Quickie idea: CoreLogic $CLGX

This post is another in a series I do on an irregular basis. A “quickie” idea is an investment specific idea that I’ve been mulling over and find interesting, but haven’t dove fully into yet. The hope is to provide the jumping off point for a discussion of an idea I find extremely interesting right now, as I suspect the opportunity could be fleeting.

The idea? Buy CoreLogic (CLGX; disclosure: long). Shares today trade for ~$75/share, and I expect the company will get bought out for >$80/share sometime in Q1, most likely alongside or before the company announces their Q4 in February.

The idea here is actually reasonably simple. In June, Senator and Cannae (CNNE) bought ~10% of CLGX and offered to buy the whole company for $65/share. CoreLogic quickly rejected that offer, setting off a bruising proxy battle.

While the proxy fight would be pretty acrimonious, CoreLogic clearly saw the writing on the wall reasonably quickly. The company had underperformed for years (perhaps because of misaligned incentives!), and shareholders would not settle for the status quo. In late October, CLGX confirmed that they were running a "robust" sales process to maximize value and had already gotten indications of interest to acquire the company for "at or above" $80/share. This was a pretty obvious face saving move by the board; they knew shareholders wanted a sale, but the board hoped that by confirming a sales process was in the works shareholders would let the current board oversee the process without anyone losing their board seat.

Despite that move, the proxy battle was eventually easily won by Senator; Glass Lewis and ISS both recommended Senator's directors, and Senator won 3 board seats and a "clear mandate" to maximize shareholder value (sell the company). However, they weren't content to just sit on their hands; on the heels of winning three seats, Senator immediately moved to replace additional directors if the company wasn't sold quickly. In response, CoreLogic put out a statement again confirming indications to acquire the company for at least $80/share from "multiple competing parties" and that they anticipated concluding the process in early 2021.

That brings us to today. As I write this, CLGX shares trade for ~$75/share. And I can't help but wonder.... what am I missing? It seems like a layup that the company gets sold for >$80/share in the next three months.

Let's just start with the downside: what if I'm wrong and the company put out a press release tomorrow that said "we're going to go it alone, will of the shareholders be damned"? Well, CoreLogic was trading for ~$53/share before Senator / Cannae made their bids, but I doubt CLGX would trade back that low. CoreLogic has massively increased their guidance not once but twice since Senator got involved, and the whole market has risen since the initial Senator bid (see screenshot of peer stock performance below).

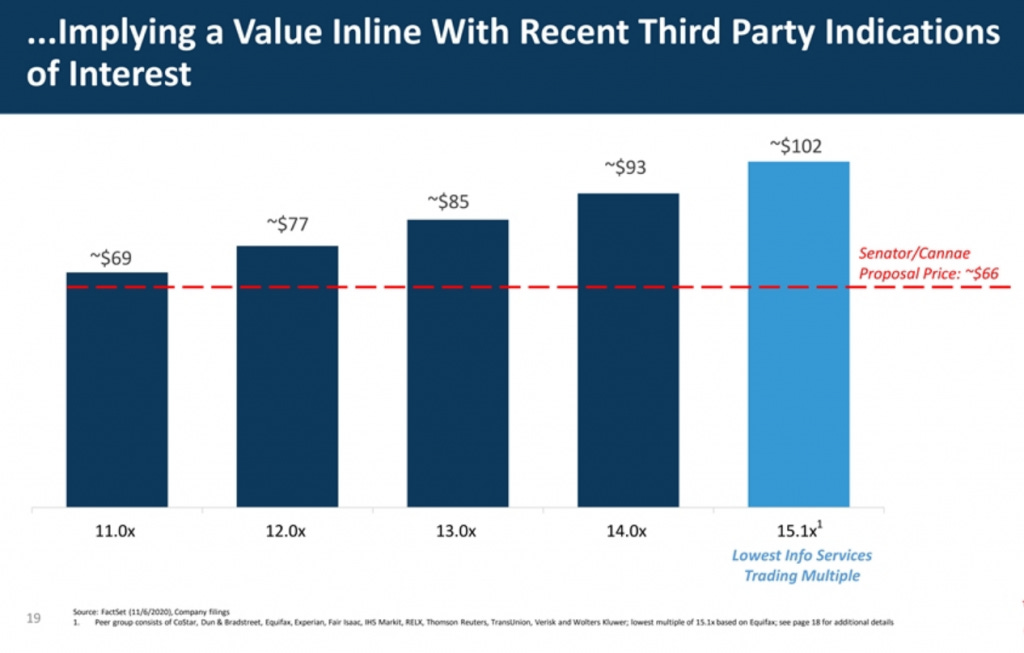

It's really tough to say where Corelogic would trade if there was really no prospect for a deal. Without a deal, initial trading would probably be pretty sloppy, but my gut tells me CoreLogic would settle in around $65/share if the deal broke, and that price would likely be pretty attractive. Why? I think, post-activism, CLGX is forever changed. The old, under performing management team and board know their days are numbered, and the market knows that too. Check out the chart below (stolen from this Senator deck)- CLGX grows slower than peers and has a multiple well below peers; if a sales process falls through, shareholders are going to quickly find a management team whose sole focus is increasing growth and getting multiple closer to peers.

At $65/share, CLGX would be trading for ~10x what management guided 2021 EBITDA. Yes, CLGX is growing slower than peers, and there's some questions around their end markets (the majority of CLGX's revenue is tied to the mortgage market, which is super hot in the wake of COVID but a lot of this revenue is likely "pull forward" of future demand), but this is a capital light data business with a nice moat in a world of zero interest rates. How many of those trade for 10x EBITDA? Based on the chart above, the answer is "basically none."

So, even if CoreLogic doesn't sell, I don't see a ton of downside here. But I just can't imagine how CoreLogic isn't sold. Shareholders want this sold, and the board knows that if they don't sell they will be replaced by someone who will sell the company. Directors have already seen three members get the ax, and I'm sure they'd like to spare themselves the embarrassment of getting chopped as well. Senator included the slide below in their proxy materials; at this point, CoreLogic knows that their shareholder base consists entirely of people who want this company sold.

So I think even if the company didn't get sold, the fundamental downside from the current share price isn't that high. But I'm pretty convinced the company is getting sold. Assuming we're getting a sale, the other big risk is that CLGX's bidders walk down their bid once they get in the data room. It's a pretty classic negotiating tactics; get a company to open their books up by suggesting you can pay ~$80, and then once they have committed themselves to a sale say you saw something concerning in the books and drop your price. The company finds themselves between a rock and a hard place; everyone at the company has been running it for a sale, investors are expecting one, and the board and management team are tired of the process. They can either take a suboptimal price or walk and face a firestorm from all fronts.

I have trouble believing that's the case here. First, the company has said they have multiple bidders; multiple bidders generally means you can't pull that type of price walk back because of the competitive tensions. But I also think potential bidders are going to be drooling over themselves to buy CoreLogic. Why? Senator has laid out a very explicit case showing that CLGX has been undermanaged for over a decade at this point.

CoreLogic's deck included the slide below highlighting why the Senator bid was too low.

As a private equity firm, when I see that valuation slide with all of the underperformance charts from Senator (I'm including one below, but there are plenty of others in the deck), I have to be thinking to myself buying CoreLogic is the easiest trade of my career. Buy CLGX for 12-13x EBITDA (~$85/share) with 6 turns of debt and install your best operator as CEO. Take CoreLogic's margins up to the 30% they've always targeted, maybe boost growth a point or two and do an accrettive acquisition. In three years, take the company public or sell it to a strategic for a high teens EBITDA multiple (the low end of the peer set). That trade would make ~4x returns to equity holders, with the potential for significantly more if you got a little better multiple, a little faster growth, or found some really accrettive tuck-ins in the mean time.

Again, CLGX is a capital light data business; how many of those trade for multiples lower than 15x EBITDA? INFO is currently being bought by SPGI for ~29x EBITDA (w/o synergies; ~20x w/ synergies). A private equity firm buying an undermanaged market leader (as CLGX is) for half of their peer's multiples (which would be the case if they sold for ~$85/share) is exactly the trade private equity firms were built to make.

Anyway, that's the story. CLGX is trading at $75/share. The company says they have multiple bidders willing to pay "at least" $80/share, and their sales process should wrap up in Q1. I don't see much fundamental downside, and I don't see what I'm missing here, so I'm throwing this quickie idea out to the masses to see if the "crowd" has some wisdom on this.

PS- I would guess one piece of the reason the opportunity exists is Senator has been selling down their CoreLogic stake, and people are worried about that for a bunch of reasons (Do they know bids are coming in weak? What happens if CoreLogic doesn't sell and Senator isn't there to force their hand?). I get it, but Senator isn't an arb. They took a mammoth swing on CoreLogic (their CoreLogic position was, by far, their largest in their 13-F) hoping to buy the company, and the stock ran well above the price. They noted at the time of their board win they'd sell down some of their position while remaining a major shareholder till the deal got done, and it seems reasonably that they're just taking some chips off the table in the wake of a big win.