Yesterday I posted a podcast with John Maxfield on what’s going on with banks right now. I’m obviously biased, but I thought it was excellent / well worth listening.

Anyway, I think the two most frequent inbounds I am getting these days are:

Look how cheap all these regional banks are! Let’s be greedy when others are fearful and buy!

This feels like early 2008 all over again. Look at these regional bank balance sheets; they’re a mess. Every one of them needs to raise tons of capital and their go forward earnings / franchises are massively impaired. How are these not all shorts?

I’ll be honest: I have no eff’ing clue. My guess is that, given the current panic, you could probably buy a basket of regional banks and do pretty well from here… but it’s a brainer. There are real risks in both the near and medium term that could effect a lot of the banks, and I wouldn’t be surprised if we see another bank failure or three before this is all over.

That’s my guess…. but it’s a low confidence one. Here’s something I have a little more confidence in: if you’re blindly buying banks because they’re trading below book, you’re probably taking on a lot of risk you haven’t thought through / aren’t aware of.

The reason I wanted to write this article is because I’ve looked at quite a few banks in the past week, and one (Western Alliance, WAL) struck me as a particularly good example as something that showed both the potential upsides and downsides for diving into banks.

So let’s dive in.

Western Alliance is your classic well run bank. It has all sorts of accolades (#1 bank above $50B, one of Forbes’ best banks “year after year”, etc.), return are great (LTM return on tangible equity of >25%, few bad loans, etc.), and I’m sure they’ve got a great culture / everyone who works or banks there is very happy.

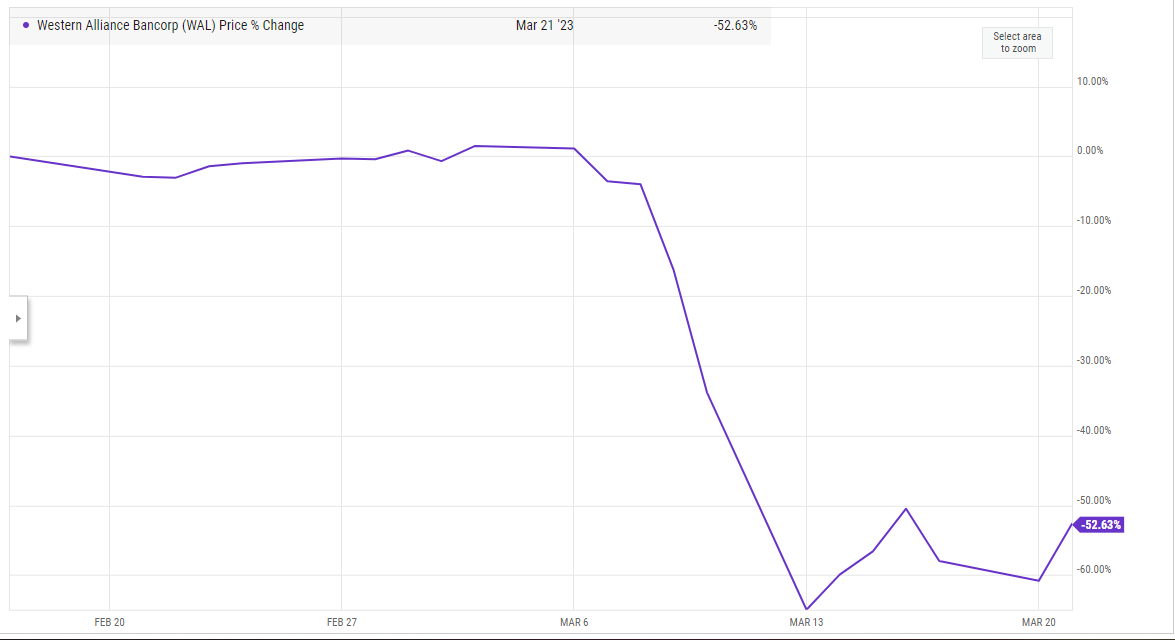

It’s not hard to build a bull case for WAL today. Regional bank fears have more than cut WAL’s stock in half over the past month.

As of last night’s close (March 21), WAL is trading for ~$33.60/share. Tangible book at the end of 2022 was $40.25/share, and the company earned ~$9.70/share in 2022. So, at current prices, you’re buying them for less than tangible book value and under 4x LTM earnings. Not bad!

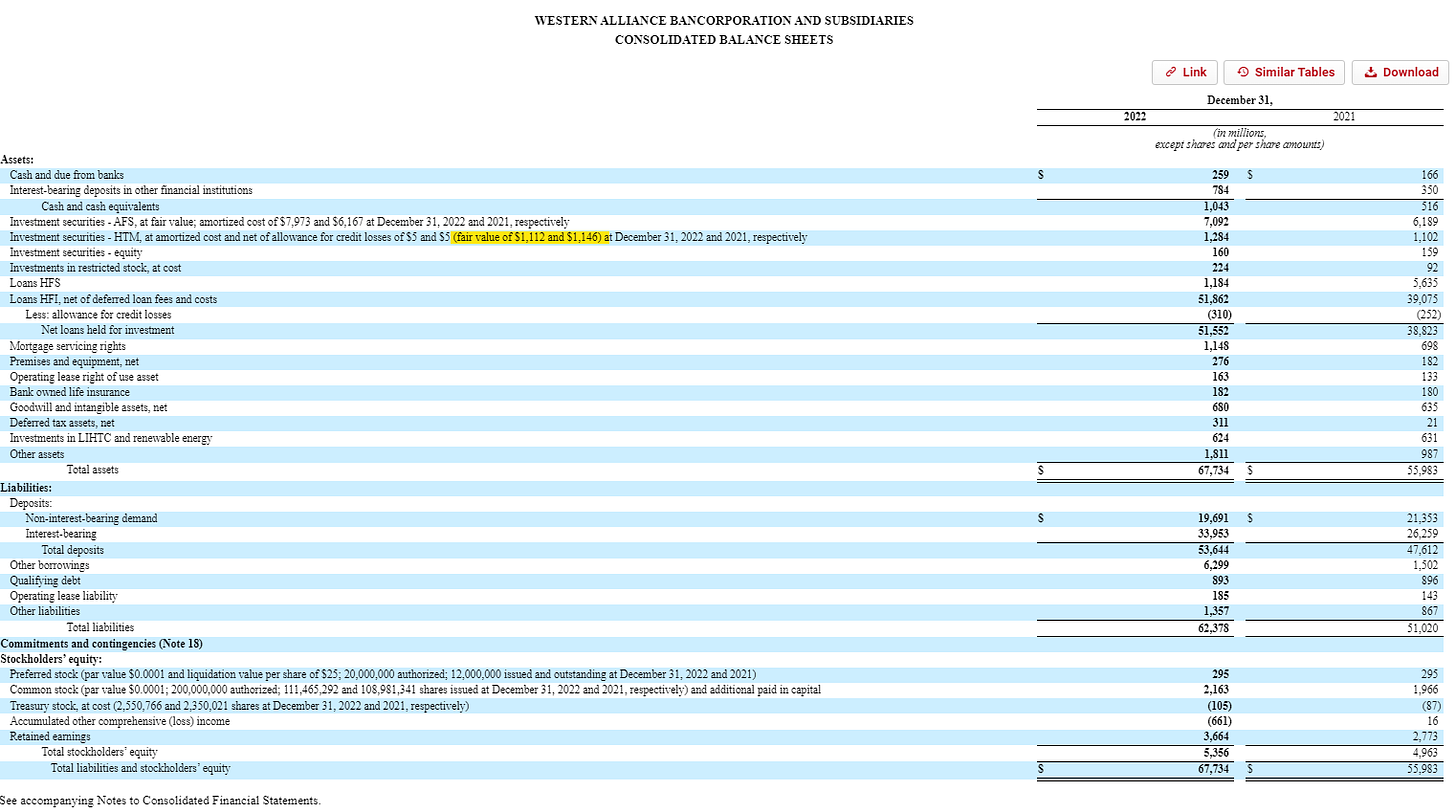

And it’s clear that WAL is not SIVB. SIVB blew up for a ton of reasons, but the two main ones were they took a bath on long term treasuries that they held at cost on their balance sheet and, when the market got worried, SIVB had a ton of uninsured deposits and they all rushed for the exit. WAL has neither of those issues; WAL’s most recent 8-k notes insured deposits exceed 50% of deposits, so they’ve got no “chunky uninsured deposit” flight risk. And Wal has only ~$1.3B of held to maturity securities (HTM) on their balance sheet; marking them to market would only result in a ~$1.60/share hit to book value. WAL earns more than that in a quarter!

So WAL’s an easy buy, right? It’s cheap, and it’s not SIVB!

Obviously, I’m not so sure.

In the short term, WAL’s >50% insured deposits is not 100% insured deposits. WAL’s 8-K notes withdrawals have been modest, but if things get a little panicky there’s still rooms for tens of billions of uninsured deposits to flee for greener pastures (Read: systemically important banks that depositors know won’t go under / where their deposits are 100% protected).

The other issue I see is in WAL’s loan book. Yes, WAL doesn’t have huge mark to market losses on treasuries like SIVB did…. but WAL does have a lot of loans that they’d take a bath on currently! Consider the table below is from p. 140 of their 10-K:

That’s a ~$4B difference between the fair value of their loans and their carrying value. If those loans were marked at fair value, it would wipe out >$35/share of WAL’s book value…. or basically WAL’s entire book value.

Remember: SIVB just went bust in large part because they had taken a bath on a bunch of long term treasuries and people panicked. Treasuries are about the most liquid market in the world; SIVB could turn their treasuries into cash in an instant. In contrast, WAL’s loan book is about as illiquid as it gets, and the loan book makes up >75% of WAL’s asset base. WAL can meet a small amount of withdrawals with their cash or liquid securities, but if there was a mini-run on WAL suddenly they could be looking at a really weird scenario of needing to borrow a ton against an underwater and illiquid loan book.

I mentioned the WAL case to John on the podcast, and his response was something along the line of “everyone just needs to chill out and these underwater loans will be fine.” And he’s probably right…. but you could have said the exact same thing about SIVB’s underwater treasury book. If SIVB could have just held those securities to maturity, of course they’d be money good. But depositors got nervous, which forced SIVB to sell and realize the losses. What would happen if something similar happened to WAL? Wouldn’t it be worse given the illiquidity of those loans?

Anyway, that’s the short term worry: I used WAL as an example, but most of these banks are pretty seriously underwater on their loan books. If the “contagion” spreads or we get another wave of bank runs, things could get really dicey.

That short term risk transitions nicely into the longer term risks that I think comes from the current “crisis.” There are a few different things I want to run through, but they all basically come down to this: it’s hard to look at what happened in the past few days and think banking franchises won’t be impaired going forward.

Let’s start with the simplest: depositors have been awakened to their deposits being at risk. For years, a bull case for banks was that if and when interest rates started to rise, the banks would see increased profits as they wouldn’t need to increase their deposit interest rates at anything close to the rate interest rates went up.

I think that’s out the window now. Investors are aware that their deposits are at risk and that they’re not getting paid anything on those deposits. Sophisticated investors can swap their money into treasuries or money market funds which will yield them increased interest and reduce the tail risk of a bank going under and the depositor taking a haircut.

Put it all together and it seems like all banks’ cost of funding has gone up. They’ll need to pay more on deposits to retain them, and companies are going to reassess how much money they leave uninsured in one institution.

On top of funding costs going up, I’d guess regulators are going to come down pretty heavy on banks on the back end of this. Regulators probably start charging more for FDIC protection, and I’d guess regulators pay a lot more attention to liquidity ratios and how much of a bank’s book is in longer term held to maturity type stuff. As a result, banks will need to shift more of their asset pool to shorter term and more liquid assets in order to meet regulatory demands and any potential bank runs (we’ve now seen how quickly / easily a run can happen in the internet age; banks will need to respond to that by increasing liquidity).

Combine all of that, and banks are looking at increased funding costs (need to pay more for deposits), increased expenses (increased regulatory expense), and lower yielding assets (more liquid and shorter term assets pay lower interest that less liquid / longer term assets!). I’d also guess regulators lean pretty hard on banks to issue equity in the near term to shore up the HTM balance sheet holes, which could prove a disaster for shareholders (raising a bunch of money to fill balance sheet holes and park in cash to prevent bank runs will cause huge earnings dilution).

Anyway, I’m just a silly generalist, so it’s entirely possible I’m wrong on every point I’ve made…. but that’s how I see everything right now. Basically every regional bank stock has dropped 20-50% in the past three months and is now trading below tangible book value and for a mid-single digit P/E. Given those stats, I’d love to run into regional bank stocks like an action hero running into a house on fire and just start buying left and right….. but I’m seeing real liquidity risks in the short term and earnings / regulatory risks in the longer term that make me too hesitant to really play here.

PS- I guess just one more thing while we’re here. It’s easy to dunk on SIVB (and FRC). They lost a ton of money in treasuries and they used an accounting fiction that let them hold the treasuries at cost to avoid the problem. They didn’t even try to hide it; the problem was right at the front of their balance sheet for all to see!

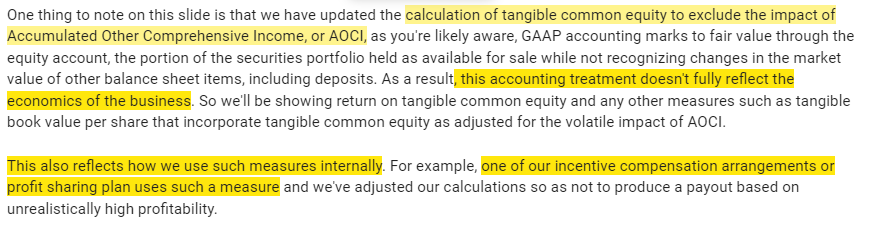

But it’s clear that banks believe they should be able to hold securities at cost / avoid these mark to market issues. Consider how ZION is presenting their tangible book value; I’ve included the table below:

See those stars? In 2022, ZION had a ton of available for sale fixed rate securities move against them, so ZION decided to switch their accounting treatment so that they didn’t have to mark those securities against their tangible book value. That >$3B add back is Zion adding back all of those losses! Absolutely wild… and not only did Zion add those losses back, but Zion bragged about it! Their Q4 conference call noted that marking assets down when interest rates rises doesn’t reflect the economics of their business because other things (like the value of their deposit funding) gets more valuable as rates rise.

What a wild statement to look at / think about on the heels of SIVB blowing up on basically those exact same things!

Thoughtful writeup thanks for sharing.

wrt John's “everyone just needs to chill out and these underwater loans will be fine.” - that comment also stands out to me. I think that probably shall be taken under the context that John acted more like a historian examining Roman Empire rise and fall, and goes Emperor X lost the battle Y that year, it happened, no biggie (despite 100k people died).

I own all of these securities, thought it was a great article - and my theory was the major panic of these banks that have suffered so far were those that pay attention to the markets and social media very intently, such as VC firms causing panic overnight and looking at where to move their money. Zion specifically is located in an area where most people just want a bank they can walk into and speak with people and get a cashiers check written every once in a blue moon. its a "blue collar" bank where most people aren't in the same category as SIVB and that's why I don't believe a liquidity problem is something to worry too much about. My bullish case for Zion is that its located in Salt Lake City Utah which is seeing a lot of growth and spillover form California as of recently due to its corporate tax haven nature. I love the article Andrew and my colleagues and I enjoy listening to your podcast!!