I think you’re paying such a cheap price that it’s not a huge concern here. The biggest risk is really on the Katapult side; it’s such a big investment and a huge piece of CURO’s value right now that it’s really the main ingredient for driving value for CURO. Shorting FSRV / Katapult is pretty much out of the question; given the SPAC dynamics the borrow and short squeeze possibilities are just too much of a risk. So yes, there is exposure to Katapult…. but the good news is that while it may be overvalued at these prices, I don’t think it’s crazy overvalued or likely to collapse or anything. Remember, $150m is going into Katapult as part of the PIPE, and the company will have no net debt after the transaction goes through. So even if the market price of FSRV came down a lot between now and CURO getting liquidity on their shares and being able to sell, CURO would still be walking away with a mammoth win and taking a huge piece of their market cap off the table. If you just benchmarked CURO to their peers since early December, and then gave them credit for $100m/from the FSRV deal (basically the fully taxed cash they will receive, giving them no credit for the hundreds of millions of equity they’re receiving), this would be a ~$12-$13/share stock. So yes, Katapult is a risk…. but I think you’ve got a lot of downside protection built in.

There are a lot of other puts and takes and angles to CURO. I’ve done a lot more work on this, but still have more to do and will hopefully be able to put out a more fully fleshed out article in the future (I’m also happy to engage offline with anyone looking to dive deeper). But, given how many SPACs are just ripping every day, I wanted to get this out fast as I think the opportunity is really juicy and the market can wake up to these opportunities pretty quickly (or FSRV can follow the path of every other SPAC and go up 10% every day and keep pushing the CURO holdco discount to insane levels).