A few quirky things that caught my eye

Based on my recent focus on Charter (CHTR, disclosure: long) and Netflix, you might figure I spend all of my time in the telecom / media space, but that's more a recent focus and, in general, I actually follow mostly smaller and quirkier companies. One of the things you learn quickly about smaller / quirkier companies is that the potential for head scratching moves and shenanigans are way higher. Sometimes the shenanigans can be a good thing (a quirky / charismatic leader making investments and experiments no one else is willing to make / try / see that pay off in the long run), sometimes the shenanigans can be a bad thing (a financially illiterate monster running your company into the ground while collecting fat paychecks), but at a minimum it’s normally interesting. Here are a few of the quirkier things I’ve seen recently.

CCA Industries (Ticker: CAW)

The Q&A for their most recent earnings call is rather hilarious and I’d encourage you to read it. Not as good as the Bob Evans conference call, but the last questioner was getting there.

He starts off innocently confusing cash and accrual accounting.

I love when (referring to a supplier) he says “they have to understand you're a public company and the money should be paid within the quarter.” Suppliers should know: pay private companies whenever you want, but public companies need to be paid before the quarter ends!

He moves on to show a complete lack of understanding on how deferred tax assets and shareholders’ equity works.

He then has the CFO instruct him on how blackout periods and form 4s work for corporate directors

He wraps up by decrying the lack of volume and stock movement in a company with a ~$20m market cap and ~$10m free float.

Another fun quirk: the CEO was issued a bunch of warrants with a strike of $3.17 (see p. 21). On the call, the CEO is openly talking about exercise some warrants to get cash into the company and help launch some new products. The stock is trading a bit under $3/share. It’s pretty rare to see a CEO fund a company by exercising out of the money warrants; it’s even more rare to see him telegraph to the market he’s going to do so.

Maybe I’ve got my timing off and the stock dipped below the warrant strike price after the call. But that’s exactly why companies / CEOs generally shouldn’t really on warrant exercises to fund a business plan!

Lannett (Ticker: LCI)

Let’s start with some background, as it’s pretty important to understanding what makes the end of September so funny.

Lannett is a specialty generic company that basically grew through price hikes. The CEO was completely unapologetic about raising prices on generics in shortage, a pretty unpopular view that honestly I have mixed feelings on.

Just to give you a bit more color on the CEO- here’s a line from their August 2016 call, “As some of you know, the music that you listen to while waiting for our call to begin usually has a connection to our financial performance. Today we selected an aria called Nessun Dorma from Puccini's opera, Turandot.” (The overall effect of that one was actually to honor a mentor, which is nice, but often it would just veer into the bizarre. In May 2014, they used “Oops I did it again” to open, and when it was becoming clear a recent acquisition was a disaster they played “Don’t let me be misunderstood” to open a call in January 2016)

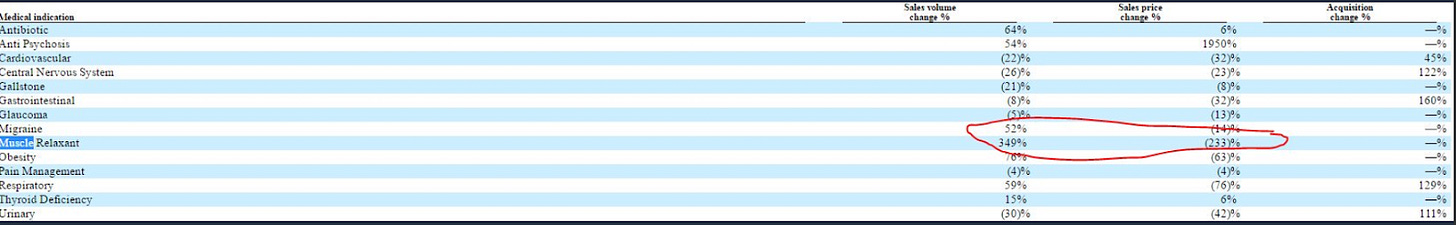

The price raises had some crazy effects on their rebates as Medicaid began to push back in later years. Here, for example, is a chart from their Feb. 2016 10-q; honestly, I thought the lowest a % change in sales could go was 100% (i.e. going to zero), so for them to post negative 233% absolutely blew my mind.

LCI has also been working, for years, on getting a new drug approved by the FDA as a local anesthetic for otolaryngologists (ear, nose, and throat doctors). That drug? They call it C-Topical, but you can call it liquid Cocaine.

In September 2015, the announced a deal to buy Kremers Urban for ~$1.23B.

The deal looked like a home run- it was done at <10x EBITDA (this in a market where spec generics were regularly trading for 15-20x), had serious tax benefits, and had big upside from recent bioequivalency data for a big drug submitted to the FDA.

The only issue? LCI didn’t put a material adverse clause into the deal. KU had a big customer stop buying their largest drug, which did >1/3 of EBITDA, in between deal announcement and deal close. LCI’s stock was hammered and their financing plans ruined when lenders refused to pay for an acquisition that had clearly gone awry. LCI ended up funding a good piece of the deal with a crazy expensive seller’s note.

Ok, background out the way, let’s turn to what cracks me up about Lannett currently: their run of press releases at the end of September

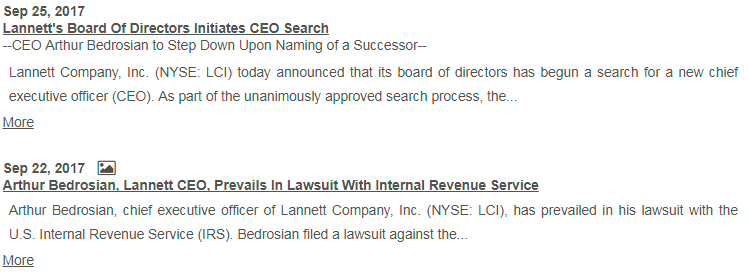

It starts with an announcement that the CEO prevailed in a personal lawsuit against the IRS.

Why does the company need to highlight the CEO winning a personal lawsuit that, to my knowledge, hadn’t been disclosed previously?

The craziest part is they highlight the specific dollar amount the CEO wins from the IRS ($9,758).

Three days after publicly announcing the CEO has defeated the IRS, Lannett announces a search for a new CEO.

The company also announces they’ve filed the NDA for their liquid Cocaine product, which the CEO notes is “among the highlights of his tenure”.

Seriously, who thought any of this was a good idea?

Lest you think I hate the company, I’ll throw some personal notes down here

I’ve got mixed feelings on the blowback for specialty generics jacking up pricing. The more libertarian side of me thinks price jacking is a symptom of a broken FDA approval process for generics, and increasing generics pricing can spur the system to build new capacity quickly for drugs that are in shortage. But then you read about Martin Shkreli and the damage his price raises caused and the liberal side of me tells my libertarian side to go to hell.

I’ll also note I owned a small position in LCIa while back, though I chalk it up to being young and naïve (they trade cheap, would have clear synergies with a strategic buyer, and generics in general are consolidating and this is one of the last acquisition targets). No position anymore.

National Beverage (FIZZ)

FIZZ is the company behind LaCroix, the addictive “soda” water sweeping the nation

And hot damn do I love this company’s press releases. I’d encourage you to read all of them, but the most recent is truly a doozy. Honestly, if you just handed me the press release, I’d assume the following:

You had found it on Bagholder Quotes Twitter in the wake of FIZZ / LaCroix collapsing as a fraud (the stock is actually up ~100% YTD and ~6.5x over the past 5 years).

The letter was written by a bagholder (obviously) who had lost all of their money in the stock

In terms of due diligence, said bagholder was more familiar with Lannett’s version of coke than the rival soft drink.

I would also believe you if you told me you found the letter on the President’s twitter account.

I’m serious- the random suggestions of a conspiracy against him. The call for some sort of investigation. Calling the brands “the genuine essence of America.” I’ve long held the line between Trump’s twitter and bagholder twitter was thin, and this just reinforces my thinking.

Just a few of my highlights from FIZZ’s press release

It starts with random breaks of ALL CAPS and EXCLAMATION POINTS!

It then moves on quickly to arguing the stock is controlled by gambling day traders, not fundamentals

Suddenly we start talking about a conspiracy theory to drive down the company’s value

Now we’re into a short seller conspiracy and a strange critique of passive versus active markets

The obligatory call for an SEC investigation into the shorts

A few sentences that don’t make much sense but portray a massive bullishness on the company

An ending noting the company’s / product’s patriotism

Maybe based on my commentary on the press release you think I’m bearish on the company. I actually don’t follow the company except to check out the CEO’s commentary. If I was a shareholder, I’d obviously be worried about the potential for LaCroix to be a fad, but I’d take a lot of comfort that very few brands achieve the mind share / consumer connection that LaCroix has (how many sodas get written about in GQ? Or get turned into cakes at Whole Foods?), and those brands are generally worth a fortune to a strategic.

As a small anecdote, my Aunt drinks ~4 LaCroix a day and raves about them.

I will remind you of the quote at the top when I mentioned running into “a quirky / charismatic leader making investments and experiments no one else is willing to make / try / see”. Again, I know nothing about this company except that the CEO’s letters make me laugh. But I’d just highlight that this type of quirky letter / communication style could be the sign of a lunatic…. Or it could be the sign of a charismatic outsider CEO who has organically grown the company into a powerhouse and just has a strange way of communicating. Maybe it’s both? Who knows? All I know is that finance can be serious business, but having CEOs like FIZZ’s makes a piece of the job a lot more interesting.

I wanted to leave it there but I had to get a rough answer to the “how much would FIZZ be worth to a strategic” question. Their EBTIDA margins were ~21% in FY17. Monster (MNST) is around 40% and both Coke and Pepsi North America are around 30%. FIZZ is on pace to do $1B in revenue this year and growing >15%/year. Monster trades at almost 10x sales. Sure, MNST has double the margins of FIZZ but it’s also growing at “only” 10%/year and has some health questions long term. Is it crazy to think an acquirer could talk themselves into paying $6B for FIZZ? If you look out to FY19, ~$6B would be ~5x sales or <15x EBITDA (both MNST and KO trade for 20x+) if an acquirer thought they could get FIZZ over 30% margins through synergies (which seems reasonable). That’d multiple would push the stock price close to $140.

Obviously that multiple / analysis assumes that LaCroix isn’t a complete fad, but given how desperate CPG companies are for growth and bolt-on acquisitions and how few of them there are, I would guess someone will talk themselves into it.