Executive summary: As befits one of the strangest situations I’ve ever seen, this post runs long. Here’s your tl;dr: in a vacuum, RCM’s current take private saga has some of the weirdest twists and head scratching decisions I’ve ever seen. As far as I know, it’s unprecedented: you have two semi-control shareholders bucking game theory (which says they should partner up to take an asset private on the cheap if they want to buy it) and instead bidding against each other (I don’t believe there’s ever been a public bidding war between two semi-control shareholders, though I could be wrong) ... but if you look at all of the moves through the prism of TCP’s July 5 13-D, I think all of the moves start making a lot more sense through the eyes of two sides who believe they have a crown jewel in RCM and have a dramatic difference of opinion on the strategic and management path forward. I think we’re about to see a bidding war for RCM that ends up with a very nice price for minority shareholders…. but, given how strange the saga is, there is certainly the caveat that I could be very wrong!!!!

PS- I rushed to get this out during the day July 8, 2024. My guess is we get some news in the very near term (likely TCP confirming their bid and providing details / a price level) and that this process plays out quickly (both bidders know the company well and it behooves no one to have this drag on), so we should have some more news quickly and I’ll look like a fool or a hero pretty soon (I mean, I’m always a fool, but hopefully not on this one).

Full post below

Every month, I post a tweet asking my followers what their favorite current special situation is. There’s always some interesting ideas in the replies, but after tweeting that thread out a situation popped up that’s completely unique that wasn’t mentioned1. In fact, this might be the single strangest / most unique take private situation I’ve ever seen (I’m worried I’ve said that in the recent past about some other deal, but as I go through the mechanics here I think you’ll agree with me that this situation is truly wild). Given the complexity / uniqueness, I wanted to put some thoughts on paper both because writing helps me think clearly and because unique situations often benefit from having an extra set of eyes on them (i.e. if you’re following the situation and have thoughts / think I’m missing something, I’d love to hear it!).

Anyway, the situation is R1 RCM. Long time readers / listeners will remember I did a podcast on them in late January. The podcast was excellent (Jon is very knowledgeable about the company), but the podcast focused on RCM as a value stock and it has become very event-y since then, so the podcast is worth it for background and understanding the company but it has very little to do with the investment case today (aside from informing the event angle and the downside thesis if the event breaks).

So a lot has changed since then. A brief (though perhaps not complete) timeline of what’s happened since:

On February 26, New Mountain (“NM”, who owns ~33% of the stock through CoyCo) files an updated 13D that notes they submitted an offer to buy RCM for $13.75/share in late January. Importantly, this 13-D asks RCM to issue New Mountain a waiver to allow New Mountain discuss the take private with TCP, RCM’s other largest shareholders who owns ~36% of the stock. New Mountain needs that waiver so they can see if TCP wants to join the bid.

It should be noted that in Mid-Feb., Change healthcare is hacked. This hack is basically the first thing mentioned when RCM reports results in Q1 (on May 8) and causes RCM to cut their full year outlook (though they’re very clear on the earnings call that they believe the hack hits their short term numbers only and does not impact their long term business or plans). But that’s important to keep in mind because all subsequent bids and events are happening in the shadow of “what is going on with the business post-Change hack” questions.

TCP responds on March 11 that they’ve engaged with prelim talks with New Mountain on a joint transaction.

New Mountain files an updated 13-D on April 29. The update notes that they have not held any discussions with TCP since March 18, but that NM is still interested in a take private and believes the only route forward is a joint deal with TCP.

May 6 / May 7: TCP and NM file 13-Ds noting the issuer has granted them a waiver to discuss a joint deal. The waiver runs till June 13; NM’s filing notes they “intend to commence discussions with TCP-ASC permitted by the May 6 Waiver.”

May 8: RCM files their Q1 results and updates their outlook for the Change hack.

Mid-May: Ascension, who is both part of the TCP group and a major customer of RCM’s, is hacked.

June 13: TCP and NM file a letter with the special committee asking for the waiver to be extended to July 12 “if the Special Committee has continued interest in receiving a proposal for a Joint Transaction.” The letter notes “the Investor Parties have engaged in constructive discussions regarding their potential pursuit of a Joint Transaction.”

Interestingly, as part of this waiver update, Jeremy Delinsky files a 13-D on RCM as part of the group. Delinsky has served on the board of RCM since June 2022 as a NM (Coyco) board designee (see p. 23 of the proxy). Delinsky’s 13-d notes that he’s assisting NM with their DD and “had preliminary discussions and intend to continue to have discussions regarding the possibility of the Reporting Person serving in an executive capacity and/or advisory role with the Issuer following such Potential Transaction.”

July 1: NM files an update noting they are “no longer interested in pursuing a joint proposal with TCP-ASC;” however, NM continues to believe a go private transaction makes sense, and they’re interested in pursuing one without TCP. NM lowers their bid from $13.75/share to $13.25/share.

While NM is not interested in pursuing a joint proposal, they are “open to having TowerBrook Capital Partners and Ascension Health participate in a Potential Transaction as equity co-investors.”

The next day (July 2) NM publicly files their letter / offer to the board. It affirms the $13.25/share price, noting that they’ve “completed” their business due diligence, and that the new offer “takes into account events that have occurred subsequent to our initial waiver request on January 26, 2024.” The letter also notes they have commitment letters to fully refi RCM’s debt.

July 5: TCP files their own 13-D, noting “The Partnership is in the process of finalizing a proposal to acquire all of the outstanding shares of Common Stock that are not currently owned by the Partnership at a price per share higher than the proposal described in the standstill waiver request by CoyCo on July 1, 2024.”

Interestingly, the TCP proposal also notes, “Joseph Flanagan, a member of the Board of Directors and the former Chief Executive Officer of the Issuer, and the Reporting Persons are in discussions regarding the possibility of Mr. Flanagan serving in a senior executive capacity with the Issuer following a potential acquisition of the Issuer by the Reporting Persons. In the interim, Mr. Flanagan expects to assist the Reporting Persons in conducting due diligence on the Issuer.”

Ok, I understand that was a ton, but it really was necessary to discuss what’s going on here and to try to see the board clearly. Why?

Well, first, it’s important to remember that this whole take private process is going on with the backdrop of the hack(s). There’s fundamental questions about what’s happening with RCM’s business, if the impact of Change is a short term hit or a long term impairment, etc. You can see that pretty clearly in RCM’s stock price; after trading above the initial $13.75/share bid on the heels of the bids disclosure, RCM trades pretty consistently below $13/share for the last few months as investors grow increasingly skeptical of the potential of a take private in the face of mounting hack uncertainty.

Second, it helps frame how strange the July 13-Ds are. When NM files their “we aren’t working with TCP, and we’re lowering the offer to $13.25/share” 13-D on July 1, it’s hard to overstate how weird that was. RCM’s stock drops from the mid-$12s to ~$11/share, because investors pick up on all the weird things in there. For example, if NM was really serious about taking RCM private, would they really drop their bid by <4% (from $13.75 to $13.25)? Bids from large shareholders need to be approved by special committees, and the time value and cost of a special committee ramping up to evaluate a new bid that was cut by <4% alone would likely outweigh the savings of cutting the bid by 4%.

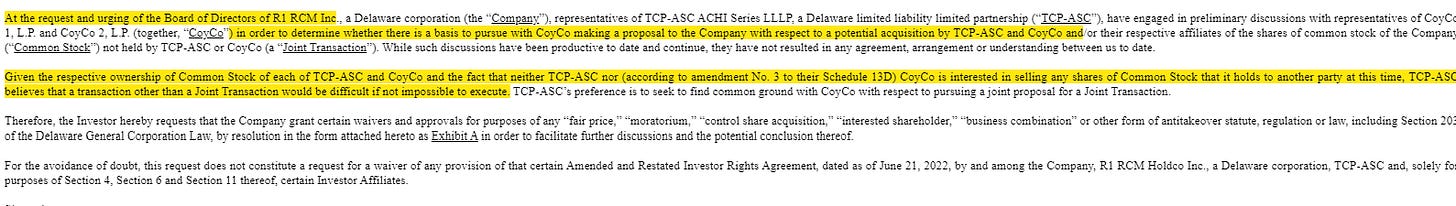

Ignoring that strange price cut, the weirder angle is that NCM’s July bid cuts TCP out completely. It seemed clear from the beginning of this saga that TCP and NM needed each other to get a deal over the finish line. TCP’s March 11 13-D noted “Given the respective ownership of Common Stock of each of TCP-ASC and CoyCo and the fact that neither TCP-ASC nor (according to amendment No. 3 to their Schedule 13D) CoyCo is interested in selling any shares of Common Stock that it holds to another party at this time, TCP-ASC believes that a transaction other than a Joint Transaction would be difficult if not impossible to execute. TCP-ASC’s preference is to seek to find common ground with CoyCo with respect to pursuing a joint proposal for a Joint Transaction.”

Combine the small price cut with NM dropping TCP out of the bid, and the whole thing screamed “something weird is going on”. Most people I talked believed that what was happening here was extremely negative; something along the lines of: the hacks were demolishing RCM’s business, and NM and TCP didn’t want to take RCM private after getting a look under the hood and seeing how things were going. A common refrain was “TCP is running away from this; NM is putting this bid in to save face before walking away.” I will say that I never believed that line of thinking; the NM letter included language that said the bid was adjusted for recent events post due diligence, and I think NM trying to save some face by forcing a company they own hundreds of millions of dollars worth of stock in to continue through a process that costs them millions of dollars in expenses (not to mention the distraction) would have been really strange…. but, given how weird the whole process was, I didn’t act on that believe with any conviction.

So, with the benefit of the TCP July 5 13-d and viewing everything historical with that in mind, let me propose a slightly different explanation: NM and TCP believe RCM has crown jewel potential / a lot of value unrecognized by the market, but they have a huge difference of view on operations / management and all of the strange filings and biddings relates to that difference of opinion.

I think that “conflict between the two major bidders” explanation would explain everything going on here, and it would shine new light at some of the disclosures in the filings.

Remember, the game theory here is that TCP and NM should partner up to bid on RCM. Doing so would remove competitive contention and let the two of them get RCM for the cheapest price. Why would the two forgo that game theory? It’s because each thinks that they can create more value at RCM by operating their own strategy, which is wildly different than the other party’s. So they’re each choosing to bid on their own despite both of them know that a joint bid makes the most sense, as each of them said exactly that in prior 13-Ds (including TCP’s “TCP-ASC believes that a transaction other than a Joint Transaction would be difficult if not impossible to execute”).

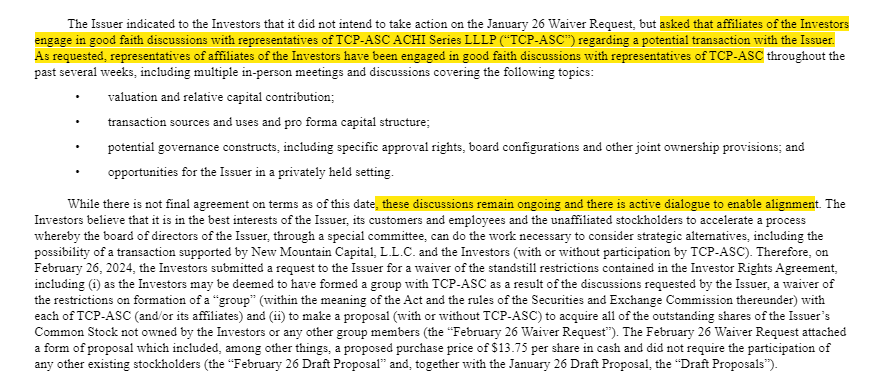

With that in mind, I’ve clipped out two sections from prior 13-Ds; the top is from NM’s Feb. 26 bid, while the bottom is from TCP’s March 11 response.

Obviously you can see my highlights there, but look at some of that language. At the time of the filing, I read those and thought “o, the control shareholders are getting ready legally to take RCM private on the cheap and need waivers.” And yes, that’s part of it. But quotes like “possibility of a transaction supported by New Mountain Capital (whether with or without participation by TCP-ASC or its affiliates)” and “at the request and urging of the Board of Directors of R1 RCM Inc.” take on a new light when you think about subsequent developments. Perhaps NM and TCP had been fighting over strategy for months, and the board was urging them to talk in order to figure out a path forward for the company so that the company didn’t bog down in disagreements over strategy / the company could remain nimble?

A big piece of that conflict is likely related to management and company vision. TCP’s July 5 13-D notes they’re working with Joseph Flanagan as part of their bid. Flanagan was the CEO of RCM until late 2022 and currently serves on the board. NM’s 13-D notes they’re working with another board member and talking to them about an executive role. Again, at the time they were made the filings bringing board members into 13-D groups were strange, but when you look at it from the angle of two firms with drastically different visions for a company trying to maximize its value through their own vision, it makes much more sense.

Anyway, I’ve rambled enough about the filings and what’s going on here. I think you get it at this point (and I’ve linked to them copiously, so you’re free to do your own work / digging and come to your own conclusion)! Let’s wrap this up by hitting on three interconnected points: why this situation is so unique, why I think the opportunity exists, and how this all plays out.

Why is this opportunity so unique? You have two semi-control shareholders with 30-35% of the stock bidding against each other. I’m not sure that’s ever happened before; I certainly can’t remember it. So you’ve got a truly unique bidding war situation that takes a long time to understand (and is happening in a slightly illiquid stock given that ownership).

Why does this opportunity exists: I think the uniqueness is driving the market crazy: it’s so strange that the market doubts it’s real. As I write this, RCM is trading for ~$12.60/share. The NM bid was $13.25 and we know TCP has said they will top it. Generally, in a bidding war, the market would trade the target well above the first bid as the market discounted the possibility of ever escalating bumps. Instead, RCM trades at a discount. Again, I think that uniqueness reflects how intense the bidding could get / how valuable the parties think RCM is, but the market disagrees. We should know who’s right shortly.

How does this play out: I think standard bidding war rules apply. Both firms have played their hands at this point: they think the company is insanely valuable and would be way more valuable under their ownership / strategy. I think we get several bumps from both sides. I’d guess the final price ultimately touches $15, though if things get really frothy we could easily push into the high teens.

Again, I want to get this piece out before market close since I suspect we’re getting news in the very short term on either an RCM response or TCP revealing their bid. I’ll hit some extra things in the odds and ends below, and I’m of course always happy to engage in discussion on the event in the comments (though it should be noted event driven investing is high risk; black swans can happen all the time. Remember, this company has suffered not one but two hacks to partners in just the few months since the initial bid!)

Odds and ends

One of the really interesting things here is both NM and TCP have indicated in past filings that they have no interest in selling RCM (for example, “the fact that neither TCP-ASC nor (according to amendment No. 3 to their Schedule 13D) CoyCo is interested in selling any shares of Common Stock that it holds to another party at this time). That creates a really interesting dynamic: what if one party outbids the other, but the other refuses to vote for the deal? In general, when a control or semi-control shareholder buys out other public shareholders, special committees want to get a “majority of minority” provision in order to reduce legal risk, and, in this case, one party saying “we will vote no” would be enough to tank a majority of minority.

It’s a really interesting thought, but ultimately I think it’s solvable. The company could just say, “bid higher if you don’t want to sell,” and if the loser still won’t agree to vote for the bid, the company could just take a vote without majority of minority and have the buyer assume legal risk.

I also think this dynamic can create really interesting bidding tension to extract the highest price from both sides; you could keep going to each side and saying “NM wants to know if you’d sign a support agreement at $15/share,” and then TCP would know that NM has a $15 offer on the table they need to top, and then you could take TCP’s new offer to NM to get a support agreement….

One more filing showing TCP really doesn’t want to sell; their July 5 13-D includes “As previously disclosed, the Partnership and its affiliates are not interested in selling any shares of Common Stock that the Partnership holds to another party at this time.”

Obviously, your big risk here is a “no deal, RCM goes it standalone” situation. I have two thoughts on that.

First, I think the fundamental downside here should be a lot better than most people expect. Remember, NM and TCP both know this company better than anyone, and they’re willing to break game theory to bid against each other. NM’s bid specifically notes, “We have completed our business due diligence and are prepared to move forward with completing definitive documentation and signing a transaction by July 12, 2024. The $13.25 per share price proposed herein reflects the completion of diligence and takes into account events that have occurred subsequent to our initial waiver request on January 26, 2024.” Obviously anything can happen, and the near term will be rocky given the hacks…. but I’d have to think the downside is much better than the market probably feared given how badly each side seems to want RCM.

Second, it’s just really hard to see no deal coming here. If you believe my read, both sides have spent months sniping and they’ve now lined up a board member to support their bids against each other. Maybe they have a “let’s all hold hands” moment and go with a joint bid again (though if I was the special committee I would never let that happen until I had extracted every last dollar from each side), but it’s just hard to see how you could go from each side working on a joint bid, to each side trying their own bid, to no bid at all. So a risk…. but this feels like we’re getting a bid

I don’t think financing will be an issue here; NM just closed a huge fund and their bid includes committed financing from GS and JPM. TCP hasn’t disclosed committed financing, but they’re huge as well so I’d have to imagine they won’t have a problem here.

How NM got their stake is really interesting: they acquired their RCM stake from RCM’s all stock purchase of NM’s portfolio company cloudmed in early 2022; RCM’s stock was in the low to mid $20s when the deal closed / for most of the negotiations (if you read the proxy background, NM references a stock price of $22/share while RCM’s CEO (Mr. Flanagan, who seems poised take over if TCP wins) tries to pitch them on a $29.50/share price). Obviously a lot has changed since 2022, but I think that background gives you a really interesting view of where each fund might think the potential value for RCM is if they can execute their own playbook on the company….

This situation (the RCM situation) popped up after the Twitter thread, but before the RCM situation developed I would have listed an entirely different situation as my favorite event idea and no one mentioned it either. I posted a premium preview of it over the weekend and will post a finalized public version of it later this week.

If it is a truly competitive situation and each party wants to implement their own strategy, then what's stopping either party from launching an unconditional tender offer to get to 50% first?

https://stocktwits.com/jbraun123/message/580010326