This year has felt a little bit like groundhog day to me. No matter how many rocks I flip over, I keep coming back to three core themes in my portfolio (and on this blog):

Pre-deal SPACs with good sponsors trading below trust are awesome risk/rewards

Obviously PSTH is/was a big area of focus here (enough that it almost warrants its own category), but plenty of other SPACs slip in as well!

Discovery is too cheap as a standalone and their deal to merge with HBO is going to be a killer

Today I wanted to revisit the third point: publicly traded cable companies are too cheap.

I will admit that I am talking my own book here; cable companies have been my largest position for several years, and while they have done well I think the set up today is as good as it’s ever been. Cable companies are spitting off free cash flow, their core business is not just recession resistant but was actually boosted by the pandemic, they are getting pricing increases as people upgrade their speeds, the levered buyback model that most of them run is rapidly decreasing their share count, and they are shrinking their share count while trading at a mammoth discounts to the private market value implied by the prices significantly inferior assets are trading at. It all makes for a powerful combination: cable companies can continue to grow and compound at attractive rates for years.

So that’s my thesis on cable companies. But I wanted to write an article today to highlight one specific thing: I think Altice is the “best” large cap domestic stock out there.

That’s a funny thing to say. What is the “best” stock? How do you define that?

To me, being the “best” stock means Altice is the best combination of cheapness + upside + good industry / moat + capital allocation. Altice is not the “best” on any of those individual qualities, but when you combine them all I know of no other large cap domestic company that does close to as well as Altice. Consider:

Cheapness: ATUS is trading at a material discount to its peers (like CHTR) and private market transactions (like the WOW deal I’ll discuss further in a second). So ATUS is cheap relative to its peers, but it’s also cheap in an absolute sense. Free cash flow to equity (cash from operations less capex) came in at well over $2B last year; ATUS’s market cap is just over $16B, so you’re paying under 8x free cash flow to equity for ATUS right now (note the FCF number is somewhat juiced by ATUS’s NOLs that shield them from taxes, but even adjusted for that ATUS is darn cheap).

Upside potential: There are plenty of stocks that are cheap, but often they don’t have huge upside. For example, companies with tons of cash on their balance sheet might look cheap on an EV / EBITDA basis, but if the stock traded up ~5% they would be ~fairly valued. That’s not the case with ATUS; ATUS runs reasonably levered, so it would take a big move in the share price to get the company to peer / precedent transaction valuation levels. ATUS’s stock would need to go up 50% to hit the multiples WOW just sold assets at, and I think ATUS deserves a strong premium to WOW’s multiple.

Good industry / moat: I won’t hit this too hard as it’s been discussed ad nauseum on this blog / elsewhere, but the cable business is a very good business. Massive moat (ask Google Fiber about the economics of overbuilding cable!) delivering a completely recession resistant product (high speed internet), and the demand for the product will only grow over time as we spend more of our lives online and need higher speeds for all of the extra devices we have in our homes and data intensive applications on the horizon (8k video, AR, etc.)

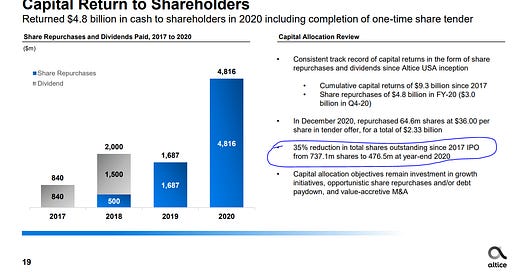

Capital allocation: Altice isn’t just sitting around while their shares are languishing at a value multiple. The company is hammering their float with share repurchases; in fact, they’re retiring shares so quickly that people are running the math on how quickly they’ll take out all of their public float. I think the quotes and screenshot (from ATUS’s Q4’20 earnings deck) below do a nice job of showing that strategy.

So, yes, there are companies that are trading cheaper than Altice. And there are companies with bigger moats than Altice, as well as companies with more upside in a bull case than Altice. And I guess there are companies repurchasing shares more aggressively than ATUS, though honestly those are few and far between. But Altice is pretty darn cheap, and it’s got a great moat, and the upside it if plays out well is substantial (and increasing as they continue to buyback shares at these levels). I know of no other companies that come close to Altice on all of those metrics.

The last time I publicly wrote up the cable companies was in February, and I was spurred to do so by the big multiple Cable One paid for Hargray. The impetuous for today’s post was similar to February’s: the big multiple paid to buy up some of the pieces of WOW! As I was reading WOW’s deal call, I could only think of one thing…. “My god; ATUS is a steal right now,” and I wanted to use that call / deal to show just how cheap ATUS is.

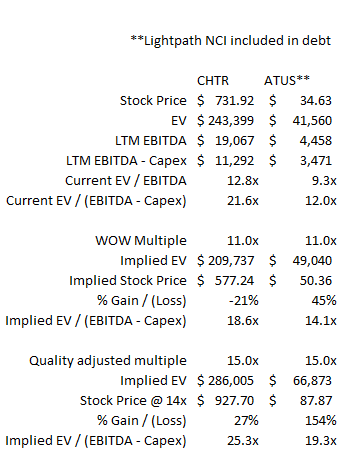

Let’s start with the headline: at current prices, Altice trades for ~9x EBITDA. Their closest public peer, Charter (CHTR), trades for ~13x EBITDA. WOW! just sold five service areas at a headline multiple of 11x. So ATUS is trading for a discount to both their public market peers and precedent transactions. What’s nice about ATUS is that it’s rather levered, so if they could just close the gap to the WOW asset multiple, the stock would go up almost 50% from here.

So that covers “it’s cheap” and “upside”….. but I actually think ATUS is cheaper and has more upside than that analysis for a simple reason: ATUS’s assets are significantly better than the assets WOW just sold, and given that quality Altice’s assets would command a large premium to the WOW multiple.

Why do I think ATUS’s assets are better? WOW is a cable overbuilder; they are competing in markets with three competitors: themselves, the original cable player in that market (Charter, Comcast, etc.), and the legacy telecom player. In some markets, the legacy telecom player might have built out fiber to the home, which would make the market unbelievably competitive, while in some market the legacy telecom might still be fiber to the node / DSL.

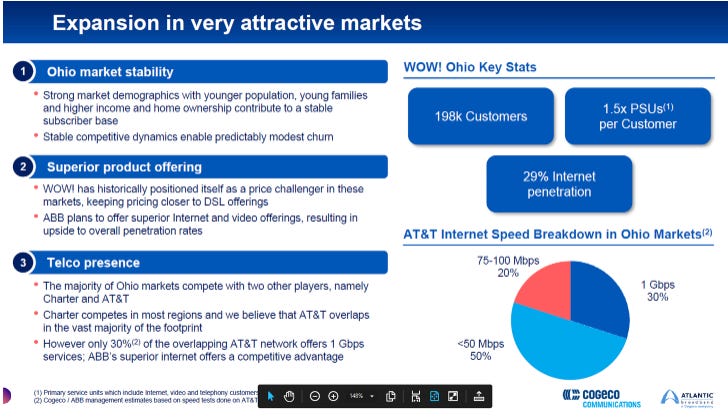

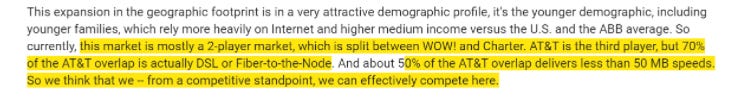

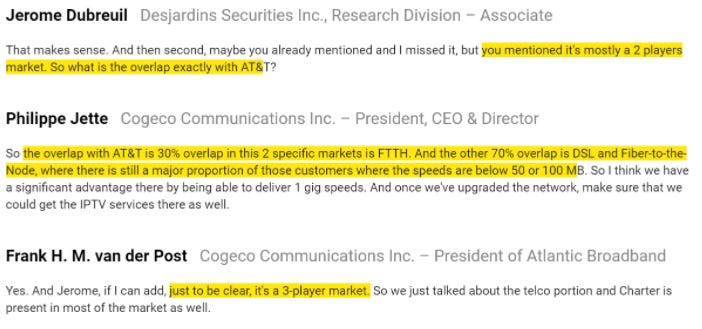

One of the buyers for WOW’s assets was Atlantic Broadband (ABB), which is owned by Cogeco. Below are some quotes from Cogeco’s deal call explaining exactly what the competitive landscape in WOW’s markets looks like, as well as a slide from their deck that laid out some stats on WOW’s assets.

Altice is an “original” cable builder. Yes, some of their markets might be three player / overbuilt markets, but the vast majority of their markets are two player markets where it’s just ATUS and the legacy telecom player. Again, in some markets, the legacy telecom player will have upgraded to fiber to the home, while in some markets the legacy player will still be selling DSL / fiber to the node. Either way, ATUS’s overall business is unquestionably better than WOW’s simply because there’s less competition in much of ATUS’s portfolio.

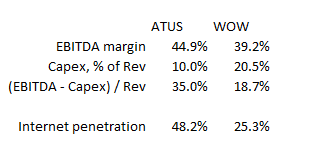

You can see how much better ATUS’s overall portfolio is than WOW’s simply by looking at their LTM financial metrics. ATUS has significantly higher internet penetration, higher EBITDA margins, lower capex as a % of revenue, and much higher free cash flow conversion ((ebitda less capex) / Revenue). (Note that the below is for WOW's overall, not the asset’s WOW sold, but the assets are close enough to WOW’s overall portfolio it’s not worth splitting hairs).

All of this is a long way of hammering home one point: ATUS’s business is significantly better than the assets WOW just sold, and they deserve a way higher multiple because of that.

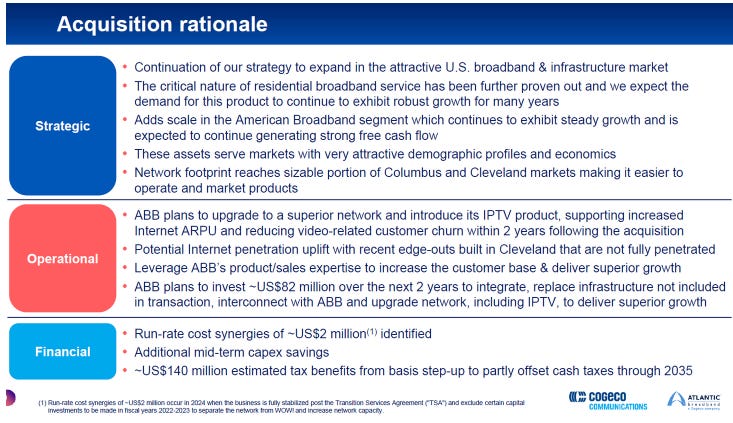

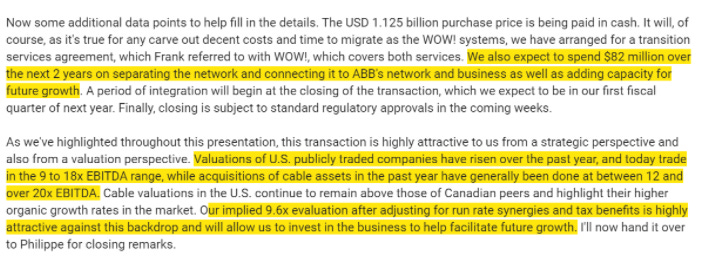

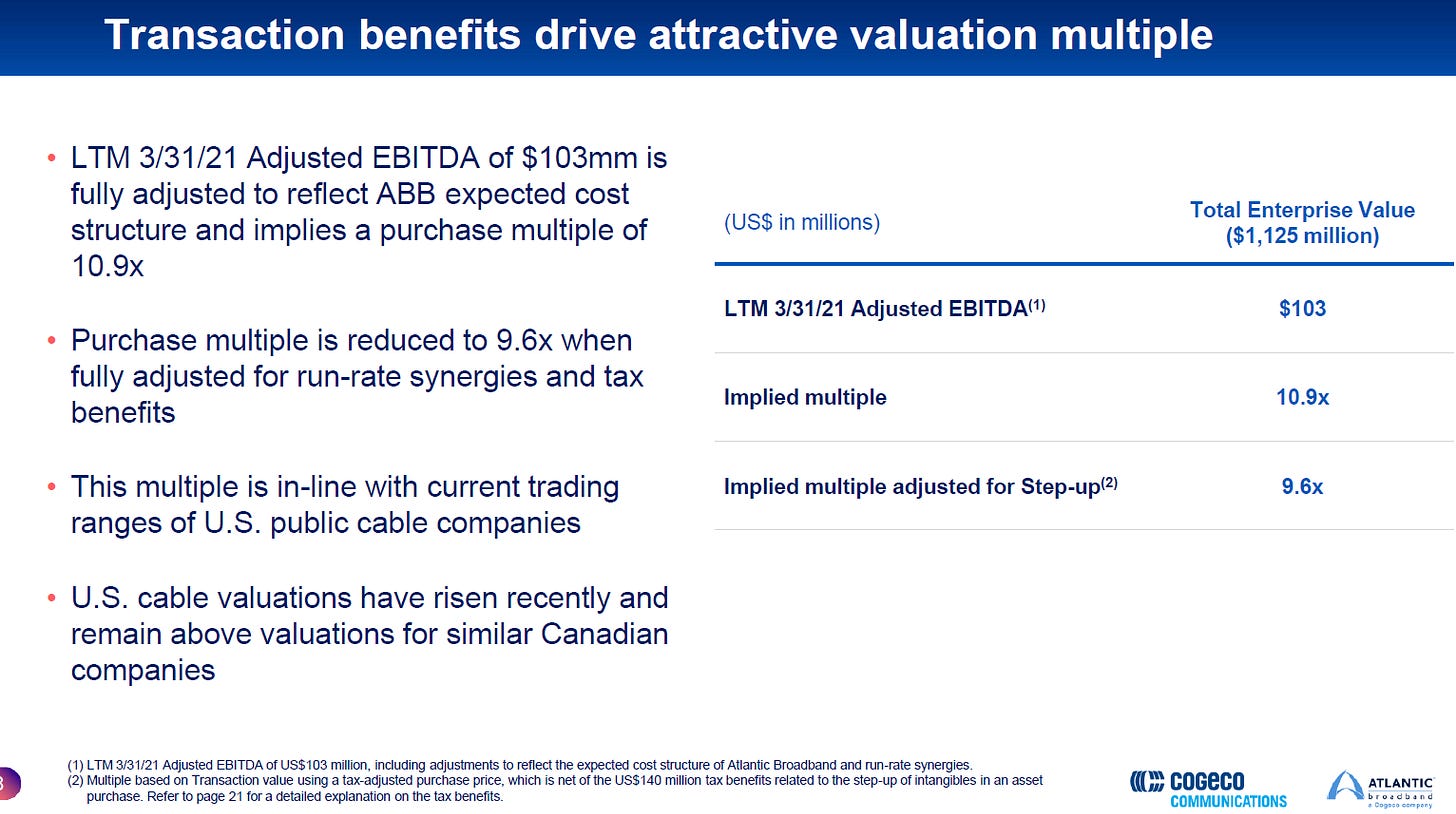

But I think it gets even better than that if you dig a little deeper. As I noted earlier, Cogeco was one of the buyers of WOW’s assets, and if you dig a little deeper into their call I think you can find reasons to believe that WOW’s multiple is a little understated in this deal (i.e. Cogeco is actually paying a higher price than the headline number would have you believe, meaning ATUS is even cheaper than a glance).

To start, below is Cogeco’s deal rationale slide.

The first thing that jumps out to me there is the synergy number. This is a >$1B transaction of assets generating >$100m in EBITDA, and the synergy number is less than $2m? How is that possible?

Turns out that the WOW deal is structured as an asset purchase, with basically no overhead coming through.

Why does that matter for our purposes?

In most mergers, you’ll see two numbers: the pre-synergy multiple, and the after synergy multiple. Because the synergies from buying a smaller competitor and cutting their overhead can run pretty high, those two numbers are often very different. For example, Cable One bought Hargray for 17.2x pre-synergy and 12.7x after synergy.

But that’s not the case for WOW: it’s a pure asset purchase with almost no synergies. So I think that 11x multiple that WOW’s assets fetched is particularly instructive when think about valuation versus Altice.

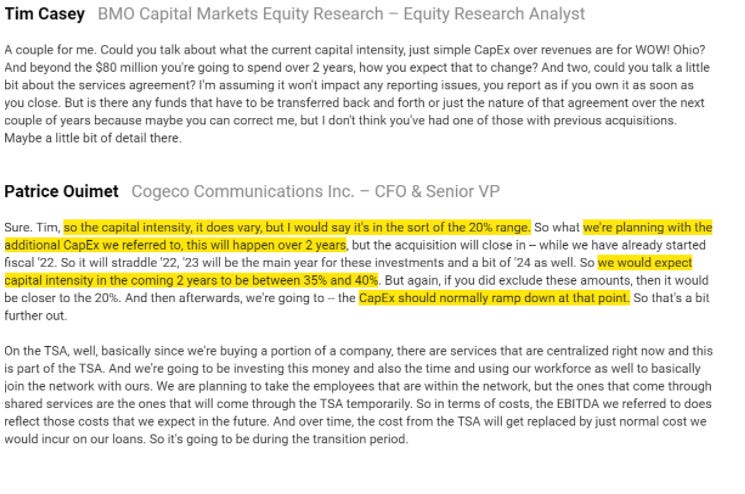

In fact, I think you could argue that the WOW multiple is a little higher than the headline number Cogeco would have you believe. Cogeco is planning on making a big investment into WOW’s markets in order to connect them to the ABB network and get them ready for future roll outs; they’re forecasting an incremental $82m over the next 2 years, which will take capex as a % of sales to 35-40%. The WOW assets do ~$100m in EBITDA/year, so that’s an awful big investment that is going to take FCF from these assets to effectively nothing over the next two years. ATUS is gushing free cash flow right now, so that’s just another little point showing how much better the ATUS assets are than WOW’s assets / emphasizing that ATUS assets would trade at a big premium.

So, yes, WOW is going for an 11x EBITDA multiple. But I think the “actual” multiple is a little higher once you factor in the capex step up Cogeco is going to need to make.

Anyway, let’s ignore that and simplify to say that WOW is going for an 11x multiple. The reason I think that’s so important is the lack of synergies means this is more a financial purchase than a strategic one (a strategic buyer is someone who has operating synergies, and there aren’t any here). So we could look at the WOW multiple as the effective multiple ATUS could get if they were sold to a private equity firm or in a take private transaction or something.

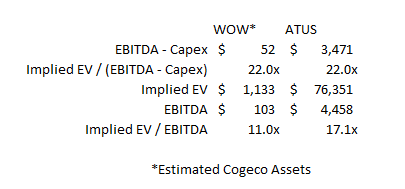

Of course, in such a transaction, we’d need to adjust for ATUS’s quality advantage over WOW. My best guess is that if WOW went for 11x EBITDA in a transaction, ATUS would be worth >15x EBITDA if they sold. I get that number by looking at after-capex cash flow: WOW’s EBITDA margins are ~39%, and their capex intensity is ~20%. So you can basically double WOW’s multiple to get their after tax cash flow multiple (i.e. 11x EBITDA equals ~22x (EBITDA - capex) multiple). If you assume cable assets are worth 22x (EBITDA - Capex) based on the WOW deal, then ATUS is worth a high teens EBITDA multiple given their dramatically lower capital intensity. I realize I just threw a lot of numbers at you, so the chart below might clarify everything a bit.

ATUS is currently trading for just over 9x EBITDA, so even approaching that multiple jump would be a huge stock price uplift. If ATUS was worth the same multiple WOW went for (11x), ATUS’s stock would be worth ~$50/share. If ATUS was worth ~15x EBITDA because their assets are better than WOW’s, this is a >$85/share stock. That’s a 150% return from today’s share price of <$35/share.

I get it’s a little bold to say a >$15B market cap stock that is covered by more than ten sell side analysts is trading for a fraction of its fair value, and I realize ATUS isn’t going to $85/share tomorrow. Heck, it almost certainly won’t get there this year, and it probably won’t hit that mark next year either.

But a lot of aggressive share price forecasts are based on multiple assumptions that aren’t rooted in reality or based on management teams who have no desire to create / realize shareholder value suddenly deciding to unlock shareholder value (i.e. it’s a controlled company with management more focused on lining their pockets than boosting shareholder value). I don’t think either is the case for ATUS. The fundamental value I’m talking about here is well supported by multiple recent precedent transactions of assets that weren’t close to as good as ATUS’s. And management clearly sees the disconnect between their share price and the fundamental value and is hellbent on doing something about it given their aggressive share repurchase plan, and with the the extreme discount they’re repurchasing shares at every share they retire adds a serious amount of value to each remaining share.

So I think the stars are aligned for Altice right now. Their stock has stalled out this year on fears of slowing growth and competition, which has caused their multiple to compress way below peers and what (inferior) comparable assets are transacting for. The management team is taking advantage of the share price to aggressively buyback shares, and they show no signs of slowing down. And, given their leverage, a snap back to peer levels would result in massive share price appreciation.

Altice might not be the cheapest company in the world. It might not have the most upside, and there are certainly better management teams out there. But, if you combine all three of those (and a host of other factors), I know of no other company that approaches Altice.

That’s why it’s the “best” stock to me.

Four last last things before I go:

I probably could have saved myself a lot of time and effort by making this post even simpler: Altice bought back 12% of their stock late last year at $36/share. The stock is trading below that level while languishing at a multiple below where peer / inferior assets trade at. Can something go wrong with that set up? Sure…. but everything about it screams “there is value here".

With any investment, it’s worth asking “why does this opportunity exist.” With Altice, I suspect it’s because people are worried about Altice’s strategy in two ways. First, Patrick Drahi controls Altice given his huge stake and super voting shares. Altice Europe had a rocky last few years; the stock had a mini-blow up when it proved to have cut costs too far and taken leverage too high, and then Drahi took them private at a bargain multiple. I suspect Altice is getting a big Drahi discount both because of that control and because of the “have they cut costs too deep / is this going to blow up?” risk (I have discussed that risk previously, but Altice is way, way ahead of Charter and Comcast on margins and capex efficiency). The second risk is that Altice’s markets are generally more competitive than Charter / Comcast’s as Altice has high overlap with Verizon Fios, so people are worried about the competitive risk + maybe building in a “Altice has pushed pricing and costs to the limits; growth will be much slower there than at peers.”

My rebuttal to those points is simple: yes, they are real risks, but at this point you are more than getting paid for them. Altice is aggressively buying back shares (increasing your upside), and worse markets than Altice’s (like the markets WOW just sold!) are going for premium multiples. Shareholder protection in the U.S. is much better than Europe; if Drahi tried to take ATUS private, it would put Altice in play and open them up to a competing bid from a strategic.

I’ve generally written about Charter on this blog, which I guess raises the question: why is Altice “better” than Charter. The answer: I still like Charter a little more (particularly through LBRDA). Yes, they’re more expensive than ATUS, but I think that’s cause they haven’t leaned on their pricing / cost cutting levers quite as hard as Altice; that’ll come in time, so there’s a lot more growth in Charter’s future than Altice. And I like Charter’s management a little more, and Charter’s mobile strategy is further along and better than Altice’s (IMO). So I still lean Charter…. but I think it’s a pretty close call. Altice’s higher leverage and more aggressive buyback strategy make a really big difference, and the multiple difference is getting pretty large these days…

Cogeco will get some tax benefits from buying WOW; they argue those benefits decrease the effective multiple they paid by >1x. Nothing wrong with that argument; I highlight it just to be fair. Even if you adjust for that tax benefit, Altice is trading below the multiple WOW just went for (and that tax benefit would almost certainly be there for a hypothetical buyer if Altice sold for cash, so I see no reason to think Altice couldn’t get that multiple or significantly higher given their assets!)

Great article! Agree on ATUS being highly attractive. On Charter, the FCF conversion is actually a bit better, given that there was no adjustment for “growth” capex (therefore more attractive). For Altice you can also make the adjustment, and the FCF multiple is more around 7x

Bad reaction to quarterly results