Christmas Presents and Altaba $AABA $BABA

Happy Holidays! As a regular reader of this blog, I bet you’re wondering what I’m getting you for Christmas?

Well, let me start by reminding you that this blog is free and you’re really greedy to be asking for something... just kidding, of course I’m getting you something! Next week I’ll be posting four of my favorite special situations heading into the New Year! I’ll have more details on them next week.

I know what you’re thinking, “Four posts / ideas? In one week!?!?! Andrew you’re too kind! I feel awful I didn’t get you anything!”

Well, not to worry. If you didn’t get me anything and you want to return the favor, a donation to a charity of your choice will suffice. If you’re looking for charity recommendations, my friend / partner Chris Demuth has helped 240 patients on Watsi, and I have another friend who works for the END fund and I think they do great work. A donation to either would help a ton of people (I love emerging market charities since I think the bang for your buck is so much higher), but feel free to go with any charity you like. No obligation whatsoever (and no need to let me know if you do or don't donate anything!), but I’ll remind you that I’m getting you four presents and that this blog is completely free (no ads, no referral fees, nothing), so if you want to get me something that’s my ask! If you’re still on the fence about donating to a charity, let me remind you that giving to charity this year versus next is probably tax efficient thanks to the tax cuts, though I’ll also remind you I am not a tax lawyer and that’s not tax advice.

And to thank you in advance for your present, here’s a quick thought / idea on tax reform. I already mentioned one big beneficiary from tax reform (MSGN was mentioned here; disclosure: long). Another likely winner from tax reform? Altaba (AABA; disclosure: long).

Altaba’s current NAV is $63.13/share, and their adjusted NAV is $95.36/share (you can see both here). The only difference between NAV and adjusted NAV is adjusted NAV completely eliminates their deferred tax liabilities.

So why is Altaba interesting? Well, their deferred tax liabilities are calculated at the current tax rate (~35%; I think they are a bit higher as they account for state taxes too). Once the new tax rate is in effect, that deferred tax liability will drop substantially. Given Altaba is currently trading for a ~25% discount to adjusted NAV, Altaba’s current share price trades for less than the value of their fully taxed NAV under tax reform. With President Trump is signing the tax bill on Jan. 3, I think Altaba should be releasing their new, updated NAV number with their Q1’18 earnings, though I wouldn’t be surprised if they put out an investor presentation or something else showing their new fully taxed NAV number earlier than that. I would guess releasing that serves as a bit of a catalyst for the stock.

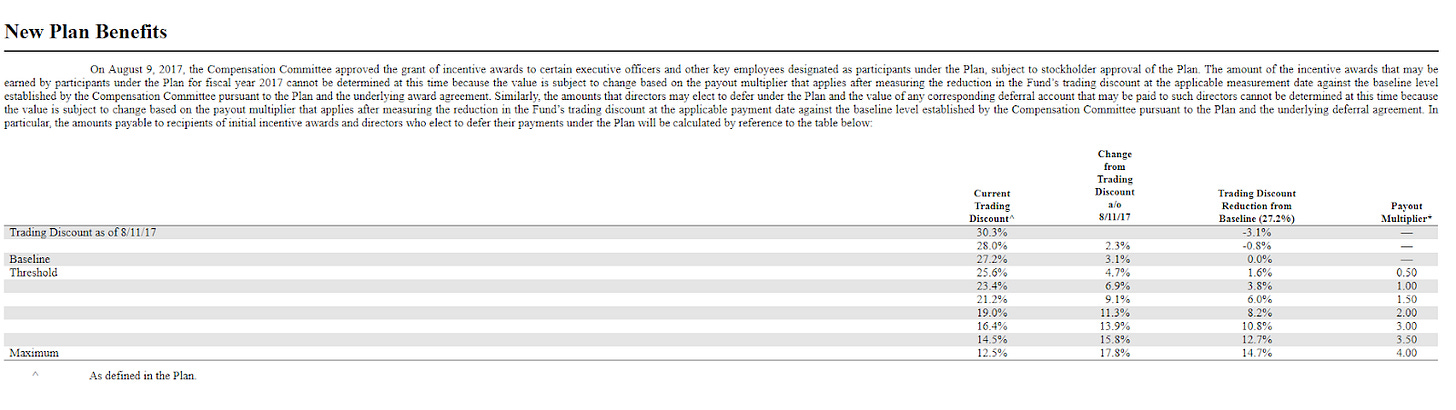

There’s a lot of other stuff to like about AABA: management’s compensation is based on shrinking the NAV discount (see table below from their proxy), and the company is vacuuming up their shares. But I think the impact of tax reform can’t be understated: a month ago, there was a risk the company couldn’t figure out anything tax efficient to do with their low basis Alibaba shares (BABA; disclosure: short some against the AABA long) and had to sell them at a full tax rate, leaving shareholders with just 65%-ish of adjusted NAV. Today, that same “sell at a full tax rate” risk exists, but shareholders in that situation would get ~79% of adjusted NAV, or more than today’s share price price, and that’s in a worst case scenario where the company has to sell everything at a full tax rate. I love the upside of buying below that worst case scenario (obviously NAV can change, particularly if BABA's stock price changes, so I'm just referring to AABA specific worst case scenario here).