I mentioned in yesterday’s post that, of all the retail companies I know, the one I think is most likely to be looked at as an “inevitable” winner is Academy Sports (ASO).

Now, an “inevitable” retail winner can come in a lot of forms. It could come in the form of investing early in Walmart or Amazon and riding their growth and retail dominance to world beating returns.

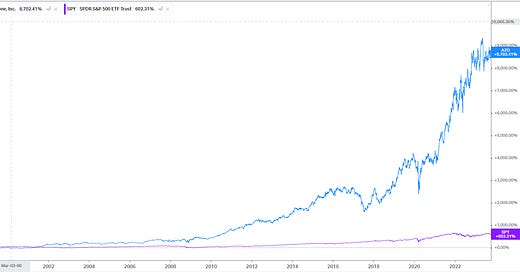

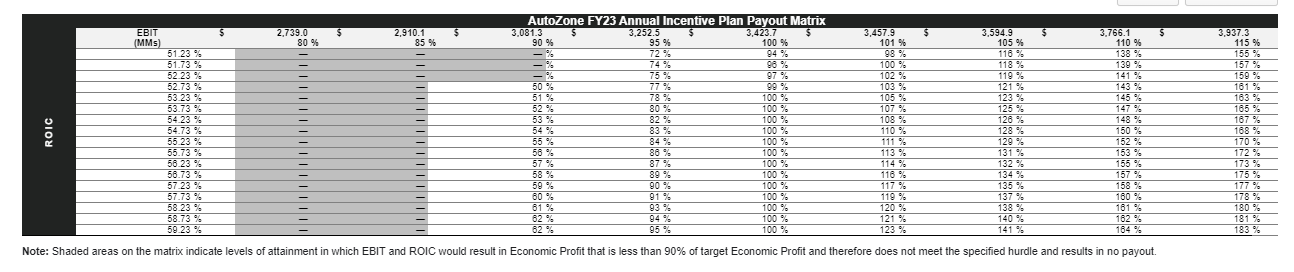

But I think the more likely route to investing an inevitable retail winner is finding something like AutoZone (AZO); a business that has competitive advantages and growth opportunities as it attacks a huge market and can grow into that market….. but one that also spews off gobs of cash and uses that cash to aggressively return capital to shareholders. And I do mean aggressively; AZO has bought back more than 100% of their outstanding shares since starting their buyback program in 1998. The results have been otherworldly; since starting the buyback program, AZO’s stock has outperformed the index by an astonishing amount.

One of the really interesting things about AZO is that it generated those incredible returns without any really multiple expansion or with its multiple getting crazy. Here’s their forward EV / EBITDA over the past twenty years; sure, it goes from ~7x at the start to ~13x by the end, but that’s over 20 years! Multiple expansion barely plays a role in AZO generating those insane returns, and at no point would you ever look at AZO and say “wow, this multiple looks ridiculous.” Instead, AZO was always available at a pretty reasonable price, and they just continued to open new stores, spew off loads of cash, and buyback shares.

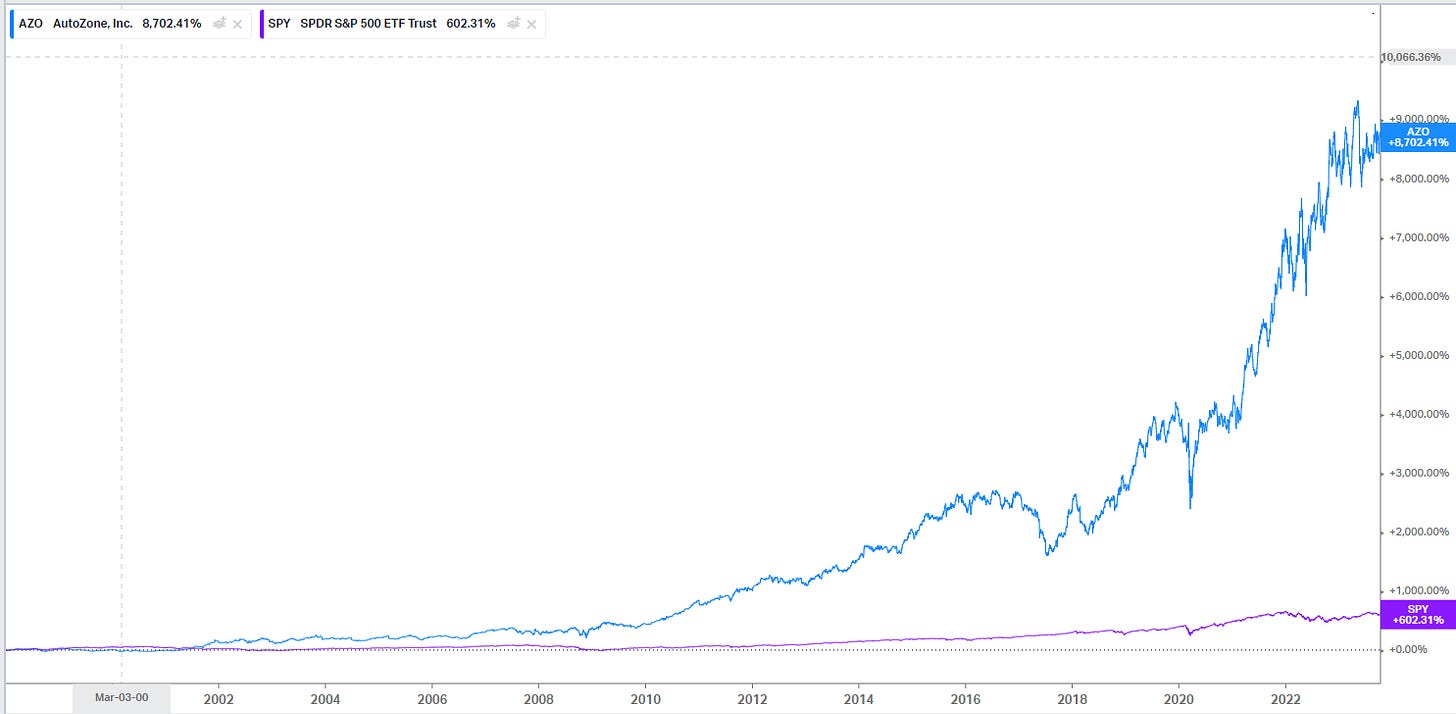

It’s also worth noting one other thing about the AZO model: they generate gobs of cash, return it to shareholders, and open new stores…. but the management is also laser focused on return on invested capital (ROIC). Every earnings release includes the chart below, which shows how outstanding their returns on capital are. And those great returns serve as a huge competitive advantage; having tremendous unit economics means you can open profitable stores where your competitors cannot, and generating insane returns on capital allows you to pursue store growth while also aggressively returns cash to shareholders (which AZO has done; again, they’ve repurchased >100% of their initial shares outstanding over the past ~25 years while more than doubling their store count).

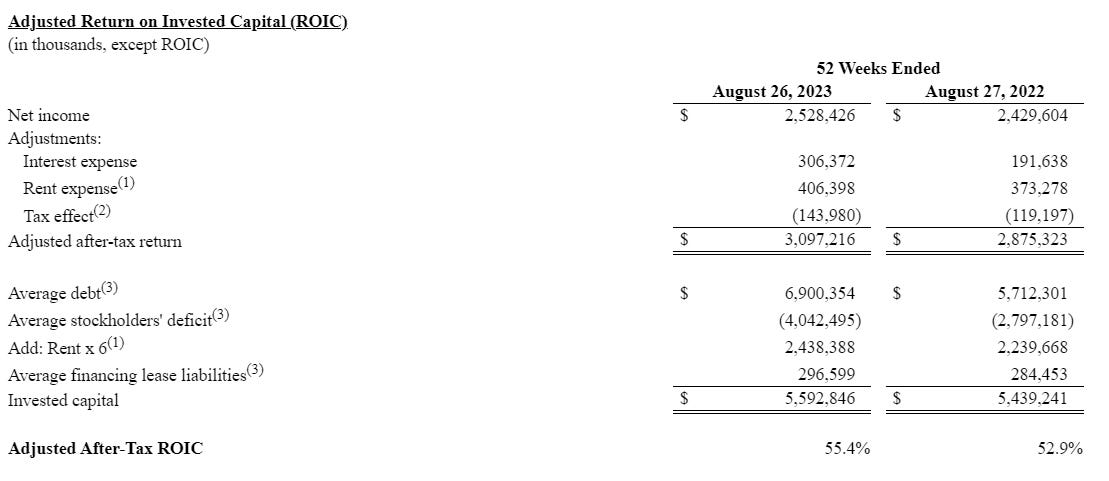

And AZO doesn’t just focus on ROIC publicly; their management bonus structure has an ROIC component to it (table below from their proxy)

So I think the AZO model would boil down to three things

Generate gobs of cash flow

Use that huge cash flow to fund new store openings and return cash aggressively to shareholders (largely through repurchases done at a low valuation)

AZO had ~3k domestic stores open in 2002 (plus 39 in Mexico!). They had 6.3k domestic stores in 2023 (plus another 740 in Mexico and 100 in Brazil). So, over 20 years, they more than doubled their domestic store base. That’s not shocking growth….. but it’s certainly nice!

Have great unit economics that lets them profitably open stores while taking share from smaller chains / mom and pops and have something that protects from Amazon style risk.

I think ASO would check each of those boxes.

First, there’s generate gobs of cash flow. Easy check there! In FY22, ASO generated ~$450m in free cash to equity (which I’m defining as cash from operations less capex). Not bad given their current market cap is <$4b, and that number was actually down substantially from the COVID spike years of 2020/2021.

The next box in the “AZO clone” check list is using that cash flow to both open new stores and return cash to shareholders (ideally through repurchases at attractive valuations). ASO checks both of those boxes.

On the returning cash to shareholders front, ASO returns >$500m to shareholders in stock buybacks and dividends in FY22 (almost all of which came through dividend) and over $400m in repurchases in FY21. Through two quarters in FY23, they’ve returned just over $170m. All of this is against a market cap under $4B. The midpoint of ASO’s EPS guide is ~$7.35/share; with the stock trading <$50, it’s trading for <7x EPS (the metrics would look similar using FCF; I just chose EPS because it’s so simple to comp). So you’ve got ASO trading for a mid to high single digit multiple of earnings and at a market cap where they’ve consistently returned ~10% of that amount in cash every year.

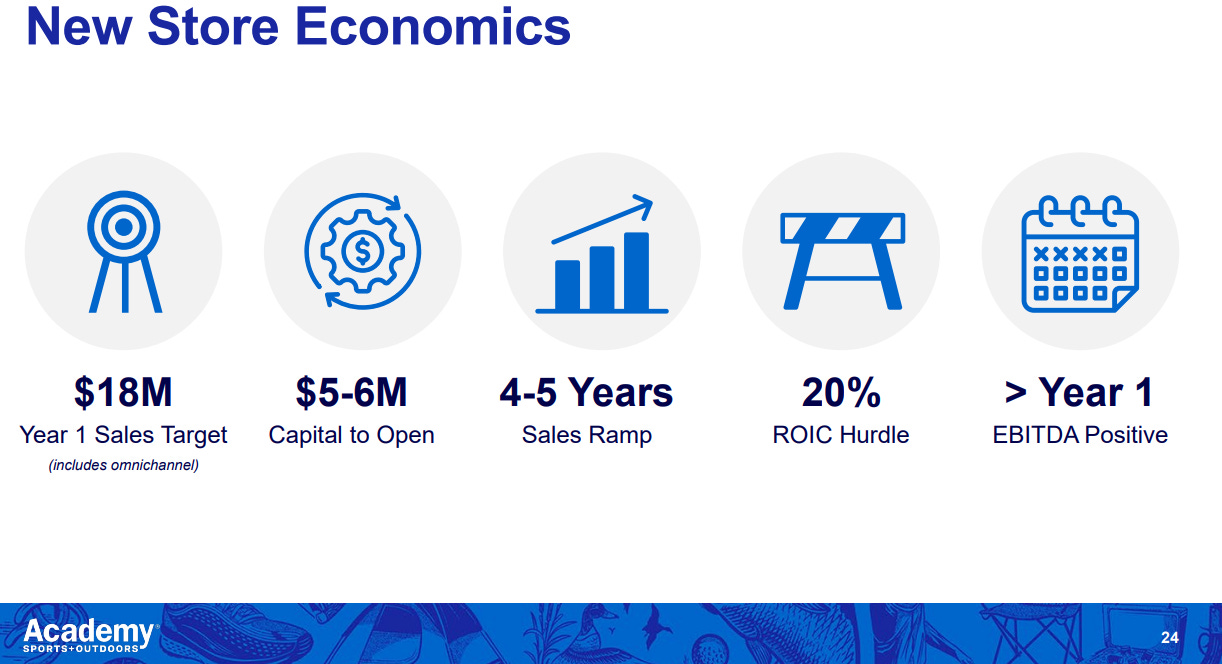

On the new stores front, ASO is targeting a minimum ~20% ROIC on investments into new stores….

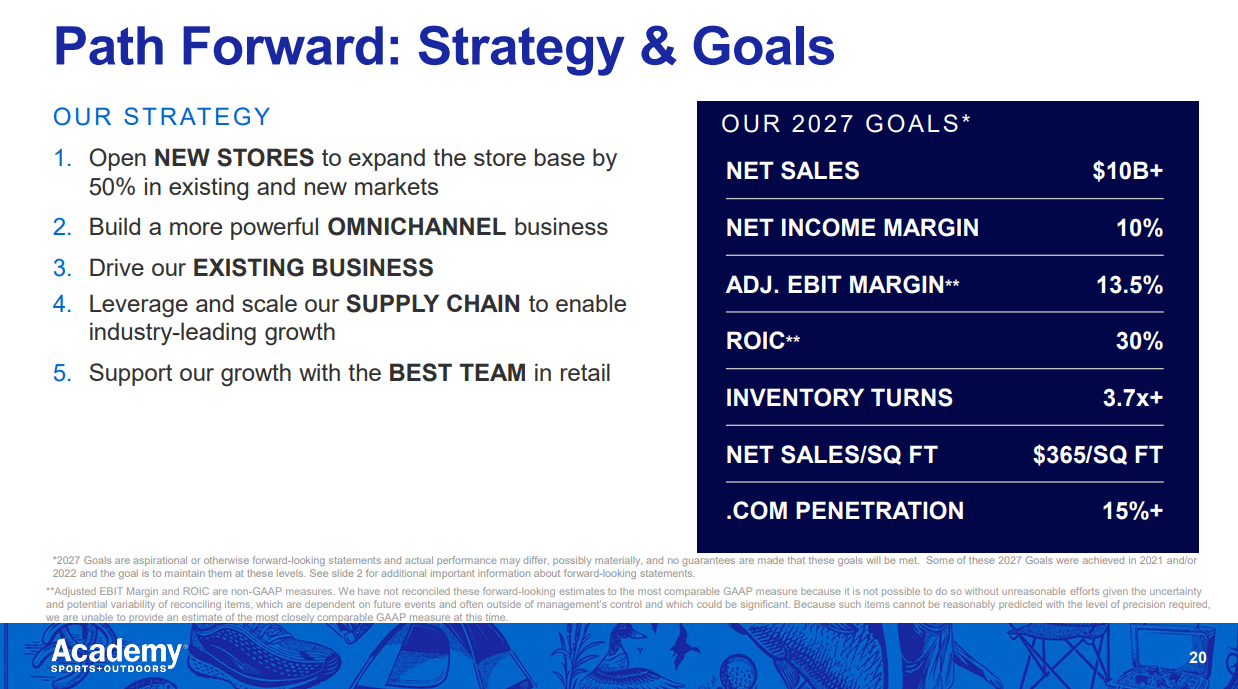

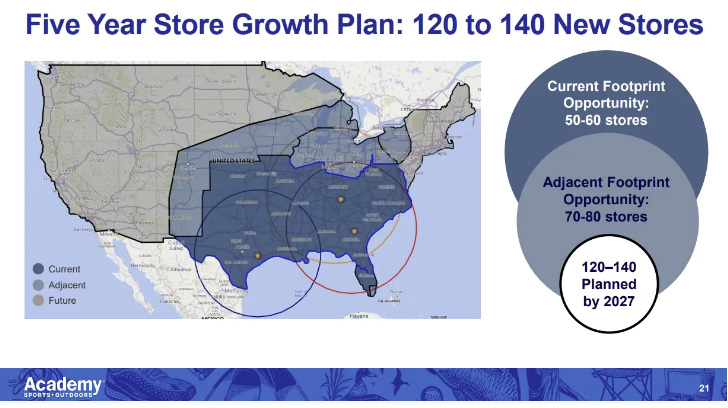

And they see room to increase the store base by 50% over the next few years while keeping company wide ROIC at ~30%; longer term, they’ve thrown out a target of 800 stores.

The last piece of the AZO puzzle is have some type of moat that lets you take share from smaller competitors but also makes it difficult for Amazon to compete with you. For AZO, the Amazon side of the moat was the “need it now” piece to their DIY parts business (when your car breaks down, you might not be able to wait for Amazon to ship you the part) while the “beat up on small players” piece was the extensive inventory each store needs (carrying literally thousands of parts), which would give a large player advantages in pricing power (negotiations with suppliers) as well as logistics (investing in tech to better manage inventory). And please note that I am no AZO expert, so I’m happy to be told I’m missing something on any side of the moat.

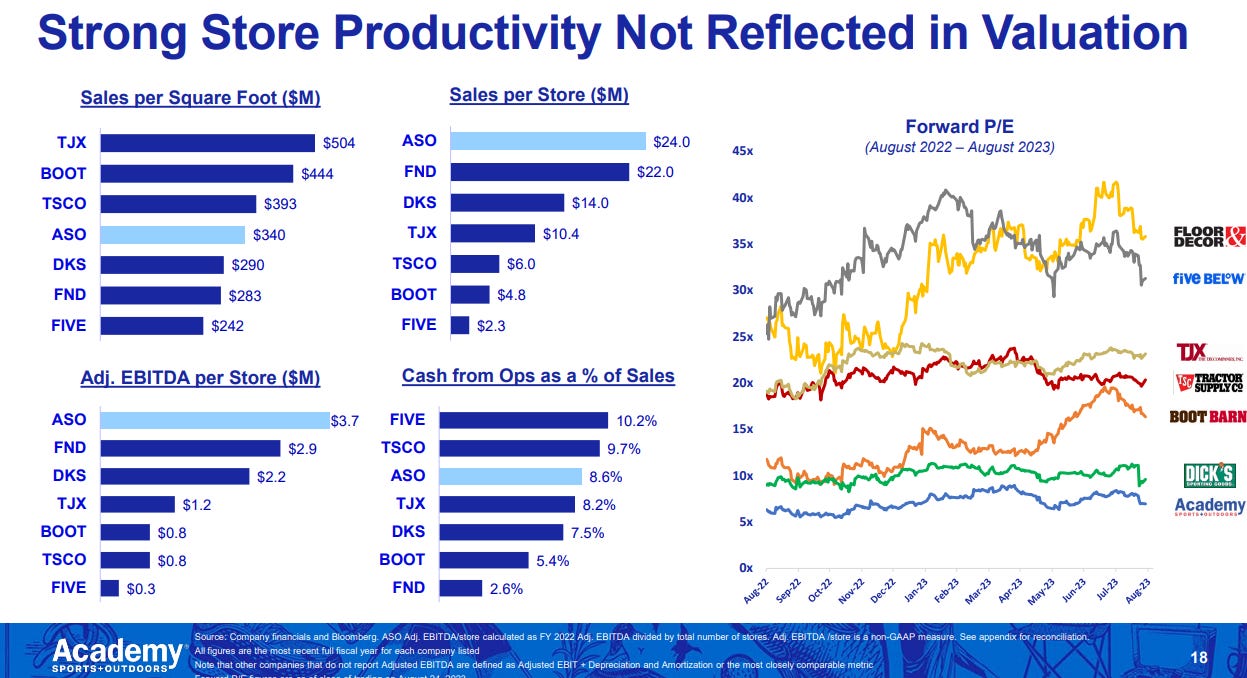

For ASO, there’s a few possible pieces to their “moat” puzzle. I think ASO would start by arguing that their stores are way more profitable than peers; I’ve included two charts below that show ASO’s sales per square foot, sales per store, and profit per store are at the high end of most peers. Obviously having high sales per square foot and profitability are not a moat in and of itself, but it’s generally a sign that something is working / that there’s some form of competitive advantage or moat at play!

Ok, anyway, what is ASO’s moat?

On the Amazon side, a lot of ASO’s products don’t fit great in the Amazon model. On the sports side, a lot of ASO’s products are ones that you actually want to touch and feel before you buy. The example that’s been given to me is a kid going to buy cleats with his family before soccer season starts up; he’s likely changed size over the summer and the whole outing is a family bonding moment. That experience is just something you can’t order on Amazon. Obviously that’s a corny little example, but there is something to it and in general people do like to try on and touch athletic equipment and the like before they buy it. Speaking of athletic equipment, the other end of a lot of what ASO sells are heavy items: treadmills, weights, etc. Those are also tough to Amazon; the shipping cost is really prohibitive. Having a store where people can come pick them up can actually reduce a lot of costs.

On the mom and pop side, ASO has three advantages I see. First, there’s the typical “ASO is much bigger, so they should get better pricing from suppliers” moat. That’s small but real. Second, a lot of ASO’s business is “omnichannel” now. A smaller competitor is not going to have the tech to invest into omnichannel. Third, a few years ago Nike made the strategic choice to stop selling to a lot of smaller accounts; it’s obviously really tough to have a sporting store without Nike. Academy made the cut, so Academy is often competing with mom and pops who don’t have the most important athletic brand.

So ASO is the retailer I see as most likely to go on a AZO style run. They trade at a cheap valuation, they return gobs of cash to shareholders, they’ve got room to open up a ton of new stores at attractive ROICs, and they have a moat/business model that lets them take share from smaller competitors while protecting them from the goliaths.

Of course, there’s risk here. ASO is my smallest position, and it would not be if I was 100% convinced they were about to go on an AZO like run (BTW- mentioning having a position in something is a great time to refer you over to our legal and disclaimer!)! Over the past 20 years, AZO’s stock did ~25% annualized. If I thought ASO was going to approach anything close to that, I’d be a fool not to sell everything else in my portfolio, plow it all into ASO, head to the beach for 10 years, and come back having delivered epic returns.

So what’s the risk?

I see three major risks with ASO.

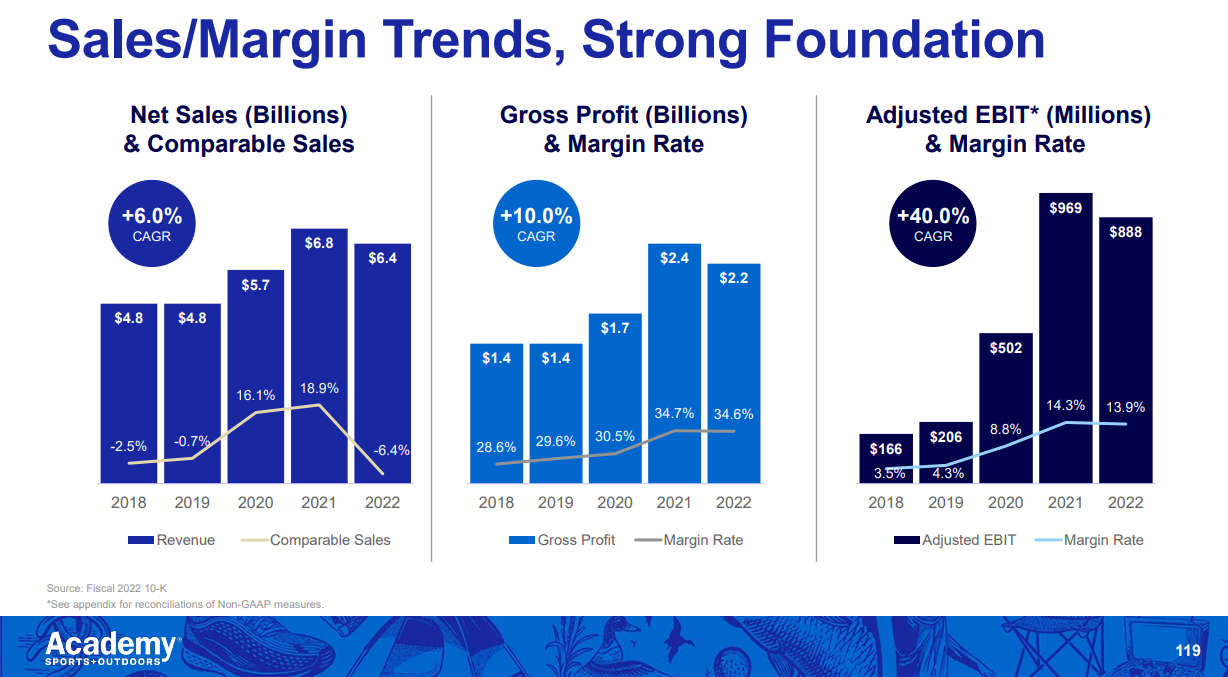

First, and most obviously, there’s COVID hangover risk. Take a look at the slide below; it’s impossible not to notice that sales and margins took a dramatic turn up right when COVID hit and outdoor spending went crazy!

Your big worry here is that ASO is riding the last tails of the COVID boom, and in a year or two that’s going to fall off and they’re going to return to the margins and return profile of the pre-COVID business.

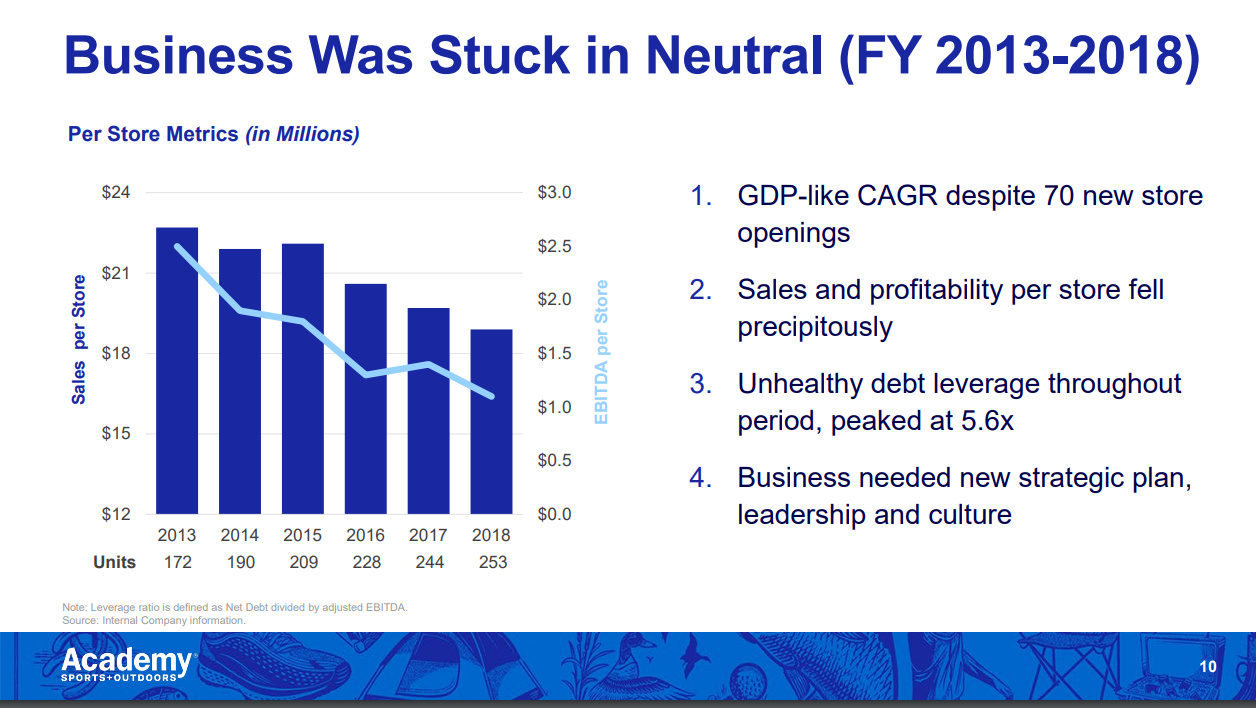

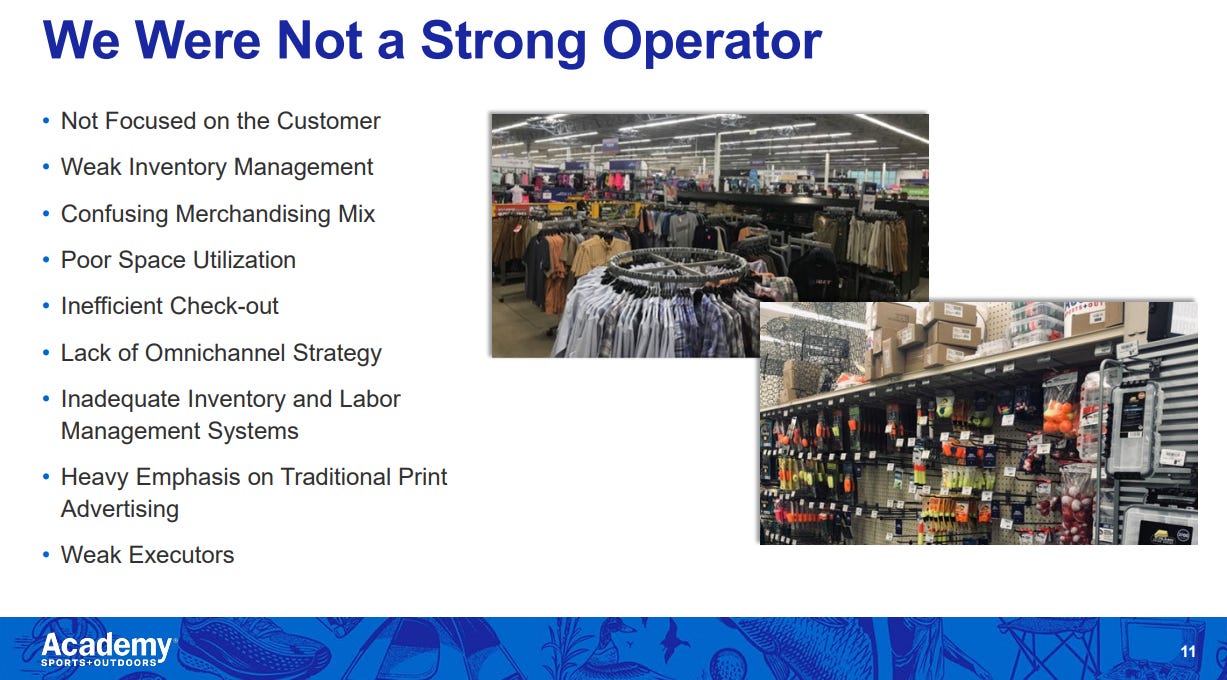

I think ASO would pushback hard on that line of thinking; new management took over in 2018, and they would argue the business was “stuck” (read: mismanaged) before they came in. They’d argue the COVID returns simply added fuel to the turnaround that was already under way at Academy, and margins has already started to expand.

The second worry relates to management and goes hand and hand with worry number one. Ken Hicks is a retail legend, and he came in in ~2018 and oversaw the ASO turnaround. He stepped down from the CEO spot in April to become executive chair; there is some worry that he was singularly responsible for ASO’s incredible turnaround / metrics, and as the business gets further and further from his leadership the results slip back to their 2018 levels.

Your final worry is that “moat against Amazon and mom and pops” sounds great on paper….. but it might be something that sounds great in theory but isn’t true in practice. The past decade has seen a slew of sporting goods chains collapse into bankruptcy (including Modell’s and Sports Authority). Now, Dick’s and Academy seem to be generally thriving today, but when you’ve got multiple chains in the same industry that have collapsed in the reasonably recent past, I think it’s fair to question if the industry is as moat-y as I’ve presented it!

Alright, I’m going to wrap this up here. Below I have my “odds and ends” portion, where I squeeze in any thoughts I have that didn’t quite fit into the article. However, below that, I have something different: quotes from ASO’s investor day that I think fit squarely with this article / back up some of the thoughts I presented above.

Odds and ends

AZO’s ROIC is is >50%; ASO is targeting ~30%. Obviously that’s a large difference and you’d rather be at 50%….. but, assuming you can’t deploy unlimited amounts of capital, the difference between 50% ROIC and 30% ROIC isn’t actually that large. Both are so far above your cost of capital that they create enormous valu, and the real differentiator is actually how much capital you can deploy at those rates. For example, you’d rather buy a retail concept that has 100 units and can grow to 5k while investing at a 30% ROIC than buy a retail concept that has 250 units and can grow to 500 while investing at 50% ROIC.

That’s important to keep in mind; remember, AZO just over doubled their store base over 20 years and generated wild shareholder returns. ASO won’t invest at AZO style ROIC, but ASO also thinks they have room to ~triple their current store base to ~800 in the long term. That longer runway, if correct, would generate outstanding returns.

I can’t emphasize this enough: ASO reports earnings this Thursday (November 30th). Writing an article this bullish a few days before earnings near guarantees the earnings will be a disaster and the stock will be down 10-20%.

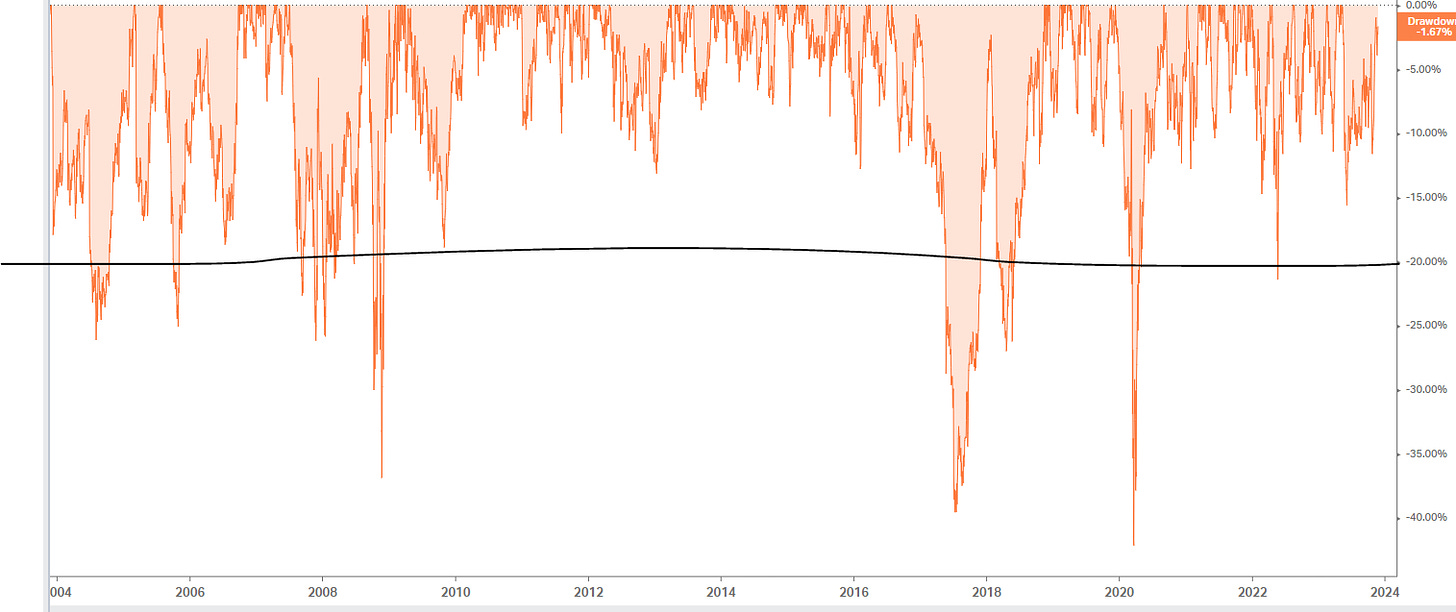

Related to the above (we might have a big pullback on earnings!), I generally hate “drawdown” charts, but I’ve included AZO’s below. I think it’s really interesting. Retail is a wildly volatile sector; it’s not unheard of for whole sectors to move up or down 10% on one component of the sector reporting earnings (i.e. when ASO competitor DKS reports earnings, it’s pretty common for DKS stock to move up or down 10% and ASO to move 5% in sympathy. Or when TGT reports earnings and poops the bed or blows the doors off and drops/pops 10%, it’s not crazy for the whole sector to go up or down 5%). So, with that in mind, it’s kind of crazy how rarely AZO had a drawdown of ~20% over the past 20 years (when, again, they were on their way to absolutely world shattering returns). Depending on how you interpret a drawdown, AZO had 5-7 drawdowns of 20% or more over the past 20 years. Two of those (the GFC drawdown and COVID drawdown) correlated with huge market crashes, and two more ~2018 and ~2022) correlated with markets that weren’t exactly friendly! I guess the takeaway for me: drawdowns in names that are on their way to world beating returns can be rare. When they happen, they should be taken advantage of, and if you’ve identified a company that you’re convinced is going to be a monster, better to just take a full position now than to wait for the rare correction (because one might not come and when one does come it might be after the stock has already 4x’d on you!).

I don’t think it’s explicitly necessary to have super happy employees to deliver incredible retail returns, but there does seem to be some correlation between having really happy employees and being a long term retail compounder. Tractor Supply has mentioned hiring their most passionate customers as employees, everyone raves about the Chick-Fil-A culture, etc. Walmart today gets a bad employer rap, but in the very early days the employees were really dedicated and happy to work there (at least that’s my memory from the Sam Walton book, which admittedly could have some bias), Anyway, I mention all those examples because ASO likes to pitch that they’ve got a little of that magic going on in their stores / with their employees, and honestly, I could believe it. Where would you rather work: selling a kid his first baseball bat at Academy, or at a generic retail job selling clothes?

One other thing ASO has pointed out that is interesting to think about as a small hiring moat in all businesses: ASO is currently growing, so if you work for them there’s growth potential (go work as an assistant manager and you might have a shot as a general manager at the new store opening next year). You can’t say that about a lot of retail (if you go work at generic department store, it’s more likely that your store gets closed than a new one gets opened!), and that upward mobility potential might give ASO a little edge in hiring.

Note I’m not saying I explicitly believe any of this hiring / culture related edge, but it’s interesting to at least think about.

A large risk worth explicitly laying out: Nike is so dominant in sports and footwear that you worry about what happens if ASO losses Nike / as Nike continues to grow their D2C business. It’s certainly a concern, but I actually think ASO is well positioned here: they don’t rely on the “high heat” items (like brand new Jordans) that are really easy for Nike to make exclusive to generate Nike buzz / grab that margin for themselves. Instead, ASO is selling a lot of basics / value plays, and I’d argue a lot of the sales someone like ASO generates are sales Nike would not make if they weren’t in ASO (if you’re a dad bring a 5 year old to buy his first pair of cleats, you’re much less concerned with a Nike or Adidas logo and much more concerned with going to the store in person and finding a proper fitting pair!).

One other thing to keep in the back of your mind: KKR owned ASO and sold out of them basically as fast as they could when ASO went public. It’s fair to ask “if ASO is going to be a world beater, why would KKR sell so quickly?” I think the answer is KKR bought ASO in 2011, and ASO was horrifically mismanaged and almost went bankrupt before Ken took over and COVID gave them some wild tailwinds. I bet mentally they had marked the investment to zero, so to get out at good prices 10 years after acquiring the company was probably a huge win internally.

Some ASO quotes that I think are interesting but I couldn’t fit in the piece

On opening new stores not being a huge risk as they’ve already got the format and proof points down:

But with regard to the elements, this is not trying a new format and will it work or won't it work? This is an execution plan.

Simply laying out their 2027 growth plans and why they’re achievable

To open new stores to expand the store base by 50% in existing and new markets. Nothing says leadership or winning in retail more than taking the cash you're generating, investing it back into yourself and multiplying it. And that's what we're going to do. We've grown 30% since 2019 through operational improvements, and through academy.com. We've grown 30% with no new units, imagine what's possible when we start adding units. And so our plan is to open 120 to 140 new stores between now and 2027. And so one more time, that's 120 to 140 new stores between now and 2027

On how profitable their stores are

The worst stores in our chain, the worst stores, the lowest performers generate roughly the same amount of profit as our competition's average stores.

On the overall industry and why there’s a spot for their growth

I think the industry as a whole is much healthier. Our vendors are more rational. We've talked about that. There's less competition. I think our lane is more clearly defined than it was in the past.

More on their growth plans

Long term, the next 5 years are just the beginning, and it still leaves about half of the United States where we can grow. And because our model is so profitable and productive, we don't need a new format. We don't need to try anything new or different.

On enthusiastic employees

Our enthusiasts, you met a couple of them yesterday, were passionate about. We hire those individuals. They love what we sell.

From their Q2’23 earnings call

On their longer term focus and goals

if we're looking out long term, and again, we're focused on the long term. We're more differentiated in this space than we were a few years ago. I think there's fewer competitors and some of the largest competitors have really backed away from this space. So short term, definitely, as Steve said, we're still running down in some of those categories. It is stabilizing. I think long term, we've got a great opportunity to pick up meaningful share and new customers as we really support and lean into this category.

On why they won’t be returning to pre-COVID profitability (or lack thereof!)

-- a couple of times we said it, we're a different company than we were pre-pandemic. We're sustaining right now at about 27% where we were in '19 from a sales perspective. The margin is about 500 basis points higher. And that's really built on the back of a lot of really strong meaningful operational changes that we've made to the business in terms of how we buy and allocate our regular price and markdown optimization work we do, the better size profiling we do in getting the right goods to the right stores.

Good analysis and I've done similar work on various retail concepts that have been beaten down but there is still one fundamental issue I have. The basis for the entire compounding of value is that they can open new locations with the proposed ROIC over a decade plus timeframe. It is easy to say they target 30% ROIC on their growth but outside of COVID they have never achieved those numbers. Yes it's possible the new management fundamentally improved the business, indeed this seems likely, but by how much?

So far all of the underlying trends are still negative. 2022 was a post-COVID hangover against tough comps but comps, transactions, and visits are still negative and the tracking data shows no inflection. So when you underwrite the long-term thesis, what is the true $/sq. ft. and margin per store they can have in a normalized environment?

If the right answer is more like $20M/store revenue and high single-digit margins (both large improvements over pre-COVID) the ROIC is only mediocre. Then you layer in all the risks you mentioned on a consumer discretionary concept that has been plagued by bankruptcies and it looks a bit different. I'm willing to believe this will be a good investment and is potentially cheap but I'm not sure it could be called inevitable until they demonstrate what the real, sustainable store economics are.

Great analysis. I might aim for a discount post earnings announcement if possible. But still good value right now