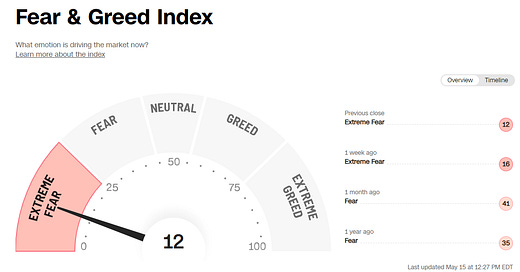

The market is fearful right now.

I don’t say that lightly. I am saying that based on the very scientific approach of going to CNN’s “Fear & Greed Index” and seeing an “extreme fear” reading.

I’m just kidding about taking the CNN Index scientifically, but that fear reading matches up with my conversations with other investors. I feel like people are tripping over themselves to be bearish. Pessimism rules the day; I’ve had multiple conversations with very sharp fundamental focused value investors that have included the phrase “I just feel like we’re set up for a crash.”

I doubt anyone can forecast what the stock market does in the short term. But I do know one thing: now is the time to be greedy (now is also the time to remind you that I’m not a financial advisor; please see my disclaimer and do your own work!). Wide swaths of the market are available at extremely attractive prices, corporate balance sheets are in great shape, and companies are taking advantage of their current great results to retire shares at huge discounts.

So I wanted to write an article planting my flag on “team bullish.” Sometimes it feels like I’m the only person who thinks stocks are just way too cheap right now, and I wanted to plant my bullish flag for three reasons.

Reason #1: To build on my piece from yesterday (The Strange Macro Environment). I mentioned at the end that stock prices look attractive, but I wanted to explicitly state how bad the market sentiment is right now and how bullish I am / how attractive I think stocks are.

Reason #2: I’ve had lots of conversations with investors recently who have said something along the lines of “I’ve been 80% invested for the past two years and I’m just so happy to have cash right now.” It’s tough to push back on that; it always feels good to have cash when the markets dropping!

But if you’re holding a large cash balance and you’re not going to deploy it when the fear is off the charts; are you ever going to deploy it? I would guess probably not. There are tons of opportunities out there right now; energy companies trade for huge discounts to the curve, event driven looks quite promising, and there are plenty of companies seeing massive demand and buying back shares like crazy while their stocks tank. Each of those buckets has wildly different drivers so they can succeed in completely different environments; if fear is rampant and you have three completely different buckets (like those) and honestly can’t find one stock that you think will generate enough positive risk adjusted returns to deploy cash right now, then I’d guess you never will. You’ve effectively committed to running with a massive cash balance forever. Nothing wrong with that, but you almost certainly can’t outperform the market over the long run running 80% invested.

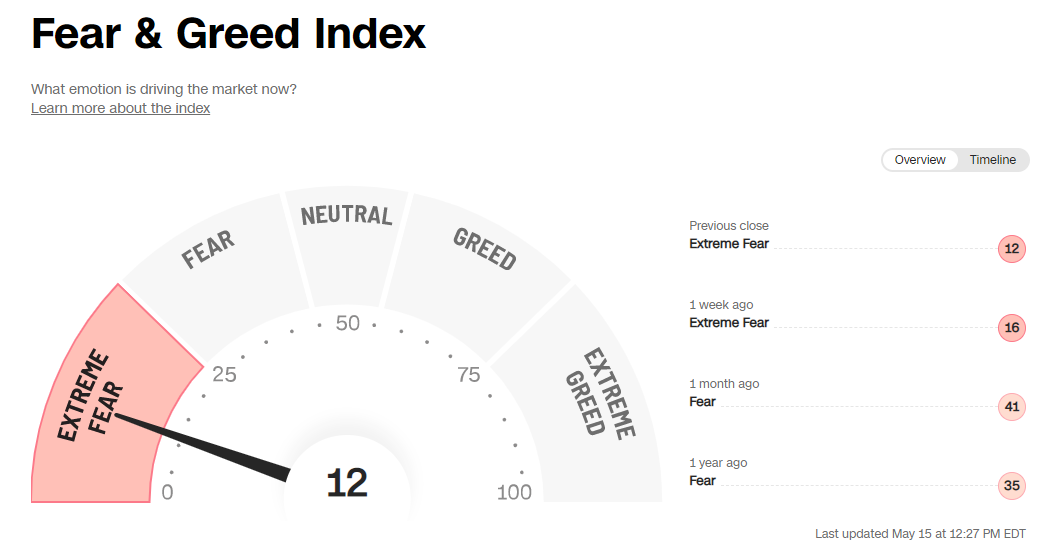

I understand those three buckets aren’t for everyone…. but it’s not like those are the only things out there! Here’s a simple one: PSH is currently trading at the widest discount it has traded for in years (excluding for a few ticks at the absolute depths of COVID). PSH owns great companies, is buying back shares, and I’m not sure who the heck would bet against Ackman after he knocked it out of the park with his COVID protection trade and his inflation trade. Sure, there’s probably better opportunities out there, but in terms of safety, simplicity, and minimal brain damage, it’s tough to beat PSH at these levels / this discount.

Reason #3: Lots of investors have said to me “I’m waiting to deploy my cash into a crash” or “I can’t invest now; a crash might be coming.” Seems reasonable, right?

I don’t think so.

It’s important to remember that “crashes” are rare, and no one can call them. So saying “I’m waiting for a crash” sounds nice, but you could be waiting a long, long time. Maybe a crash never comes (and, even if one does, I’d refer you to point #2; you’re probably not going to buy the crash if you’re not buying now).

But let’s say we are going to have a “crash”…. are you 100% sure that we’re not already in one? Because I’d argue we’re already in a “crash” of some form, and history suggests we’re closer to the trough than the peak. Consider:

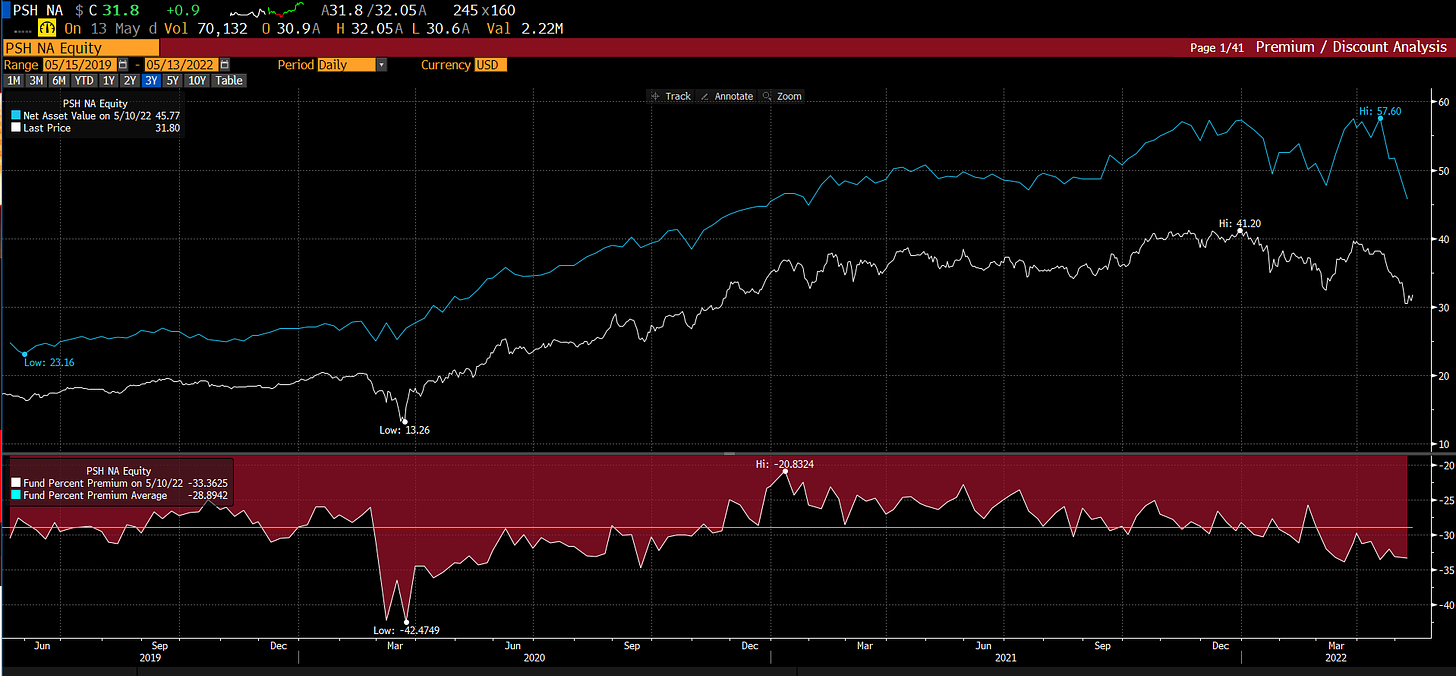

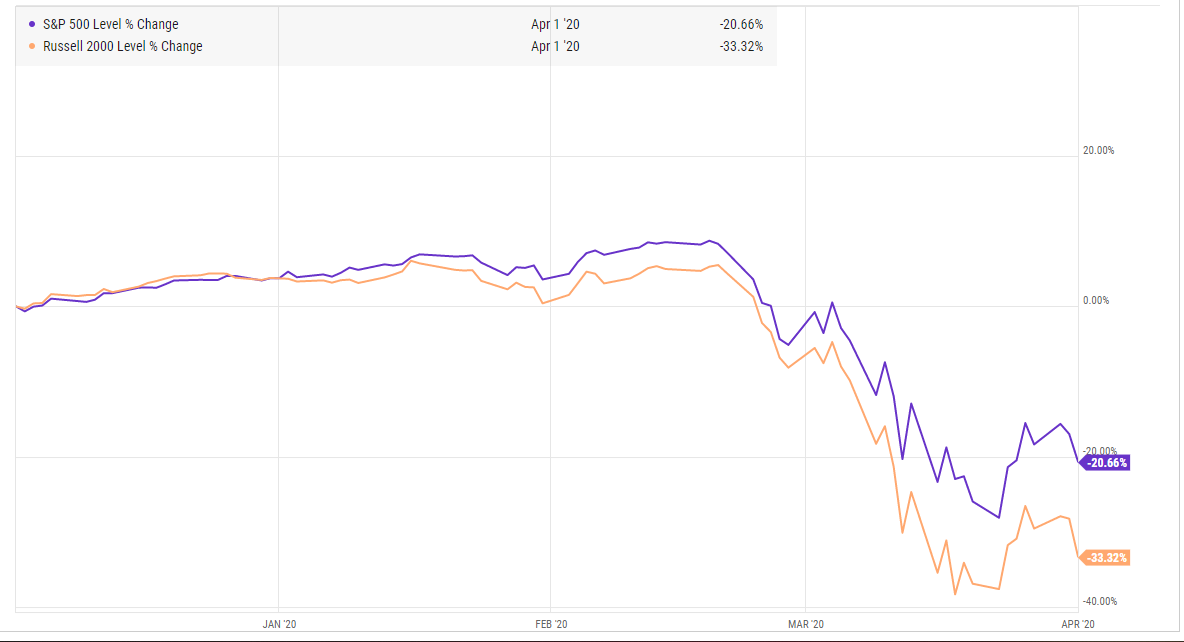

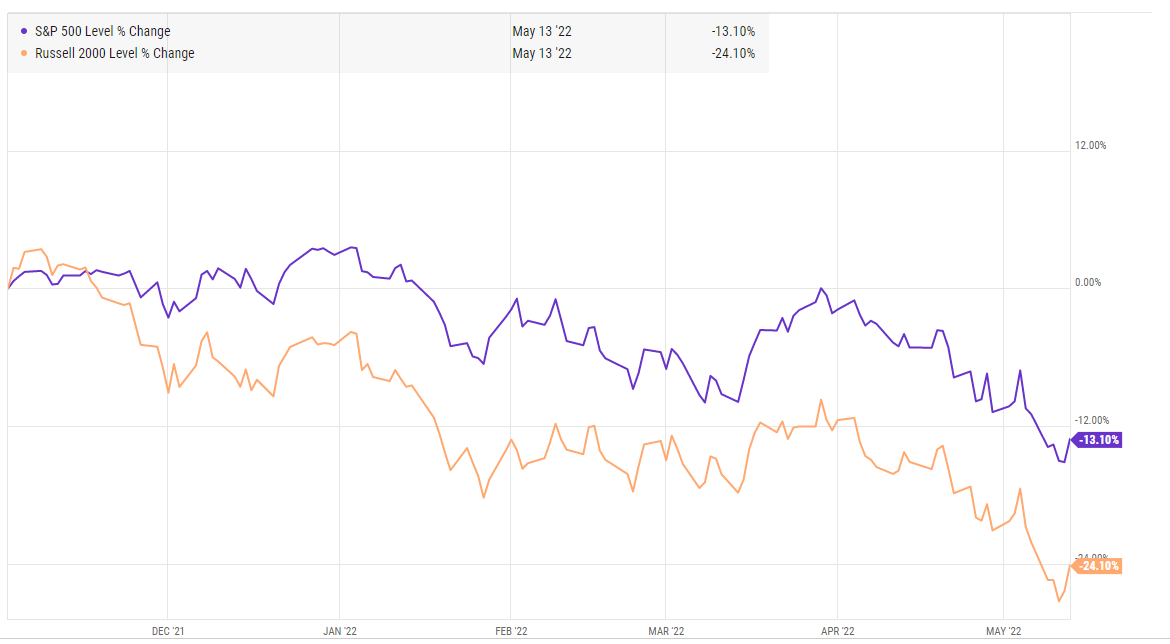

The Russell and S&P both fell ~50% from absolute peak to absolute trough during the Global Financial Crisis.

And the indices fell by 30% to 40% from the start of 2020 to the COVID lows in March 2020.

I’d venture those are the two worst market environment we’ve seen outside of the Great Depression. In the GFC, we came pretty damn close to the entire financial system blowing up. At the depths of COVID, it felt like we were all going to be stuck in lock down for years while bleaching our mail and groceries to make sure they didn’t kill us.

Compare that to today’s market. We’re already down ~15% on the S&P 500, and ~25% on the Russell.

Just basing it on those two most recent crises, it seems like we’re probably a lot closer to the trough than it might seem from the fear and hysteria that are wide. And, honestly, this “crisis” feels a lot less scary than past ones (provided we don’t enter full out nuclear war, which I acknowledge is a big tail risk that wasn’t present during the last two crises, though I think people forget how scary the depths of March 2020 were….), so I’m not sure why the “trough” of this “crash” should be close to as bad as the prior two.

Plus, it’s worth noting that everything is almost certainly in much better shape now than it was in the GFC or in 2020. Corporate and consumer balance sheets are way stronger, the largest businesses are much more resilient, etc. And we’ve already seen a lot of froth come out of the system; crypto ponzis are blowing up, and almost every high flying SPAC or IPO from the past year has blown up (many trade below net cash currently). So, again, I think we have a less scary environment with a better starting point today than the past two crises…. I’m not sure why stocks should fall close to as hard now as they did then.

But let’s say I’m wrong. Assume you put cash to work today and we have that “big crash” tomorrow. Even in that scenario, I still think history suggests you’d be pretty pleased in the long run with having put your cash to work today.

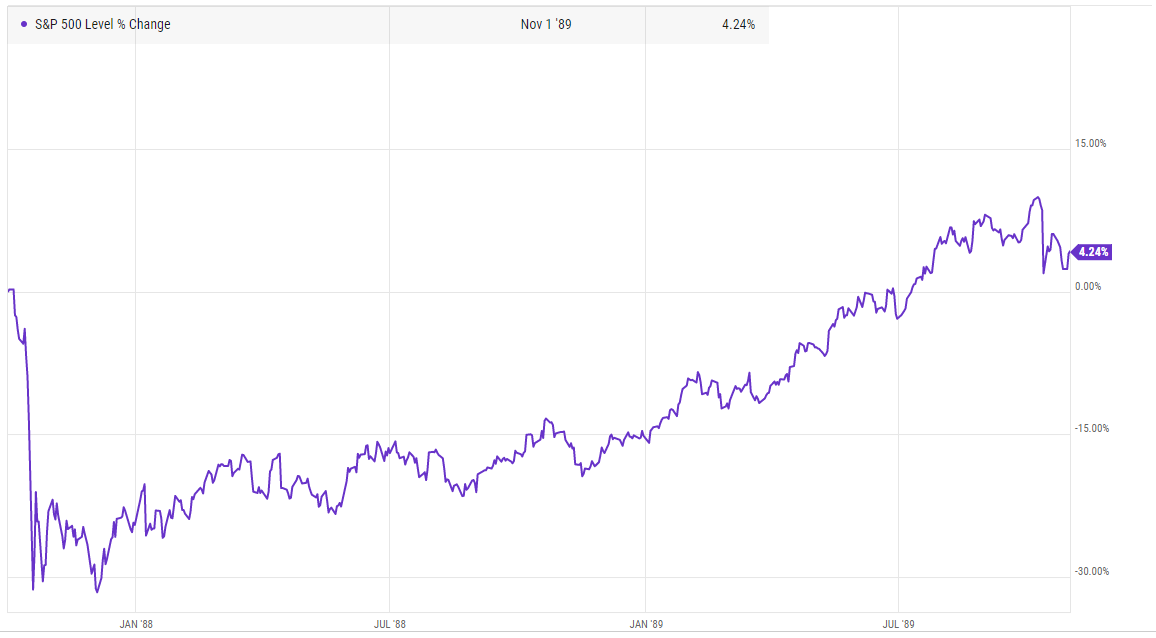

Let’s say you bought the index right before Black Monday in 1987. Sure, you’d wish you had waited just a few days and gotten absolute panic prices… but, guess what?Even with that unfortunate timing of buying the day before a true crash, you would have been up on your purchases within two years (and you could make similar arguments with every other crash we’ve seen).

I get all of these are small sample sizes, and they’re based on an environment when interest rates were low (and going lower) and inflation was steady (very different than today). The future is unknowable; I personally think inflation has probably peaked but I am not a macro person. What I am is a micro / company specific focused person, and I see tons of stocks and companies that look way too cheap where the board is focused on taking advantage of the share price to buyback every share they can at a discount. When companies do that, it tends to lead to very good returns for shareholders in the long run.

I’m not saying to go YOLO short term call options on the market. Nor am I saying the stock market can’t go down in the short to medium term. The stock market can do anything it wants in the short term, and I don’t think anyone can predict it.

But I am saying that there is a lot of fear out there. I say that based on both the CNN front page and my conversation with tons and tons of investors.

Is now the time to be cautious? Sure, the world’s a scary place; when is it not the time to be cautious? Make sure whatever you’re looking at is a real company that can survive a rocky economy in the near to medium term. But now is not the time to be fearful. If you’ve been holding on to cash, congrats! But now is the time to be greedy and put that money to work. In the long run, you’ll be happy you did (even if we crash tomorrow).

Also from history, Japan has still not regained its 1987 level. If you were in the market in 1929, the Dow would not return to that level until 1954.

Pull up a 5 year chart on the Dow Jones Industrial Average. Heck of a crash!

https://www.google.com/search?channel=nus5&client=firefox-b-1-lm&q=dow+jones+

There was way too much speculation and junk in the market. Probably in the early innings of a nine inning game in terms of working through that. The knock on effects of this bubble imploding are unknowable, but expect MUCH spillover into areas of the economy and markets that appear safe at the current moment.

But I agree long term investment plans should not be abandoned due to short term economic or market concerns, but crashes and economic downturns need to be planned for. Cash on sidelines for living expenses so you don't have to sell into a depression, avoid margin debt, speculative positions, etc. I personally think very few have planned for what is possibly coming, and most lack the stomach for it.