A DeSPAC value idea: Alight $ALIT

I realize I am a broken record, but I will continue to hammer this point until it is no longer true: we have never seen anything like the SPAC boom from the back half of last year and the first few months of this year, and that presents all sorts of opportunities.

So far this year, >350 SPACs have gone public, raising over $10B. All of those SPACs will need to find companies to merge with or else their sponsors will lose millions of dollars of risk capital. In a typical year, ~200 “normal” companies would go public, so to have that many SPACs with that much capital searching for deals means that the public markets are going to see companies and industries that traditionally would not have been “public ready” hit the market as the sponsors get more and more desperate for deals.

Why does that matter for investors? Because there are now hundreds of SPACs looking to merge; that’s hundreds of new stocks / companies that have basically no sellside coverage at the start that investors can due diligence. I’ve generally been skeptical of SPACs given the poor incentive structure, but with that many SPACs out there (and reasonably limited coverage), it is impossible for me to imagine that someone willing to think creatively and put in work won’t be able to find some alpha in SPAC land.

Traditionally, my favorite way to play SPACs has been the simple / vanilla way: buy SPACs with good sponsors around trust, and then sell if the stocks pop on deal announcement or some type of good news or redeem if the market doesn’t get excited about the deal (though increasingly the market is getting excited about deals after the SPAC has merged).

However, for people willing to do fundamental work, I think the sheer wave of SPACs presents the opportunity to buy interesting companies at interesting prices. So I wanted to do a showing how interesting post-deSPAC companies can be; I know of a few interesting ones, so this may ultimately turn into a mini-series.. Note that I’m not recommending any of these companies (nothing on this site is ever investing advice or a recommendation); I just wanted to highlight how interesting deSPACs can get because I don’t see a lot of people talking about them.

So the first (and maybe best) example I want to highlight of deSPACs presenting opportunity is Alight (ALIT). Alight announced a merger with WPF (a Foley SPAC) in late January; the deal closed at the end of June / early July. As I write this, ALIT is trading for ~$9/share. As with most SPACs, WPF had ~$10/share in trust before deSPACing into ALIT, so ALIT is trading ~10% below trust value.

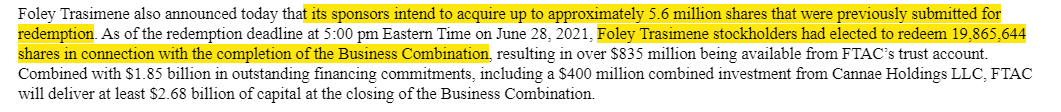

I think ALIT is interesting for a host of reasons, but the headliner here would be “what management / the sponsors are doing.” ALIT faced a wave of redemptions when they deSPAC’d; SPAC sponsors can do a lot of things in the face of a redemption wave. They can get the target to agree to reduced cash consideration in exchange for more equity, they can try to raise some outside capital to cover the gap, etc. But ALIT didn’t do any of that; instead, they decided to buy ~5.6m of the redeeming shares at trust value (in total, a >$56m check).

That $56m is on top of a pretty big commitment the sponsors had made. Cannae (CNNE), Bill Foley’s grab bag of assets / quasi-hedge fund, was already committed to a $250m PIPE and a $150m forward purchase agreement.

Let’s step back and think of this from an insider perspective. Cannae has ~$3.5B of shareholder’s equity. As part of the ALIT deal, they were already committed to writing a $400m check. That’s more than 10% of their equity, so it’s not a small commitment. Still, when they had the opportunity to increase their commitment at the end of the deSPACing, Cannae jumped at it.

So here you have a sponsor with a great track record committing a material portion of their invested capital into a deal. And then, several months later, when they were offered the opportunity to commit even more, they jumped at it.

Obviously, nothing in life is guaranteed. Cannae / Foley could just be wrong with what they’re underwriting at Alight, or the business could fail to perform in the future.

But imagine a different world, where Alight was just a normal publicly traded company and Cannae, their largest shareholder with a ~10% ownership in Alight, increased their stake by 10% and bought 1% of Alight’s shares on the open market. How do you think the market would respond? I’d guess the stock would go up a nice bit.

But one week after Cannae did exactly that by buying 5.6m shares of Alight to cover redemptions, the stock is trading ~10% below what Cannae paid. With a normal company, value investors would be screaming at each other to look at the opportunity. Because Alight is a SPAC, no one is talking about that combo… yet.

Here’s the other interesting thing: because CNNE bought the shares directly from the company, normal “insider trading rules” don’t apply. I don’t mean that in a sketchy way; what I mean is that CNNE / Foley almost certainly have access to up to the second data on Alight giving they sponsored this deal and will be joining the board. Normally, if they had that access, they wouldn’t be able to buy Alight’s stock on the open market. But because they did redemption guarantee in a negotiated transaction with Alight, CNNE can make that deal with full knowledge of exactly how the business is performing.

So walk through the “what if Alight was a normal company” scenario I framed earlier again, except this time ask yourself how the market would respond if Alight put out a press release saying “Cannae is a major shareholder of ours and has access to up to the minute granularity on how our business is performing; with that data, they’ve gone and increased their position in ALIT by 10% by buying 1% of our shares on the open market.”

How would the stock respond to that announcement? I’m guessing it would go parabolic. But, in this case, ALIT and CNNE basically did just that and the stock dropped 10%.

Of course, it’s possible I’m wrong on that point. Maybe CNNE / Foley firewalled themselves off from new information heading into the deal announcement / their board seats. Perhaps that’s even likely given several WPF insiders made decent sized purchases of WPF right before the deal closed.

I don’t know. What I do know is that CNNE / Foley are sponsors with a very good track record, and they are not only writing a big check into WPF but actually adding to that bet at prices well above the current levels. Maybe WPF is cheap, maybe it isn’t. But that combination certainly screams “there could be value here,” and because WPF / ALIT is a deSPAC I haven’t seen anyone pick up on it the way they would with a “normal” company.

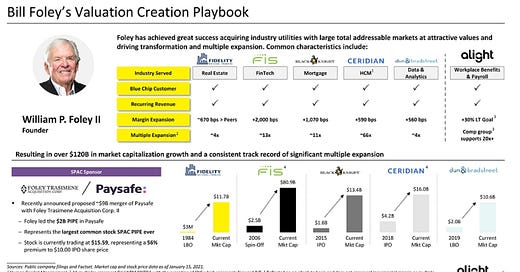

PS- CNNE isn’t just the SPAC sponsor / a borderline insider buying shares of ALIT on the “open market” through covering redemptions. CNNE is all of that plus an investor with a good track record in the space in a similar company. I’m going to post the “Foley track record” slide again below; look at all of the companies that have had success under his watch. All of them are similar in some way to ALIT; in fact, one of them (CDAY) is one of ALIT’s best comps! It’s also probably worth noting that THL was part of the forward purchase group for WPF / ALIT; THL has partnered with CNNE / Foley on several profitable investments in similar spaces in the past, including CDAY and DNB. So there was a lot of institutional knowledge of the space that was committing to buying at a price above the current market price.

On top of the insider buying signals, I think we’ve got some other signs that Alight is doing well / could be undervalued. First, their June presentation noted the business is “tracking well” since the merger announcement, with Q1’21 modestly ahead of expectations and several recent new business wins.

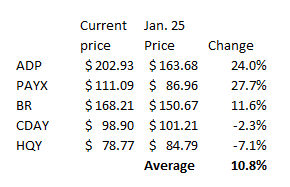

Second, as all SPACs do, ALIT framed their deal valuation as at a discount to their peers.

Since that announcement, peers have generally performed well; the average peer is up ~10%. Given ALIT has dropped 10% post deSPAC despite an the business is tracking ahead of their projections in January, if you believe it was cheap at deal announcement that gap has only widened!

I’m going to wrap this up here. Again, I’m not saying ALIT is a screaming value, though it looks cheap versus peers. But I wanted to highlight it because some very credible sponsors committed tens of millions of extra dollars to the company last week (on top of some chunky insider purchases), and the market not only seemed to yawn that off but actually traded the stock down substantially. If this was a normal company, value and event investors would be going crazy over that combo. Because it’s a SPAC, the market seems to be sleeping on it… so far.