CorePoint / La Quinta Ira Sohn Contest Winner $LQ

My investment thesis for CorePoint Holdings, the taxable spinoff from La Quinta (LQ, disclosure: long), was selected as the winner of the Ira Sohn Contest. It was a really cool experience to present at the conference; if my presentation ever makes it on youtube or CNBC I'll be sure to share a link (and if a reader sees the video somewhere, I'd be grateful if you shared it with me!). Till then, you can view the slides I presented here. I've also copied the investment thesis I submitted below (the thesis was limited to four pages; you can find a longer version of my investment thesis over on VIC). Enjoy!

Summary thesis: La Quinta’s (LQ; disclosure: long) upcoming spin of their owned hotels (in combination with the sale of their franchised business) into a REIT presents investors with all the hallmarks of a classic undervalued / underestimated spin: the spun off business will be completely different than the current one, management is going to the spinco, the trailing financials are messy, a quirk in the deal structure incentivizes management to sandbag numbers / valuation heading into the spin, and the spinco will be a juicy acquisition target for a variety of strategic acquirers. I believe the entire company is worth more than $23/share today, which presents solid upside from today’s price of $18.60/share. However, I also think that upside undersells the opportunity, as $8.40/share will be returned in cash in the near term (sometime in Q2). Looking through that cash distribution, you’re creating the REIT business (CorePoint) for ~$10 against my valuation of >$15, presenting over 50% upside.

La Quinta today consists of two businesses: the La Quinta brand / franchise and the ownership of 317 La Quinta hotels. In early 2017 the company announced a plan to pursue a taxable spin that would split off the owned real estate into a REIT and leave behind the high margin franchise / brand management business. In early 2018, the plan changed slightly: the company announced they were selling the La Quinta franchise / management business to Wyndham, and concurrent with the sale they would spin off the REIT as a company known as CorePoint Lodging. The whole transaction should close in Q2’18.

The terms of the Wyndham agreement call for Wyndham to pay LQ shareholders $8.40/share in cash in addition to paying off some debt and covering taxes associated with spinning CorePoint off in a taxable spin. So, at today’s price of ~$18.60, LQ shareholders are paying for the right to receive ~$8.40 when the Wyndham transaction closes in the next few months plus the remaining CorePoint business, which I believe is worth >$15/share.

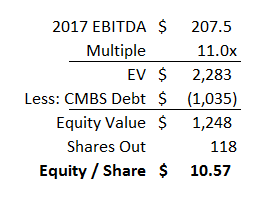

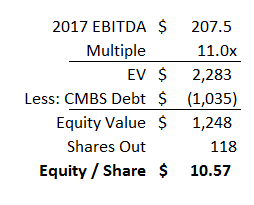

On a PF basis (with a fully loaded standalone cost structure and adjusted for the new external management contract), CorePoint earned ~$207m in Adj. EBITDA in 2017. While CorePoint will be unique in its focus (it’ll focus on midscale and upper-midscale select service hotels; most peers are higher end and tend to be full service focused), both peer multiples (CLDT, HT, INN, and RLJ are the best peers) and individual La Quinta hotel transactions suggest CorePoint should be worth at least 11x EBITDA. With 118m shares out and the company taking out a $1,035m CMBS loan as part of the transaction, we can come up with a loose valuation.

Add that to the $8.40 payment from Wyndham and you get a combined company value of ~$19, which gives a little upside from today’s prices, but it would basically be a rounding error of upside. Here’s where things start to get interesting: I think both the debt and earnings number I used in that valuation will prove much too conservative. I’ll discuss why in a second, but let me start by discussing why the company would intentionally obfuscate its value. After all, most managers know that spinoffs have trouble finding an investor base and are constantly out pitching what a great deal the stock is leading up to a spin, particularly in a spin that’s part of a deal shareholders have to vote on / approve. I think the answer to that question lies in a hidden tax provision in their Wyndham deal.

The press release on the La Quinta sale contains a near throwaway line that Wyndham will “set aside a reserve of $240 million for estimated taxes expected to be incurred in connection with the taxable spin-off of La Quinta’s owned real estate assets into CorePoint Lodging Inc.” However, if you dig through the proxy and the merger agreement, you can see that the tax reserve amount was not a throwaway amount; in fact, it was the subject of a good deal of negotiation. But what’s really interesting is that the tax reserve is just an estimate of how much tax the spin will incur, and, to the extent the tax incurred is less than $240m, CorePoint gets to keep the difference (if it’s more than $240m, CorePoint has to pay La Quinta the difference, but as I’ll show in a second that’d be a happy problem for investors at today’s prices to have).

You can probably see where I’m going with this: the CorePoint / Wyndham agreement calls for a fixed tax payment. If the taxes are lower than that payment, CorePoint keeps the proceeds. If the taxes are higher, CorePoint covers the excess. The ultimate tax payment is based on the difference between CorePoint’s tax basis in their hotel assets and the enterprise value at the time of the spin, so a lower share price at spin time results in a lower tax liability. Because the tax payment is based on CorePoint’s share price at the time of spin, CorePoint is actually incentivized to try to keep their share price as low as possible heading into the spin, as doing so results in more cash coming on to their balance sheet / less going to Uncle Sam (Wyndham doesn’t really care what happens here; they’re on the hook for $240m no matter what). Note that this is not a completely unique situation: Disney / Fox have a somewhat similar issue with their taxable spin of the remaining Fox assets, though they use an increase in Disney shares to FOX holders to resolve the “lower than expected” tax “problem”.

With the incentive for management to keep the share price low discussed, let’s turn to the two key sources of upside to my valuation: the net debt number and the EBITDA number.

I’ll start with the debt number. In my valuation, you’ll notice that I used the gross CMBS debt number, which I think will end up being much too punitive. The reasoning lies in the details of the merger agreement. While the press release highlights that Wyndham will “repay $715m of La Quinta debt net of cash” as part of the acquisition, the deal is actually structured so that CorePoint will take out the $1,035m CMBS loan to pay a $983.95m dividend to LQ Parent (the franchise business Wyndham is buying) as part of the spin off. This dividend is subject to adjustment up or down to the extent “estimated existing net indebtedness” is different than the target net debt of $1.665B (see page E-4 and E-23); the difference between those two numbers is how they arrive at that $715m debt paydown number. La Quinta had net debt of ~$1.55B at 12/31/17, so they’re already >$100m below the net debt target before any cash build between 12/31/17 and the spin. Given CorePoint’s raising $1,035m in debt to pay a ~$984m dividend (so ~$50m excess there) and they are already >$100m below their net debt target, CorePoint should spin with at least $120m in excess cash on their balance sheet, good for ~$1/share in value.

Let’s move on to the EBITDA number. I think it’s wildly conservative to use the ~$207m in trailing EBITDA for a few reasons.

Hurricane impact: Hurricane Irma affected a significant piece of CorePoint’s business; per the Q4 call, over 8% of owned rooms were out of service at peak interruption time. Management estimated the Q4 impact was ~$6m in lost EBITDA, and they estimate the 2018 impact will be $28-35m. As we move into 2019, that hurricane impact should fully annualize, which will drive serious earnings growth.

Capital Investment program: CorePoint / La Quinta started a $180m renovation project in Q4’16; the bulk of the project finished in January 2018 and the whole thing will be done around spin time. Their Q3’17 call provide some details on the early returns of these projects, which include NPS scores renovated hotels up 50% and RevPAR up 11% (driven by a 10%+ increase in ADR). Given the project just completed, it’s actually having a negative impact on trailing earnings (renovations leave rooms out of order) but should have a serious positive impact on go forward earnings. Most hotel renovation projects I’ve seen assume mid-teens ROI, but for conservatism I assume the $180m investment results in ~$15m annualized increase in EBITDA (~8.5% ROIC) in run rate earnings increase.

Synergies from La Quinta combining with Wyndham: CorePoint should realize some return from La Quinta being brought into the Wyndham family. Wyndham’s size should yield significant advantages for all La Quinta franchisees (better OTA pricing, better rates for advertising given the company’s size, combining La Quinta’s loyalty program into Wyndham’s to get a new base of users (probably in 2019), offering CorePoint hotels the ability to switch to other Wyndham brands in locations where it makes sense), which should result in some improvement in CorePoint’s hotel performance. Wyndham certainly thinks there’s synergies from buying La Quinta; they’re forecasting $50m+ in synergies against <$100m of Wyndham’s definition of Adj. EBITDA for La Quinta. Obviously we’re talking apples to oranges comparing franchisor earnings / synergies to hotel earnings, but it’s tough to imagine that Wyndham could improve the whole system by that much and it wouldn’t have some positive impact on the franchisees (FWIW, Wyndham is also forecasting accelerating La Quinta’s long term growth as they fully integrate the system, which should drive revenue growth for CorePoint as well). I assume Wyndham buying La Quinta eventually adds another $10m in EBITDA for CorePoint (just over 1% of LTM revenues). I point to three facts to back this synergy estimate up.

La Quinta’s proxy makes explicitly clear that one factor the board considered in selling La Quinta was how much value the buyer could bring as an operator for the CorePoint business.

La Qunita’s owned hotels (which will become CorePoint) have substantially underperformed LQ’s franchised hotels over the past two years (average ADR at owned hotels ~$81/night versus franchised at ~$89), and the LQ brand in general still has a rate gap versus its peers (ADR of ~$85 versus peers at >$100); Wyndham’s scale should help close both gaps.

CorePoint’s hotel EBITDA margins (Adjusted EBITDA with SG&A added back) are currently ~30%. That would be at the low end of a basket of full service hotel REIT peers. Most select service REITs have EBITDA margins 3-5% higher than full service peers, suggesting CorePoint has significant margin upside to just match peer select service REITs.

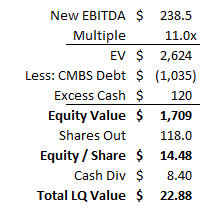

Combining the three things mentioned above (Wyndham synergies, Hurricane impact rolling off, and returns from their capital investment program) add another ~$31m to EBITDA, taking CorePoint’s “run rate EBITDA” to ~$239m. Note that this is by no means a heroic EBITDA number; even if we assumed all of the “addbacks” to get to run rate EBITDA flowed straight through to the bottom line, these EBITDA numbers would result in ~34% hotel EBITDA margins / ~29% adjusted EBITDA margins, still towards the low end of peers and below what CorePoint was doing in 2015 (before the oil bust, which hit La Quinta particularly hard).

So let’s put it all together: if we slap an 11x multiple on $239m of EBITDA and take out $1,035m of CMBS debt but addback $120m of excess cash, we come out with an equity value of ~$1.7B and a per share value for CorePoint of ~$14.48/share. Add that to the $8.40/share in cash from the Wyndham deal and shares should be trading for ~$22.90, presenting ~23% upside to today’s share price of ~$18.60 (or ~42% looking through the $8.40/share cash payment).

Note that this value seems to be backed up by the Wyndham tax payment agreement. We know that Wyndham has agreed to pay $240m in tax payments, and we also know that the CorePoint assets have a tax basis of ~$1.7B (management gave that number on their split call). ). If we assume CorePoint will have a ~25% tax rate (a bit higher than federal after adjusting for state / local), that would imply Wyndham and CorePoint agreed on a ~$2.66B valuation ($240m / 25% + $1.7B) for the CorePoint assets, just slightly above the $2.63B valuation I came up with above.

Speaking of the tax payment, there is one other source of upside. At current share prices, I estimate that the company will owe only ~$150m in taxes as part of the spin; the difference between that payment and the $240m Wyndham will cover (so $90m net) will flow straight through to new CorePoint’s balance sheet, representing ~$0.80/share in extra cash and bringing my “post tax / excess cash” fair value for CorePoint to just shy of $15.30/share.

At this point, I think I’ve walked through a credible case for CorePoint being undervalued and why management might be trying to undervalue the company. Let’s talk about how this plays out. The shareholder vote will happen at the end of April, and I’d expect the companies to close the transaction soon after the vote (they’ve already got HSR). Once the deal closes (and the low EV for tax purposes is locked in place), I’d expect management to be more open about potential levers for EBITDA growth, what the PF balance sheet will look like, etc. Management also has a history of being shareholder friendly (on top of this spin / sale, they have been aggressive share repurchasers in the past), so I wouldn’t be surprised to see some excess cash returned to shareholders if valuation’s remain low (they will also be spinning well below their leverage targets and have been clear that returning capital to shareholders is a key area of focus, so a buyback could come very quickly).

The real prize, however, is potential M&A. Being a REIT 100% focused on La Quinta is probably unacceptable to investors long term, so I would guess there’s some M&A in the cards in the near term. My preference would clearly be for CorePoint to be a seller, and I’d note that this transaction being structured as a taxable spin would allow for the company to immediately be sold. The Hotel REIT M&A market is pretty strong (just last year we saw a bidding war between Ashford and RLJ for FelCor), and PEB just launched a hostile offer for LHO, and the synergies from throwing CorePoint on to another player’s platform would be pretty sizable. Based on past deals, I’d estimate at least $20m in G&A synergies; at an 11x multiple that would be worth ~$2/share to a buyer. Obviously the valuation is dependent on the ultimate EBITDA levels and what the balance sheet ends up looking like, but if a larger player is willing to underwrite $250m in EBITDA plus another $20m in synergies, a sale price could easily approach $20/share and still prove accretive to a buyer.