Last Black Friday’s “Inevitable Retail winners” post got some really interesting feedback and recommendations for stocks that could fit the “inevitable” winner mold.

My personal favorite recommendation was a friend who mentioned Sweetgreen (SG) as an inevitable winner….. but only if Americans would stop being such pigs and actually care about their health (so basically no chance!).

On the more serious side, the recommendations did go a little broader than hard retail, but some of the companies receiving multiple votes for having passed the “inevitable” point included SFM, JYNT, and DG. All are interesting, though I’m not sure I’d describe any of them as “inevitable” winners.

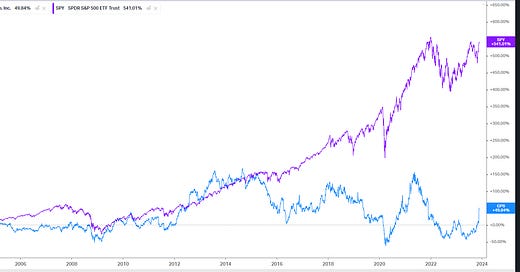

The second most popular recommendation as an inevitable winner was CROX (which I have a great podcast with Mitchell Scott here) on the thesis they’ve proven to have international legs and the market has way underestimated the likelihood of continued growth for something that’s proven to be this popular internationally. (Note: on top of asking for companies that could be hitting the winning “inflection”, my post also asked readers examples of different potential inflection points that could identify a winner, and a very popular one was when a company successfully expands into an international market. I think international expansion is a sign of a successful company, but I absolutely do not think it makes for an inevitable winner. HD has been an enormously successful company, and they’ve achieved that success with largely domestic dominance (international sales make up <10% of their sales). On the other hand, there are plenty of apparel retailers (like GPS) that have crated very successful international businesses but whose stocks have materially underperformed; the SPY is up >10x on GPS over the past 20 years!).

The most popular recommendation for an inevitable winner was First Watch (FWRG), a chain of breakfast focused cafes that is expanding rapidly (and, as a breakfast lover, I am excited to do some serious diligence on it; I also plan on having a podcast on it in the new year). FWRG certainly believes they’ve got some inevitability potential; consider the slide below (from their investor deck). If that’s not a company that believes their growth is inevitable, I’m not sure what is!

All of those recommendations are interesting in their own right; honestly, I wouldn’t be shocked if someone followed up on this post five years from now and it did turn out one of those companies had outperformed in an “inevitable” way.

But none of those are the company I think is most likely to be an “inevitable” winner. The company I think is most likely to be “inevitable” in that sense is Academy Sports (ASO)*; I could easily see them following an Autozone type playbook over the next few years and delivering a multi-year run of exceptional performance fueled by both capital returns and new store growth….. but I’ll leave you on a cliff hanger and save my thoughts on ASO for a follow up post tomorrow! (Editor’s update: the ASO post is now live here).

See ya then.

*PS- ASO reports earnings later this week; obviously, naming a company my favorite to follow the AZO model a few days before earnings is a recipe for a huge earnings miss and a stock to drop 20%, so my apologies to the longs!

No apologies needed. We buying Dec 1 ASO puts ASAP. ez game

I think part of story is also about relationships with suppliers, inventory turnover, payment terms, and when suppliers are paid. AZO has a pretty unique business model (there is a good Business Breakdowns on it) that is pretty hard to replicate. They’re dealing with a pretty unique customer base and it is hard to compete with them (as far as I know you can’t buy auto parts on Amazon).