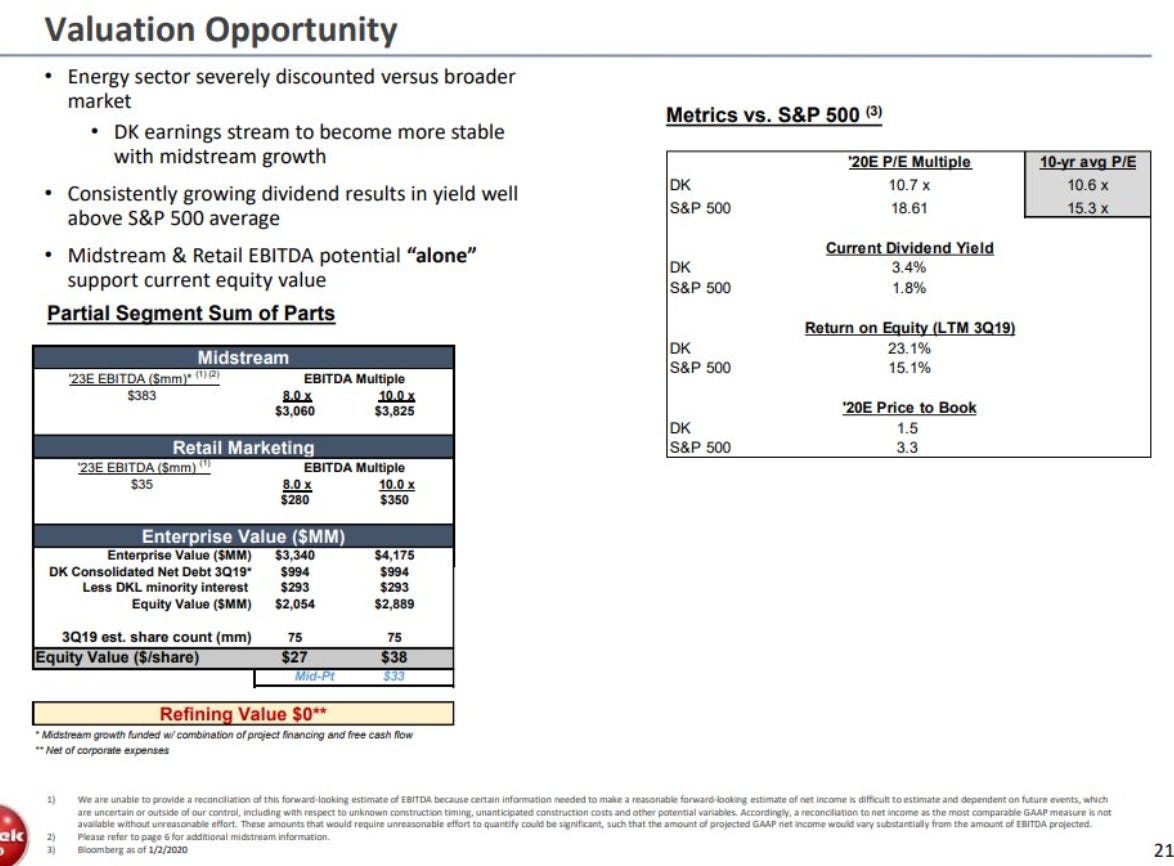

A while back, I mentioned I was going to start a series of "quickie ideas". These were ideas that weren't fully researched yet, but where I thought the position was interesting enough to warrant a small position. Sometimes the idea wasn't fully researched because I simply don't have the scope to research it (for example, with a land bank like JOE, I think fully researching the idea would involve a lot of time spent digging through tax records and on the ground due diligence looking at their property, and while I would be happy to do that if I had unlimited time, opportunity cost and natural limits to how large I would feel comfortable sizing a land bank suggests my time would be spent better on other research) and sometimes it might be because I've hit the limits of what I personally am capable of researching in that field (I'm not a doctor and have no medical training, so while I'm happy to look at and take small positions in quirky biotechs with pre-approval drugs, I don't feel like there's a big edge for me there). Basically, with a quickie idea, I had hit a limit to what I was willing to research based on my skill set or the opportunity cost of researching other stuff, but the company looked interesting so I could take a small position and maybe do a quick write up on it. As so often happens with series, life and other ideas got in the way, and I only ended up posting two quickies. Still, I like the idea of quick write ups, and recently I've been stumbling over a few situations that seem reasonably interesting, so I figured I'd revive the series. I'm going to focus on one such idea today, and if the reception is good I'll post one or two more over the next week or so. I should note that the reason this is a "quickie" is because I have plenty of questions open on it, so if you're knowledgeable on the industry and have areas for improvement, I'm all ears! Quickie Idea #1: Delek (DK; disclosure: long in small size) Delek is an oil refiner. I got interested in them because of this SOTP slide from their investor deck, which suggests their refining business is currently being given away for free.

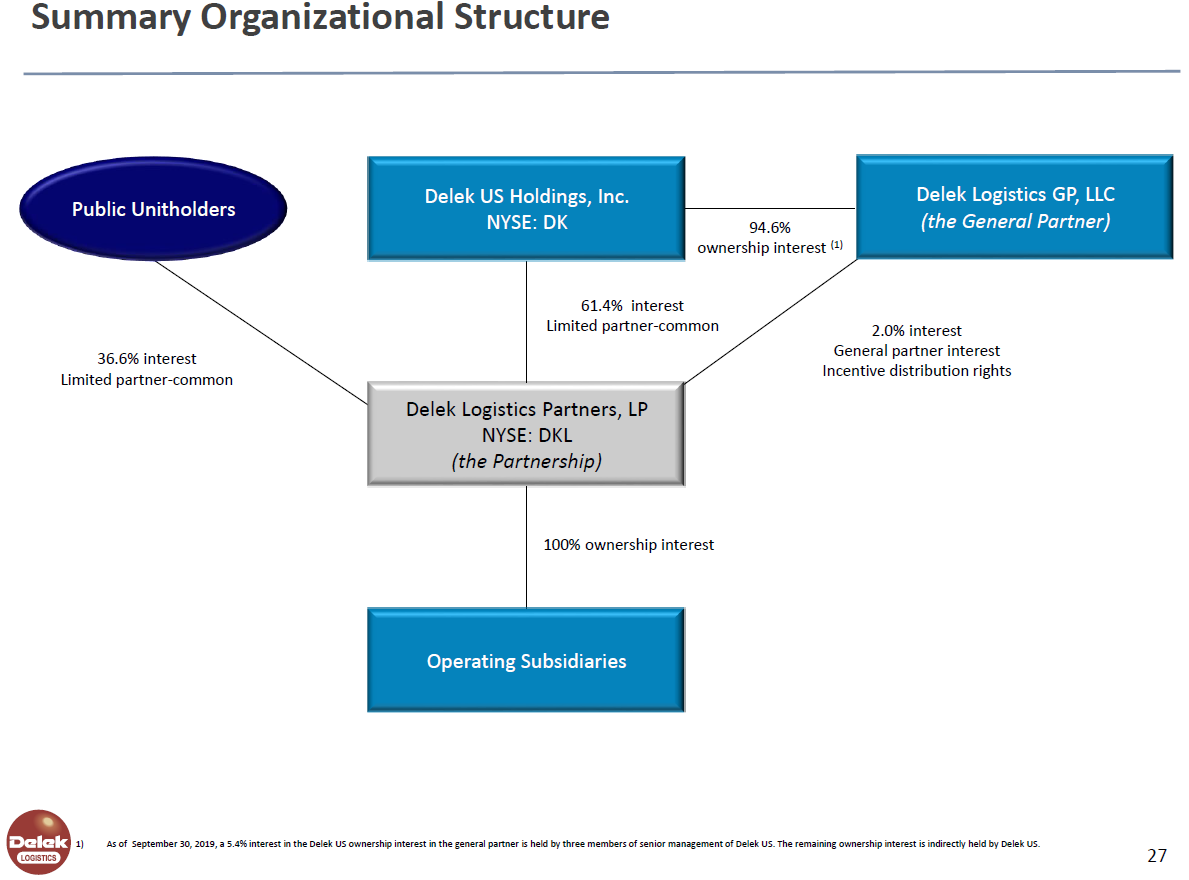

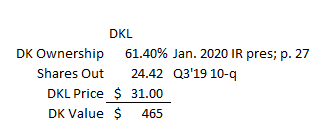

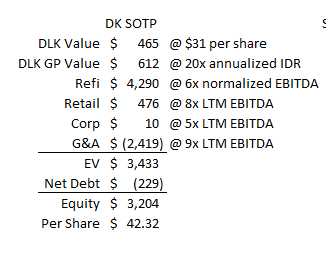

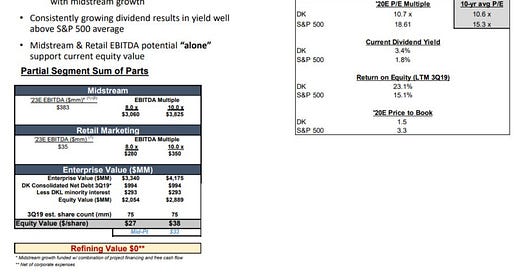

I spent a decent bit of time on Delek, and I'm still not sure where I come out on it. It's obviously cheap, but (as I'll mention later) I'm still not sure I have a good enough handle on their business and some of the details of their accounting still eludes me. I'm going to spend more time on their accounting when they file their 10-K later this month. Anyway, the basis for this idea was that SOTP slide, so let's start by discussing it. I think Delek's SOTP slide paints them in too positive a light. I know it's shocking that a company might try to pain themselves in a flattering light in their IR deck, but bear with me. Delek operates four different segments: retail (operating gas stations), refining (oil refiners), logistics (pipeline, storage tanks, terminals, etc.), and corporate / G&A (corporate overhead). I think the right way to value DK is to value each of those parts individual. Let's start with what should be the simplest: logistics. The logistics business is actually publicly traded under DKL (Delek Logistics Partners); DK owns ~61% of DKL as well as owning / controlling DKL's GP. So the right way to value DK's logistics business is to just apply the market price of their DKL stake and then add something on for the GP.

DKL currently trades for ~$31/share. DK owns ~15m shares, so DK's DKL ownership stake is worth ~$465m.

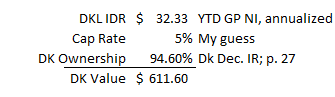

DK's DKL IDR's are well into the money; you can see details of the IDR's on p. 13 of DKL's 10-q, but basically DK gets 48% of any future increases in DKL's dividend. YTD, the GP has gotten $24.2m from DKL. I would guess this goes up at a pretty nice clip going forward, so this is going to be worth a pretty substantial amount. It's tough to put an exact value on this earnings stream, but my rough guess is that the GP stake deserves a 20x multiple (5% cap rate in table below) given it's basically straight margin. DK owns 94.6% of the GP, so if we annualized the YTD distribution and slap a 20x multiple on it (a 5% cap rate), the GP stake is worth >$600m.

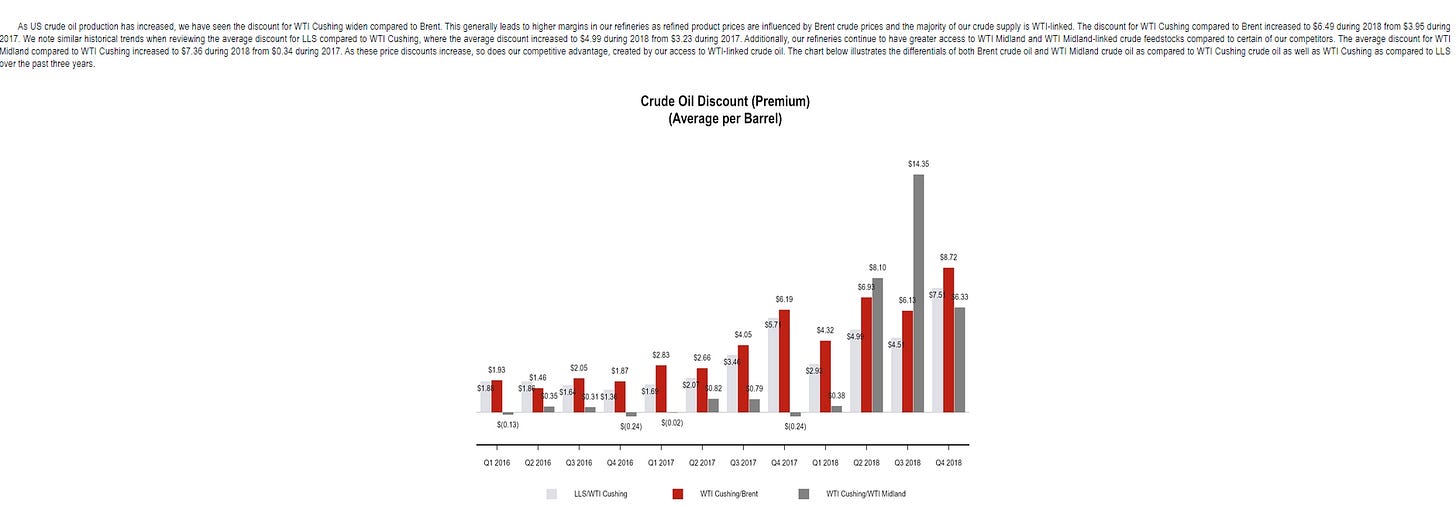

Ok, we've got the DKL pieces of DK valued. Let's turn to the next simplest segment: retail. Retail is a bunch of gas stations in Texas and New Mexico. This segment is rather small; Delek had actually sold all of their gas stations in a prior deal and their current retail segment is the product of the Delek / Alon merger the closed in 2017. There's the possibility for some interesting stuff here, but it's so small the it's not really worth spending time on. Over the LTM, retail has made $60m in segment margin. Peers trade for ~9-10x EBITDA. Let's say that this segment is worth 8x EBITDA; it'd be worth ~$480m. That leaves us with two more segments to value: refining, and corporate / G&A. Of course, those are the doozies. Let's start with refining. Over the LTM, refining has made $835mm in EBITDA (down slightly from 2018's $865m; prior numbers are incomparable given the Alon merger). The big issue with a refiner is that earnings are something of a boom / bust, so you really want to normalize earnings for the environment the refiners are producing in, and there's reason to believe that DK's 2018 / LTM refinery numbers are closer to a "boom" than "bust" earnings number. All of Delek's refineries are located in the Texas / Arkansas / Louisiana region. Basically, they've all been benefiting from super cheap inputs from the Permian drilling boom: Oil and gas companies were doing tons of drilling in the area, so there was tons of crude oil, but there wasn't a lot of infrastructure around to get that crude oil out, so oil in the Permianin area was priced a lot cheaper than elsewhere because it had extra delivery cost. Delek benefited from that differential because their refineries had access to that cheap Permian oil. However, now that more infrastructure has been built out around the Permianian, that price differential should come down and DK's refining arbitrage earnings should drop (the clip below is from their 2018 10-k and shows how big the differentials got for a while).

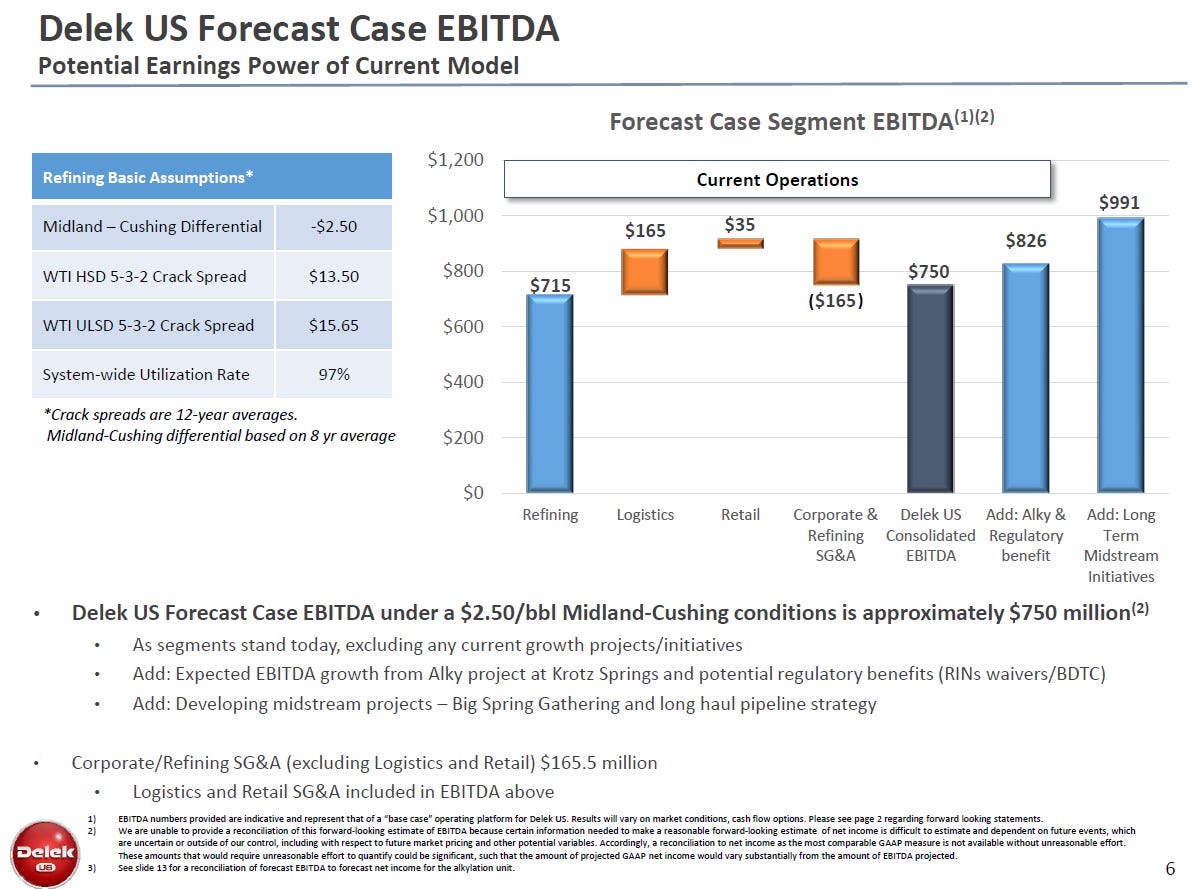

So what do normalized earnings look like for DK's refineries? The company has previously published a slide suggesting normalized earnings were around $715m/year.

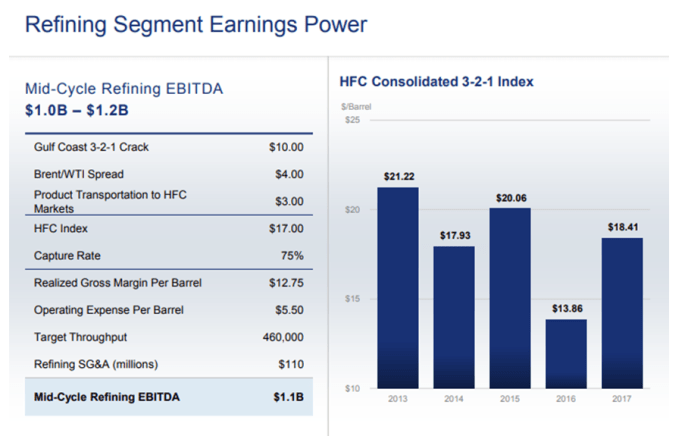

That slide is from DK's Q4'18 earnings deck; interestingly, I haven't seen that normalized earnings breakout in any of their more recent slides. I don't think some of the assumptions match up to current market realities; for example, I believe crack spreads are currently well below what that deck suggests. However, given those spreads and differentials are based on ~a decade of averages, I do think they are interesting for use as a midcycle earnings numbers. (PS I wrote up CVI in the past and used the slide below to guesstimate their midcycle earnings; it suggests a somewhat similar number to what DK's slide would suggest, though obviously it's using slightly different spreads and everything. It also allocates corporate G&A to the refining segment, which as I'll talk about in a second is handled differently in this SOTP).

So let's say refining's normalized EBITDA is $715m (as suggested in Delek's slide). 2019 maintenance + regulatory capex comes is estimated at ~$210m (per their most recent IR; it was closer to $130m in 2018 so I actually think a normalized number would be a bit lower); that would suggest unlevered cash flow from refining is around $500m/year on a normalized basis. I estimate refining is worth ~6x normalized EBITDA, which translates into just over 8x normalized unlevered FCF. That feels right / conservative to me. The last piece we need to account for is DK's corporate overhead / G&A. This is actually one of the areas where I have the most questions, but I'll come to those in a second. Delek reports G&A separately from the rest of their segments. In the LTM, it's ~$270m. It was $250m last year. That is a rather large expense; we were estimating refining's normalized RR EBITDA at ~$715m, so more than a third of refining's earnings is getting eating up by corporate overhead. I mentioned I had questions on that area. I don't find DK's disclosure very good here, so I'm unsure what exactly is in here. For example, does G&A include consolidated corporate overhead from the logistics segment (I suspect yes, and since that should be captured by DKL's value, thos expenses would need to be stripped out for a SOTP)? Does it include all the G&A from the individual subs or just the corporate overhead (I suspect the former)? In a hypothetical merger, is this all so excess that it would be easy to cut out as synergy (I suspect some but not all)? Perhaps I'm simply missing the disclosures, but I've been through the 10-K twice and (I believe) all of their recent conference calls and investor presentations and I'm still unsure. Anyway, given the lack of disclosure in this bucket, I've had trouble with how to think about and value the SG&A. I haven't come up with the exact right answer yet; if you follow Delek and have some thoughts I'd love to hear them. For now, I've settled on just valuing them at 9x trailing EBITDA. Honestly, that's probably too conservative; again, there's not a lot of info on what's in here, but I would guess the costs should scale as the company grows and a lot of them would likely be on the cutting board for a synergy if the company were sold. To value the G&A line at a multiple higher than any of their other businesses are getting is quite conservative! Put it all together and my SOTP comes up with a share price of >$42/share; pretty serious upside from today's price <$30 (note: the model includes both a corporate line and a G&A line. DK has a "corporate and other" segment which includes some smaller revenue streams; I include / value it mainly for my own modeling purposes because I like to track all numbers and segments. Everything I've been talking about is in the G&A line).

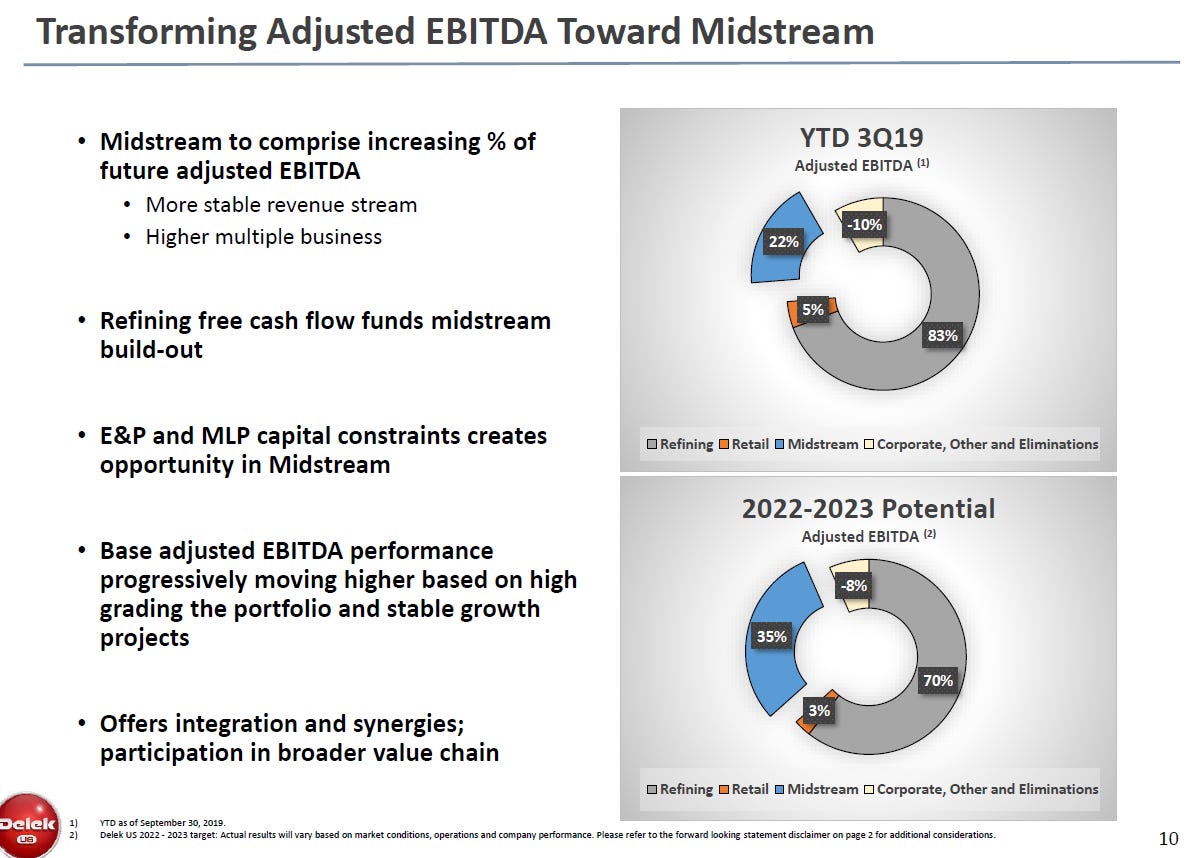

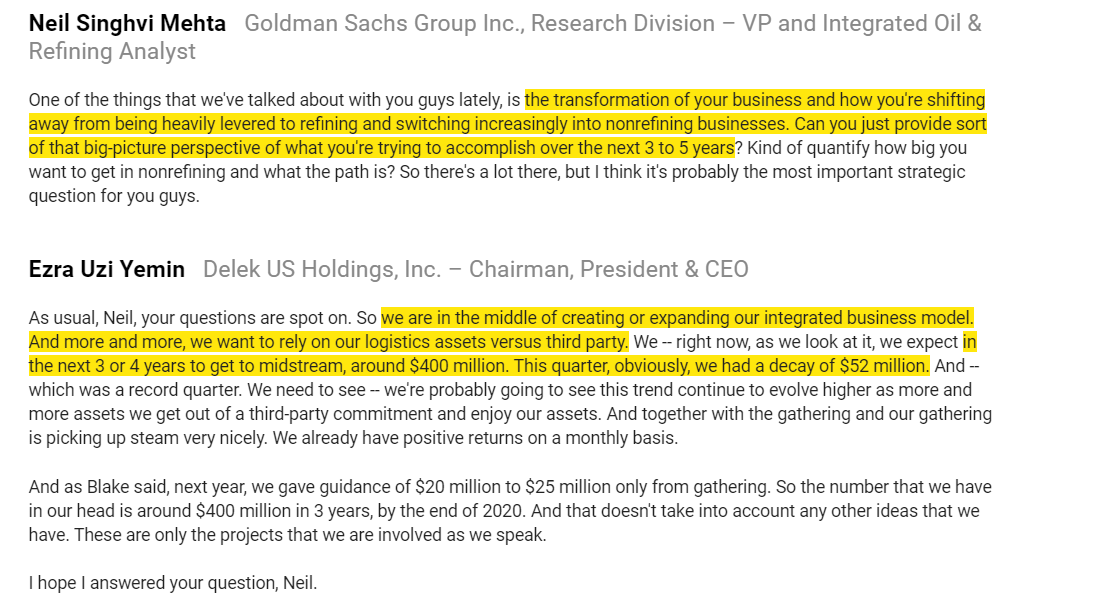

Aside from that valuation / SOTP discount, there are two things about DK that I really like. First, it's one thing for a company to suggest their stock trades at a discount.... but I don't put much stock in those words. I like to see companies take advantage of that discount by buying shares, and management teams show their confidence in the discount by purchasing stock on the open market. DK checks both those boxes. The CEO bought ~$1m worth of stock in mid-November, and the company has been an aggressive share repurchaser since 2018: they bought back ~9m shares for ~$365m in 2018 (~10% of shares outstanding), and this year they'll likely buyback 6-7% of the company (as noted on their Q3'19 call, the company has bought back ~16% of their shares outstanding since they started getting aggressive with share repurchases in Q2'18). If the company is right and they're trading at a big discount, those share repurchases are going to pay off in a big way over the long term. Second, increased earnings from their logistics / midstream business. DK is plowing most of their growth capital into the logistics side, which should be a steadier business worth higher multiples than the refining business. I like that for a lot of reasons, but in particular I like it because I've historically had a lot of success investing in businesses that traditionally are worth a low multiple but are plowing their earnings into growing a business that should get a higher multiple. I'll use cable as an example: traditionally, it was probably an 8x EBITDA business because all of the earnings came from video, which was much lower margin and more capital intensive than broadband. As more and more of the earnings shift to broadband, cable's deserved multiple should go up because broadband free cash flows better given higher margins and lower capex (and because it cash flows better, a ~12x EBITDA multiple on a broadband business is a similar unlevered FCF multiple as an 8x EBITDA multiple on a video business). DK could be going through something of a similar thing here: as more of their earnings come from higher multiple midstream businesses, investors may anchor on old multiples without looking at the dynamics of the underlying business. That can present opportunity, and if DK keeps up with the aggressive share buybacks they'll be well positioned to take advantage of that opportunity. (Slide and commentary below from DK's Q3'19 earnings just to show how big the shift towards midstream / logistics they are talking about is).

At this point, I think I've covered most of what I want to cover here. I think DK is obviously cheap, at has some really interesting assets and an aggressive share buyback policy, and what's more exciting than investing in a sector that's been beaten down (as anything refining / oil has been over the past few years)? All of which begs the question: Why isn't this idea bigger / what's the sticking point? A few reasons

There is a lot of dependence on oil and oil outputs here. Yes, the logistics / pipeline pieces should be isolated from the near term movements in oil, but pipelines basically move oil to and from refiners. To say that they're completely isolated from oil demand / prices seems insane to me; if DK's refineries are in for a series of tough years, it seems very likely that the pipeline value is coming down (either because the rates will need to be cut or because the refiner is bankrupt and can't pay!).

A lot of refining comes down to the outlook for oil pricing and differentials / crack spreads in whatever geography it's exposed to; Delek has a lot of exposure to Permian, and I don't feel like I have a great grasp on the long term drivers there.

It also looks like spreads are currently well below what's implied in my normalized earnings number. I'm fine buying into weaker environments; in fact, that's where money is normally made! But I like to keep positions with commodity components smaller to allow room to buy into more commodity weakness since it's so far outside of a company's control.

Note that DK controls ~95% of DKL's GP; the other 5% is controlled by DK's management team. This raises some red flags and has the potential to create some misaligned incentives...

I guess my overarching view here is this: while I've done work in the space so far, I'm by no means an expert. I'm going to keep doing work, but I'm not sure I'll ever feel comfortable enough with my refining knowledge / my edge in the space to make this a bigger position (and it has to be sized a bit smaller than a lot of other things given the cyclicality!)

Other odds and ends

In general, in speaking with investors more knowledgeable on the space, I've gotten really good feedback on DK's CEO. I don't have a strong opinion, but I have liked what I've seen from him in terms of communication and capital allocation.

One analyst said something along the lines of "every deal you've done has been an absolute steal" on a conference call; I'm not sure how true that is but obviously that's the type of CEO I like!

The company has a few growth projects that they've invested in that aren't currently earnings anything but should have pretty significant value. Some of these projects are in DKL, so I assume their value is fairly captured in DKL's price. However, some have had major investments and haven't produced earnings yet and are fully owned by DK, so they could be a source of hidden upside. For example, DK has invested ~$75m into Wink to Webster, and on their Q3'19 call they guided that they could refi that project and get a bit of cash back. That could be an incremental boost to my SOTP.

In addition, DK has been talking about some other investments they've been making that should improve earnings soon. The big one here is the Alkylation Project at Krotz, which finished in early April. This was a $138m investment that DK think will improve EBITDA by ~$50m/year.

Another thing that really attracts me to DK? It's accounting is complex, which can make it screen funny. Because DK controls DKL, they have to consolidate DKL. That makes their financial statements somewhat unrepresentive of the actual economics of the business. For example, consider the sentence below (from their Q3'19 earnings release). DK has basically no net debt (~$159m of net debt versus >$800m in annual EBITDA); however, their balance sheet shows a billion of net debt because they have to consolidate the non-recourse DKL debt.

Absolutely no reason to sell after today right? Impatient special sitters I imagine. How does mgmt not start buybacks at this point. Stock dividend isn't a taxable event though - why don't they just distribute DKL?

Is this a good deal or is the selloff just regular DK pessimism?

https://ir.delekus.com/news/news-details/2024/Definitive-Agreement-Signed-for-FEMSAs-Acquisition-of-Retail-Assets-from-Delek-US/default.aspx