Big Three Cable: still too cheap $ATUS $CHTR $CMCSA $CABO

Long time readers know that I've been a cable bull for.... well, a long time. Charter is the headliner here, as it's probably the company I've written the most about on this site, but I've touched on basically every publicly traded cable company at some point in this site's history. The thesis has always been reasonably simple: cable's core business is providing broadband, and they have a mammoth infrastructure advantage in huge swaths of the country (where they have no competition or only compete against legacy DSL) that will provide them with a bunch of upside optionality as we move into the future (from price increases, launching mobile services, etc.). I haven't mentioned the sector in a while, and some recent activity in the sector made me want to put some updated thoughts down.

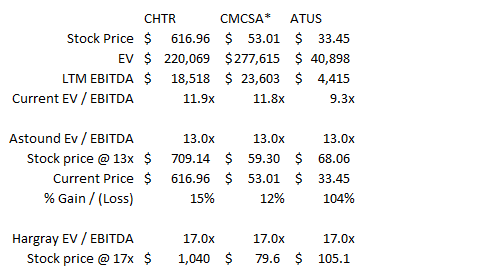

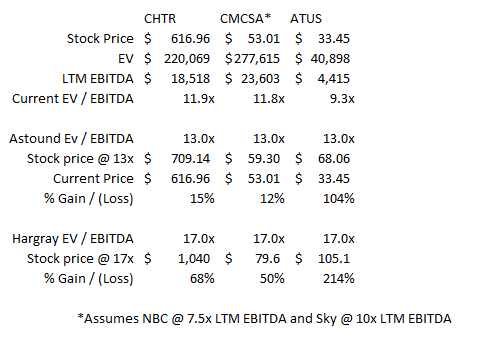

Let me start with the headliner and kind of the inspiration for writing this post: I continue to believe the major cable companies trade much, much too cheaply. I called this out in November's "Does the Astound deal show cable multiples are too cheap? (Yes)" post, but we continue to see smaller systems sell for multiples that are well in excess of what the big 3 of ATUS / CHTR / CMCSA trade for (despite the fact that I believe the big 3 are better businesses / assets).

The most recent data point backing that statement up is Cable One's $2.2B deal to buy Hargray. Cable One didn't provide a ton of details on the deal (we'll probably get more with their Q4 earnings later this month), but they did note the deal is priced at 17.2x Hargray's Q4'20 annualized EBITDA and 12.7x once you factor in synergies. The synergies are meaningful; Hargray is run rating $128m in EBITDA and CABO thinks they'll get $45m in run-rate synergies in three years.

So we've now got two meaningful cable deals in the past ~4 months. Astound, which is mainly a cable overbuilder, sold for ~13x EBITDA to a financial buyer. Hargray, a regional (I believe mainly rural?) cable operator, sold for 17x Q4 annualized EBITDA. The major public players trade for multiples way below those levels.

You could take issue with lots of pieces of this analysis both ways (positive and negative). On the positive side, there's mobile expenses buried in here that a smaller player wouldn't have but that will likely create value long term. CHTR, for example, has ~$400m in EBITDA losses from the mobile business that are buried into their LTM EBITDA numbers; I think that spend will actually create value long term but in the short term it's a drag on their valuation in this simple model. Adding that back would be good for another >$20/share in value at a low teens multiple. And the valuation for Comcast's NBC / Sky segments is laughably low, as I just slap a multiple on LTM EBITDA. NBC's LTM EBITDA includes a year where all of their parks shut down; I doubt that people value NBC on a steady state basis with their parks closed! So there's probably some conservatism baked into that screenshot. On the other hand, you could argue that these three businesses almost certainly aren't getting sold anytime soon, so why use a takeout multiple on them? You could rightly point out that I haven't adjusted for a variety of complexities in their financials (for example, I haven't fully teased out Altice's minority partner in Lightpath). And you could also point out that the synergies if these businesses were sold would be significant in a sale, but they'd almost certainly be materially lower as a % of earnings than a bolt on acquisition like CABO buying Hargray. Finally, you could point to plenty of idiosyncratic stuff; we don't know what Hargray's growth or competitive profile looks like, and each of the major companies faces somewhat unique challenges that Hargray likely doesn't have to worry about.

So yes, there are gives and takes, but everything in this sector is screaming "the large players are not getting enough respect in the public markets." And I think the companies' capital allocation backs up that their shares are way too cheap. Altice bought back ~25% of their shares last year (including ~12% in one swoop in a tender), Charter bought back 7% of their shares in 2020 and I'd expect a similar number in 2021, and Comcast has accelerated their plans for resuming repurchases from 2022 to the back half of 2021.

To me, Altice looks particularly interesting here. Shares have sold off this year as Q4 earnings disappointed and called into question Altice's growth trajectory and the competition in some of their markets, but the multiple just screams too cheap. Altice appears ready to vacuum up every share they can at their current prices; remember, the company just bought back a ton of shares at $36/share (above today's prices) back in December, when they almost certainly had a good view on the Q4 earnings that caused the current dramatic sell off in the stock (and they probably take a longer term view of the business / their intrinsic value than one quarter's results anyway!). Altice is also probably the only one of the big three that could realistically be involved in needle moving M&A; they're small enough that buying one of the other outstanding cable systems (like Cox) at a good price would move their needle or that CMCSA / CHTR could consider buying them. CMCSA and CHTR are so big that they'll never get sold and M&A, while nice, probably doesn't really move the needle these days. Given the leverage and operational questions, Altice is certainly a riskier bet than Charter or Comcast, but I think the valuation and capital allocation suggest that the upside here is both likely and reasonably high.

So that covers the main reason I wanted to write / update the cable sector today (shares remain too cheap, worse assets are trading for higher multiples in the private sector, and Altice in particular looks interesting), but I did want to pull on one thread a little further before wrapping up. I mentioned briefly that the cable companies are getting dinged for their wireless initiatives, and I think that's wrong. I've been bullish on cable's wireless prospects for a long time, and I think investors are underestimating how quickly the story on wireless can flip. Again, right now, wireless is a drag on the cable companies' trailing financials, and I don't think anyone gives them serious credit for value creation opportunities here. That should change in 2021. At a minimum, these things should start being less of a drag on the financials.

The quote below is from Charter's Q4 earnings call. They project flat mobile capex in 2021, with capex declining into 2022. Given the rest of the business is growing, simply keeping mobile capex flat means it's less of a drag going forward, and that'll improve into 2022. Combine that with lots of commentary from cable companies that they won't be major spenders in the upcoming spectrum auctions, and I think investors can start to breath a little easier that wireless won't be an endless cash drag going forward.

So that's one way the script could / will flip in 2021. But I think the real fruits come as investors start to give cable credit for value creation from wireless in 2021. The quote below is from Comcast's Q4'20 call.

Why do I think that quote matters? Because Comcast has historically been much more cautious in their approach to wireless. I think it's pretty significant that they're now starting to talk about their wireless business accelerating. They wouldn't be doing that without great line of site into the business accelerating, and they wouldn't be leaning into the acceleration unless they were super happy with the economics of their wireless business to date.

Anyway, it's a little awkward to write about the wireless segment of the cable business because it's still a small part of the story and I've written about it so many times in the past on the blog (in particular here). So I'll refer you to my past writings if you're looking to dive more into that opportunity, but a quick summary: I think cable's wireless business goes from "value drag" to "exciting growth opportunity" as we approach the back half of 2021 and investors continue to gain comfort that the wireless business is actually inflecting upwards / this isn't going to be an endless capex suck with no returns prospects, and I don't think the market is at all thinking about that switch flipping at all.

But that's probably a sideshow to the overall takeaway: multiples for the big three remain way too cheap. Inferior assets are going for huge premiums to where these are trading. Management is screaming their stock is too cheap on both their earnings calls and through their capital allocation decisions. Combine all that into an economically resistant business with untapped pricing power and a mobile growth opportunity, and I continue to think the cable shares are set to outperform for years to come.