My recent posts on NYCB (here and here) have generated quite a bit of inbound interest and some really fun discussions with readers, so I figured I’d do one follow up piece.

I mentioned it in both posts, but NYCB today trades at ~50% of tangible book value; there’s plenty of questions about if they can make it to the other side of their current issues, but if they can their stock will probably do well (that’s a big if though!). Given the upside if they can make it through, NYCB could be an interesting investment worth looking at.

When considering NYCB as a potential investment, investors don’t just need to consider NYCB stock and all the pitfalls (and opportunities) it presents, they also need to think about the opportunity cost of buying NYCB. That opportunity cost is broad: after all, you need to compare NYCB to every other publicly traded security! But, in general, when thinking about opportunity cost, it’s best to try to segment by comparing intra-industry opportunities and then try to compare against other stuff. So, for NYCB, I think the best way to think about NYCB opportunity cost is to compare it to other bank stocks (and, from there, compare your favorite bank stocks to everything else, whether it’s momentum AI plays or small cap international stocks).

In terms of banks, I think the most interesting opportunities are things that have been knocked down by the NYCB sell off. The KRE is down ~5% since NYCB reported, and many banks are down even more. NYCB is one of the last banks to report, so you’re seeing banks that had already reported numbers and asset trends getting their stock smacked by a pretty large amount on fears that they have NYCB like exposure even though we already know their loan trends and many don’t have exposure anything close to like NYCB!

So I wanted to dive into one company that could be an opportunity: BankUnited (BKU).

BKU reported earnings January 26. Earnings were fine, and the stock barely budged on them. Then NYCB reported their awful results on January 31. BKU’s stock sold off in sympathy, diving almost 20% in a few days before recovering ~half those losses over the past few days. As I write this, the stock is down ~9% year to date, with all of those losses coming after NYCB’s earnings report.

This is interesting because BKU was explicitly asked about rent-regulated loans (the loans that got NYCB into trouble) on their earnings call and they noted they have insignificant exposure ($121m of loans on a ~$25B loan book is basically zero).

So here you’ve got a bank whose stock is down ~10% on NYCB sympathy fears that basically don’t apply to them. As I write this, the stock is trading for ~$27.50/share, which looks pretty cheap versus tangible book value of $33.62/share and 2023 EPS of $2.38/share (down from $3.54/share in 2022!).

Put it all together, and the stock is probably interesting… but I actually wanted to use BKU to highlight one other thing: the problem with management teams who don’t own stock.

Now, this is not a problem unique to BKU or the banking sector, but it’s just a problem that’s just so vividly illustrated by BKU. As noted above, BKU is trading pretty cheaply. They’re trading for roughly 80% of book value and a low double digit earnings multiple, and earnings were depressed in 2023 by some one time charges and the rapid rise in interest rates. I don’t think it’s a stretch to say BKU trades for 7-8x normalized earnings.

BKU is well capitalized (CET1 of 11.4%) and loans to deposits are in the low 90s. They don’t have any obvious asset issues (0.52% non-performing loans to total loans), and they should have some deposit franchise value (they’ve historically hit >30% of deposits as non-interest bearing, and they think back to that level). ROE was in the low double digits in 2022; I see no reason why they can’t get back there over time given that deposit franchise.

What I’m trying to get to is this: if you were just looking at a quantitative screen, it’d be pretty obvious BKU shouldn’t trade for under book value and it’s too cheap…. but they are trading for under book value, and that cheapness is something that management should be taking advantage of. Instead, the company is explicitly focused on growing their balance sheet and specifically their loan book.

Just a wild decision. There’s simply no way the risk adjusted returns from growing the loan book can compare to buying back stock at 80% of book. From a shareholder perspective, it’s completely irrational.

However, from a management standpoint, growing loans versus buying back stock is completely rational if you think insiders are most concerned with maximizing their own personal payout. Management and insiders own very little BKU stock:

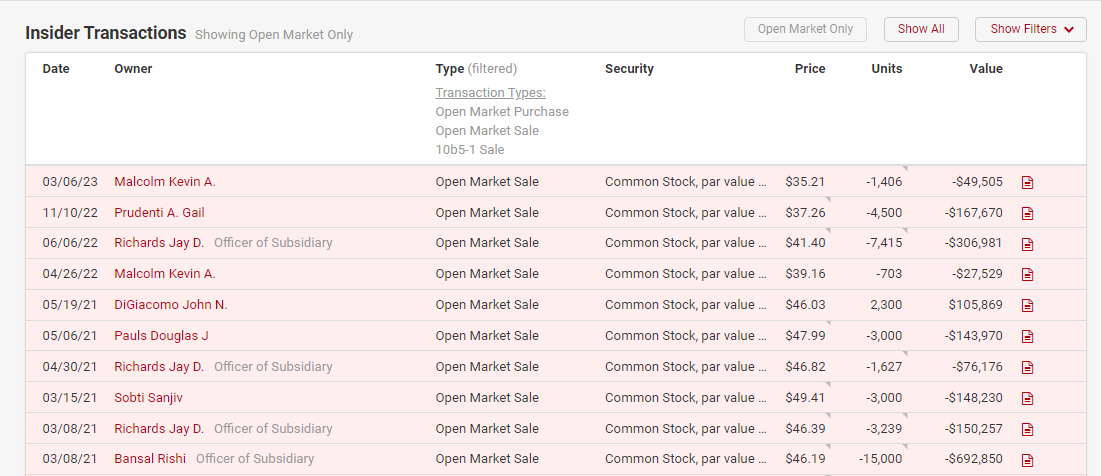

And insiders have basically only ever sold stock, never bought any. That’s particularly interesting as almost every bank had a wave of insider buying in Spring 2023 as bank insiders took advantage of depressed prices on the heels of SIVB and FRC failing / bank insiders tried to build market confidence to avert a bank run (it could be either, depending on who you asked). Here, for example, is VBTX’s insider transactions over the past year; it’s broadly representative of most smaller banks.

BKU sat out that wave of insider buying:

Now, you might be thinking, “Andrew, the CEO owns >300k shares; that’s almost $9m at today’s prices. That’s a decent chunk of change; how could he not be motivated by that ownership?!” And, while it’s true the CEO has a decent amount of stock, it’s honestly not huge compared to his ~$6m in annual comp.

I think there’s a very credible argument to be made that the CEO (and all insiders) would be personally better off growing the bank’s balance sheet and asset level versus the stock price. Sure, both would be nice, but ultimately insider pay is a function of the size of a bank. If the bank grows asset levels, then pay is probably going up. Insiders need to own a heck of a lot of stock for it to make more sense to increase shareholder value versus blindly grow; BKU isn’t close to that level of stock ownership!

Consider this very simplified example: if BKU bought back 10% of their stock over the next year, and the stock went up 20%, the CEO would make ~$1.8m on his share ownership. In contrast, if BKU took all of that equity and invested it into loans (and assuming they used ~their current leverage ratio), BKU’s asset base would grow by ~10%. Insiders could all go to the board and say “hey, this is now a much bigger bank; we need a commensurate pay raise.” That request would almost certainly get approved, resulting in the CEO’s pay going up by ~$600k (and directors would be happy too; a 10% bigger bank would justify a little bump in their director fees….. and, for everyone involved, running / directing a bigger bank would come with a little added prestige!).

What’s better: a one time $1.8m gain in share price, or taking home $600k more annually?

I’d vote option B, and I’d guess most executives would as well (and yes, this was a bit of a simplification, but it’s directionally correct!).

I also think you can see some misalignment in BKU’s bonus metrics. Insiders are paid on growth in EPS, non-performing assets, and efficiency ratio.

All of those metrics have issues:

EPS growth: This is a simplification with some assumptions, but if your stock is worth 3x book value and trades for 1x book value, shareholders would be way better served if you just bought back as much stock as possible. However, buying back stock at that level almost certainly won’t result in as much EPS growth as more lending, so insiders will logically tilt more towards loans.

NPA ratio: one of the sneakiest metrics to game, you generally throw an NPA ratio in a bonus payout to discourage excessive risk taking. However, it’s too easy to game; you could report 0% NPAs every year by simply only investing in treasuries. That’s extreme, but an NPA ratio bonus metric often encourages executives to avoid any loan with default risk, even if it’s a great risk adjusted reward.

Efficiency ratio: there’s generally return to scale, so an efficiency ratio metric can encourage insiders to grow the bank even if the shareholders would be better served by shrinking (i.e. if the stock trades for half of book, shareholders would do better with share buybacks even if the lower asset base resulted in a bit less efficiency).

There’s no such thing as a perfect compensation package. In all honesty, BKU’s comp package is probably right in the middle / average versus other banks. So I am picking on them a little.

But BKU trades at 80% of tangible book. It’s stock is down ~10% since NYCB, and the NYCB issues generally don’t apply to BKU. It’s probably an opportunity here…. but the decision to not buy back shares is kind of crazy to me, so I just wanted to use that and the incentives at play to highlight some of the common pitfalls and incentive issues you’ll see at companies.

Another negative in this set up, low stock ownership vs high current comp, is you are less likely to see a bank sale out of this set up. I contend the set up to look for is : p:tbv <1, high CEO ownership, high % of commercial DDAs in deposits, and maybe most importantly CEO is older than 60. Great recipe for a sale

Liked the critical thoughts on incentives!

The NPA ratio (I guess it is non performing loans over total assets or loans) can also be depressed by growing the bank I guess, since most assets do not get non performing status immediately. (Same for growing insurance)